The biotechnology industry: Systems of innovation and lessons learnt

advertisement

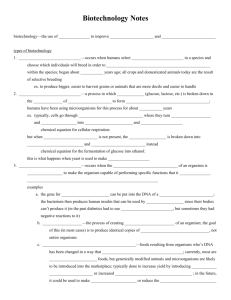

The biotechnology industry: Systems of innovation and lessons learnt December 2011 Christina G. Siontorou and Dimitris K. Sidiras Laboratory of Simulation of Industrial Processes Department of Industrial Management & Technology 80, Karaoli & Dimitriou Str., 18534 Piraeus GREECE csiontor@unipi.gr; sidiras@unipi.gr Page 2 The biotechnology industry: Systems of innovation and lessons learnt Abstract To succeed in the market, companies have to address the marketing issues and tackle them adequately. Biotechnology companies are a special case, because the strategic decisions and the marketing issues to handle may not be ordinary. In fact, due to the science based nature of the sector, most companies are technology intensive, being often involved in the development of highly innovative products within a new, still evolving, field, while struggling to gain a leading edge over competitors in the market. Thus, companies have to leverage their technological capabilities by selecting R&D projects that lead to a competitive advantage, still leaving ample space for knowledge creation that will feed a system of innovation serving both, market success and academic excellence. The inevitable university-industry interplay is not always straightforward, owing to the different scopes and strategies of each side. This works presents the challenges to knowledge exploitation, using the case of biosensors as an exemplar for highlighting efficient knowledge transfer mechanisms from lessons learnt. Keywords: system of innovation, product development, technology frames, university-industry alliance Page 3 1. Innovative product development Biotechnology is having an increasingly important impact on the environmental, agricultural, pharmaceutical, energy and industrial sectors, providing innovations in genetic engineering, diagnostic devices and tissue/culture engineering (Fumento, 2003). By 2010, the worldwide industry was represented by over 6,200 public and private biotechnology companies (Ernst & Young, 2011), 64% of which small to medium enterprises (SMEs) hatched from academic spin-offs, concentrated in four key markets: US, Canada, Europe, and Asia/Pacific. The US is leading the biotechnology industry with over 60% of global biotechnology revenues; Canada holds the second place, numbering over 400 companies. Europe’s biotechnology market continues to grow with more product approvals and venture capital financing than ever. The Asia/Pacific market is emerging and expanding across the region with Australia, China, India, and Singapore dominating this market (Ernst & Young, 2009). As the biotechnology industry has become more geographically diverse, companies have pursued more cross-border collaborations; global competition in the sector has also increased as investors search for the best deals and most promising technologies, regardless of location (Thompson and Vonortas, 2005). However, new product launching is still limited due to the relatively low rate of successful final products, especially regarding pharmaceuticals and biomedical devices (Thompson and Vonortas, 2005), owing to the strict regulatory framework and increased expenses for clinical trials, a burden which cannot be solely undertaken by SMEs. For example, while 24 biotech drugs, vaccines, and new indications and uses were approved in the US in 2001, there were over 450 still in the clinical trial phase (Thompson and Vonortas, 2005). Even when a product finally reaches the market, its success is not at all guaranteed. Monsanto, for example, being the early leader in agro-biotechnology, invested heavily on insect-resistant genetically modified crops; although the products were a major technological success, Mosanto’s efforts to introduce them to the market failed due to negative public opinion (Chataway et al., 2004). The company, whose share prices had fallen dramatically, was sold to Pharmacia, a European pharmaceutical company that shortly announced its intention to sell the agro-chemical division but was unable to find a buyer. To succeed in the market, companies of any sector have to address the marketing issues and tackle them adequately. Biotechnology-based companies are a special case, because the strategic decisions and the marketing issues to handle may Page 4 not be ordinary. In fact, due to the science based nature of the sector, most companies are technology intensive, being often involved in the development of highly innovative products within a new, still evolving, field, while struggling to gain a leading edge over competitors in the market. Thus, companies have to leverage their technological capabilities by selecting R&D projects that lead to a competitive advantage (Siontorou and Batzias, 2010). Options cover mainly two major areas. The first is selecting the pioneering posture, where a company, acting as a knowledge creator, aims at introducing niche products and technologies into the market; biotechnology being still strongly bound to basic research, readily available from academia, makes innovation and novelty more feasible in comparison with other traditional technology sectors, provided that a company can afford the high cost and risk of extensive research, development, authorization and promotion; clearly, this option can be sustained only by large multinational corporations. The second option is choosing a combination of applied and basic research projects by using the company’s internal and external R&D resources and building on already existing knowledge. The former usually refer to in-house R&D activities, whereas the latter may include purchasing or licensing of technology from other companies, or joining strategic alliances to acquire that technology. Inter- and intra- technical/scientific knowledge and competency may be disseminated in a variety of ways: patent disclosure, publications, technical meetings, conversations between employees of the same or competing companies, partnership within the same consortium that carries out a big project, hiring of employees from rival companies and reverse engineering of products (Nonaka et al., 1996; Luo et al., 2005; O’Connor and DeMartino, 2006). Opportunities arise mainly from the specific, and often difficult to fulfill, deficits of marketed products, requiring a lot of ‘speculative’ R&D, which is a valuable path for strengthening the company’s position (Bernstein and Singh, 2006). Depending on the company’s resources and capabilities, technological development may start from advancing basic biochemical research on an early-stage candidate, or from re-engineering/re-designing later stage products. The more basic the ‘product-tobe’ is, the higher the investment required and the uncertainty of the outcome, but the more prominent becomes the differentiation of the product for gaining a satisfactory market share. When a biotechnology company seeks to define the balance between R&D in established areas of corporate knowledge and speculative R&D for enhancing its Page 5 innovative capability, a decision has to be made on how to prioritize investment. Extensive research has been conducted over the last 30 years to produce methods for improving project selection processes. The decision-making support methods relying on artificial intelligence provide a systematic approach to the implementation of computer-aided designs, which produces a final structure from initial specifications (Sidiras and Koukios, 2004; Günay et al., 2008; Sidiras et al., 2011; Tashkova et al., 2012). Notwithstanding, successful development and market acceptance still entails high risk, especially at accelerated market entry strategies (Rodríguez-Pinto et al., 2011). A versatile organization, with high degrees of freedom and ability (in both, resources and sustainability) to risk taking, commonly supports the development of breakthrough products and supports innovation, while balancing between having projects that run efficiently according to plan and leaving room for exploration and the creation of new knowledge that will initiate a new cycle of product development in the future. Ultimately, systems of innovations are created, that push and pull actors at definite places, according to the needs of the innovator at first, but later of the system itself (Gilsing and Nooteboom, 2006; Mittra et al., 2011). The inevitable universityindustry interplay is not always straightforward, owing to the different scopes and strategies of each side. This works presents the challenges to knowledge exploitation, using the case of biosensors as an exemplar for highlighting efficient knowledge transfer mechanisms from lessons learnt. 2. Systems of Innovation Innovation systems and science policies predominantly focus on linkages between universities and industry, and the commercial translation of academic discoveries. Overlooked in such analyses are the knowledge discovery processes within academic research and the non-commercial aspects of science. The desire to move research into practical applications in order to capture the benefits derived from scientific discovery has long motivated science funding and program development, especially in the biotechnology sector. Distinctions between ‘pure’ and ‘applied’ science were common during the 1960’s through the 1980’s. However, it is now widely recognized that this linear model of innovation, in which pure science is published in the academic literature, then picked-up by industry and developed into useful applications, is unnecessarily simplistic and frequently inaccurate; more likely, Page 6 scientific research contains aspects of both, basic inquiry (discovery) and practical application (utility), and moves back and forth between the two (Stokes, 1997). These movements take place at a deeper phenomenological level and their traces become somehow evident only to researchers who actually incorporate instinctively the relevant methodological paths into their hypotheses. On the other hand, methodologists or technology managers, engaged with the theoretical or the practical aspect, respectively, of research but not with the research itself, stay usually on a surface level being able to discriminate only quasi-linear segments of a trace which is rather complicate, sometimes tending to cover part of the surface like a Peano curve. Bio-related academic research remains at the forefront of the scientific and industrial infrastructure for two decades now, feeding a push-pull mechanism that serves both, academic excellence and product innovation, through an efficient technology transfer stream (Schmoch, 2007; Bishop et al., 2011). The impact of biotechnology on the pharmaceutical sector is a case in point . The innovative network developed has not only altered the technological profile of the sector, by driving chemical production to bioprocesses, but has also shifted drastically the trajectories from chemistry towards life-sciences (Gilsing and Nooteboom, 2006). The network’s grounding in basic research, together with its multidisciplinary and decentralized dynamics, increased the relevance of academic research outputs, fostered the emergence of specialized biotechnology firms that necessitated (and promoted) intraindustrial cooperations and university-industry links, while obliged the pharmaceutical firms to reposition their strategies (Salicrup and Fedorková, 2006; Canongia, 2007). Markedly, the high transformative capacity of the science-enabled technology, i.e., the high capability of the scientific bodies involved to constantly redefine the portfolio of their products based on endogenously produced knowledge (Garud and Nayyar, 1994), brought about significant structural and institutional changes to the sector, giving rise to new scientific and technological opportunities. There are cases, however, where several new technologies, incubated and fostered within the same evolutionary frame of bio-sciences, had only an indirect, supportive, and subsidiary impact and failed to challenge the sectoral system and its established structures in any substantial way. Biosensor technology, for example, was set off to revolutionize instrumentation and measurement (see e.g., Churchouse et al., 1986; Griffiths and Hall, 1993), as well as medical diagnostics and treatment (see e.g., Mascini, 1992; Wilson et al., 1992). Yet, the industry was very reluctant to capitalize Page 7 on the university-produced knowledge and innovation. That gave rise to a, mostly European, paradox where long-term academic excellence has been sustained by a large number of university-hosted biosensor groups with a high absorptive capacity, i.e., a marked capability to recognize, value and assimilate exogenous technological change within their scope of research (Siontorou and Batzias, 2010), yet low translational capability, i.e., low commercialization of the work produced (Luong et al., 2008). 3. Building the innovation hub: the case of glucose sensors The pioneering work of Leland C. Clark, Jr. in 1960s that transformed an oxygen probe into a glucose meter (Clark and Lyons, 1962), paved the way for the evolution of biosensor revolution. The enzyme probe (Fig. 1) reached the market almost a decade later, when Yellow Springs Instruments (YSI) launched its whole blood glucose analyzer (Model 23 Glucose Analyzer) with a polarographic electrode based on Clark’s patent (Clark, 1970). The various actors engaged in the emergent techno-economic network, drew roadmaps to commercialization that shifted drastically the trajectories of the biomedical industry (Churchouse et al., 1986). Roadmapping, set at early 1980s (see, e.g., Severinghaus and Astrup, 1986), followed a strong market-pull mechanism for clinical diagnostics and home-care over-thecounter glucose sensing. Three paths emerged, namely on glucose self-monitoring devices, artificial pancreas and continuous (in vivo) glucose monitoring; the drivers that created and sustained the paths were industry, society, and scientific community, respectively, creating ad hoc an efficient thick innovation system, i.e., a sui generis system consisting of actors with endogenous knowledge and interest on glucose sensing, characterized, at least until 1990, by knowledge asymmetry and limited dispersion around the early US biosensor research clusters. Inevitably, the concrete structure of the network pushed and pulled players into finite sets of positions (Siontorou and Batzias, 2010), according to the needs for knowledge absorption and knowledge exploitation, patterning knowledge flows through the mechanisms of demand-driven absorptive capacity and supply-driven transformative capacity, respectively. During 1970-1989, this mono-disciplinary glucose frame gained its structural properties, outlining scopes, technology strategies, definitions, and classifications, focusing on glucose monitoring (Heller and Feldman, 2008), although other possible Page 8 and plausible fields of biosensing applications started timidly to emerge. Markedly, a strong and effective university-industry alliance had been formed (Siontorou and Batzias, 2010), mostly in US, engaging actors with similar awareness of the technology at hand, aiming at solving rapidly scientific and technical problems (vastly on accuracy and sample size, respectively) and at building capabilities in line with customers’ requirements. Thereby, this productive coexistence of industry, science and society (Fig. 2) outlined, inevitably, a strategic perspective within which the companies strived to align their technology trajectories in order to sustain the performance of their product concepts and enhance the existing knowledge base. As more industries got involved, including Ames/Miles, Lifescan, Roche, Boehringer Mannheim, Bayer, Medistron, and Johnson & Johnson, more researchers got involved, lifting fast expectations from ex vivo measurements to in vivo monitoring within less than a decade (Vadgama, 1984). Clearly, industry realized the new scientific field as a discontinuous and disruptive technology at an era of ferment, i.e., as an innovation system resulting in the generation of new technologies and in changes in the relative weighting of existing technologies, presenting superior performance trajectories along critical dimensions that customers (i.e., diabetic patients) value. Larger firms struggled to take advantage of this technology ahead of competitors in the market. Some have developed in-house R&D for capitalizing on own architectural innovation (i.e., of the whole system and its components, according to the definition of Carayiannis et al., 2003) and for extending the radical technology; for example, after Roche launched the Haemo-Glucotest in 1968, the company spent 10 years on improving it and needed another ten years to launch its line of glucose meters (Accu-Chek). Others tried to form direct links with the firms that had already the technology at near to ‘fully fledged’ innovations, i.e., outsourcing knowledge through acquisitions that enabled rapid market entries secured by proprietary rights; for example, Bayer acquired Ames/Miles in 1978 and launched Glucometer® a few years later, while Johnson & Johnson acquired Medistron and LifeScan in 1986 to get hold of the Glucoscan®. Gradually distancing itself from the university science-base, the industry established a high competition arena at early 1990s that gave rise to significant advances in technology, with miniaturization of analyzers and a remarkable increase in the numbers of devices available, nowadays listed by the ‘ADA's Buyer's Guide to Diabetes Products’. This arena was determined by the timing and impact of the Page 9 innovation under consideration: the new technology was called to address fast the needs of 5% of the US population and 0.4% of the world population, at an increasing rate of 3-5% annually and at a direct health care cost of $2000 per patient (Steck and Rewers, 2004). This innovation gave a straightforward cost reduction trajectory at a performance level higher than that of the earlier processes that it cancelled out. Four strategies have been consecutively followed in industrial research to deal with the challenges and opportunities of diabetic management (Fig. 3), as determined by patent searching for mapping scientific knowledge: (i) steepening of the slopes of the market trajectories using marketing initiatives so that the performance improvements demanded by the health care providers could be successfully addressed by the industry (R&D on performance), (ii) ascending the trajectory of sustaining technology into ever-higher tiers of the market (R&D on reliability), (iii) aligning with the needs of end customers (R&D on convenience), and (iv) increasing the market share with less costly formats and processes. When the marketed technologies became comparable in most critical aspects, the real clinical needs for detecting unsuspected hypoglycemia, neonatal screening, and adolescence diabetes monitoring, urged the industry to look into the science pushpool for alternate testing, giving rise to minimally invasive glucose monitoring (Fig. 4). Knowing that this shifting was not enough to maintain the competitive advantage, non-invasive ‘glucometry’ became rapidly the new target of the industries, enabling the renewed intensification of university-industry relation seen today. 4. Lessons learnt from the knowledge-demand and knowledge supply interplay Industrial biosensor advancements have been marked by a knowledge supplydemand tradeoff. The former, driven by availability of knowledge, supported innovations during the 1990s, while the latter, derived from market needs, has just started to evolve, especially in USA and Japan. Biosensor research did not always paid out, so companies reduced patents referring to applications other than glucose monitoring. Bio-Nano Sensium Technologies, a company specializing in nanobiotechnology for biomedical devices, has exclusive access to Toumaz Technology's patent portfolio. The increasing number of patents over the last five years reflects the company's rapid progress in its scientific discovery process toward offering advanced wireless biosensors. Page 10 Researcher patents increased although very few have been managed to support their claims or find their way to the market. Much of the work has been done in secrecy by science based enterprises. At the early 1990s, research papers have dramatically increased, prompting various universities and institutes to specialize first in biosensor (academic spin off) and long after to provide biosensor courses. Some of the researchers have turned to private companies and institutes to offer their insight and experience. Biacore, for example, began operating in 1984, when expertise from Pharmacia, Linköping Institute of Technology and the Swedish National Defense Research Institute, were brought together with Biacore’s predecessor, Pharmacia Biosensor AB. Approximately 65 million US$ has been invested in the development of Biacore and the technology on which it is based. An initial research phase which essentially included development of the fundamental affinity-based biosensor technology comprising surface chemistry, flow systems and optical detection methods was completed in 1989. The result was Biacore®, a biosensor-based analytical instrument for studying molecular interactions, launched in 1990. Further products followed, all based on surface plasmon resonance technology. The business evolved into a largely independent commercial enterprise, which posted its first profit in 1994. Another example of know-how transfer from academics to industry is the establishment of Agamatrix in 2001 from the collaboration between S. Vu, an expert in machine-learning algorithms, and S. Iyengar who has just finished his PhD in biosensors at Cambridge University. A considerable increase of research funding for biosensors has been seen in 2004, along with new lines of funding for technology demonstrators and industrial investment in prototype systems. This can boost the supply side, provided that universities will be encouraged to support the area. This presupposes liberation of university staff time for R&D, longer term funding for individuals who can demonstrate the quality of their work and its relevance to user requirements, as well as improved support for graduates. For example, the alcohol wristwatch (Dummet et al., 2008) has been developed through a collaboration between the University of Southern California and the Brown University Medical School, investing largely on simulation of alcohol metabolism (Fig. 5). The demand side, on the other hand, has proved to provide a strict marketorientation as well as resources necessary for successful commercialization. Most companies, however, realizing the huge cost of research, have decided to collaborate Page 11 with academics, mostly on a short-term basis, although permanent collaborations do exist. In 1996, Bioacore acquired control of EBI Sensors Inc.; this acquisition gave Biacore access to fiber optic sensor technology developed by the University of Washington (USA) and of which EBI is the exclusive worldwide licensee. International scientific projects have also led to the involvement of the private sector to research, as for example, the development of the biosensor for food born bacteria from the Georgia Research Tech Institute. As there are still ineffective links between research base and the end-user, mechanisms to foster more effective technology transfer and better communication of technological opportunities and user requirements should be established, in order for biosensors to grasp the opportunities ahead. The global market competition has been started to take shape: major breakthroughs come from countries with strong infrastructures for microsystems technology (MST), especially in the interface between biotechnology and nanotechnology. For example, Germany has growing strengths and capabilities in both fields. The group developed AWACCS and its predecessor RIANA (Tschmelak et al., 2005a; 2005b), has a long history back on chemical sensors and multi-analyte detection by artificial nose and ear devices. Groups from US and Japan are also starting to focus major research efforts on these interfaces. Competition is also emerging from Taiwan, Korea, Singapore and China, rendering this a hotly contested field. products. 5. Concluding remarks The key issues emerging from the experience gained in biosensor progress and development, taken as a representative example of university-fostered biotechnology revolution, refer to early information transfer and utilization, product innovation, product quality, and efficient collaboration. Commercialization and research progress entails the capability of research institutions and organizations to introduce new concepts, products and features. The fast pace of technological change and the market demands for novel and better products requires continuous innovation and fast market introduction. This implies primarily a market-targeted research strategy, focusing on needs requiring attention and not on substitution of niche technologies, especially on the misjustification of cost-effectiveness. Progress should be quick to assimilate sidetechnological advancements as these become available. The momentum increase Page 12 largely relies upon information flow, which is expected to benefit largely from concurrent engineering practices Technology perfection will not be enough to assure biotechnology success in the near future, however. Successful products will have to fulfill unmet market needs at a highly competitive arena. The successful biotechnology marketer, therefore, will have to come up with convincing evidence to prove that his/her system has a clear advantage over existing, well-known and public-accepted technologies. Cross-functional teams provide an avenue for constituents to express concerns and a mechanism for capturing learning. Early involvement empowers downstream participants; they have a say before decisions are finalized. Simultaneous planning of product, process, and manufacturing allows issues of manufacturability to be evaluated and incorporated in the final product design. This approach affords a group a stream of integrative innovations that may improve the value of the end-product, enhance quality, and reduce development cost. With early release of information, engineers can begin working on different phases of product development process while final designs are evolving. The early release of information reduces uncertainty and promotes the early detection of problems, which enables groups to avoid timeconsuming changes. Moreover, the economic aspects of biotechnology are not been taken into account when research strategies are considered. For the immediate future, nanotechnology could be still expensive. If high volumes and low-cost products are achieved, the markets could be huge. The question is whether the increased capability of nano-products will be sufficient to open up large markets quickly, and thus engendering a rapid decrease in costs. A related question is whether there will be scope for small firms to invest on nanotechnology. References Bernstein, B. and Singh, P.J. (2006). An integrated innovation process model based on practices of australian biotechnology firms. Technovation 26, 561-572. Bishop K., D’Este P., Neely A. (2011). Gaining from interactions with universities: Multiple methods for nurturing absorptive capacity. Research Policy 40, 30-40. Canongia C. (2007). Synergy between competitive intelligence (CI), knowledge management (KM) and technological foresight (TF) as a strategic model of Page 13 prospecting — The use of biotechnology in the development of drugs against breast cancer. Biotechnology Advances 25, 57-74. Carayannis E.G., Gonzalez E., Wetter J. (2003). The nature and dynamics of discontinuous and disruptive innovations from a learning and knowledge management perspective. In: Shavinina L, editor. The international handbook on innovation. Elsevier, pp. 115-138. Chataway, J., Tait, J. and Wield, D. (2004). Understanding company r&d strategies in agro-biotechnology: Trajectories and blind spots. Research Policy 33, 10411057. Churchouse S.J., Battersby C.M., Mullen W.H., Vadgama P.M. (1986). Needle enzyme electrodes for biological studies. Biosensors 2, 325-42. Clark L.C. Membrane polarographic electrode system and method with electrochemical compensation. US patent no. 3,539,455 Nov. 10, 1970. Clark L.C., Lyons C. (1962). Electrode systems for continuous monitoring in cardiovascular surgery. Annals of New York Academy of Science 102, 29-45. Dumett M.A., Rosen I.G., Sabat J., Shaman A., Tempelman L., Wang C., Swift R.M. (2008). Deconvolving an estimate of breath measured blood alcohol concentration from biosensor collected transdermal ethanol data. Applied Mathematics and Computation 196, 724-743. Ernst & Young (2011). Beyond borders - Global biotechnology report 2011. Funding biotech projects. Available at http://www.ey.com. Ernst & Young (209). The 2009 business risk report: top 10 business risks affecting life sciences companies. Available at http://www.ey.com. Fumento, M. (2003). BioEvolution: How biotechnology is changing our world. Encounter Books. Garud R., Nayyar P.R. (1994). Transformative capacity: continual structuring by intertemporal technology transfer. Strategic Management Journal 27, 365-85. Gilsing V., Nooteboom B. (2006). Exploration and exploitation in innovation systems: The case of pharmaceutical biotechnology. Research Policy 35, 1-23. Griffiths D., Hall G. (1993). Biosensors — what real progress is being made? Trends in Biotechnology 11, 122-30. Günay M.E., Nikerel I.E., Oner E.T., Kirdar B., Yildirim R. (2008). Simultaneous modeling of enzyme production and biomass growth in recombinant Page 14 Escherichia coli using artificial neural networks. Biochemical Engineering Journal 42, 329-335. Heller A., Feldman B.. (2008). Electrochemical Glucose Sensors and Their Applications in Diabetes Management. Chemical Reviews 108, 2482-505. Luo L., Kannan P.K., Besharati, B. and Azarm S. (2005). Design of robust new products under variability: Marketing meets design. The Journal of Product Innovation Management 22, 177-192. Luong J.H.T., Male K.B., Glennon J.D. (2008). Biosensor technology: Technology push versus market. Biotechnology Advances 26, 492-500. Mascini M. (1992). Biosensors for medical applications. Sensors and Actuators BChemical 6, 79-82. Mittra J., Tait J., Wield D. (2011). From maturity to value-added innovation: lessons from the pharmaceutical and agro-biotechnology industries. Trends in Biotechnology 29, 105-109. Nonaka, I., Umemoto, K. and Senoo, D. (1996). From information processing to knowledge creation: A paradigm shift in business management. Technology in Society 18, 203-218. O’Connor, G.C. and DeMartino, R. (2006). Organizing for radical innovation: An exploratory study of the structural aspects of RI management systems in large established firms. The Journal of Product Innovation Management 23, 475-497. Rodríguez-Pinto J., Carbonell P., Rodríguez-Escudero A.I. (2011). Speed or quality? How the order of market entry influences the relationship between market orientation and new product performance. International Journal of Research in Marketing 28, 145-154. Salicrup L.A., Fedorková L. (2006). Challenges and opportunities for enhancing biotechnology and technology transfer in developing countries. Biotechnology Advances 24, 69-79. Schmoch U. (2007). Double-boom cycles and the comeback of science-push and market-pull. Research Policy 36, 1000-1015. Severinghaus J.W., Astrup P.B. (1986). History of blood gas analysis. IV. Leland Clark's oxygen electrode. Journal of Clinical Monitoring 2, 125-39. Sidiras D., Batzias F., Ranjan R., Tsapatsis M. (2011). Simulation and optimization of batch autohydrolysis of wheat straw to monosaccharides and oligosaccharides. Bioresource Technology 102, 10486-10492. Page 15 Sidiras D.K., Koukios E.G. (2004). Solar systems diffusion in local markets. Energy Policy 32, 2007-2018. Siontorou C.G., Batzias F.A. (2010). Innovation in biotechnology: moving from academic research to product development—The case of biosensors. Critical Reviews in Biotechnology 30, 79-98. Steck A.K., Rewers M.J. (2004). Epidemiology and geography of type 1 diabetes mellitus. In: DeFronzo RA, Ferrannini E, Keen H, Zimmet P, editors. International textbook of diabetes mellitus. West Sussex: John Wiley & Sons Ltd., pp. 15–32. Stokes D.E. (1997). Pasteur’s quadrant: Basic science and technological innovation. Washington DC: Brookings Institute Press. Tashkova K., Šilc J., Atanasova N., Džeroski S. (2012). Parameter estimation in a nonlinear dynamic model of an aquatic ecosystem with meta-heuristic optimization. Ecological Modelling 226, 36-61. Thompson, E. and Vonortas, N.S. (2005). Biotechnology evolution and regulation of pharmaceuticals. In: R. Carruth, Ed., Global governance of the pharmaceuticals industries: Transatlantic and trilateral regulatory harmonization multilateral policy cooperation for drug safety. and The George Washington University, Ch. 9. Tschmelak J., Proll G., Riedt J., Kaiser J., Kraemmer P., Bárzaga L., et al. (2005a). Automated Water Analyser Computer Supported System (AWACSS) Part I: project objectives, basic technology, immunoassay development, software design and networking, Biosensors and Bioelectronics 20, 1499-1508. Tschmelak J., Proll G., Riedt J., Kaiser J., Kraemmer P., Bárzaga L., et al. (2005b). Automated Water Analyser Computer Supported System (AWACSS): Part II: intelligent, remote-controlled, cost-effective, on-line, water-monitoring measurement system, Biosensors and Bioelectronics 20, 1509-1519. Vadgama P. (1984). Enzyme electrodes for continuous in-vivo monitoring. TrAC – Trends in Analytical Chemistry 3, 13-6. Wilson G.S., Zhang Y., Reach G., Moatti-Sirat D., Poltout V., Thévenot D.R., et al. (1992). Progress toward the development of an implantable sensor for glucose. Clinical Chemistry 38, 1613-7. Page 16 Figure 1. Schematic of the glucose probe manufactured by YSI Inc. that later termed ‘first generation’ biosensor system. Page 17 biosensor proof-of-concept recruitment and training sources and new ideas fundamental understanding of sources adsorption of external knowledge problem solving innovation system knowledge dissemination and transfer transformation of knowledge to university industrial collaborations technology knowledge interpretation awareness and acquisition of knowledge biosensor concept Figure 2. The glucose biosensor dynamic innovation system Figure 3. The glucose sensor technology performance roadmap referring mainly to the ‘context’ of innovation, i.e., the socio-technical perspective drawn by the industry (via a cost reduction trajectory) on the basis of the environment in which the innovation emerged, and the effect of that environment on the technology evolution Page 18 invasive glucose monitoring lab-on-chip technology fluorescence low precision infrared strong scattering laser reflectance poor ruggedness impedance spectroscopy coulometric electrochemical Precision Xtra Abbot Inc. Breeze 2 Contour Bayer minimally invasive glucose monitoring amperometric tear sensor sensor-based microdialysis Glucoday thin film holographic optical sensor sub-cutaneous sensor Menarini Diagnostics STS CGMS Medtronic Minimed Guardian REAL-time SCGM Roche Diagnostics Dexcom Inc. Freestyle navigator Abbot Inc. Paradigm REAL-time trained user time-lag reverse iontophoresis bulky configuration frequent time-lag local calibration inflammatory reaction moderate precision GlucoWatch Biographer Animas Corp. GlucoWatch G2 Biographer low accuracy time-lag high false rates long-term sensor system skin irritation LTSS Minimed-Medtronic non- invasive glucose monitoring optical coherence tomography near infrared spectroscopy GluControl GC300 ArithMed GmbH Diasensor high false rate nonspecific low ruggedness Bico In. mid infrared spectroscopy OrSense orSense Ltd. SugarTrac LifeTrac Systems Inc. raman spectroscopy TouchTrak Samsung Ltd. temperature-modulated localised reflectance non-specific low precision poor penetration lag time high false rate low precision interference instability impedance spectroscopy Pendra Pendragon Medical Ltd low reliability ocular spectroscopy polarization changes Glucoband Calisto medical Inc. scattering ultrasound technology error-prone poor specificity electromagnetic sensing GlucoTrack Integrity Appl. Ltd. low precision thermal spectroscopy moderate precision interference background noise poor ruggedness poor patient convenience Aprise Gluco Inc. low scientific clarity low precision lag time poor ruggedness low manufacturability non-specific instability Hitachi Hitachi. Ltd. low precision poor ruggedness iontophoresis KMH Co Ltd. GluCall Sysmex Sysmec Corp. skin irriation lag time poor ruggedness low sensitivity performance/quality constraints Figure 4. The three phases of glucose monitoring, invasive, minimally invasive and non-invasive, represented industrial efforts to produce devices according to specifications set by the intermediate customers (health care providers) and the endusers (patients). Each phase apprehended available (at the time) technologies, each with drawbacks that pushed the path forward. Interestingly, R&D was not about improving performance and/or minimizing faults but kept focusing on the next phase generation and moving fast between technology platforms in order to get ahead of competition. The last phase is clearly dependent upon university research, setting off again strong pull mechanisms and high speed information flow patterns. Page 19 development of algorithm for sensor software development calibration University of Southern California, Department of Applied Mathematics development of biochemical model of alcohol metabolism University of Southern California, Department of Applied Physics Brown University Medical School Department of Psychology development of biosensor for in vivo sensor design and monitoring of alcohol metabolism calibration of biosensor on a per subject basis production clinical data on alcohol metablism model evaluation prototype development: wristwatch biosensor to track alcohol use Figure 5. The development of the alcohol wristwatch has been realized through an inter-university cooperation under a governmental financial framework addressed to the Psychology Department of Brown University for controlling alcoholism.