Equations from Damodaran

advertisement

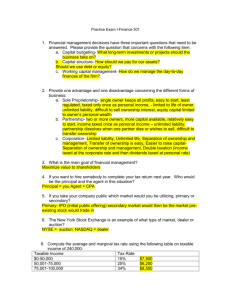

EQUATIONS OF THE BOOK “INVESTMENT VALUATION”, 2ND ED. BY DAMODARAN t n Value CFt t 1 (1 r)t t n CF Value of Equity t 1 t n Value of Firm to Equity (1 k e ) t CF to Firm t 1 (1 WACC CAPM )t E(R) = Rf + B (Rm- Rf) Cost of Equity = E(Ri) = Rf + Equity Beta * (E(Rm) - Rf) Cost of equity = Risk-free rate + Beta * (U.S. risk premium) + Country risk premium Cost of equity = Risk-free rate + Beta * (U.S. risk premium + Default spread) Relative standard deviation country x = Standard deviation country x / Standard deviation U.S. Equity risk premium country x = Risk premium U.S. * Relative standard deviation country x Country risk premium = Country default spread * ( Std. Dev. equity / Std. Dev. country bond) E(Return)=Riskfree Rate+ Вeta (US premium) + λ (Country risk premium) λ =% of revenues domesticallyfirm / % of revenues domesticallyavg firm BETA ESTIMATION Rj = a + b Rm BL = Bu (1+ ((1-t) D/E) BL = Bu (1+ ((1-t)D/E) - Bdebt (1-t) (D/E) ii 1k Bi Operating Incomei Operating Income Firm Changes in earnings firm, t = a + B * Changes in earnings Market, t Interest Coverage Ratio = EBIT / Interest Expenses Pre-tax cost of debt = Risk free rate US + Country default spread EM. MRK + Company default spread Company synthetic rating MV of debt = Int. Exp. (1/r – 1 / r(1+r) n) + BV of debt / (1+r) n Market value of equity = number of shares * price per share 1 Inflation Peso 1 Inflation USD Cost of capital= (1 Cost of CapitalUSD) Straight bond component = Market value of bond Conversion option = Book value of bond at issuance – Straight bond component Cost of PS = Preferred dividend per share / Market price per preferred share CASH FLOW DEFINITIONS EBIT (1 – tax rate) - (Capital Expenditures – Depreciation) - Change in non-cash working capital = Free Cash Flow to Firm (FCFF) Net Income - (Capital Expenditures – Depreciation) - Change in non-cash Working Capital - (Principal Repaid – New Debt Issued) - Preferred Dividend + Dividends and Stock Buybacks = Free Cash Flow to Equity Revenues (-) Operating Expenses = Operating Income (-) Financial Expenses (-) Taxes = Net Income before Extraordinary Items (-) or (+) Extraordinary Losses (Profits) R&D, OPERATING LEASE ADJUSTMENTS Adjusted operating income = Operating income + Current year’s R&D expense – Amortization of research asset Adjusted net income = Net income + Current year’s R&D expense – Amortization of research asset Debt Value of Operating Leases = PV of Operating Lease Expenses at the pre-tax cost of debt Adjusted debt = Debt + Present value of lease commitments Adjusted Operating Earnings = Operating Earnings + Operating Lease Expenses - Depreciation on Leased Asset Adjusted Net Capital Expenditures = Net Capital Expenditures + Current year’s R&D expenses Amortization of Research Asset Adjusted Net Cap Ex = Net Capital Expenditures + Acquisitions of other firms - Amortization of such acquisitions GROWTH ESTIMATION – DIFFERENT MODELS Net Income - (1- δ) (Capital Expenditures - Depreciation) - (1- δ) Working Capital Needs = Free Cash flow to Equity δ = Debt/Capital Ratio Reinvestment Rate = Retained Earnings/ Current Earnings = Retention Ratio Return on Investment = ROE = Net Income/Book Value of Equity gEPS = Retained Earningst-1/ NIt-1 * ROE = Retention Ratio * ROE = b * ROE gEPS= b *ROEt+1 +(ROEt+1– ROEt) ROEt gEPS= b *ROEt+1 + (ROEt+1– ROEt)(BV of Equityt )/ ROEt (BV of Equityt) ROE = ROC + D/E (ROC - i (1-t)) BV of capital = BV of Debt + BV of Equity Reinvestment Rate = (Net Capital Expenditures + Change in WC)/EBIT(1-t) Return on Investment = ROC = EBIT(1-t)/(BV of Debt + BV of Equity) gEBIT = (Net Capital Expenditures + Change in WC)/EBIT(1-t) * ROC Expected Growth Rate = ROCt+1 * Reinvestment rate +(ROCt+1 – ROCt)/ROCt Value = Expected Cash Flow Next Period / (r - g) Stable Growth Payout Ratio = 1 - g/ ROE Reinvestment Rate = Growth in Operating Income/ROC Value of Bond = PV of coupons at market interest rate + PV of face value of bond at market interest rate RELATIVE VALUATION P0 DPS1 r gn P0 Payout Ratio * (1 g n ) PE = EPS0 r-g n Value Market Value of Equity + Market Value of Debt EBITDA Earnings before Interest, Taxes and Depreciation Enterprise Value Market Value of Equity + Market Value of Debt - Cash EBITDA Earnings before Interest, Taxes and Depreciation FCFF = EBIT (1-t) - (Cex - Depr) - Working Capital = (EBITDA - Depr) (1-t) - (Cex - Depr) - Working Capital = EBITDA (1-t) + Depr (t) - Cex - Working Capital Value = EBITDA (1 - t) + Depr (t) - Cex - Working Capital WACC - g Value (1 - t) Depr (t)/EBITDA CEx/EBITDA Working Capital/EB ITDA = + EBITDA WACC - g WACC - g WACC - g WACC - g Price/Book Value = P0 Market Value of Equity Book Value of Equity BV0 * ROE * Payout Ratio * (1 g n ) r-gn P0 ROE * Payout Ratio * (1 g n ) PBV = BV0 r-g n P0 ROE * Payout Ratio PBV = BV0 r-g n g = (1 - Payout ratio) * ROE P0 ROE - g n PBV = BV0 r-g n V0 = FCFF1 WACC - g V0 FCFF1/BV = BV WACC - g V0 ROC - g = BV WACC - g n Price/ Sales= Market Value of Equity Total Revenues P0 DPS1 r gn P0 Net Profit Margin * Payout Ratio * (1 g n ) PS = Sales 0 r-g n Value/ Sales= Market Value of Equity + Market Value of Debt-Cash Total Revenues MERGERS AND ACQUSITIONS Value of Control = Value of firm, with restructuring - Value of firm, without restructuring Value of Control = Value of Firm - Status Quo Value of Synergy = Value of Firm - Change of Control V(AB) > V(A) + V(B) the cause of synergy.