Regional Economic Integration

advertisement

Chapter 08 - Regional Economic Integration

Regional Economic Integration

Learning objectives

Be able to explain the different

levels of regional economic

integration.

Understand the economic and

political arguments for regional

economic integration.

Understand the economic and

political arguments against

regional economic integration.

Be familiar with the history,

current scope, and future

prospects of the world’s most

important regional economic

agreements.

Understand the implications for

business that are inherent in

regional economic integrations

agreements.

8

8

This chapter discusses regional economic integration,

agreements among countries within a geographic region to

achieve economic gains from the free flow of trade and

investment among themselves.

There are five levels of economic integration. In order of

increasing integration, they include free trade area,

customs union, common market, economic union, and full

political union.

Integration is not easily achieved or sustained. Although

integration brings benefits to the majority, it is never

without costs for the minority. Concerns over sovereignty

often slow or stop integration attempts.

The creation of single markets in the EU and North

America means that many markets that were formerly

protected from foreign competition are now more open.

This creates major investment and export opportunities for

firms within and outside these regions.

The free movement of goods across borders, the

harmonization of product standards, and the simplification

of tax regimes make it possible for firms based in a free

trade area to realize potentially enormous cost economies

by centralizing production in those locations within the

area where the mix of factor costs and skills is optimal.

8-1

Chapter 08 - Regional Economic Integration

OUTLINE OF CHAPTER 8: REGIONAL ECONOMIC INTEGRATION

Opening Case: The European Energy Market

Introduction

Levels of Economic Integration

The Case for Regional Integration

The Economic Case for Integration

The Political Case for Integration

Impediments to Integration

The Case Against Regional Integration.

Regional Economic Integration in Europe

Evolution of the European Union

Political Structure of the European Union

The Single European Act

The Establishment of the Euro

Enlargement of the European Union

Management Focus: The European Commission and Media Industry Mergers

Country Focus: Creating a Single European Market in Financial Services

Regional Economic Integration of the Americas

The North American Free Trade Agreement

The Andean Community

MERCOSUR

Central American Common Market, CAFTA and CARICOM

Free Trade Area of the Americas

Regional Economic Integration Elsewhere

Association of Southeast Asian Nations

Asia Pacific Economic Cooperation

Regional Trade Blocks in Africa

Implications for Managers

Opportunities

Threats

Chapter Summary

Closing Case: NAFTA and the U.S. Textile Industry

8-2

Chapter 08 - Regional Economic Integration

CLASSROOM DISCUSSION POINT

Choose either the European Union or the North American Free Trade Area, and then ask

students to think about what economic integration means for companies inside the bloc.

Then, ask students to consider economic integration from the perspective of a firm

outside the bloc.

Next, ask students to consider economic integration from the perspective of a consumer.

Try to organize student responses in a positive/negative chart on the board, and then at

the end of the discussion, ask students whether they would support economic integration

or not.

OPENING CASE: The European Energy Market

The opening case explores the effort by the European Union to create a single continentwide market for electricity and gas. The goal is to increase competition and lower prices

for consumers, however, so far, political opposition and the existing industry structure

have made this goal difficult to attain. Discussion of the case can revolve around the

following questions:

1. Why is the European Union eager to create a single continent-wide market for energy

and gas? What does the European Union hope to gain? How would such a market affect

producers? Would consumers benefit?

2. Discuss how the existing industry structure in the European electricity and gas market

is making it more challenging to move toward a single continent-wide market. What

changes need to occur for the European Union to achieve its goal?

3. Some politicians have slowed efforts to create a single continent-wide electricity and

gas market. Why are the politicians concerned? Are the issues they raise valid?

LECTURE OUTLINE

This lecture outline follows the Power Point Presentation (PPT) provided along with this

instructor’s manual. The PPT slides include additional notes that can be viewed by

clicking on “view”, then on “notes”. The following provides a brief overview of each

Power Point slide along with teaching tips, and additional perspectives.

8-3

Chapter 08 - Regional Economic Integration

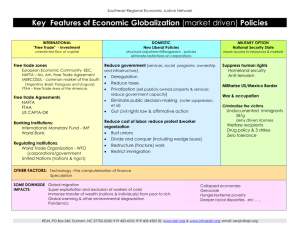

Slide 8-3 Introduction

Regional economic integration refers to agreements between countries in a geographic

region to reduce tariff and nontariff barriers to the free flow of goods, services, and

factors of production between each other.

Despite the rapid spread of regional trade agreements designed to promote free trade,

there are those who fear that the world is moving toward a situation in which a number of

regional trade blocks compete against each other. In this scenario of the future, free trade

will exist within each bloc, but each bloc will protect its market from outside competition

with high tariffs.

Slides 8-4-8-7 Levels of Economic Integration

The five levels of economic integration are: free trade area, customs union, common

market, economic union, and political union.

The most enduring free trade area in the world is the European Free Trade Association. EFTA

currently joins four countries-Norway, Iceland, Liechtenstein, and Switzerland. Other free trade

areas include the North American Free Trade Agreement (NAFTA).

Another Perspective: A site with information and additional links on NAFTA is available

at: {http://www.fas.usda.gov/itp/Policy/NAFTA/nafta.asp}. The site includes

downloadable power point presentations on the benefits of NAFTA

Another Perspective: To find out more about EFTA, go to {http://www.efta.int/}, and

click on “EFTA AELE”. From here you can click on several icons to get quick facts,

more in- depth reports, information on the European Economic Area, and many other

issues related to EFTA.

Customs unions around the world include the current version of the Andean Pact

(between Bolivia, Columbia, Ecuador and Peru).

Currently, MERCOSUR, the South America grouping that includes Brazil, Argentina,

Paraguay, and Uruguay, is aiming to eventually establish itself as a common market.

The European Union (EU) is an economic union, although an imperfect one since not all

members of the EU have adopted the euro, the currency of the EU, and differences in tax

rates across countries still remain.

Slide 8-10 The Economic Case for Integration

Regional economic integration can be seen as an attempt to achieve additional gains from

the free flow of trade and investment between countries beyond those attainable under

international agreements such as the WTO.

8-4

Chapter 08 - Regional Economic Integration

Slide 8-11 The Political Case for Integration

The political case for integration has two main points: 1) by linking countries together,

making them more dependent on each other, and forming a structure where they regularly

have to interact, the likelihood of violent conflict and war will decrease, and 2) by linking

countries together, they have greater clout and are politically much stronger in dealing

with other nations.

Slide 8-12 Impediments to Integration

There are two main impediments to integration:

although a nation as a whole may benefit significantly from a regional free trade

agreement, certain groups may lose

concerns over national sovereignty

Slide 8-13 The Case Against Regional Economic Integration

Whether regional integration is in the economic interests of the participants depends upon

the extent of trade creation as opposed to trade diversion. Trade creation occurs when

low cost producers within the free trade area replace high cost domestic producers. Trade

diversion occurs when higher cost suppliers within the free trade area replace lower cost

external suppliers. A regional free trade agreement will only make the world better off if

the amount of trade it creates exceeds the amount it diverts.

Slides 8-15-8-16 Regional Economic Integration in Europe

There are two trade blocks in Europe:

the European Union (EU)

the European Free Trade Association

The EU is by far the more significant, not just in terms of membership, but also in terms

of economic and political influence in the world economy.

8-5

Chapter 08 - Regional Economic Integration

Slide 8-17 Evolution of the European Union

The EU is the product of two political factors:

the devastation of two world wars on Western Europe and the desire for a lasting

peace

the European nations’ desire to hold their own on the world’s political and

economic stage.

The forerunner of the EU was the European Coal and Steel Community, which had the

goal of removing barriers to trade in coal, iron, steel, and scrap metal formed in 1951.

The EEC was formed in 1957 at the Treaty of Rome. While the original goal was for a

common market, progress was generally very slow.

Another Perspective: The EU web site is {http://europa.eu.int/index-en.htm}. The site

contains a broad array of information about the historical role and current activities of the

EU in the global economy.

Slide 8-18 Political Structure of the European Union

The five main institutions of the EU are:

the European Council (resolves major policy issues and sets policy directions)

the European Commission (responsible for implementing aspects of EU law and

monitoring member states to ensure they are complying with EU laws)

the Council of the European Parliament, (the ultimate controlling authority

within the EU)

the European Parliament, (debates legislation proposed by the commission and

forwarded to it by the council)

the Court of Justice, (the supreme appeals court for EU law).

Slide 8-19 The Single European Act

The Single European Act called for the removal of border controls, mutual recognition

of standards, open public procurement, a barrier free financial services industry, no

currency exchange controls, free and open freight transport, and freer and more open

competition.

8-6

Chapter 08 - Regional Economic Integration

Slides 8-22-8-24 The Establishment of the Euro

The Treaty of Maastricht, signed in 1991, committed the EU to adopt a single currency,

the euro, by January 1, 1999. The euro is used by 12 of the 27 member states. By

adopting the euro, the EU has created the second largest currency zone in the world after

that of the U.S. dollar.

Since its establishment January 1, 1999, the euro has had a volatile trading history with

the U.S. dollar. Initially, the currency fell in value relative to the dollar, but has since

strengthened.

Another Perspective: The European Union has a web page devoted to the euro

{http://ec.europa.eu/economy_finance/euro/our_currency_en.htm}. Students can explore

the site and click on the pages to see pictures of the coins and notes, the advantages of

participating in the euro zone, and frequently asked questions about the euro.

Another Perspective: The European Central Bank maintains a web site with current

information on the euro. The site is available at {http://www.euro.ecb.int/}.

Slide 8-26 Enlargement of the European Union

Several countries, particularly from Eastern Europe, have applied for membership in the

EU. In December of 2002, the EU formally agreed to accept the applications of 10

countries, and they joined on May 1, 2004. Today, membership is up to 27 countries.

Slide 8-27 Regional Economic Integration in the Americas

The North American Free Trade Agreement (NAFTA) is the most significant attempt at

economic integration in the Americas. Other efforts include the Andean group and

MERCOSUR. In addition, there are plans to establish a hemisphere wide Free Trade Area of

the Americas (FTAA.)

Slides 8-28-8-33 The North American Free Trade Agreement

The free trade agreement between the United States, Canada, and Mexico became law

January 1, 1994.

Another Perspective: The NAFTA Homepage can be accessed at

{http://www.mac.doc.gov/nafta/}.

Following approval of NAFTA by the U.S. Congress a number of other Latin American

countries indicated their desire to eventually join NAFTA. Currently the governments of

both Canada and the U.S. are adopting a wait and see attitude with regard to most

countries.

8-7

Chapter 08 - Regional Economic Integration

Another Perspective: Many organizations are anxious to take advantage of the

opportunities offered by NAFTA. The NAFTA Register

{http://www.naftaregister.com/}is a directory of export management companies, export

service providers, and trading companies that want to profit from NAFTA by helping

buyers and selling take advantage of NAFTA related opportunities.

Another Perspective: An interesting analysis of NAFTA after 10 years is available at

{http://www.ustr.gov/assets/Trade_Agreements/Regional/NAFTA/asset_upload_file606_

3595.pdf}.

Slide 8-34 The Andean Community

The Andean Pact, originally formed in 1969, was based on the EU model, but was far less

successful in achieving its stated goals. In 1990, the Andean Pact was relaunched, and now

operates as a customs union.

Another Perspective: To see new developments with the Andean Community go to

{http://www.comunidadandina.org/endex.htm}.

Slide 8-35 MERCOSUR

In some industries MERCOSUR is trade diverting rather than trade creating, and local

firms are investing in industries that are not competitive on a worldwide basis.

Another Perspective: MERCOSUR's Homepage, which includes a broad array of useful

information, can be accessed at {http://www.sice.oas.org/trade/mrcsr/mrcsrtoc.asp}.

Another Perspective: Information of the EU’s relations with MERCOSUR can be found

at {http://europa.eu.int/comm/external_relations/mercosur/intro/}.

Slide 8-36 Central American Common Market and CARICOM

There are two other trade pacts in the America, the Central American Trade Market and

CARICOM, although neither has made much progress as yet.

Slide 8-37 Free Trade of the Americas

If the FTAA is established, it will have major implications for cross-border trade and

investment flows within the hemisphere. The FTAA would create a free trade area of

nearly 800 million people.

Another Perspective: Additional information on the Free Trade of the Americas can be

found at

{http://www.ftaa-alca.org/alca_e.asp}.

8-8

Chapter 08 - Regional Economic Integration

Slide 8-38 Regional Economic Integration Elsewhere

Several efforts have been made to integrate in Asia and Africa

One of the most successful is the Association of Southeast Asian Nations (ASEAN)

Slides 8-39-8-40 Association of Southeast Asian Nations

Formed in 1967, ASEAN currently includes Brunei, Indonesia, Malaysia, the Philippines,

Singapore, Thailand, and, most recently, Vietnam, Myanmar, Laos, and Cambodia. The

basic objectives of ASEAN are to foster freer trade between member countries and to

achieve some cooperation in their industrial policies.

Slides 8-41-8-42 Asia Pacific Cooperation

APEC currently has 21 members including such economic powerhouses as the United

States, Japan, and China. The stated aim of APEC is to increase multilateral cooperation

in view of the economic rise of the pacific nations and the growing interdependence

within the region.

Another Perspective: For more on APEC, go to its web site at

{http://www.apecsec.org.sg/}.

Slide 8-43 Regional Trade Blocks in Africa

There are nine trade blocs on the African continent, however progress toward the

establishment of meaningful trade blocs has been slow.

Slide 8-44 Implications for Managers

The EU and NAFTA currently have the most immediate implications for business.

Slide 8-45 Opportunities

The greatest implication for MNEs is that the free movement of goods across borders, the

harmonization of product standards, and the simplification of tax regimes, makes it possible for

them to realize potentially enormous cost economies by centralizing production in those locations

where the mix of factor costs and skills is optimal. By specialization and shipping of goods

between locations, a much more efficient web of operations can be created.

8-9

Chapter 08 - Regional Economic Integration

Slide 8-46 Threats

Just as the emergence of single markets in the EU and North America creates

opportunities for business, so it also presents a number of threats.

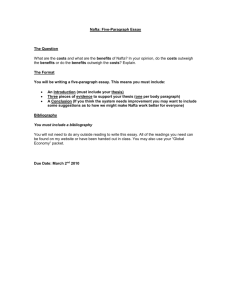

CRITICAL THINKING AND DISCUSSION QUESTIONS

QUESTION 1: NAFTA has produced significant benefits for the Canadian, Mexican and

US economy. Discuss.

ANSWER 1: NAFTA’s proponents argue that the agreement should be viewed as an

opportunity to create an enlarged and a more productive base for the U.S., Canada, and

Mexico. As low-income jobs move from Canada and the United States to Mexico, the

Mexican economy should be strengthened giving Mexico the ability to purchase highercost American and Canadian products. The net effect of the lower income jobs moving

to Mexico and Mexico increasing its imports of high quality American and Canadian

goods should be positive for the American and Canadian economies. In addition, the

international competitiveness of United States and Canadian firms that move production

to Mexico to take advantage of lower labor costs will be enhanced, enabling them to

better compete with Asian and European rivals.

QUESTION 2: What are the economic and political arguments for regional economic

integration? Given these arguments, why don't we see more integration in the world

economy?

ANSWER 2: The economic case for regional integration is straightforward. As we saw in

Chapter 5, unrestricted free trade allows countries to specialize in the production of goods

and services that they can produce most efficiently. If this happens as the result of

economic integration within a geographic region, the net effect is greater prosperity for

the nations of the region. From a more philosophical perspective, regional economic

integration can be seen as an attempt to achieve additional gains from the free flow of

trade and investment between countries beyond those attainable under international

agreements such as the WTO. The political case for integration is also compelling.

Linking neighboring economies and making them increasingly dependent on each other

creates incentives for political cooperation between neighboring states. Also, the

potential for violent conflict between the states is reduced. In addition, by grouping their

economies together, the countries can enhance their political weight in the world.

Despite the strong economic and political arguments for integration, it has never been

easy to achieve (on a meaningful level). There are two main reasons for this. First,

although economic integration benefits the majority, it has its costs. While a set of

nations as a whole may benefit significantly from a regional free trade agreement, certain

groups may loose. The second impediment to integration arises from concerns over

national sovereignty.

8-10

Chapter 08 - Regional Economic Integration

QUESTION 3: What effect is the creation of a single market and a single currency

within the EU likely to have on the competition within the EU? Why?

ANSWER 3: By creating a single market and currency, member countries can expect

significant gains from the free flow of trade and investment. This will result from the

ability of the countries within the EU to specialize in the production of the product that

they manufacture the most efficiently, and the freedom to trade those products with other

EU countries without being encumbered by tariffs and other trade barriers. In terms of

competition, the competition between European firms will increase. Some of the most

inefficient firms may go out of business because they will no longer be protected from

other European companies by high tariffs, quotas, or administrative trade barriers.

Companies from those countries that have not adopted the euro may find that their costs

are higher as they deal with currency exchanges. In addition, because it will be easier to

compare prices across markets, firms in the euro zone will be pushed to lower prices and

become more efficient.

QUESTION 4: Do you think it is correct for the European Commission to restrict

mergers between American companies that do business in Europe? (For example, the

European Commission vetoed the proposed merger between WorldCom and Sprint, both

U.S. companies, and it carefully reviewed the merger between AOL and Time Warner,

again both U.S. companies).

ANSWER 4: Many students will probably suggest that the European Commission has a

right to regulate the European market, even if the regulation involves American

companies. Students taking this perspective will probably suggest that such restrictions

should be made independently of other considerations, even when the parent

governments of the companies have approved the mergers. Other students however, may

argue that the European Commission does not have the right to restrict a merger that has

been approved by parent governments. In doing so, the European Commission is in

effect protecting domestic companies from foreign competition, and violating the spirit of

the WTO.

QUESTION 5: How should a US firm that currently exports to only ASEAN countries

respond to the creation of a single market in this regional grouping?

ANSWER 5: A US business firm that is currently exporting to only ASEAN countries

should seriously consider opening a facility somewhere in this grouping, as the

economics of a common market suggest that outsiders can be at a disadvantage to

insiders. The opening of borders within ASEAN also has the potential to increase the

size of the market for the firm. Of course it is possible, after careful consideration, that

exporting may still be the most appropriate means of serving the market.

8-11

Chapter 08 - Regional Economic Integration

QUESTION 6: How should a firm with self-sufficient production facilities in several

ASEAN countries respond to the creation of a single market? What are the constraints on

its ability to respond in a manner that minimizes production costs?

ANSWER 6: The creation of the single market means that it may no longer be efficient

to operate separate duplicative production facilities in each country. Instead, the facilities

could either be linked so that each specializes in the production of only certain items or

several sites should be closed down and production consolidated at the most efficient

locations. Existing differences between countries as well as the need to be located near

important customers may limit a firm’s ability to fully consolidate or relocate production

facilities for production cost reasons. Minimizing production costs is only one of many

objectives. For example, location of production near R&D facilities can be critical for

new product development. The location decision needs to examine long run economic

success, not just cost minimization.

QUESTION 7: After a promising start, MERCOSUR, the major Latin American trade

agreement, has faltered and made little progress since 2000. What problems are hurting

MERCOSUR? What can be done to solve these problems?

ANSWER 7: MERCOSUR originated in 1988 as a free trade pact between Brazil and

Argentina. The pact was expanded in 1990 to include Paraguay and Uruguay with goal

of becoming a full free trade area by 1994, and a common market sometime after. While

initially considered a success, critics began to question whether the trade diversion effects

of MERCOSUR outweighed it trade creation effects. Then, in 1998 member states

slipped into a recession and in 1999, Brazil’s financial crisis led to a significant

devaluation of its currency creating further turmoil. Finally, in 2001, Argentina beset by

economic stresses asked that the customs union be temporarily suspended, effectively

ending MERCOSUR’s quest to become a fully functioning customs union. However, in

2003, Brazil’s new president announced his support for a revitalized and expanded

MERCOSUR that would be modeled after the EU.

Another Perspective: Students can check the current status of the agreement online

{http://www.sice.oas.org/trade/mrcsr/mrcsrtoc.asp}.

To solve the problems of MERCOSUR, the countries should reduce or eliminate high

tariffs on products that can be produced more efficiently in other parts of the world. It

should strive to develop industries in which it has a comparative advantage and direct its

financial resources to those industries. Finally, it should begin to develop an economy

that fosters the free flow of trade and goods throughout the region.

QUESTION 8: Would the establishment of a Free Trade Area of the America’s (FTAA)

in 2005 be good for the two most advanced economies in the hemisphere, the United

States and Canada? How might the establishment of FTAA impact the strategy on North

American firms?

8-12

Chapter 08 - Regional Economic Integration

ANSWER 8: In 1994, a Free Trade of the Americas (FTAA) was proposed. If the

agreement comes about, it would effectively create a free trade area of nearly 800 million

people responsible for more than $12 trillion in GDP in 2003. However, the U.S., while

initially a strong advocate of the agreement, has lessened its support for the FTAA

recently. The question of whether the agreement is good for the U.S. and Canada will

likely produce a lively debate among students.

QUESTION 9: Reread the Management Focus case on the European Commission and

Media Industry Mergers, then answer the following questions:

a) Given that both AOL and Time Warner were U.S. based companies, do you think the

European Commission had a right to review and regulate their planned merger?

b) Were the concessions extracted by the European Commission from AOL and Time

Warner reasonable? Whose interests was the Commission trying to protect?

c) What precedent do the actions of the European Commission in this case set? What are

the implications for managers of foreign enterprises with substantial operations in

Europe?

ANSWER 9: a) This question deals with the delicate issue of just how far a country can

extend the reach of its law, and should set the stage for a good debate. While some

students will argue that the European Commission is overstepping its boundaries by

restricting mergers between American companies doing business in Europe, other

students will recognize that the U.S. might act in a similar fashion if American firms

were being threatened by foreign companies seeking to merge and operate in the U.S.

market.

b) Time Warner and EMI, bowing to pressure from the European Commission, agreed to

drop their joint venture plans after the European Commission raised concerns about the

size of a jointly owned company, which would have been three times that of the next

largest competitor. According to the European Commission, the joint venture would

have too much market power. The European Commission’s goal was to preserve a

competitive market for consumers. A similar situation existed with the Time Warner

AOL deal, which if approved would dominate the emerging market for downloading

music over the Internet. The companies involved had little choice in the matter, if they

wanted to operate in the European market, they had to follow the rules.

c) Some students will argue that the European Commission had no right to become

involved in the business decisions of the companies, especially the ones from the United

States. Others however, will probably note that one of the roles of the European

Commission is to preserve a fair market system that protects consumers. In this

particular case, that meant that the deals had to be blocked.

8-13

Chapter 08 - Regional Economic Integration

CLOSING CASE: NAFTA and the U.S. Textile Industry

The closing case explores the effect of NAFTA on the U.S. textile industry. Prior to the

signing of the NAFTA agreement, many concerns were raised regarding the potential for

a significant loss of jobs in the American textile industry. Indeed, between 1994 and

2004, employment in the U.S. textile industry fell from about 858,000 to 296,000.

However, at the same time, U.S. consumers have enjoyed lower clothing prices and U.S.

fabric and yarn makers have seen a boost in their exports to Mexico. Discussion of the

case can revolve around the following questions

QUESTION 1: Why did many textile jobs apparently migrate out of the United States in

the years after the establishment of NAFTA?

ANSWER 1: Between 1994 and 2004, despite strong and growing demand by American

consumers, U.S. apparel production fell by 40 percent and textile production fell by 20

percent. The cuts in production led to significant job losses, with employment in textile

mills falling from 478,000 to 239,000, and apparel employment dropping from 858,000

to just 296,000.

QUESTION 2: Who gained from the process of readjustment in the textile industry after

NAFTA? Who lost?

ANSWER TWO: Thanks to NAFTA and the cheaper labor available in Mexico, American

consumers have watched prices on clothing fall. Designer jeans, for example, fell from

about $55 in 1994 to about $48 today. For consumers, this means more money to spend

on other items. However, while many consumers may be happy about the shift in apparel

production from the United States to Mexico, some consumers may have been one of the

unlucky individuals who also saw their job move to Mexico. With any luck, those

individuals were able to find a new job as a yarn maker, and are now benefiting from the

increase in U.S. yarn exports. Companies that were able to take advantage of larger

markets and cheaper labor were also beneficiaries of this agreement. However, some

companies probably saw their profits drop as competition from companies producing in

Mexico increased. Certainly, gains were made by the newly employed Mexican textile

workers and the companies they worked for.

QUESTION 3: With hindsight, do you think it is better to protect vulnerable industries

such as textiles, or let them adjust to the painful winds of change that follow entering into

free trade agreements? What would the benefits of protection be? What would the costs

be?

8-14

Chapter 08 - Regional Economic Integration

ANSWER 3: Trade theory suggests that free trade benefits all countries because it allows

countries to specialize in what they do best and trade for everything else. However, the

theory does not consider the painful adjustment that may need to occur before the

benefits of free trade can be fully realized. For displaced workers, NAFTA is probably

viewed quite negatively. However, workers who were able to increase their skill base

may not actually be better off than they were prior to NAFTA. Certainly, it would seem

that consumers are better off with free trade. Many students may come to the conclusion

that for countries to remain competitive today, economic integration is a necessary,

though sometimes painful, process.

Another Perspective: Students can access a wealth of information on NAFTA at

{http://www.ustr.gov/Trade_Agreements/Regional/NAFTA/Section_Index.html}. Students can

explore NAFTA in more depth by clicking on the various icons that provide information on

NAFTA after 5 years, and after 10 year. There is also a report on textiles that links directly to

this feature.

INTEGRATING iGLOBES

There are several iGLOBE video clips that can be integrated with the material presented

in this chapter. In particular, you might consider the following:

Title: Revisiting Coverage of NAFTA

Abstract: This video explores the effect of NAFTA on a small town in Alabama.

Key Concepts: NAFTA, globalization, free trade, manufacturing, foreign direct

investment

Notes: In Autaugaville, Alabama life has changed since the passage of NAFTA. In 1993,

238 residents of the tiny town worked at Crystal Lake Manufacturing making brooms.

Today, that number has dwindled to just 100. Founded in the 1930s, Crystal Lake

Manufacturing initially provided jobs to tenant farmers who had been displaced by

mechanization. Sixty years later, many of the company’s employees were the

descendants of the sharecroppers. When Congress considered the passage of NAFTA,

residents spoke out against the agreement fearing that their jobs would be lost to Mexico.

Workers at the Alabama plant earned $9 per hour, while Mexican labor cost about a

dollar an hour. Today, two-thirds of the broom-making jobs have disappeared, and those

that remain have changed dramatically.

8-15

Chapter 08 - Regional Economic Integration

Crystal Lake Manufacturing has shifted its production process from a more laborintensive method to one that involves very little skill. It is cheaper now for the company

to buy pre-assembled broom heads from China, and handles from Honduras, and then

assemble the product at the Crystal Lake Manufacturing facility. Interestingly, displaced

workers have been able to find new jobs. Thanks to NAFTA, Alabama, like Mexico, is

luring jobs from the northern part of the U.S. In addition, many large foreign automakers

have built plants in Alabama. The automakers are attracted to the region because of its

lower cost of doing business. In fact, Alabama has actually become more productive

since the passage of NAFTA. The state now exports peanuts to Canada and beef to

Mexico. The state even boasts an unemployment rate well below the national average.

Still, critics of the agreement remain. Some say that economic inequality in America has

grown as a result of the passage of NAFTA, that the rich have gotten richer and the poor

poorer. They argue that while unemployment in Alabama is only 3 percent, many

workers who might have continued working at Crystal Lake Manufacturing or other

companies like it, have simply dropped out of the workforce entirely and so contribute to

a misleading picture of the state’s true unemployment rate. Concerns arise too about the

magnitude of profits made in America that are now earned by foreign companies, and

what little share is left over for the local market.

Discussion Questions:

1. Discuss the controversy over the passage of NAFTA. Were the fears of those who

opposed the passage of the agreement real at the time? As a worker at the Crystal Lake

Manufacturing plant in the early 1990s would you have been opposed to NAFTA? Why

or why not?

2. Over a decade has passed since the ratification of NAFTA. Was there any merit in the

arguments against the passage of NAFTA? Has the agreement brought the benefits to

Americans that were promised?

3. Consider the irony of Alabama’s situation. While workers in the state were opposed to

seeing NAFTA pass because of the potential loss of jobs to Mexico, the state has now

lured manufacturing from northern states to Alabama creating the very same job loss in

the northern states that Mexico was expected to create in Alabama. Should workers in

northern states protest against the southern states or is the loss of jobs to the north

different because it all takes place within the country. Would a worker in the north agree

with your opinion? Why or why not?

4. Several large, foreign automakers have moved to Alabama providing attractive jobs to

residents. What are the dangers of relying on foreign companies to support a local

economy? Do the foreign companies have any responsibility toward the state of

Alabama?

8-16

Chapter 08 - Regional Economic Integration

INTEGRATING VIDEOS

There are also several longer video clips that can be integrated with the material

presented in this chapter. In particular, you might consider the following:

Title 8: U.S. Farmers Respond to CAFTA

Notes: According to American sugar farmers, the proposed Central American Free Trade

Agreement (CAFTA) which is intended to liberalize trade with five Central American

nations and the Dominican Republic, will be a disaster. Other farmers, such as corn and

dairy farmer Duane Alberts, are in full support of the proposed agreement and the larger

market of an additional 44 million consumers it promises. But, for sugar farmers such as

Marc Olson, CAFTA could spell the end to a way of life. Unlike most U.S. farmers,

sugar farmers are not directly subsidized by the government. Instead, sugar imports are

sharply limited, keeping prices higher in the domestic market. Passing the CAFTA

agreement would result in falling trade barriers, and increased sugar imports.

According to Olson, U.S. producers cannot compete with other countries where farmers

receive government subsidies. He notes that even though U.S. producers are among the

most efficient in the world, if CAFTA passes, foreign producers, thanks to the subsidies,

will be in a position to dump sugar on the U.S. market and eventually drive 140,000

Americans who depend on sugar out of their jobs. The Bush Administration argues that

the sugar producers are overstating their case, that the negative effect of CAFTA would

be much smaller. But some lawmakers remain unconvinced of the benefits of the

agreement. Republican Gil Gutknecht from Rochester for example, a self-proclaimed

free trader, believes the jury is still out on CAFTA, but that if NAFTA is anything to go

by, then the proposed agreement would certainly not help farmers. So, for now, farmers

will continue to plead their cases with lawmakers, hoping that their side of the debate

wins.

Discussion Guide:

1. Discuss how Adam Smith and/or David Ricardo might view CAFTA? Would Michael

Porter look at the agreement any differently?

2. According to farmers, some 140,000 people are employed by the sugar industry, would

eventually lose their livelihood if CAFTA, and other agreements went into effect. Yet,

CAFTA spells promise for pork and diary farmers. How can the needs of these two

related, yet very divided groups be met?

3. American sugar producers are among the most efficient in the world, yet would stand

to lose if CAFTA is passed. Reflect on this scenario. According to the basic theory of

comparative advantage, American farmers ought to be producing and exporting sugar.

Should the U.S. remove its import barriers to sugar, yet allow direct subsidies to sugar

producers in other countries remain? Should the U.S. subsidize American producers?

8-17

Chapter 08 - Regional Economic Integration

4. Free trade advocates believe Americans are paying too much for sugar thanks to the

barriers limiting cheaper imports. If CAFTA passes, what will be the effect for American

consumers? Will they really see a substantial benefit from the agreement? Why or why

not?

globalEDGE™ Exercise Questions

Use the globalEDGE™ site {http://globalEDGE.msu.edu/} to complete the following

exercises:

Exercise 1

Your company is considering an expansion by opening new customer representative and

sales offices in the European Union (EU). Nevertheless, the size of the investment is

significant and top management wishes to have a clearer picture of the current and

probable future status of the EU. A colleague who spent some time living in the EU

indicated that Eurostat might be a comprehensive source to assist in your project.

Prepare an executive summary describing the features you consider as crucial in making

such a decision.

Exercise 2

Trade agreements can impact the cultural interactions between countries. In fact, the

establishment of the Free Trade Area of the Americas (FTAA) can be considered a threat

as well as an opportunity for your company. Identify the countries participating in

negotiations for the FTAA. What are the main themes of the negotiation process?

Answers to Exercises

Exercise 1

A variety of reports and statistics can be accessed by searching the term “Eurostat” at

{http://globaledge.msu.edu/ResourceDesk/}. At the bottom of the linked Eurostat

webpage are a series of publications, tables, and data that are useful for completing this

exercise. Be sure to check the “Resource Desk only” checkbox of the search function on

the globalEDGE website.

Search Phrase: “Eurostat”

Resource Name: EUROPE: Eurostat

Website:

{http://epp.eurostat.ec.europa.eu/portal/page?_pageid=1090,30070682,1090_33076576&

_dad=portal&_schema=PORTAL}

globalEDGE™ Category: “Research: Statistical Data Sources”

8-18

Chapter 08 - Regional Economic Integration

Exercise 2

The Free Trade Area of Americas website can be accessed by searching the term

“FTAA” at {http://globaledge.msu.edu/ResourceDesk/}. This resource is found under

the globalEDGE category “Research: Organizations”. Be sure to check the “Resource

Desk only” checkbox of the search function on the globalEDGE website.

Search Phrase: “FTAA”

Resource Name: AMERICA: Free Trade Area of the Americas

Website: {http://www.ftaa-alca.org}

globalEDGE™ Category: “IB Topics: Regional Trade Agreements” or “Trade: Trade

Portals”

8-19