Additional Lease Disclosures

advertisement

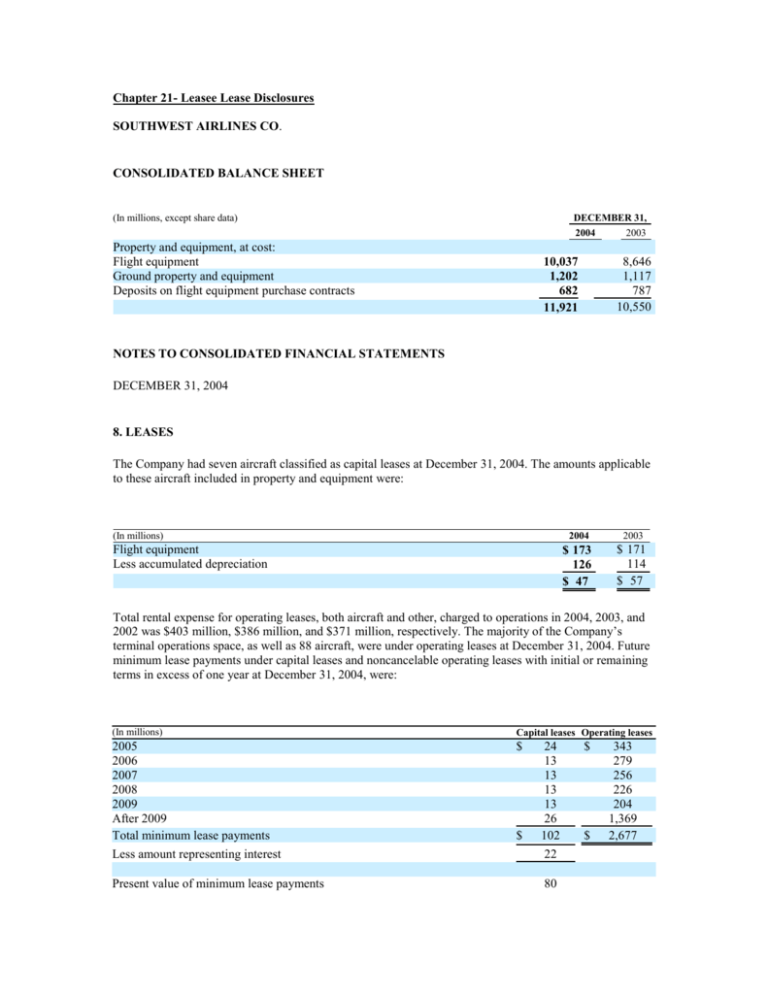

Chapter 21- Leasee Lease Disclosures SOUTHWEST AIRLINES CO. CONSOLIDATED BALANCE SHEET (In millions, except share data) DECEMBER 31, 2004 Property and equipment, at cost: Flight equipment Ground property and equipment Deposits on flight equipment purchase contracts 2003 8,646 1,117 787 10,550 10,037 1,202 682 11,921 NOTES TO CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2004 8. LEASES The Company had seven aircraft classified as capital leases at December 31, 2004. The amounts applicable to these aircraft included in property and equipment were: (In millions) Flight equipment Less accumulated depreciation 2004 2003 $ 173 126 $ 47 $ 171 114 $ 57 Total rental expense for operating leases, both aircraft and other, charged to operations in 2004, 2003, and 2002 was $403 million, $386 million, and $371 million, respectively. The majority of the Company’s terminal operations space, as well as 88 aircraft, were under operating leases at December 31, 2004. Future minimum lease payments under capital leases and noncancelable operating leases with initial or remaining terms in excess of one year at December 31, 2004, were: (In millions) Capital leases Operating leases 2005 2006 2007 2008 2009 After 2009 Total minimum lease payments Less amount representing interest $ Present value of minimum lease payments $ 24 13 13 13 13 26 102 22 80 $ $ 343 279 256 226 204 1,369 2,677 Less current portion Long-term portion $ 17 63 The aircraft leases generally can be renewed at rates based on fair market value at the end of the lease term for one to five years. Most aircraft leases have purchase options at or near the end of the lease term at fair market value, generally limited to a stated percentage of the lessor’s defined cost of the aircraft. GAP INC. CONSOLIDATED BALANCE SHEETS Jan. 29, 2005 ( $ in millions except share amounts and par value) Property and Equipment, net of accumulated depreciation of $3,793 and $3,789 Other assets Total assets Liabilities and Shareholders’ Equity Current Liabilities Current maturities of long-term debt Accounts payable Accrued expenses and other current liabilities Income taxes payable 3,376 368 Jan. 31, 2004 (as restated, see Note B 3,626 384 $ 10,048 $ 10,713 $ — $ 1,240 283 1,178 924 78 906 180 Total current liabilities 2,242 2,547 Long-Term Liabilities Long-term debt Senior convertible notes Lease incentives and other liabilities 513 1,373 984 1,107 1,380 1,031 Total long-term liabilities 2,870 3,518 NOTES TO CONSOLIDATED FINANCIAL STATEMENTS NOTE E: LEASES We lease most of our store premises and some of our headquarters facilities and distribution centers. These operating leases expire at various dates through 2033. Most store leases are for a five year base period and include options that allow us to extend the lease term beyond the initial base period, subject to terms agreed to at lease inception. Some leases also include early termination options, which can be exercised under specific conditions. For leases that contain predetermined fixed escalations of the minimum rentals, we recognize the related rental expense on a straight-line basis and record the difference between the recognized rental expense and amounts payable under the leases as deferred lease credits. At January 29, 2005, and January 31, 2004, this liability amounted to approximately $361 million and $362 million, respectively. Lease payments that depend on factors that are not measurable at the inception of the lease, such as future sales volume, are contingent rentals in their entirety and are excluded from minimum lease payments and included in the determination of total rental expense when it is probable that the expense has been incurred and the amount is reasonably estimable. Cash or rent abatements received upon entering into certain store leases are recognized on a straight-line basis as a reduction to rent expense over the lease term. The unamortized portion is included in deferred lease credits and other liabilities. At January 29, 2005 and January 31, 2004, the long-term deferred credit was approximately $496 million and $543 million, respectively. At January 29, 2005 and January 31, 2004, the short-term deferred credit was approximately $82 million and $83 million, respectively. The aggregate minimum non-cancelable annual lease payments under leases in effect on January 29, 2005, are as follows: Fiscal Year ($ in millions) 2005 2006 2007 2008 2009 Thereafter $ 945 823 689 605 502 1,767 Total minimum lease commitment $ 5,331 Rental expense for all operating leases was as follows: ($ in millions) Minimum rentals Contingent rentals Total 52 Weeks Ended Jan. 29, 2005 52 Weeks Ended Jan. 31, 2004 52 Weeks Ended Feb. 1, 2003 $ $ $ 819 148 967 $ 808 146 954 $ 816 123 939 $ Lessor Lease Disclosures CATERPILLAR INC. Consolidated Financial Position at December 31 (Dollars in millions) 2004 Assets Current assets: Cash and short-term investments Receivables—trade and other Receivables—finance Retained interests in securitized trade receivables Deferred and refundable income taxes Prepaid expenses Inventories Total current assets Property, plant and equipment—net Long-term receivables—trade and other Long-term receivables—finance $ 2003 445 $ 7,616 6,510 — 398 1,369 4,675 20,856 7,682 764 8,575 2002 342 $ 4,025 5,508 1,550 707 1,424 3,047 16,603 7,251 510 7,394 309 3,192 5,066 1,145 781 1,224 2,763 14,480 7,009 433 6,347 Investments in unconsolidated affiliated companies Deferred income taxes Intangible assets Goodwill Other assets Total assets $ 517 674 315 1,450 2,258 800 616 239 1,398 1,895 747 711 281 1,402 1,295 43,091 $ 36,706 $ 32,705 8. Finance receivables Finance receivables are receivables of Cat Financial, which generally can be repaid or refinanced without penalty prior to contractual maturity. Total finance receivables reported in Statement 3 are net of an allowance for credit losses. During 2004, 2003 and 2002, Cat Financial securitized retail installment sale contracts and finance leases into public asset backed securitization facilities. The securitization facilities are qualifying special purpose entities and thus, in accordance with SFAS 140, are not consolidated. These finance receivables, which are being held in securitization trusts, are secured by new and used equipment. Cat Financial retained servicing responsibilities and subordinated interests related to these securitizations. For 2004, subordinated interests included subordinated certificates with an initial fair value of $8 million, an interest in certain future cash flow (excess) with an initial fair value of $2 million and a reserve account with an initial fair value of $10 million. For 2003, subordinated interests included subordinated certificates with an initial fair value of $9 million, an interest in certain future cash flow (excess) with an initial fair value of $14 million and a reserve account with an initial fair value of $10 million. For 2002, subordinated interests included subordinated certificates with an initial fair value of $8 million, an interest in certain future cash flow (excess) with an initial fair value of $11 million and a reserve account with an initial fair value of $10 million. The company's retained interests generally are subordinate to the investors' interests. Net gains of $13 million, $22 million and $18 million were recognized on these transactions in 2004, 2003 and 2002, respectively. Significant assumptions used to estimate the fair value of the retained interests and subordinated certificates at the time of the transaction were: 2004 Discount rate Weighted-average prepayment rate Expected credit losses 10.7% 14.0% 1.0% 2003 2002 11.0% 14.0% 1.0% 10.9% 14.0% 1.0% The company receives annual servicing fees of approximately 1% of the unpaid note value. As of December 31, 2004, 2003 and 2002, the subordinated retained interests in the public securitizations totaled $73 million, $73 million and $47 million, respectively. Key assumptions used to determine the fair value of the retained interests were: 2004 Cash flow discount rates on retained interests and subordinated tranches Weighted-average maturity Average prepayment rate Expected credit losses 10.7% 28 months 14.0% 1.0% 2003 9.1-10.8% 27 months 14.0% 1.0% 2002 9.0-10.7% 29 months 14.0% 1.0% The investors and the securitization trusts have no recourse to Cat Financial's other assets for failure of debtors to pay when due. We estimated the impact of individual 10% and 20% changes to the key economic assumptions used to determine the fair value of residual cash flow in retained interests on our income. An independent, adverse change to each key assumption had an immaterial impact on the fair value of residual cash flow. We consider an account past due if any portion of an installment is due and unpaid for more than 30 days. Recognition of income is suspended when management determines that collection of future income is not probable (generally after 120 days past due). Accrual is resumed, and previously suspended income is recognized, when the receivable becomes contractually current and/or collection doubts are removed. Investment in loans/finance leases on nonaccrual status were $176 million, $233 million and $370 million and past due over 90 days and still accruing were $11 million, $25 million and $72 million as of December 31, 2004, 2003, and 2002, respectively. Cat Financial provides financing only when acceptable criteria are met. Credit decisions are based on, among other things, the customer's credit history, financial strength and intended use of equipment. Cat Financial typically maintains a security interest in retail financed equipment and requires physical damage insurance coverage on financed equipment.