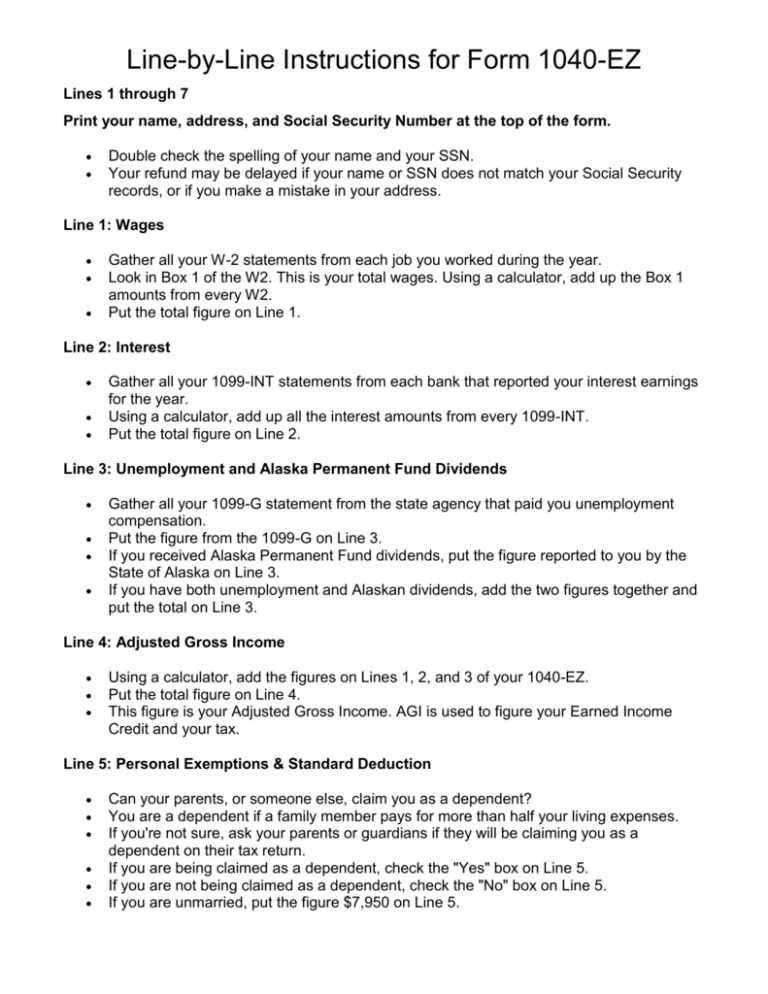

Line-by-Line Instructions for Form 1040-EZ

advertisement

Line-by-Line Instructions for Form 1040-EZ Lines 1 through 7 Print your name, address, and Social Security Number at the top of the form. Double check the spelling of your name and your SSN. Your refund may be delayed if your name or SSN does not match your Social Security records, or if you make a mistake in your address. Line 1: Wages Gather all your W-2 statements from each job you worked during the year. Look in Box 1 of the W2. This is your total wages. Using a calculator, add up the Box 1 amounts from every W2. Put the total figure on Line 1. Line 2: Interest Gather all your 1099-INT statements from each bank that reported your interest earnings for the year. Using a calculator, add up all the interest amounts from every 1099-INT. Put the total figure on Line 2. Line 3: Unemployment and Alaska Permanent Fund Dividends Gather all your 1099-G statement from the state agency that paid you unemployment compensation. Put the figure from the 1099-G on Line 3. If you received Alaska Permanent Fund dividends, put the figure reported to you by the State of Alaska on Line 3. If you have both unemployment and Alaskan dividends, add the two figures together and put the total on Line 3. Line 4: Adjusted Gross Income Using a calculator, add the figures on Lines 1, 2, and 3 of your 1040-EZ. Put the total figure on Line 4. This figure is your Adjusted Gross Income. AGI is used to figure your Earned Income Credit and your tax. Line 5: Personal Exemptions & Standard Deduction Can your parents, or someone else, claim you as a dependent? You are a dependent if a family member pays for more than half your living expenses. If you're not sure, ask your parents or guardians if they will be claiming you as a dependent on their tax return. If you are being claimed as a dependent, check the "Yes" box on Line 5. If you are not being claimed as a dependent, check the "No" box on Line 5. If you are unmarried, put the figure $7,950 on Line 5. If you are married and filing a joint return with your spouse, put the figure $15,900 on Line 5. This figure ($7,950 for Single people, and $14,900 for Married people) is the combination of your Standard Deduction and your Personal Exemptions. Together, this figure represents the amount of income which is tax-free. If you earn less than $7,950 (Single) or $14,900 (Married), your income is completely taxfree. You should still file a tax return, because you probably will have a refund from any tax that was withheld on your paycheck. You may also qualify for the Earned Income Credit. Line 6: Taxable Income Using a calculator, enter the figure from Line 4 (your Adjusted Gross Income), and then subtract the figure from Line 5. Put the result on Line 6. This is your taxable income. This figure will be used to calculate your tax. Line 7: Federal Income Tax Withheld Go back to your W-2 statements. Look at Box 2. This is the amount of income tax that was withheld from your paychecks and sent to the IRS on your behalf. Using a calculator, add up the Box 2 amounts from every W-2. Put the total figure on Line 7. Line 8a: Earned Income Credit You are eligible to claim the Earned Income Credit if you meet the following criteria: Your Adjusted Gross Income on Line 4 is less than $12,120 (for Single people) or less than $14,120 (for Married people). You and your spouse cannot be claimed as a dependent by someone else. You and your spouse are between the ages of 25 and 64. Use the EIC Assistant on the IRS website if you are not sure if you qualify. Click on the the link that reads "Start Here: Am I Eligible?" (The EIC Assistant is not yet available for 2006.) How to calculate the Earned Income Credit: Use the worksheet in the Instructions for Form 1040-EZ, pages 13 through 16, to calculate your Earned Income Credit. Use your "earned income" figure from the worksheet on page 14 to look up your tax credit amount on the EIC table on page 17. Or, if you want, the IRS to calculate your Earned Income Credit for you, enter the word "EIC" on Line 8a. Or, even better, you can use the IRS' EIC Calculator. (Not yet available.) Put the EIC figure on Line 8a. Line 8b: Nontaxable Combat Pay Election If you received combat pay, your non-taxable combat pay is shown on your W-2, Box 12, code Q. There will be a dollar amount next to the "Q." You can choose to include your combat pay for Earned Income Credit purposes, or you may choose to leave it out. Calculate your EIC credit amount both ways. First calculate the credit using only your "earned income" from the worksheet, and then calculate it again using your "earned income" plus your combat pay. Take whichever credit amount is higher. If you decide to include your combat pay, enter the amount coded as "Q" on your W-2 on Line 8b. If you are not including your combat for EIC, leave Line 8b blank. Line 9: Credit for Federal Telephone Excise Tax Paid You can claim a standard refund of the telephone excise tax. You can also claim a refund of your actual telephone taxes. The standard amounts are: $30 if your filing status is single and you did not check any boxes on line 5. $30 if your filing status is married filing jointly and you checked only one box on line 5. $60 if your filing status is married filing jointly and you did not check any boxes on line 5. The standard amounts include both the tax paid and interest owed on that tax. Line 10: Total Payments Add the figures from Lines 7, 8a, and 9. Put the total figure on Line 10. This represents the total amount of money paid-in towards your income tax. Line 11: Tax Look at the figure on Line 6. This is your taxable income. Use this figure to look up the amount of tax using the tax tables in the instruction booklet, beginning on page 24. Put the tax figure on Line 11. Lines 12a or 13: Refund or Amount Due Using a calculator, enter the figure on Line 10 (your total payments), and subtract the figure on Line 11 (your tax). Look at the result. If the number is positive, you have a refund. Enter this figure on Line 12a. If the number is negative, you owe additional tax. Enter this figure on Line 13. Lines 12b, 12c, and 12d: Direct Deposit If you are getting a refund, the amount on Line 12a can be deposited directly to your checking or savings account. Getting direct deposit is faster and more secure than getting a refund check mailed to you. Get out your checkbook, and look at one of your checks. In the bottom left-hand corner you will see lots of numbers. The first series of numbers should be a 9-digit bank code. This is called the Routing Number. Copy your routing number to Line 12b. Next, check the appropriate box on Line 12c, depending on whether you want your refund deposited into a checking or savings account. Next, find your account number on your check. Enter your account number on Line 12d. Triple check your bank numbers. If you are not sure, call your bank and ask them. Last year, one reader lost her $5,000 tax refund because of incorrect direct deposit information. Please do not let this happen to you.