Career Enhancement Program

advertisement

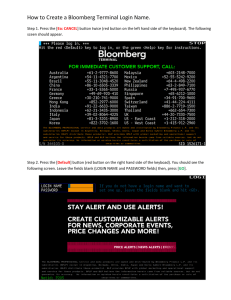

Career Enhancement Program Industry Research 2 Data Company: Bloomberg & Reuters By group5: Benny, Joe, Stanly There are two main market players in the data industry. They are Bloomberg and Reuters Bloomberg: Background: Bloomberg L.P. is an information services, news and media company serving customers around the world. Headquartered in New York, we employ more than 8000 people in 108 offices worldwide. Bloomberg has forged a unique position within the financial services industry with the Bloomberg Professional service, which provides an unparalleled combination of data, analytics, electronic trading and straight-through processing tools in a single platform. By providing instantaneous access to real-time historical financial data — and the ability to act on it — Bloomberg transformed the securities business and leveled the playing field between buyers and sellers. Our clients include the world's central banks, investment institutions, commercial banks, government offices and agencies, corporations and news organizations. In addition to the Bloomberg Professional service, Bloomberg has grown to include global news, television, radio, Internet, and magazine and book publishing operations. Bloomberg News was founded in 1990 as a financial news wire service and has grown to include 1500 reporters and editors in 87 bureaus worldwide. Bloomberg Television , a 24-hour business and financial news network, is produced and distributed globally in seven different languages. Bloomberg Radio is syndicated through more than 700 affiliates worldwide and gives listeners up-to-the minute business, national and international news. Bloomberg's 24-hour flagship station is Bloomberg WBBR 1130 in New York. The company publishes three magazines in the U.S. for consumers and professionals. Bloomberg Wealth Manager is published for money managers and advisers; Bloomberg Markets™ is a business magazine for investment professionals and complements the Bloomberg Professional service. On Investing is a personal investment magazine produced exclusively for Charles Schwab's top-tier clients. Bloomberg also publishes, in conjunction with local partners, Bloomberg Money™ in the U.K. and Bloomberg Investment in Italy. Bloomberg's Web site, Bloomberg.com , is among the top five most visited sites in the U.S. for financial news and information. Core Business: 1. Bloomberg Professional service The Bloomberg Professional service is the interactive, financial information network that is Bloomberg's core business. Available 24 hours a day to more than 260,000 professionals in over 100 countries, the service seamlessly integrates data, news, analytics, multimedia reports and e-mail into a single platform. It is used by market professionals around the world to make informed decisions and to complete transactions — in any currency and in a way that is meaningful, accurate, and consistent. Bloomberg News is a central element of the Bloomberg Professional service. With a constantly updated database, more than 1,200 journalists in Bloomberg News bureaus around the world report and analyze the very latest business and financial news. By leveraging that data and its analysis, Bloomberg News can provide clients with comprehensive coverage of markets, economies, companies, politics, sports, entertainment and more. Bloomberg News generates more than 4,000 news stories daily and is also the main content provider for the entire family of Bloomberg media. Due to its success, over 350 leading newspapers worldwide now depend on Bloomberg News as a key source for business news stories. An intrinsic feature of the Bloomberg Professional service is its analytic ability. Bloomberg analytics help clients see the markets more clearly by means of real-time tools. Clients can monitor risk and exposure, utilize pricing models, and evaluate long- and short-term performance. For pre-trade analytics, the quality and depth of Bloomberg data make the system an exceptionally powerful tool, giving clients the confidence they need in their analysis and investment conclusions. Once you've signed up as a member of the Bloomberg Professional service, you have the private and secure Bloomberg network at your disposal to manage your positions, analyze your exposure and trade electronically. Bloomberg is the only serious choice for the financial professional. To support such an important network of information, Bloomberg employs a highly trained, multilingual team of more than 1,300 people who find solutions to any problems clients may have. Clients need only contact the Bloomberg help desk to receive a response within minutes — 24 hours a day, 7 days a week, and 365 days a year. And there are both technical operators who provide instant assistance over the phone and rapid-response field engineers who can be on-site in a matter of hours. Bloomberg clients know that if they have a problem, the company is always on call and ready to help. The Bloomberg Professional service has become an integral way of understanding global financial markets. By the offer of all of this assistance and functionality to clients in one single package, for one single price, financial professionals recognize the Bloomberg Professional service as the definite tool for achieving their goals. 2. BLOOMBERG Portfolio Order Management System BLOOMBERG Portfolio Order Management System (POMS) is a front office solution for asset managers. POMS seamlessly integrates Bloomberg's leading market data and global communication network with portfolio management applications which include: risk analysis, order management, cash and position management, portfolio modeling and benchmarking, compliance, and straight-through processing. POMS seamlessly connects fund managers to dealers in real-time at multiple locations. Decision Support analytics and modeling tools enable fully informed investment decisions to be made by the fund manager. Orders are electronically transferred to dealers who manage the order flow through a real-time trade blotter that integrates market data with order details. This powerful tool ensures that dealers have all necessary information consolidated into easy to use applications. BLOOMBERG Trade Order Management System BLOOMBERG Trade Order Management System (TOMS) is a global risk management, position-keeping platform incorporating top quality data with electronic trading and risk management applications. TOMS connects sales and trading desks at multiple locations and enables personnel to make educated trading decisions quickly and accurately. Traders can view their positions, risk, and 'profit & loss' in real time, whilst managers may view these in real time on a firm wide, departmental and trader/sales level. TOMS provides personnel with effective tools to digest market conditions and efficiency process customer enquiries and orders. Bloomberg's comprehensive global securities database eliminates the need, time and expense of maintaining your own internal database. Up to date information on the securities held in your trading system will ensure an accurate representation of your overall trading position. In addition to the benefits to salesmen, traders and risk managers, the integrity of data and range of applications are invaluable in middle and back office areas such as trade processing and reporting. 3 BLOOMBERG Data License An Arsenal of Premium Data BLOOMBERG Data License addresses the demand for performance and efficiency by providing access to the most comprehensive, timely, and accurate financial database in the world. By harnessing the power of Bloomberg's data to fuel critical applications or custom databases, users will benefit from more accurate valuations, increased trade processing, and a decrease in settlement errors. The Data License provides firms with the unique ability to query Bloomberg's unparalleled global database with custom data requests or, alternatively, subscribe to a pre-defined bulk asset database. The Trusted Source for Indicative Detail No other data provider has the reliance of the portfolio manager or trader, which Bloomberg does via the BLOOMBERG PROFESSIONAL service. Over 260,000 users not only base their trading decisions on our data for 4 million securities, but also use it to price instruments, confirm the terms and conditions of securities process/execute trades, and manage the characteristics and parameters of investment portfolios. By relying on Bloomberg data to analyze their investments, these users provide the best means of quality assurance available. Data Driven Clients benefit from the data collection efforts of over 1,300 data specialists and 170 specialists dedicated to quality assurance, located in Bloomberg offices around the world. Bloomberg's data department is unrivaled in its collection, verification, and data maintenance efforts and serves as the backbone of the most respected securities database in the world. As part of Bloomberg's aggressive quality control efforts, response time for corrections and confirmation is as close to real time as possible. Reuters: Background: Reuters is a global information company providing indispensable information tailored for professionals in the financial services, media and corporate markets. It is best known as the world largest international multimedia news agency, more than 90% of its revenue derives from its financial services business. Nearly 500,000 financial market professionals working in the equities, fixed income, foreign exchange, money, commodities and energy markets around the world use Reuter’s products. They rely on Reuters services to provide them with the information and tools they need to help them be more productive. It supplies news, text, graphics, video and pictures to media organizations and websites around the world. It also provides news and research services to businesses outside financial services. Reuters divided its business into four customer segments. Three serve financial markets: Services for Asset Managers Investment Banking Treasury Services The fourth, Corporate & Media, is building on its established media business and aims to use Reuter’s assets in a broader corporate context as well. 1. Services for Asset Managers Revenue by Segment at 31 March 2003 Services for Asset Managers 24% The asset management market is a large and diverse sector in which Reuters has a substantial presence: the top 50 firms around the world are our customers. It provides tools and information to help asset managers make trading and investment decisions and gain access to liquidity. It helps them to differentiate their services from those of their competitors and to communicate effectively with their customers and with each other. Reuters enables them to streamline their businesses and transact more easily... The key products Institutional equities It provides products to help traders execute investment strategies at the best price. Reuters 3000 Extra provides a rich source of cross-asset information and powerful analytics to support trading decisions, whilst Institutional Order Entry provides order-routing capability. Portfolio management It focuses on the needs of professional institutional fund managers in carrying out their jobs. It provides tools, analytics, data and products that fit the operations of this customer base. Private client services It provides services that help financial organizations and their advisers offer enhanced services to their customers, for example information and services to create customer web-sites. Reuters Portfolio Management System helps advisers manage a range of portfolios and Reuters Plus provides market data and information to thousands of advisers in the US. Back office Reuters provides data and information to help institutions automate and integrate their internal business processes. Reuters Data scope delivers and manages market data for easy integration across the organization. The market The global asset management industry represents a significant opportunity for Reuters. Its participants spent $12.5 billion in 2001 on decision support, tools and infrastructure. Demographic shifts and deregulation, most notably in Europe, are promoting strong growth in demand for asset management services worldwide, particularly for private client services. However, asset managers are operating in a fragmented and highly competitive market and are being driven to adapt quickly to maintain profit margins, retain their customers and build assets under management. The recent poor market performance is driving an urgent need within the sector to cut costs and gain efficiencies. 2. Investment Banking Revenue by Segment at 31 March 2003 Investment Banking 27% Reuters is well established in the investment banking sector. It provides information, analytical, transaction and community services for a diverse range of organizations and end-users. Key products Reuters 3000Xtra and Reuters Bridge Station Reuters 3000 Extra and Reuters Bridge Station are our premium cross-market products. They provide market data, news, value-added content and analytics for sales and trading professionals. Reuters Knowledge Due for launch in mid-2003, Reuters Knowledge is a new information service for research and investment banking professionals. It combines everything they need to do their job into one product to enable them to work more productively while eliminating costs. Reuters Research & Advisory Reuters Research & Advisory is a product designed specifically for the needs of research analysts and corporate finance and M&A professionals. It combines delayed market data, real-time news and company fundamental content. Back office Reuters provides data and information to help institutions automate and integrate their internal business processes. Reuters Data scope delivers and manages market data for easy integration across the organization. Research groups Its segment also encompasses a number of research groups: Our market The investment banking sector has experienced a challenging trading environment. Its customers are being forced to respond to increasing competition, regulatory pressures and decreasing barriers to entry. In the face of such trends, they can no longer pursue traditional means to generate growth. They must generate efficiency in their operations, differentiate their services by exploiting their intellectual capital, and seek better ways to monetize their assets. This creates a need to invest in solutions that drive efficiency and create differentiation. 3. Treasury Services Revenue by Segment at 31 March 2003 Treasury Services 38% Reuters has a long history of helping customers operate more effectively in the financial markets and has built a powerful global franchise. Treasury Services is Reuter’s largest customer segment and continues to perform strongly in a changing market. It provides news, prices and transaction services. It also offers solutions that enable its customers to service their customers efficiently and software applications that enable financial institutions to understand and manage their risks, cash flow and order flow. Key products Information: Reuters 3000 Extra is a cross-market product and is our premium desktop offering for the treasury market. It enables treasury users to monitor the market with extensive news coverage, including surveys and forecasts, and a broad coverage of market data including prices from more than 2,000 foreign exchange and money market contributors. The product also provides sophisticated analysis tools, charting and the ability for users to customize their own work style. Trading: Reuters Dealing 3000 Spot and Forward Matching products provide an electronic automatic matching service which enables users to trade spot and forward foreign exchange. Reuters Dealing 3000 Direct is a conversational dealing service, which has become the standard for electronic trading and communication in the foreign exchange and money markets. It is used by a community of more than 18,000 members. Reuters Dealing Link, launched in 2002, is designed for users who require basic trading functionality yet depend on reliable access to the community. It is a cost-effective way for customers to provide a trading capability to more dealers and sales people than ever before. 4. Coporates & Media Revenue by Segment at 31 March 2003 Corporate & Media 11% Corporate and Media comprises two businesses. Media is the traditional heart of the company. It has been serving the media industry for more than 150 years. Media represents Reuter’s news business and provides a broad array of products including text/print services, pictures, TV/video, books and online services. Corporate serves customers outside financial services and the media, providing research, advisory and business intelligence services. Key products Media It provides two main text services. Reuters News Wires deliver up-to-the-minute news and analysis. The Reuters On-line Reports service posts automatically to customers websites breaking news stories with photos, video and graphics. Reuters Book Publishing was established in 1999 to draw on our expertise in news, pictures and data. The Reuters book imprint comprises more than 30 titles including the best-selling "September 11: a testimony". Reuters.com is targeted at investors, business professionals and high net worth individuals. It combines comprehensive coverage of the world financial markets with major breaking news to provide online readers with a single destination for staying reliably informed. Corporate Fictive, its joint venture with Dow Jones operates one of the world richest and most diverse news and information retrieval service, providing access to over 8,000 sources of information.