GST and Financial Services - Tax Policy website

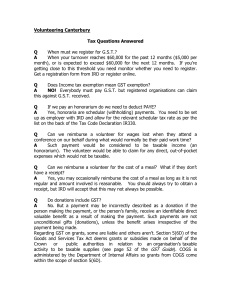

advertisement