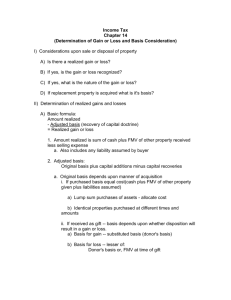

Chapter 10 Nonmonetary Exchanges

advertisement

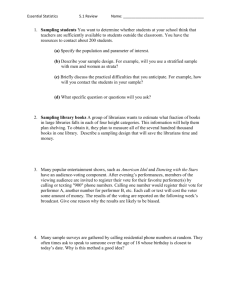

CHAPTER 10: NONMONETARY EXCHANGES Note: if cash exchanged in the transaction is 25% or more of the transaction, treat as a MONETARY transaction, where both parties recognize full gain or loss. Nonmonetary Exchanges - Exchange of PPE for other PPE (exchange of nonmonetary assets): the following questions need to be asked before recording the exchange: 1. Can fair market value (FMV) be determined? No: record the acquired asset at book value of assets given up (no gain or loss is recognized. Yes: continue with the additional questions below. 2. If FMV is determinable - is there a gain or a loss on the exchange? To find G/L, compare FMV to BV: (1) FMV of assets given up - BV of assets given up or (2) FMV of assets received - BV of assets given up Use equation (1) unless FMV of assets received is more clearly evident. If cash is given or received, include it in the FMV and the BV; cash has a FMV = BV. If difference is a loss, recognize loss. If difference is a gain, an additional question must be asked: 3. Does the exchange have commercial substance? (significant change in future cash flows as a result of the exchange) Yes: Use fair value for the exchange and recognize the gain. No: (No commercial substance) Was some cash (<25%)involved? Yes: recognize portion of gain. No: no gain recognized. In all the transaction alternatives, the amount of gain or loss recognized determines the recorded value of the asset received. EXCHANGE OF PROPERTY- EXAMPLE PROBLEMS (All situations below assume that FMV can be estimated on asset given.) A. Gain Situation (no cash received) - commercial substance (received land; gave trucks and $17,000 cash) FMV BV Given Given Trucks (old) 49,000 Trucks cost 64,000 Cash 17,000 Accum. Depr. (22,000) 66,000 Cash 17,000 59,000 Recognize Gain = $7,000 (since commercial substance) Basis for new asset = FMV Given = $66,000 Journal Entry: Land Accum. Depr. -Trucks Trucks Gain Cash 66,000 22,000 64,000 7,000 17,000 B. Gain situation – (no cash received) NO commercial substance (received trucks; gave trucks and $17,000) Trucks (old) Cash FMV Given 49,000 17,000 66,000 BV Given Trucks cost 64,000 Accum. Depr. (22,000) Cash 17,000 59,000 Gain = 7,000 --- Not recognized because no commercial substance in the exchange (no increased future cash flows) Basis = Book Value Given = 59,000 Journal Entry: Trucks (new) A/D -Trucks (old) Trucks (old) Cash 59,000 22,000 64,000 17,000 C. Gain situation (cash received) YES -commercial substance (cash received $7,000, and truck given with FMV of $49,000). Note treatment of cash received in exchange: FMV BV Given Given Trucks (old) 49,000 Trucks cost 57,000 Cash received ( 7,000) Accum. Depr. (22,000) 42,000 Cash recvd. (7,000) 28,000 Total Gain = 14,000 (recognize since commercial substance) Journal Entry: Trucks (new) 42,000 Cash 7,000 A/D (old) 22,000 Trucks (old) 57,000 Gain 14,000 D. Gain situation – no commercial substance and cash received (7/49 = 14.28%. recognize partial gain; 14,000 x 7/49 = 2,000 Journal Entry: Trucks (new) Cash A/D (old) Trucks (old) Gain 30,000 7,000 22,000 57,000 2,000 E. Loss situations - as long as loss (and FMV) determinable - recognize loss. Old asset Cash given FMV Given 6,000 7,000 13,000 BV Given Asset cost 12,000 Accum. Depr. (4,000) Cash given 7,000 15,000 Loss = $2,000 (recognize since FMV is determinable) Basis = FMV Given = $13,000 Journal Entry: New Asset 13,000 Loss on Exchange 2,000 Accum. Depr. (old) 4,000 Old Asset (Cost) 12,000 Cash 7,000