AT&T: The Second Breakup -- Divide to Conquer

advertisement

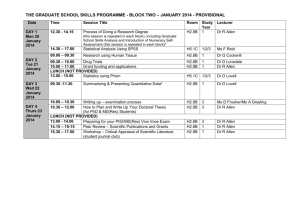

AT&T: The Second Breakup -- Divide to Conquer : Defying Merger Trend , AT&T Plans to Split Into Three Companies --Long Distance, Freed of NCR And Equipment Business, Will Take On the Bells --Capital Subsidiary Is For Sale By John J. Keller 09/21/1995 The Wall Street Journal Page A1 (Copyright (c) 1995, Dow Jones & Company, Inc.) NEW YORK -- Eleven years after AT&T was forcibly split into pieces by the federal government, it is breaking up again -- without a shove from anyone. AT&T Corp. yesterday stunned the business world with a plan to divide itself into three independent, publicly traded companies, in effect jettisoning an ailing computer unit and a potent equipment business to focus tightly on its communications mainstay. The plan comes as the world's largest telecommunications empire faces a new cascade of competition -- both in the long-distance market it dominates and in the local business it hopes to enter -- as Washington pushes to open all telephone markets. It is a bold move that could free AT&T of the distractions of the other operations as it tries to protect and expand the core businesses that provide 80% of its annual profit and 60% of sales. But the breakup also amounts to a risky gamble and raises the question: Could AT&T be shedding too much of what made it great? While heavyweights in medicine, entertainment and banking are in hellbent pursuit of mergers and bigness, AT&T has decided that the opposite course is better suited to the global telecom wars. The new AT&T, after the restructuring takes effect around the end of 1996, will have about $50 billion in annual revenue from long-distance, cellular service, credit cards and consulting. The second public company -- still unnamed -- will have about $20 billion in sales and be based on the huge Network Systems switch-making unit, on telephone manufacturing and on Bell Laboratories, the renowned research center. The third company will be formed out of AT&T's money-losing computer unit, Global Information Solutions -- formerly NCR -- with $8 billion in annual revenue. The seeds of this second AT&T breakup lay in Chairman Robert E. Allen's frustration over the stock price and in rising conflicts among its businesses as the company pushes into cellular, local and other new markets. On paper, AT&T has had the kind of "vertical integration" that strategists revere: It owns and runs the world's most sophisticated telephone network, powered by gear from its Network Systems unit. But the Baby Bells and cellular firms have accounted for a big chunk of that unit's $9 billion in annual sales. Now AT&T has taken over cellular rival McCaw and is targeting the local markets of the Bells. Network Systems' main customers have been increasingly chary about buying from a rival. At the same time, AT&T's computer business has become a drag on earnings, running up nearly half a billion dollars in losses so far this year and halving AT&T's overall profit growth in the first half. Yesterday, the unit unveiled plans to slash thousands of jobs, as expected. The total number cut will be 8,500, and the move will mean a one-time pretax charge estimated at $1.5 billion that will reduce third-quarter AT&T earnings by $1 billion, or 66 cents a share. "The complexity of trying to manage these different businesses began to overwhelm the advantages of our integration," Mr. Allen said in an interview yesterday. "The world has changed. Markets have changed. Conflicts have arisen, and each of our businesses has to react more quickly." But in shedding a strong business -- Network Systems -- and a weak one -- computers -- AT&T will be left primarily with its communications business, which faces ever more daunting challenges. Archrival MCI Communications Corp. continues to grow at twice the rate of AT&T in long distance. MCI also is far out front in global expansion, thanks to its partnership with British Telecommunications PLC. A spate of new competitors in wireless services will put price pressure on AT&T cellular. And if the Bells enter long distance -- as a pending bill in Congress would allow them to do -- they will target the residential customers who make up AT&T's most important base. After a split-up, AT&T will no longer be able to rely on its big equipment unit as a cushion for financial results and as a captive supplier that puts AT&T's needs first. And in shedding Bell Labs, AT&T will no longer be privy to its technology breakthroughs. Instead, AT&T will keep a small cadre of researchers. The two new companies other than AT&T will face hurdles, as well. The equipment-manufacturing business will have to begin operations without the AT&T brand, an important asset. The computer unit also will have to drop the AT&T name -- after having shed its well-known NCR label a year ago. Some of the competitive issues prompting Mr. Allen's move were hampering the company's stock price. While AT&T lately had traded in the upper $50 range, near the 52-week high, the shares have been more or less stalled since hitting $65 in mid-1993. "The market value of AT&T was being buried," Mr. Allen said. "Investors couldn't understand the strategy of the combined company." Under the new setup, AT&T will be the biggest pure play in telecommunications. "Investors will clearly understand it now," the chairman said. "I'm trying to shape the future rather than react to it. This was the time." Mr. Allen will continue to head the slimmed-down AT&T Corp. that emerges. Wall Street gave AT&T's plan an ovation, pushing the stock up $6.125 to $63.75 on hectic trading of 28 million shares. The nearly 11% jump added some $9.5 billion to the company's stock-market value. The split-up could have a big effect not just on rivals but also on shareholders in what is one of the world's most widely held stocks. Since the historic Bell System breakup, investors who have held on to both their AT&T shares and the shares they got in the seven newly formed Bell companies have realized hefty gains. The total combined value has risen more than sixfold from the day the spinoff plan was announced in January 1982 to yesterday, compared with less than a fivefold rise in the Standard & Poor's 500 index. To help finance the new, voluntary breakup and pretty up the balance sheets of the spinoffs, AT&T, which holds more than 80% of AT&T Capital Corp., plans to sell its remaining interest in the leasing and finance company. It will apply the proceeds to reduce each new company's debt. Capital Corp. had revenue of about $1.4 billion in 1994. Early next year, AT&T also intends to mount a public offering of 15% of the equipment business, with the rest later to be given to existing AT&T shareholders. In recent months, some speculation had arisen that AT&T might shed its computer business or perhaps even sell Network Systems to gird for competition. But few had anticipated the kind of dramatic move unveiled yesterday. The split marks a stark departure from Mr. Allen's oft-stated strategy of combining his communications assets with higher-growth computers and multimedia products to offer customers a seamless array of services as the various technologies converged. But to hear Mr. Allen tell it yesterday, he had been weighing this latest move almost since the breakup of the old AT&T took effect 11 years ago. Vertical integration "worked well in the [old] Bell System," he told a packed news conference in New York, but "it's an idea whose time has passed." The urgency to transform AT&T has been heightened in the past year as the Bell forces gained support in Washington for their plans to win new entry into the long-distance business that AT&T now leads. Mr. Allen first mentioned the possibility of a breakup last March in discussions with the AT&T board, but kept the idea secret from most of his senior managers. In May, he formed a three-member team to pursue the plan, consisting of himself, the company's top lawyer, John Zeglis, and Richard Miller, AT&T's chief financial officer. A month later Mr. Allen brought in his most senior unit managers, including Alex J. Mandl, who heads AT&T's main long-distance business, and Richard McGinn, chief executive of the Network Systems unit, and explained his plans for the new AT&T. Mr. Mandl will lead the transition to the new AT&T. Mr. McGinn will oversee the equipment-business spinoff. AT&T's outside advisers are Morgan Stanley Group Inc. and Wachtell Lipton Rosen & Katz. The AT&T team spent the summer setting a structure for the breakup, and directors approved it yesterday morning. Shareholder approval isn't required. Some analysts say the AT&T split will alter the industry's landscape. If the three new companies truly are separate, AT&T may be able to make a credible case that it should be allowed to buy a Baby Bell outright, says William F. Baxter, a former Justice Department official who helped engineer the breakup of the Bell System. Such a move has long been barred by the consent decree that broke up the old Bell System, and AT&T would have to persuade the federal judge who oversees the decree to lift the ban. But AT&T could argue that its core communications company is similar in structure to the Bells, which are allowed to buy each other. A nod from the federal court would let a slimmed-down AT&T buy a rapid entry into the local phone business. Analysts say AT&T must act quickly in one way or another, for the Baby Bells are perilously close to gaining entry into the long-distance market. That could steal one-third of AT&T's market share in long distance in only 18 months, some experts have predicted. "While the restructuring allows AT&T to better focus on its core business, the business issues for AT&T don't go away," notes Jack B. Grubman, an analyst at Salomon Brothers Inc. "Let's put it this way," he adds, "I still have a hold on AT&T's stock. This ain't a layup." That is why AT&T's long-distance unit, which now is run by Mr. Mandl and will be the heart of the new AT&T, must brace to take on a host of new competitors, even as it targets new markets. Yet AT&T's ability to get into the local market by teaming up with cable-TV companies may be constrained. Sprint Corp., its other major long-distance rival, has lined up three of the largest cable companies -- Tele-Communications Inc., Comcast Corp. and Cox Communications Inc. -- to begin reselling Sprint long-distance service to their millions of customers. The cable partners also plan to offer Sprint a local link into their markets, and together they will offer nationwide wireless service. The new AT&T also will have to shore up efforts to build world-wide partnerships as it seeks to enter individual countries. Analysts complain that the company's alliances thus far are nebulous and have yet to produce meaningful revenue, while MCI's international corporate service with British Telecom has already captured upwards of $1 billion in annual revenue. The breakup may actually prove to be better for the Network Systems unit. The Bells had been showing signs of delaying huge equipment orders from the unit as they transform their local networks to carry multimedia voice, data and video traffic. Bell Atlantic Corp., for example, has yet to sign a deal reached early last year in which AT&T would sell $11 billion of network equipment and services. And when four Bell-related partners in a wireless venture negotiated to pick a supplier for their new national network, some quarters were at odds over whether to pick AT&T, despite the excellence of its switches and transmission gear and software. AT&T ultimately split the $1 billion contract with Motorola Inc. Overseas, foreign phone companies such as Deutsche Telekom in Germany and France Telecom have been wary of buying from AT&T, which plans to invade their local markets. "After the breakup, Network Systems could now even sell to MCI, which wouldn't buy equipment from AT&T in the past because of its long-distance arm," says Brian Adamik, an analyst at Yankee Group in Boston. Still, he notes, the equipment business could have a rough time adjusting to losing one of its primary assets: the AT&T brand -- one of the world's most heavily advertised logos. "If there's no AT&T brand anymore, what are you going to call yourself?" Mr. Adamik asks. It is possible the new AT&T may license its brand to some extent, though. In consumer phones, AT&T is struggling to rush out a redesigned line that will better compete with the more attractive models marketed by Sony Corp. and other offshore, lower-cost suppliers. In cellular telephones, Motorola continues to rule, although AT&T is currently finding some success with its own branded line. The computer business, Global Information Solutions, may have the toughest time of all. Without the financial might of AT&T to back it up, the unit will curtail its ambitions to expand as a full-fledged computer company. Yesterday, AT&T confirmed that computer chief Lars Nyberg, a former Philips Electronics NV executive, has begun cutting the company back to its business of making and selling checkout systems for the retail market, automated teller machines and computers for the phone industry. GIS will quit making personal computers and selling PCs in the retail market. It will lay off more than 20% of its workers, close facilities and write down assets as it tries to return to profitability after losses that analysts estimate could hit $600 million this year. Similar cutbacks could come at other AT&T spinoffs. The core long-distance business, which has 93,000 workers, has been through several layoffs in recent years, including a force reduction of 4,000 jobs in early 1994. AT&T has cut more than 100,000 jobs since the 1984 breakup, creating tremendous dislocation for a force that had been raised in a paternalistic, no-layoffs culture. After the new split-up, the AT&T that remains may eventually cut its work force by a further 15%, or 12,000 to 15,000 people, if the Bells cut deeply into its market, one executive says. Less-severe cuts in the Network Systems business also have been made in recent years, and further reductions may loom as it struggles to match offshore competitors in telephones and network gear. Mr. Allen maintains that the new breakup "is not about job cuts." He says the idea is to create "three new powerhouses" in their respective markets. But Mr. Adamik of Yankee Group notes, "Allen has chosen which one he wants to be with. He's aligning himself with the surviving AT&T." --- A Three-Way Split Yesterday's plan would turn AT&T into three publicly traded, global companies while selling off AT&T Capital. Here's a look: Communications Dominate Business breakdown, based on approximate 1994 revenue, in billions Communication Services $49 Network Systems $20 Global Information Solutions $ 8 A Look at the Companies COMMUNICATION SERVICES Name: AT&T CEO: Robert Allen Employees: 121,000 What They'll Have/Do: -- Current Communications Services Group -- AT&T Universal Card Services -- AT&T Solutions -- AT&T Wireless Services -- AT&T Laboratories NETWORK SYSTEMS Name: As yet unnamed CEO: Richard A. McGinn Employees: 137,000 What They'll Have/Do: -- AT&T Network Systems Group -- Global Business Communications Systems -- Consumer Products -- AT&T Paradyne -Microelectronics GIS Name: Global Information Solutions CEO: Lars Nyberg Employees: 43,000** What They'll Have/Do: -- AT&T's current computer unit (with focus on financial, retail and communications) -- Halt manufacture of PCs, but will support current hardware and software installations -- Will offer PCs as part of integrated solutions through agreement with outside supplier **Before 8,500 new layoffs announced yesterday Sources: AT&T, Disclosure Inc.