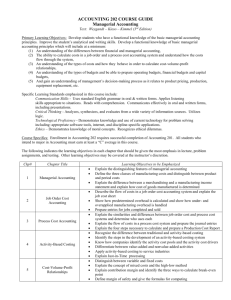

Homework - Glendale Community College

advertisement