Chapter 7: Demand Estimation and Forecasting

advertisement

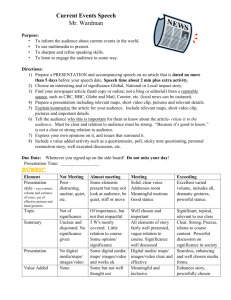

CHAPTER 7: DEMAND ESTIMATION AND FORECASTING I. INTRODUCTION A. Specification of Empirical Demand Functions 1. Microeconomic Theory tells us what variables to include in a demand model and what the signs of the parameters should be. 2. Choosing a functional form. a. linear b. log - linear B. Market Determined vs. Management Determined Prices 1. Estimating Industry demand for price-taking firms. 2. Estimating Demand for price-setting firms. C. Definitions. 1. Endogenous Variable: Variable whose value is determined by a system of equations. 2. Exogenous Variable: Variable whose value is determined outside a system of equations. D. Linear Demand Specification. 1. General form Qx = a + bPx + cM + dPr + eN Where: b= ΔQ x ΔP c= ΔQ x Δm d= ΔQ x ΔPr e ΔQ x = ΔN ; b < 0 law of demand ; c > 0 normal good, c < inferior good Substitutes ; d > 0 Substitutes d < 0 Complements ;e>0 2. Elasticities a) E = ΔQ x ( ΔPx since b = Px )( Q x ) ΔQ x ΔPx P Eˆ bˆ. x Qx M Eˆ m cˆ. b) Qx Pr Eˆ xr dˆ. c) Qx 3. If the parameter estimates are significant, the elasticities are significant. 4. If no particular point on the demand curve is specified, it is customary to evaluate the elasticity at the mean values Px and Qx. D. Log-linear or constant elasticity functional form. 1. Qx = aPxbMcPrdNe 2. Transformation: ln Qx = ln a + b ln Px + c ln M + d ln Pr + e ln N 3. The expected signs for the parameters are the same as for the linear function. 4. bˆ, cˆ, dˆ are also elasticities. III ESTIMATING INDUSTRY DEMAND FOR PRICE TAKING FIRMS. A. Problem: Demand: Q = a + bP + cM + Ed Supply: Q = h + kP + lPI + Es 1. Price is an endogenous variable – as is the case with all price-taking firms. Price is therefore correlated with the random error term which results in biased estimates. 2. Simultaneous Equation Bias – When the (OLS) estimation method is used to estimate the parameter of an equation for which one or more of the explanatory variables are endogenous. B. Solution: Two-Stage Least Squares 1. Specify the industry supply and demand equations. Demand: Q = a + bP + cM + dPr Supply: Q = h + kP + lPt 2. Check for identification of industry demand. In order for demand to be identified, so that the sample data will trace out the true demand curve, the specification of supply must include at least one exogenous variable that is not in the demand equation. 3. Process: a. P, the right hand side variable is regressed against all of the exogenous variables in the system. b. Stage 2: P̂ is now exogenous so that the following equation is estimated: Q = a + b P̂ + cM + dPr c. Example: Estimating world-wide demand for copper: Data on page 306 1. Equations: Q = a + bPcopper + cM + dPAluminum Q = e + fPcopper + gT + hX 2. Is the demand equation identified? 3. Computer printout page 263. 4. Are the parameter estimates significant at the 5% level? 5. Evaluate the price, income, and cross-price elasticities. - Use the last year from the data set. III. Estimating Demand for price-setting firm, checkers pizza: Data page 307 A. Linear functional form. 1. Q = a + bP + cM + dPal + cPmac Where Q = sales of pizza at Checkers Pizza P = price of pizza at checkers. M = average annual H.H. income. Pal = price of pizza at Als. Pbmac = Price of Big Mac at McDonalds. 2. Evaluate computer printout. a) Which parameter estimates are significant at the 5% level of significance? b) As the F-statistic significant at the 5% level of significance. c) Write the predictive model. 3. Evaluate elasticities around the values assigned to the independent variable. P Eˆ bˆ( ) Q 9.05 (-213.422) 2784.4 = = -0.694 M Eˆ m cˆ( ) Q = (0.9109) = 0.871 26,614 2784 . 4 PAL ˆ ˆ EAL d ( ) Q = (101.303) = 0.368 10.12 2784 . 4 PBMAC Eˆ BMAC eˆ( ) Q = (71.8448) = 0.030 1.15 2784.4 B. Log linear functional form. 1. Q = aPbMcPALdPBmace 2. Transform ln Q = ln a + b ln P + c ln M + d ln Pal + e ln PBmac 3. Evaluate computer printout on page 269. a) Which parameter estimates are significant at the 5% level of significance? b) Is the F-statistic significant at the 5% level of significance? c) Write the predictive equation in exponential form. 4. What are the elasticities? III. TIME-SERIES FORECASTING. A. Linear trend forecasting. 1. Common business applications: Sales over time. 2. Hypothesize a linear trend between sales and time. Qt = a + bt where: Qt = sales in dollars t = time. Qˆ t aˆ bˆt 3. If there is a statistically significant trend, you can use the model to forecast by extrapolating into future time periods. B. Example of linear trend forecasting: Terminator Pest Control. 1. Hypothetical data: figure 7.4 computer print-out on page 274. 2. Test for significance at the 0.01 level of significance. tcritical = 3. Forecast future sales. Qˆ t aˆ bˆt Q̂ = 46.57 + 4.53t April 2000 May 2000 June 2000 = 46.57 + 4.53(16) = 119. Q̂ 17 = 46.57 + 4.53(17) = 123.6 Q̂ 18 = 46.57 + 4.53(18) = 128.1 Q̂ 16 C. Example: Lumber sales for Georgia Lumber Products Observations: 2001 (III) – 2003 (II) 1. Computer printout – page 273. 2. Test for significance at the 0.05 level t critical = 3. Forecast future price of lumber for next two quarters. P̂ = 2066 + 25t P̂ 2003(III) = 2066 + 25 (9) = $ 2,291 per ton P̂ 2003(IV) = 2066 + 25 (10) = $ 2,316 per ton IV. SEASONAL OR CYCLICAL VARIATION. A. Example: Retail sales and Christmas season. B. Graphical depiction (figure 7.5) 1. There is an upward shift of the trend line in the fourth quarter. 2. To take this into account: Estimate: Qˆ t = a + bt + c Where c = 0 for quarters 1, 2, 3 and 1 for quarter 4. C. Correcting for seasonal variation using a dummy variable 1. A dummy variable is a variable that takes on values of 0 or 1. 2. Process: a. D = 0 for first three quarters and 1 for fourth quarter (Table 7.1) b. Estimate: Qt a bt cD c. To forecast sales in the first three quarters Qˆ t aˆ bˆt To forecast sales in the fourth quarter ˆ Qˆ t (aˆ cˆ) bt D. Multiple Dummy Variables 1. Seasonal Variation in every quarter Specify: Qt = a + bt + c1D1 + c2D2 + c3D3 Where: D1, D2, D3 are dummy variables for quarters 1, 2, 3 2. Hypothetical Example: Sales data for statewide trucking company. a. Data: Table 7.2 b. Computer Printout: Pg. 278 1. Test for significance at the 0.05 level of significance. 2. Interpret meaning of: a. Slope Parameters b. Intercept Parameter 3. Predicted Sales: Q̂ 2005, I =139,625–69,788+2737.5 (17) Q̂ 2005, II =139,625–58,775+2737.5 (18) Q̂ 2005, III =139,625–62,013+2737.5 (19) Q̂ 2005, IV =139,625+2737.5 (20) Chapter 7 Assignment Technical Problems: 1, 2, 3, 7, 8, 9, 10 Applied Problems: 1, 4 Not Responsible for Section 7.7