chapter 10 the ad-as model and fiscal policy pop quiz

advertisement

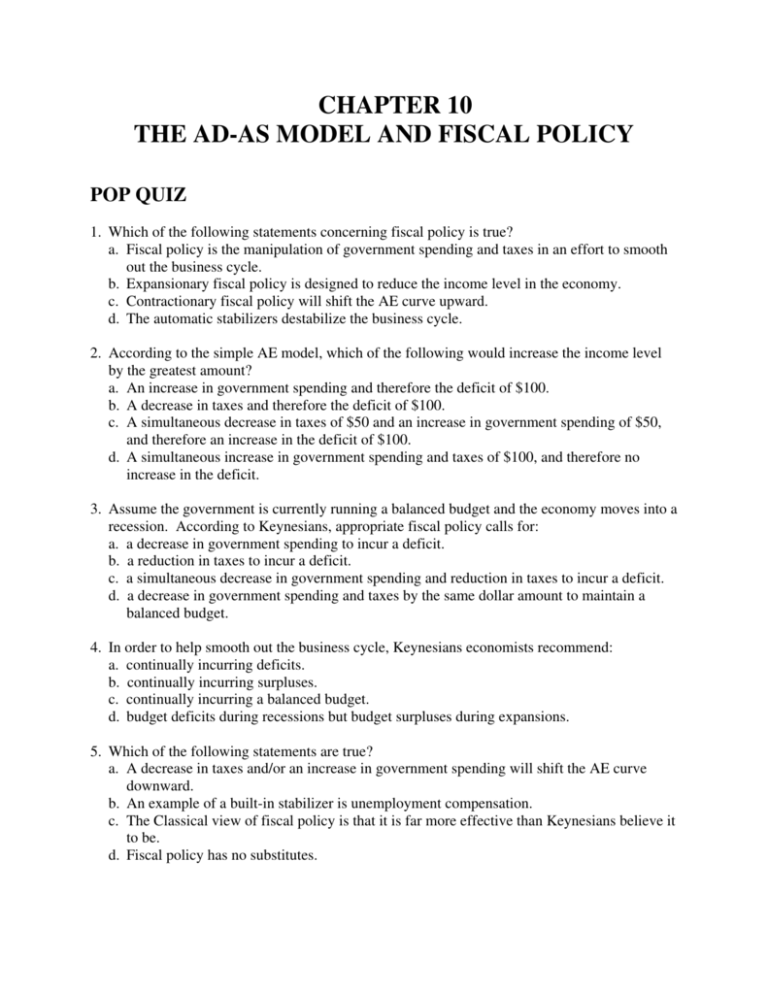

CHAPTER 10 THE AD-AS MODEL AND FISCAL POLICY POP QUIZ 1. Which of the following statements concerning fiscal policy is true? a. Fiscal policy is the manipulation of government spending and taxes in an effort to smooth out the business cycle. b. Expansionary fiscal policy is designed to reduce the income level in the economy. c. Contractionary fiscal policy will shift the AE curve upward. d. The automatic stabilizers destabilize the business cycle. 2. According to the simple AE model, which of the following would increase the income level by the greatest amount? a. An increase in government spending and therefore the deficit of $100. b. A decrease in taxes and therefore the deficit of $100. c. A simultaneous decrease in taxes of $50 and an increase in government spending of $50, and therefore an increase in the deficit of $100. d. A simultaneous increase in government spending and taxes of $100, and therefore no increase in the deficit. 3. Assume the government is currently running a balanced budget and the economy moves into a recession. According to Keynesians, appropriate fiscal policy calls for: a. a decrease in government spending to incur a deficit. b. a reduction in taxes to incur a deficit. c. a simultaneous decrease in government spending and reduction in taxes to incur a deficit. d. a decrease in government spending and taxes by the same dollar amount to maintain a balanced budget. 4. In order to help smooth out the business cycle, Keynesians economists recommend: a. continually incurring deficits. b. continually incurring surpluses. c. continually incurring a balanced budget. d. budget deficits during recessions but budget surpluses during expansions. 5. Which of the following statements are true? a. A decrease in taxes and/or an increase in government spending will shift the AE curve downward. b. An example of a built-in stabilizer is unemployment compensation. c. The Classical view of fiscal policy is that it is far more effective than Keynesians believe it to be. d. Fiscal policy has no substitutes. 6. The crowding out effect: a. states that deficit spending financed by borrowing will increase interest rates and thereby crowd out private spending. b. occurs because when the government runs a deficit it must buy bonds to finance that deficit. c. occurs because businesses become more pessimistic about the future whenever government spending rises. d. gets smaller the closer the economy comes to full employment. 7. Which of the following statements is true? a. Higher taxes and higher marginal propensities to import increase the size of the real world multiplier. b. Reducing the deficit during a recession would help keep the recession from getting worse. c. The purpose of expansionary fiscal policy is to reduce inflationary pressures. d. Contractionary fiscal policy involves raising taxes and/or reducing government spending — moving in the direction of a budget surplus. 8. In a simple AE model with a mpc of 0.75, if the target level of national income is $3000 billion and the economy is currently operating at an income level of $3200, then: a. the recessionary gap is $200 billion and government could close the gap by increasing government spending by $50 billion. b. the recessionary gap is $200 billion and government could close the gap by reducing taxes by approximately $66.67 billion. c. the inflationary gap is $200 billion and government could close the gap by reducing taxes by approximately $50 billion. d. the inflationary gap is $200 billion and government could close the gap by increasing taxes by approximately $66.67 billion. 9. Which of the following statement is true? a. Keynesian economists argue that an increase in aggregate demand is divided between a rise in the price level and a rise in real income. b. Classical economists believe that the crowding out effect is small. c. Countercyclical fiscal policy is designed to offset shocks to the economy. d. A recession is caused by anything that results in an increase in AE (total spending). 10. The Classical view of expansionary fiscal policy is that it: a. shifts the AD curve to the left by less than the Keynesians believe. b. moves the economy along the upward sloping portion of the AD curve. c. creates some inflation. d. shifts the AE curve down by a smaller amount than what the Keynesians argue because of inflation and crowding out. ANSWERS TO POP QUIZ 1. a 2. a 3. b 4. d 5. b 6. a 7. d 8. d 9. c 10. c