MONEY DEMAND

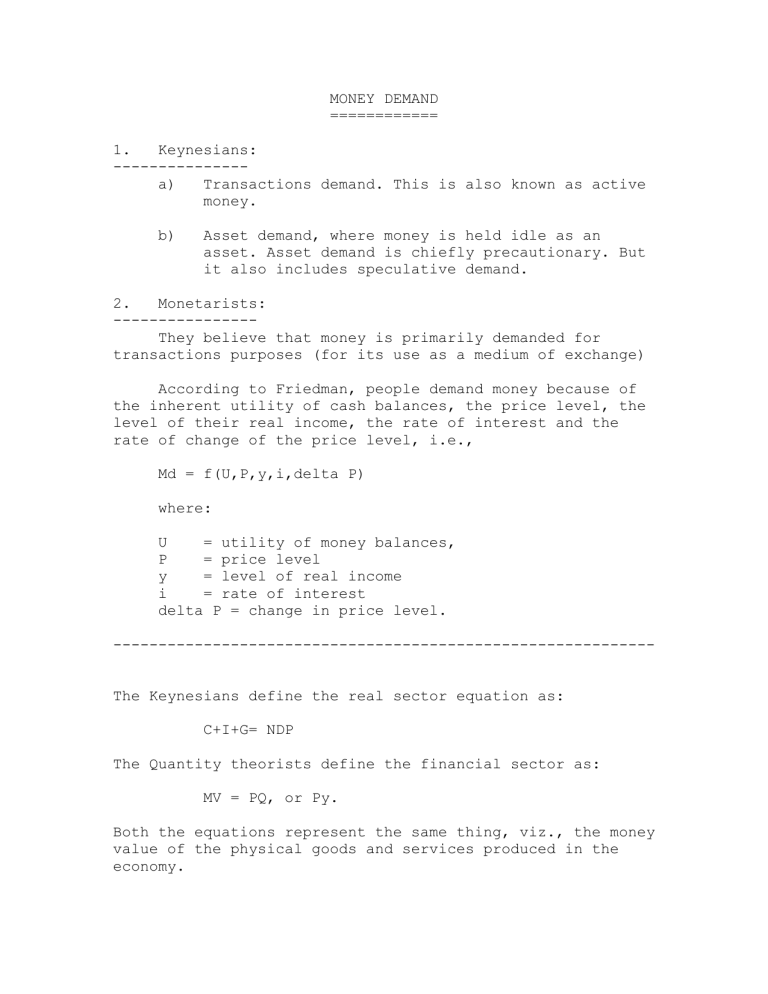

1. Keynesians:

--------------- a) Transactions demand. This is also known as active money. b)

MONEY DEMAND

============

Asset demand, where money is held idle as an asset. Asset demand is chiefly precautionary. But it also includes speculative demand.

2. Monetarists:

----------------

They believe that money is primarily demanded for transactions purposes (for its use as a medium of exchange)

According to Friedman, people demand money because of the inherent utility of cash balances, the price level, the level of their real income, the rate of interest and the rate of change of the price level, i.e.,

Md = f(U,P,y,i,delta P) where:

U = utility of money balances,

P = price level y = level of real income i = rate of interest delta P = change in price level.

------------------------------------------------------------

The Keynesians define the real sector equation as:

C+I+G= NDP

The Quantity theorists define the financial sector as:

MV = PQ, or Py.

Both the equations represent the same thing, viz., the money value of the physical goods and services produced in the economy.

Thus, MV = C+I+G

The monetarists find that M (money supply) closely parallels the growth of GDP. Thus they feel that money supply causes

GDP change. Whereas Keynesians doubt this causation.

KEYNSIAN IS-LM ANALYSIS

=======================

(also called Hicksian IS-LM analysis):

LM curve: (eqbm. in financial sector)

--------

L = demand for money function

M = supply of money function

The LM curve is the locus of those combinations or pairs of aggregate money income and the rate of interest at which the money market is in equilibrium in the sense that there is equilibrium between the total demand and the total supply of money. (Vaish:285)

LM curve is the locus of all the equilibria values of real incomes and real interest rates that are consistent with equilibrium in the money market sector.

Money market equilibrium:

M

--- = L (r, Y)

P

See Auerbach:440,572

Here, M/P = money supply (stock)

L = demand for real balances r = nominal interest rate on bonds

(opportunity cost of holding money)

Y = Real income

The demand for money is directly related to income, and negatively related to the real interest rate.

This equation is referred to the LM curve.

(Kearney/MacDonald:10)

IS curve (eqbm. in real sector)

--------

I = investment

S = savings

We know that investment is determined by the rate of interst and that saving is determined by income. It follows that some combination of interest and income will result in saving and investment being equal. In fact, there are a variety of such combinations.

IS curve is the locus of all those combinations of income and rate of interest at which aggregate savings equals aggregate investment, i.e., S = I , showing that aggregate supply equals aggregate demand. This curve shows the equilibrium in the real sector of the economy.

(Vaish:292)

The IS shedule shows all possible combinations of interest and income where investment equals saving and hence shows all possible points of equilibrium in the real sector.

Liquidity trap:

It is that interest rate (usually about 2%) at which people withdraw all their money from bonds, etc., and keep it in the form of money. Lowering interest rates beyond this point will convert the entire bonds into money: it traps all the money. Hence the name (Keynes)

Vaish:272

What is the price (or cost) of money?

1. Classical: The price of money is the reciprocal of the absolute price level. The absolute price level is measured by a standard basked of commodities.

Let P be the price level, or the money required to buy a standard basket of currencies (say, 1000 dollars).

Then the price of money is 1/P, or 1/1000.

If the price level doubles, i.e., you require 2000 dollars to buy the same basket of goods, then the price of money is halved, 1/2000.

Thus 1/P measures the internal purchasing power of money.

2. Neo-classical and Keynesian notion: According to this view, the price of money is = the alternative opportunity cost of holding cash balances, which is, in other words, the rate of interest on alternative investment opportunities, where interest rate is the rental price of money.

ROLE OF MONEY IN THE ECONOMY

===========================

Why should we bother to study money in economics.

Presumably, money is studied because it is non-neutral in its effect on the real sectors of the economy. But first, a few concepts:

Money illusion:

---------------

In case price level increases by 5% and the incomes increase by 5%, then money illusion refers to the illusion of increase in income in such circumstances. There has been of course, no real increase in incomes. (Don Patinkin) If people suffer from money illusion they will spend more of their illusionary increase in income, thus causing increased consumption.

Money neutrality:

-----------------

According to this view, increase in money supply has merely served to increase the price level proportionately, and no one is better off; money has played a neutral role in the economy. All economists agree that money is neutral in the long run, but both Keynesians and monetarists agree that money is non-neutral in the short run, and that increase in money supply does not increase prices immediately, on the other hand, it increases aggregate demand/ output. However, the new classicals, who support the rational expectations

hypothesis, believe that money is neutral both in the short and long run, since people know that prices are going to rise, and therefore tend to increase the prices immediately, rather than going through the complicated process of increase in Y, etc.

(A) MONEY IS NEUTRAL EVEN IN THE SHORT RUN:

==========================================

Given:

MV = PY (equation of exchange)

Extreme classical view:

-----------------------

In this case, V is constant since it is determined by payments technology. Further, Y is independent of the variables above, since it is determined by factor supplies .

Accordingly, increase in M leads to increase in P. Thus, according to this view also, money has no impact on the real economy.

Extreme Keynesian view:

-----------------------

According to this, the velocity of money, V, is inversely proportional to M, i.e., MV is constant. In this case, increasing M simply reduces the velocity of money, and there is no change either in P or in Y. Thus, money has no role whatsoever in the real sector of the economy.

(B) MONEY IS NON-NEUTRAL IN THE SHORT RUN:

==========================================

1. Keynesian view:

-------------------

Change in monetary policy -> change in trading bank reserves

-> change in money supply -> change in the interest rate -> change in investment

Keynesians distinguish between the real sector and financial sector. They regard money as just one financial asset among many. They analyse the transmission of changes in money supply as follows:

Increase in quantity of money leads to buying of short-term debt instruments. This is portfolio adjustment.

This increases the interst rate, including the long-term interest rate. Till now, all transactions have taken place only in the financial sector.

Increase in interest rates begins affecting the real sector through reducing investment. This is the transmission mechanism.

However, Keynesians say that there are a lot of factors which affect the portfolio adjustment and the transmission mechanism, and it is quite possible that the effects of the increase in money supply may not be transmitted to the real sector at all.

Thus they discount the influence of money as the primary policy variable in the economy. They lay greater stress on fiscal policy, and believe in a mixture of monetary and fiscal policies. They are also called fiscalists. Keynesianism supports a liberal political approach with greater involvement of government in the economy.

See diagram, Waud:opp.289

Keynesians believe that the velocity of money, V, changes with the interest rates. It is intimately linked to the demand for money.

2. Quantity theorists (or monetarists)

----------------------------------------

Trans.mech: change in monetary policy -> change in money supply -> change in GDP

Monetarists believe that the velocity of money, V, is an a steady, long-term trend.

According to the monetarists (who believe in the quantity theory of money), however, there is no great difficulty in transmitting the effects of increase in money supply to the real sector. This is because of the quantity equation. If people have more quantity of money, they spend it and this leads to increase in investment. The monetarists discount the value of fiscal policy. They feel that an increase in

government spending will be offset by a decrease in private spending, as a result of which total spending will rise very little. Monetarism supports a conservative political approach, with monetary policy playing its role in the background.

The quantity theory starts from the equation of exchange which is an undisputed truism. It is a tautological identity. MV = PT. It cannot be false. And it is not a theory of money any more than a balance sheet is a theory.

However, this equation helps us develop a theory of money, the quantity theory. When we criticise the quantity theory of money, we are not disputing the quantity equation; only the behaviours that are allegedly derived from it.

INTEREST RATES AND MONEY SUPPLY CANNOT BE TARGETED

SIMULTANEOUSLY. (See Jackson:303)

Difference between Keynesians and Monetarists:

----------------------------------------------

(a) Monetarists think that the short run is much shorter than the Keynesians. The real effects of money are therefore temporary on the real economy, but much faster on inflation.

(b) There is the difference in transmission. Keynesians transmit to the real economy through INTEREST RATES.

Monetarists transmit through INCREASE IN CONSUMPTION.

3. New Classical View: (after Robert Lucas (1972) Rational expectations)

This view is similar in its results to the money neutrality, but does not go through the equation of exchange. It simply presumes that since people know that prices are going to increase, they will do so at once.

Rational expectations logic shows that government need not follow discretionary policy, and resembles monetarists to that extent. According to this view, the govt. would be best to follow a steady growth in M, rather than allow spurts, since these will be merely translated into inflation, and will cause destabilisation in the economy.

Read Juttner:572-574

Other differences between Keynesians and Monetarists:

----------------------------------------------

1. Quantity theorists tend to believe that monetary policy is all that is needed to stabilise the economy and that fiscal policy isn't effective anyhow. Keynesians feel that fiscal policy is a powerful force in the economy and that both monetary and fiscal policy are needed to avoid inflations and recessions.

2. In the quantity theory, the quantity of money impinges directly on spending decisions of all types. Keynesians see the quantity of money as influencing the economy indirectly, primarily through interest rates.

3. Quantity theorists see major disturbances in the economy as arising in the monetary sector while

Keynesians see them as arising in the real sector

(especially in private business investment I). Thus, monetarists argue that monetary policy should be conducted according to a fixed rule (nondiscretionary), e.g. it should be increased at, say, 4% p.a., come what may. The Keynesians argue that instability occurs due to different levels of business investment at different points of time, and argue that this can be levelled out only by applying different interest rates at different times, (i.e., the policy should be discretionary).

Others: a) Monetarists and neo-Keynesians (new Classicals), favour a more laissez-faire or free-market economy, with government intervening mainly to restrain monopoly and other forms of anticompetitive behaviour. They fear that fiscal policy gives rise to too much direct government intervention in the economy. Keynesians believe that the government can and should play a more effective and active role in correcting the shortcoming of the market mechanism.