Chapter M2

advertisement

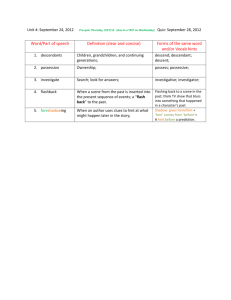

Chapter M2: Classifying Costs Multiple Choice 1. The following statement is true regarding costs: Direct costs cannot be specifically traced to a cost object. * Examples of direct costs include the wheels and gears of a bicycle. Indirect costs can be specifically traced to a cost object. Examples of indirect costs include the salaries of employees assembling the bicycles. Hint for question 1 Managers need cost data on all aspects of the business to make wise decisions. A cost object is anything for which a separate measurement of costs is desired. Close window 2. The following statement is true regarding service, merchandising, and manufacturing companies: For service companies the most significant cost is usually cost of goods sold. Merchandising companies convert raw materials into finished products. Examples of merchandising companies including Nike and Reebok. For manufacturing companies the most significant cost is usually cost of goods sold. Hint for question 2 * Service companies provide intangible services. Merchandise companies buy ready-made inventory for resale to customers. Manufacturing companies use labor, plant, and equipment to convert raw materials into finished products. Close window 3. Product costs -- include selling and administrative expense. might be reported in three different inventory accounts on the balance sheet of a merchandising firm. include the cost of shipping inventory to customers. are expensed on the income statement in the period the product is sold. Hint for question 3 * Product costs are incurred making products available and ready to sell. Close window 4. Period costs -- are also known as inventoriable costs. * will only be found on the income statement and not on the balance sheet. include freight-in. include direct materials, direct labor, and manufacturing overhead for a manufacturing firm. Hint for question 4 Period costs are all costs not considered product costs. Period costs are typically divided into selling and administrative expense. Close window 5. Direct materials -- have been purchased but have not yet entered the production process. include cleaning supplies used in the factory. become part of the manufacturing overhead costs. are included in both work-in-process inventory and finished goods inventory. Hint for question 5 * Direct materials include raw materials that become a part of the final product and can be easily traced to the individual units produced. Close window 6. Direct labor costs -- include the salary of the VP of Marketing. will never be found in inventory. * include the salaries and wages of factory workers who are part of the manufacturing process. can be classified as either a product or a period cost depending on the work performed. Hint for question 6 Direct labor costs include the cost of all production labor that can be traced directly to units of a manufactured product. Close window 7. Manufacturing overhead includes -- utility costs for executive headquarters that are separate from the manufacturing plant. salaries and wages of factory workers who put the product together. * depreciation expense on plant equipment. indirect and direct costs. Hint for question 7 Manufacturing overhead includes all costs associated with the operation of the manufacturing facility besides direct material costs and direct labor costs. It is composed entirely of indirect manufacturing costs. Close window 8. * Bicycle oil $500; bicycle wheels $10,000; cashier salary $15,000; cleaning fluid $200; bicycle polish $300; and store rental costs $60,000. For the Pro Bicycle Shop indirect material costs total -$1,000. $10,500. $16,000. $61,000 Hint for question 8 Indirect materials are raw materials used in production that cannot be traced to the individual units produced. Close window 9. Compute manufacturing overhead from the following information: Direct materials $30,000; indirect materials $10,000; direct labor $40,000; indirect labor $20,000; factory depreciation $50,000; and administrative salaries $60,000. * $80,000. $140,000. $150,000. none of the above. Hint for question 9 Manufacturing overhead only includes indirect manufacturing costs. Close window 10. * Beginning WIP inventory $10,000; ending WIP inventory $15,000; 2007 direct material costs $30,000; 2007 direct labor costs $40,000; and 2007 manufacturing overhead costs $80,000. 2007 cost of goods manufactured equals -$145,000. $150,000. $155,000. none of the above. Hint for question 10 Cost of goods manufactured is the cost of the goods that completed the production process in 2007. It's the cost of inventory that was transferred from WIP to FG inventory. Close window 11. Beginning FG inventory $20,000; ending FG inventory $25,000; and 2007 cost of goods manufactured $145,000. The following statement is true: Goods available for sale equals $165,000. Cost of goods sold equals $140,000. At the end of the accounting period, the amount reported on the balance sheet totals $25,000. * All of the above are correct. Hint for question 11 Finished goods can either be sold or remain unsold. Close window 12. Service corporations -- generally report cost of goods sold as their largest expense. report only one type of inventory on the balance sheet. * report cost of services on the income statement. report no period costs on the income statement. Hint for question 12 Service companies provide intangible services rather than a product. Close window Submit for Grade Chapter M2: Classifying Costs True or False 1. * Cost information is one of the key components of financial decision making. TRUE FALSE Hint for question 1 Cost is how much you give up to get something. Price is what we charge; cost is what we pay. Close window 2. Inventory is expensed in the accounting period purchased. TRUE * FALSE Hint for question 2 Inventory only includes product costs. In which accounting period are product costs expensed? Close window 3. * Period costs are never included in the cost of inventory. TRUE FALSE Hint for question 3 Period costs are expensed in the accounting period they are incurred. Close window 4. In a manufacturing company, employee salaries are always reported as period costs. TRUE * FALSE Hint for question 4 Does the employee work at administrative headquarters or in the factory? Close window 5. * Cost of services performed for a service corporation is similar to cost of goods sold for a merchandising firm. TRUE FALSE Hint for question 5 Cost of services performed includes the cost of materials, labor, and overhead required to perform services. Close window Submit for Grade Chapter M2: Classifying Costs Fill In The Blanks 1. A __________ company buys ready-made inventory for resale to customers. wholesale service manufacturing * merchandising Hint for question 1 Service companies provide intangible services. Merchandise companies buy ready-made inventory for resale to customers. Manufacturing companies use labor, plant, and equipment to convert raw materials into finished products. Close window 2. Advertising is an example of a(n) __________ cost expensed on the income statement in the accounting period the advertisement is used. product indirect direct * period Hint for question 2 What type of cost is expensed when incurred? Close window 3. * The cost of factory insurance is an example of __________, which is an inventoriable product cost. manufacturing overhead direct labor indirect materials direct materials Hint for question 3 There are three inventoriable costs: direct materials, direct labor, and manufacturing overhead. Close window 4. __________ is defined as the cost of the units completed during the production process this accounting period. Finished goods inventory Work-in-process inventory * Cost of goods manufactured Cost of goods sold Hint for question 4 In other words, these units were finished this accounting period. Close window 5. Product costs appear on the __________ in the accounting period the product is sold. balance sheet statement of stockholders' equity * income statement statement of cash flows Hint for question 5 Unsold product costs appear on the balance sheet as inventory. What happens to those costs when the product is sold? Close window Submit for Grade Chapter M2: Classifying Costs Essay Questions 1. Describe inventoriable product costs and period costs for a merchandising company. Explain in which accounting period each type of cost is expensed. 2. Describe the three components of a manufacturing company's inventoriable product costs. List one example of each type of cost. 3. For a manufacturing firm, list the four financial statement accounts that may include costs for raw materials. Indicate the financial statement that would report each of these amounts. Submit for Grade