Turnaround Firm Rescues Minneapolis

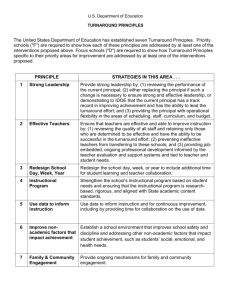

advertisement

For Immediate Release Contact: Chris Martin 630.670.2745 Turnaround Firm Rescues Minneapolis-based Company from Shut Down and Bankruptcy Chicago—January 12, 2007--Is it possible to sell a company that is in Chapter 11 and still get a better than value than anyone could have expected? Chicago-based turnaround specialists Morris-Anderson pulled it off, and for its efforts, the Turnaround Management Association Chicago/Midwest Chapter is presenting them with an award for best turnaround of 2006 in the Mid-Size Company Category Annual Awards Program on January 12 in Chicago. Morris-Anderson was brought in to salvage a company called Hitchcock Industries, which was a third generation, family-owned business that made large aluminum and magnesium castings for commercial airplane engines. Like many companies that served the airline industry, the suburban Minneapolis-based Hitchcock was hit hard after 9/11. Bad market conditions, continued pricing pressure from customers, and management missteps put the company into financial distress in 2003. In response, Hitchcock’s board had replaced the existing chief financial officer with a board member and quickly found out that senior management had been pre-billing shipments and misreporting the company’s accounts receivables. “When the board learned about this, it terminated the CEO and reported this to company’s major lenders,” said Dan Dooley, principal of Morris-Anderson. “Unfortunately, the lender chose to discontinue funding Hitchcock, effectively shutting the company down in September.” When Hitchcock’s major customers found out, they agreed to provide a $4 million guarantee to the lender to keep this company afloat. After this funding was arranged, the company filed Chapter 11 and began searching for a firm to help the board sell the company. Morris-Anderson was retained at this time and immediately began to go though the company’s books and financial statements. Much to his chagrin, Dooley found that things were worse than suspected. “Hitchcock’s financial records were in poor shape and there was no historical financial knowledge on the new staff to explain any of the numbers,” Dooley explained. After the Chapter 11 filing, Morris-Anderson worked with management to create a multi-year financial projection. “We believed that Hitchcock could operate at approximately $50 million in sales and $5.5 million of Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA), which was much stronger than the company’s recent track record of $1 to $2 million,” Dooley said. In the first quarter of 2006, Morris-Anderson began marketing Hitchcock to potential buyers and was able to attract two buyers to go through due diligence and five parties participated in its bankruptcy court supervised auction in April, 2006, according to Dooley. As a result of this competition, Morris-Anderson was able to negotiate a successful sale of Hitchcock to CFI Holdings for $46 million, at least double the expectations of the Hitchcock stakeholders, 8.4 times prospective earnings and 31 times recent historical earnings. Dooley attributes Morris-Anderson’s success to its strategy of allowing prospective buyers conduct preliminary due diligence in a manner in which the competitors actually ran into each other, which focused bidders on the competitive nature of the transaction. “We were also successful negotiating two ‘stalking horse’ bids that ensured that Hitchcock would receive a fair market value for its assets should no bidder tender a competitive offer,” Dooley said. The Turnaround Management Association (www.turnaround.org) is the only international non-profit association dedicated to corporate renewal and turnaround management. The Chicago/Midwest Chapter of TMA has over 1,000 members and is comprised of turnaround practitioners, attorneys, accountants, consultants, investors, lenders, venture capitalists, appraisers and liquidators. For more information, visit the Chapter’ s web site at www.chicago.turnaround.org or call 815-469-2935.