TO:

advertisement

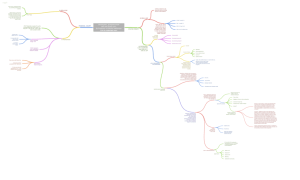

A PROFESSIONAL LIMITED LIABILITY COMPANY CALIFORNIA DELAWARE GEORGIA MARYLAND NORTH CAROLINA SOUTH CAROLINA VIRGINIA WASHINGTON, DC MEMORANDUM Privileged and Confidential Attorney-Client Communication TO: [Client] FROM: Press Millen DATE: October 21, 2013 SUBJECT: Checklist for Avoiding Contacts Sufficient for U.S. Jurisdiction – Foreign Parents with U.S. Subsidiaries Do’s and Don’ts. Many non-U.S. companies which own U.S. subsidiaries prefer to operate in such a way as to avoid jurisdiction in the U.S. courts. In order to minimize the chances of becoming a defendant subject to jurisdiction in the U.S. courts, there are certain steps – a checklist of Do’s and Don’ts – that foreign parent companies can take. General Jurisdiction in the United States The U.S. Supreme Court has held that a U.S. court may, consistent with the due process clause of the U.S Constitution, exercise jurisdiction over a foreign entity if there exist “minimum contacts” between that foreign entity and the forum. See Int'l Shoe Co. v. Washington, 326 U.S. 310, 316 (1945). The minimum-contacts test focuses on whether the entity’s “conduct and connection with the forum are such that he should reasonably anticipate being haled into court there.” World-Wide Volkswagen Corp. v. Woodson, 444 U.S. 286, 297 (1980). In evaluating the reasonable anticipation, there must be “some act by which the [entity] purposefully avails itself of the privilege of conducting activities within the forum State, thus invoking the benefits and protections of its laws.” Burger King Corp. v. Rudzewicz, 471 U.S. 462, 474-75 (1985). To that end, the foreign entity must have purposefully directed actions towards the forum sufficient to satisfy a finding of minimum contacts. Rudzewicz at 476; see also Asahi Metal Indus. Co., Ltd. v. Superior Court of Calif., 480 U.S. 102, 112 (1987) (The “substantial connection . . . between the defendant and the forum State necessary for a finding of minimum contacts must come about by an action of the defendant purposefully directed toward the forum State.”) (citations omitted) (emphasis in original). In other words, “[w]hen a corporation ‘purposefully avails itself of the privilege of conducting activities within the forum State,’ it has clear notice that it is subject to suit there . . . .” World-Wide Volkswagen, 444 U.S. at 297 (citation omitted). “Minimum contacts” can further be divided into contacts that give rise to “specific” personal jurisdiction and those that give rise to “general” personal jurisdiction. See Helicopteros Nacionales de Colombia, S.A. v. Hall, 466 U.S. 408, 413-16 (1984). “Specific” jurisdiction is Memorandum Page 2 based on minimum contacts with a state where the asserted causes of action “arise out of” or are “related to” those contacts. Id. at 414 n.8. “General” jurisdiction exists when a party has “continuous and systematic” contacts in a state such that the claims for relief do not have to arise out of the defendant's contacts with the forum. See Perkins v. Benguet Consol. Mining Co., 342 U.S. 437, 445 (1952); see also Helicopteros. 466 U.S. at 414 n.9. In general, “continuous and systematic” direct sales into the U.S. can be the basis for establishing general jurisdiction over a foreign entity. As a general matter, a foreign entity’s presence in the U.S. sufficient to establish general jurisdiction will also permit the application of U.S. laws to that foreign entity, as well as the laws of any given individual state in which there is general jurisdiction. See Pasquantino v. U.S., 544 U.S. 349, 371-72 (2005). While mere ownership of a U.S. subsidiary or affiliate will not necessarily create jurisdiction for a foreign parent corporation, the manner in which the parent and subsidiary interact will often determine whether jurisdiction can be asserted over the foreign entity. See Goodyear Dunlop Tires Operation, S.A. v. Brown, 131 S.Ct. 2846 (2011). A Checklist of Do’s and Don’ts In order to avoid establishing sufficient minimum contacts with the U.S. for jurisdictional purposes while owning U.S. subsidiaries, foreign parents should avoid the following: DON'T own property in the U.S. DON’T maintain bank accounts in the U.S. DON'T travel, or minimize travel, on business purposes in the U.S. DON'T directly solicit business from U.S. customers/vendors DON'T advertise or target customers/vendors in the U.S. DON’T operate a website that permits transaction of business in the U.S. or which repeatedly transmits information directly to the U.S. DON'T enter into contracts with U.S companies DON'T control day-to-day business activity of U.S. affiliates DON'T negotiate commercial agreements with U.S. companies DON'T fail to observe corporate formalities with respect to U.S. affiliates DON’T exercise direct supervisory authority over U.S. employees DON'T conduct act as importer of record in the U.S.. Memorandum Page 3 Foreign parent companies should do the following: DO allow U.S. corporate affiliate to own property in the U.S. DO allow U.S. personnel to solicit business from U.S. customers/vendors DO allow U.S. corporate affiliate to operate a U.S. website DO allow U.S. personnel to target customers/vendors/advertise in the U.S. DO allow U.S. affiliate to negotiate and enter into contracts with U.S. companies. DO allow U.S. affiliate to manage day-to-day business DO have a written arms-length services agreement with the U.S. affiliate for U.S. services provided to/by the respective legal entities. P.M.M. WCSR 31356115v1