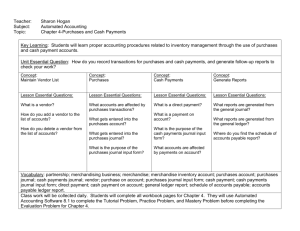

Chapter 9 Notes

advertisement

Chapter 9: Journalizing Purchases and Cash Payments 9.1—Journalizing Purchases Using a Purchases Journal Merchandise—goods that a business purchases to sell Merchandising Business—a business that purchases and sells goods Retail Merchandising Business—a merchandising business that sells to those who use or consume the goods Wholesale Merchandising Business—a business that buys and resells merchandise to retail merchandising businesses Vendor—a business from which merchandise is purchased or supplies or other assets are bought Forming a Corporation (read page 234, do questions #1-2) The Hobby Shack, Inc (read page 235) Corporation Stock holders Continue beyond her lifetime Special Journals Business with limited daily transactions may use one journal, but those with more use special journals Special Journal—journal used to record only one kind of transaction o Purchases Journal—for all purchases of merchandise on account o Cash Payments Journal—for all cash payments o Sales Journal—for all sales of merchandise on account o Cash Receipts Journal—for all cash receipts o General Journal—for all other transactions Purchasing Merchandise Cost of Merchandise—price a business pays for goods it purchases to sell o Markup—amount added to the cost of merchandise to establish the selling price Must add something on top of cost of merchandise to make a profit o Purchases Account Account used for recording the cost of merchandise Cost account Temporary account Normal debit balance Record only cost of merchandise purchased (not supplies, etc.) o Historical Cost—accounting concept applied when the actual amount paid for merchandise or other items bought is recorded o Purchase on Account—transaction in which the merchandise purchased is to be paid for later Accounts Payable Account Those with only a few accounts may keep separate ledger accounts for each business, but larger businesses summarize all vendors on one account Normal credit balance Purchases Journal Purchases Journal—special journal used to record only purchases of merchandise on account o only for those purchases on account, not cash purchases Each on account purchase is recorded on one line: o Date o Account Credited o Purchase invoice number o Post reference o Purchases debit/accounts payable credit (same amount, same accounts) Purchase Invoice—invoice used as a source document for recording a purchase on account transaction o Vendor fills out when we purchase on account, includes: Quantity of item Description of item Price of each item Total amount of invoice o What to do when receive invoice: 1. Stamp the date received and Hobby Shack’s purchase invoice number in the upper right corner a. Date—date received by Hobby Shack, not to be confused with invoice date b. Purchase Invoice Number—number assigned by Hobby Shack, not to be confused with the invoice number from the vendor 2. Place a check mark by each of the amounts in the Total column to show that the items have been received and the amounts have been checked and are correct. 3. The person who checked the invoice should initial below the total amount. 4. Review the vendors terms. a. Terms of Sale—an agreement between a buyer and a seller about payment of merchandise i. Example: 30 days means we have 30 days to pay Purchasing Merchandise on Account November 2. Purchased merchandise on account from Crown distributing, $2,039. Purchase Invoice No. 83. 1) Date: November 2, 2009 2) Account Credited: Crown Distributing 3) Purchase Invoice Number: 83 4) Purchases Dr. Accounts Pay. Cr.: $2,039. Totaling and Ruling a Purchases Journal Rule journal at the end of each month 9.2—Journalizing Cash Payments Using a Cash Payments Journal Cash Payments Journal Cash Payments Journal—a special journal used to record only cash payment transactions Date Account Title Ck. No. Post. Ref. General Amount Columns—columns not headed with an account title o General Debit/Credit Special Columns: o Accounts Payable Debit For receiving cash on account o Purchases Discount Credit Normally pay amount shown on purchase invoice, but to encourage customers to pay early, vendors offer a discount Cash Discount—a deduction that a vendor allows on the invoice amount to encourage prompt payment Purchases Discount—a cash discount on purchases taken by a customer o When discount is taken, we pay less than amount recorded in the purchases account o Cash Credit Cash Payment of an Expense Transaction o Debit—Expense o Credit—Cash Cash Payments for Purchases Not all vendors allow purchases on account, so therefore we must pay some vendors before shipment can be made List Price—the retail price listed in a catalog or on an Internet site Trade Discount—a reduction in the list price granted to customers o List Price – Trade Discount = Invoice Amount o Do not record this discount Transaction o Debit—Purchases o Credit—Cash Cash Payments on Account with Purchases Discounts Cash Discount o Stated as a percentage deducted from the invoice amount o Example: 2/10, n/30 (two ten net thirty) 2/10 = 2% can be deducted if the invoice is pad within 10 days of invoice date n/30 = total invoice amount must be paid within 30 days o Purchases Discount account Contra account—an account that reduces a related account on a financial statement Purchases Discount is a contra account to Purchases Is also in the Cost of Merchandise division of the general ledger Normal Credit Balance (opposite that of Purchases) Record this discount Transaction o Debit—Accounts Payable o Credit—Purchases Discount o Credit—Cash Cash Payments on Account Without Purchase Discounts Full amount paid, because discount not offered or business does not have cash to take discount Transaction o Debit—Accounts Payable o Credit—Cash 9.3—Performing Additional Cash Payments Journal Operations Petty Cash When replenishing the petty cash fund, fill out a petty cash report. Errors may be made when making payments from the petty cash fund. Errors are: o Cash Short—petty cash on hand amount that is less than a recorded amount o Cash Over—petty cash on hand amount that is more than a recorded amount Steps to fill out: 1. Date 2. Fund total (from general ledger) 3. List payments by account, with amounts 4. Find total payments 5. Find Recorded Amount on Hand (Fund Total – Total Payments) 6. Record Actual Amount on Hand 7. Find difference between actual and recorded 8. Find amount to replenish 9. Record in journal Transaction: o Cash Short—Debit (Actual < Recorded) o Cash Over—Credit (Actual > Recorded) Totaling, Proving, and Ruling a Cash Payments Journal Page Total and prove a page when it is filled and at the end of the month. Carried Forward at bottom of page, Brought Forward to top of next page. 9.4—Journalizing Purchases and Cash Payments General Journal Not all transactions can be recorded in a special journal—use General Journal. Memorandum for Buying Supplies on Account When we buy supplies on account, we receive a purchase invoice from the vendor, but to avoid confusion and mistakes, we attach a memo that will serve as the source document. Buying Supplies on Account November 6. Bought store supplies on account form Gulf Craft Supply, $210.00. Memorandum No. 52. Transaction: o Debit—Supplies o Credit Accounts Payable (/Vendor Name) Debit Memorandum for Purchases Returns and Allowances Purchases Return—credit allowed for the purchase price of returned merchandise, resulting in a decrease in the customer’s accounts payable. o When the merchandise is inferior in quality or damaged—and is returned. Purchases Allowance—credit allowed for part of the purchase price of merchandise that is not returned, resulting in a decrease in the customer’s accounts payable. o When the merchandise is damage and still useable or is of a different quality—and is kept for a discounted price. Debit Memorandum—a form prepared by the customer showing the price deduction taken by the customer for returns and allowances. Transaction: o Debit—Accounts Payable/Vendor Name o Credit—Purchases Returns and Allowances