A Recession Won't Wreck Your Retirement

advertisement

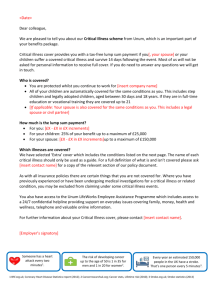

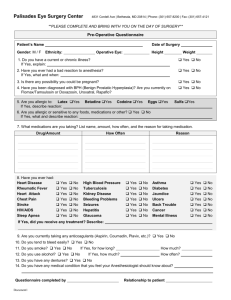

Risk Management Through Insurance By Ellen Tan Risk management is the identification, analysis and economic control of risks that threaten the assets or earning capacity of an enterprise or individual. It is an important aspect of financial planning that can provide relief and comfort in the event that something unfortunate happens to you, for which you have carefully insured yourself against. Some of the personal risks you may encounter include: Premature death Total & permanent disability Contracting critical illness Income needs in retirement Children’s education funding Parent’s long-term care To put it briefly, you may die too young, live too long, succumb to illness or disability. Insurance is a risk transfer mechanism by which an individual or organisation can exchange its uncertainty for certainty. The individual agrees to pay a fixed premium and in return, the insurance company agrees to meet any loss that falls within the terms of the policy. Insurance planning should be based on the ‘Large Loss Principle’, which means, insure low frequency but high severity risks. For example, insure for critical illnesses such as cancer or heart attack, which occur probably just once in a lifetime (low frequency) but when it occurs, the financial loss is severe. It is worthwhile taking out insurance for such illnesses but not for the common flu or for visiting the panel doctor that may costs RM40. Risk is essentially a combination of likelihood of event and the severity should the event occur. What are the benefits of insurance? Firstly, for peace of mind, knowing that insurance exists to meet the financial consequences of certain risks. There is also control of loss as insurers have an interest in reducing the frequency and severity of losses. For example, if a person is suffering from high blood pressure and wishes to take out an insurance policy to cover critical illness, the insurance company would probably require him/her to take medication and to prove that he/she has a lifestyle that keeps the illness under control. It is in the insurance company’s interest to control the loss. There are also social benefits because funds are available, allowing you to help yourself so that you do not burden others. What types of insurance are available? Below are listed the general types of life insurance 1. Term 2. Whole Life 3. Endowment 4. Investment-linked 5. Child Education Here are the more common riders attach to a life policy 1. Critical Illness 2. Disability Income 3. Personal Accident 4. Medical Reimbursement 5. Hospitalisation 6. Premium Waiver Investment-linked Insurance Investment-linked insurance is a regular premium whole life plan that combines with unitised investment-linked funds. Its greatest benefit is the flexibility it provides. You can adjust the protection and investment ratio to suit your needs. You can vary the amount of insurance protection, top-up your investment, or make withdrawals. Essentially, you can adjust the plan to suit the financial changes during the various stages of your life. Medical costs The table below gives you an idea of how much medical costs can amount to. Coronary heart bypass RM20,000 – RM30,000 per surgery Cancer RM3,000 – RM140,000 for treatment Chemotherapy RM200-RM1,000 per therapy Radiotherapy RM200-RM1,000 per therapy Open heart surgery RM20,000- RM50,000 per surgery Heart transplant RM50,000-RM80,000 per surgery Kidney failure RM2,000 per month for dialysis for life. What types of critical illness cover is there? Most of the illnesses claimed fall within the first five examples given below. Heart Attack Coronary Artery Disease Stroke Cancer Kidney Failure Paralysis Major Organ Transplantation Multiple Sclerosis Fulminant Viral Hepatitis Primary Pulmonary Arterial Hypertension Coma Blindness Heart Valve Replacement Surgery To The Aorta Alzheimer’s Disease Deafness Loss of Speech Major Burns Terminal Illness AIDS Due To Blood Transfusion Motor Neurone Disease Parkinson’s Disease Chronic Liver Disease Chronic Lung Disease Aplastic Aneamia Muscular Dystrophy Poliomyelitis Bacteria Meningitis Benign Brain Tumour Encephalitis Full Blown AIDS Brain Surgery Major Head Trauma Female illnesses Incidence rates of various types of cancer among women Breast cancer – 31% Ovarian cancer – 4% Cancer of cervix uteri – 2% Cancer of vagina – 1% Carcinoma-in-situ – 8/100,000 (Source: American Cancer Society) Insurance for ladies There are special types of insurance available to women, for example, covering the illnesses and special conditions below: Female cancer – cancer of breast, cervix uteri, fallopian tube, ovary, uterus, vagina Carcinoma-in-situ Systematic Lupus Erythematosus – SLE Rheumatoid arthritis Facial reconstructive surgery Skin grafting Pregnancy complications Infant congenital illnesses Also for life-stage benefits such as Marriage benefits Childbirth benefits Retrenchment benefits Divorce benefits Benefit on spouse’s death Long-term care This type of insurance is for elderly and disabled people. The cost of long-term care is high. They are unabled to perform routine daily activities which we often take for granted, such as Transfer – Getting in & out of a chair Mobility – The ability to move from room to room Continence – The ability to voluntarily control bowel and bladder functions Dressing – Putting on and taking off all necessary items of clothing Bathing/Washing – The ability to wash in the bath or shower Eating – All tasks of getting food into the body There are also insurance for parents above age 50, to cover: Medical care – reimburse actual hospital charges for surgical and nonsurgical stay. Long- term care – monthly benefit for inability to perform daily activities of normal living. Death Benefit The above benefits are subjected to a life-time limit.