Answer to Homework

advertisement

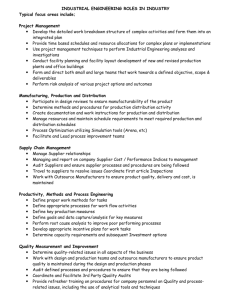

Answer to Homework Cht. 4 Supply Chain Management MGMT4102, J. Wang Page 154. #1. FCmake = $300,000, VCmake = $1.50/unit, FCbuy = $120,000, VCbuy = $2.25/unit. (a) Indifference point: FC make FCbuy $300,000 $120,000 $180,000 Qindiff 240,000 units VCbuy VC make $2.25 / unit $1.50 / unit $0.75 / unit (b) If demand is 300,000 units, then insourcing would be a better choice in terms of cost since 300,000 is larger than the indifference point 240,000 and making inside has lower variable cost. To verify, we have following total costs comparison: T. costinsourcing = $300,000+($1.50/unit)(300,000units) = $750,000; T. costoutsoucing = $120,000+($2.25/unit)(300,000units) = $795,000. #2. Continuation of problem #1. Total cost of buying from the new supplier: T. cost = $200,000+($1.8/unit)(300,000units) = $740,000. Therefore, outsourcing to the new supplier has lowest cost. If cost is the only factor to consider and we have confidence on the accuracy of the numbers involved in our above calculations, then outsourcing to the new supplier is the best choice. Or, calculate the indifference point of making and buying from the new supplier: FCmake = $300,000, VCmake = $1.50/unit, FCbuy = $200,000, VCbuy = $1.80/unit. FCmake FCbuy $300,000 $200,000 $100,000 Qindiff 333,333 units VCbuy VCmake $1.80 / unit $1.50 / unit $0.3 / unit Since the predicted demand is 300,000 units which is less than the indifference amount 333,333 units, and buying from the new supplier would incur a lower fixed cost, the company would be better off by buying from the new supplier. 1 #3. FCmake = $125,000, VCmake = $0.90/unit, FCbuy = $170,000, VCbuy = $0.65/unit, Current production quantity = 160,000 units. (a) Current annual cost of making in Downhill Boards: T.Costmake = $125,000+($0.90/unit)(160,000units) = $269,000. (b) Total annual cost of buying from DFC: T.Costbuy = $170,000+($0.65/unit)(160,000units) = $274,000. (c) Indifference point: FC make FCbuy $125,000 $170,000 $45,000 Qindiff 180,000 units VCbuy VC make $0.65 / unit $0.9 / unit $0.25 / unit Note: Here fixed cost of buying is greater than fixed cost of making, and variable cost of buying is less than variable cost of making, which is not as in ordinary cases. The formula for Qindiff is still applicable to such a situation. But its numerator and denominator become negative. (d) At least 20,000 units more (180,000-160,000) in demand is needed to justify outsourcing. #5. FCinsourcing = $85,000, VCmake = $15/order, FCoutsourcing = $100,000, VCbuy = $5/order, Number of orders last year = 1,450 orders. (a) Last year annual cost of making orders with insourcing: T.Costinsourcing = $85,000+($1.5/order)(1,450 orders) = $106,750. (b) Total annual cost if outsourcing last year: T.Costoutsourcing = $100,000+($5/order)(1,450 orders) = $107,250. (c) Indifference point: FCmake FCbuy $85,000 $100,000 $15,000 Qindiff 1,500 orders VCbuy VCmake $5 / order $15 / order $10 / order (d) If number of orders is 1,600, then using VB as the outsource will incur lower cost: T. costinsourcing = $85,000+($15/order)(1,600 orders) = $109,000; T. costoutsoucing = $100,000+($5/order)(1,600 orders) = $108,000. (e) Other factors to consider whether HFC should outsource to VB include: - The current two employees for purchasing will be laid off; - Variations in the future, internally and externally; - How much HFC would prefer to keep and control the purchasing information; - Credibility of VB; … 2