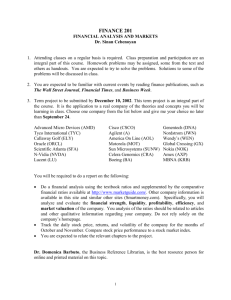

Topic 4: Analysis of Financial Statements

advertisement

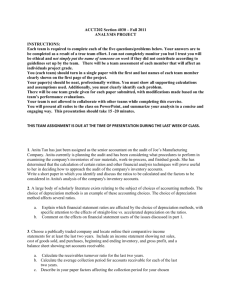

Topic 5: Analysis of Financial Statements Sections: I. Overview II. Ratio Analysis III. An Overall Analysis I. Overview There are at least 5 categories of inquiries should be answered through the analysis of financial statements: 1. The firm’s strengths, weaknesses, opportunities, and threats. 2. Short-term liquidity. 3. Profitability. 4. Operating Efficiency. 5. Capital structure and long-term solvency. The first category of inquiries can be appropriately answered only if one knows the firm’s business well. The basis for this understanding starts with a careful reading of the following sections of 10-K: business of company, and management discussion and analysis. In addition, external reports of the firm can be found at Yahoo Finance. The last four categories can be addressed with the help of ratio analysis. Nevertheless, ratio analysis has limitations. This technique is more a screening device; it is usually not accurate, nor predictive. The relative importance of these five categories depends on the needs of information users. For creditors, they would want to emphasize on the 2nd and 5th categories. In addition, they would want to know (1) the borrowing cause and whether the cause seems reasonable and promising, (2) what will be the source of repayment and is it generated from operation (i.e., sufficient OCFs). For investors, they would generally want to emphasize more on the 1st, 3rd, and 4th categories. They pay particular attention to the 2nd and 5th categories when the firm has a realistic chance of default. In addition, they would want to know (1) the quality of earnings, (2) future expectations about earnings and OCFs, and (3) corporate governance. II. Ratio Analysis As we have done in the previous topics, ratio analysis starts with the preparation of common-size income statement and balance sheet. The common-size income statement reveals the trends of expenses and margins. The common-size balance sheet shows the trends of asset, liability, and equity structures. Then, individual categories of ratio analysis are in order. In general, you would like to have at least five years of financial ratios. Short-Term Liquidity 1. Current ratio = current assets/current liabilities Intel’s current ratios are 2.38 (1993), 2.04 (1994), 2.24 (1995), 2.81 (1996), 2.64 (1997), 2.32 (1998), 2.51 (1999), 2.45 (2000), 2.68 (2001), 2.87 (2002), 3.33 (2003), and 3.00 (2004). 2. Quick ratio = (current assets – inventory)/current liabilities This is a more conservative measure of liquidity because it excludes inventory – the least liquid part of current assets. Intel’s quick ratios are 2.04 (1993), 1.65 (1994), 1.68 (1995), 2.55 (1996), 2.35 (1997), 2.05 (1998), 2.30 (1999), 2.19 (2000), 2.34 (2001), 2.52 (2002), 2.96 (2003), and 2.88 (2004). Profitability 1. Profit margin (on sales) = net income available to common shareholders/sales Intel’s profit margins are 26.13% (1993), 19.86% (1994), 22.01% (1995), 24.73% (1996), 27.70% (1997), 23.10% (1998), 24.89% (1999), 31.24% (2000), 4.86% (2001), 11.65% (2002), 18.72% (2003), and 21.97% (2004). 2. Return on common equity (ROE) = net income available to common shareholders/common equity Intel’s ROEs are 30.60% (1993), 22.86% (1994), 27.72% (1995), 30.08% (1996), 32.55% (1997), 25.74% (1998), 22.39% (1999), 28.23% (2000), 3.60% (2001), 8.79% (2002), 14.91% (2003), and 19.48% (2004). Operating Efficiency 1. Inventory turnover ratio = sales/inventories Intel’s inventory turnover ratios are 10.48 (1993), 9.86 (1994), 8.08 (1995), 16.12 (1996), 14.77 (1997), 16.61 (1998), 19.88 (1999), 15.05 (2000), 11.78 (2001), 11.76 (2002), 11.97 (2003), and 13.05 (2004). 2. Total asset turnover ratio = sales/total assets Intel’s total asset turnover ratios are 0.77 (1993), 0.83 (1994), 0.93 (1995), 0.88 (1996), 0.87 (1997), 0.83 (1998), 0.67 (1999), 0.70 (2000), 0.60 (2001), 0.61 (2002), 0.64 (2003), and 0.71 (2004). Capital Structure (Long-Term Solvency) 1. Debt ratio = total liabilities/total assets Intel’s debt ratios are 0.34 (1993), 0.28 (1994), 0.27 (1995), 0.28 (1996), 0.26 (1997), 0.25 (1998), 0.26 (1999), 0.22 (2000), 0.19 (2001), 0.20 (2002), 0.20 (2003), and 0.20 (2004). 2. Equity multiplier = total assets/common equity Intel’s equity multipliers are 1.51 (1993), 1.38 (1994), 1.36 (1995), 1.38 (1996), 1.35 (1997), 1.33 (1998), 1.34 (1999), 1.28 (2000), 1.24 (2001), 1.25 (2002), 1.25 (2003), and 1.25 (2004). Limitations: Ratio analysis is not rocket science, so the technique is widely used. The downsides include: 1. Ratios are subject to window dressing and accounting manipulation. Most of these ratios are calculated based on “reported” accounting numbers. 2. In general, there is no simple answer as to whether a particular ratio is good or bad. A good interpretation may need experience and supplemental information via careful reading of 10-K and other materials. 3. The Enron event again shows us that understanding business models is the foundation of firm analysis: if a firm cooks its book, numbers become meaningless. III. An Overall Analysis Now, we’d like to put all the pieces together. Du Pont identity is useful for this task. NI Sales Total Assets * * Sales Total Assets Equity = profit margin * total turnover * equity multiplier ROE = Intel’s Du Pont decomposition for the period of 1993-2004 is given as follows. 1993 1994 ROE 30.60% 22.86% Profit Margin 26.13% 19.86% Turnover 0.77 0.83 Multiplier 1.51 1.38 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 27.72% 30.08% 32.55% 25.74% 22.39% 28.23% 3.60% 8.79% 14.91% 19.48% 22.01% 24.73% 27.70% 23.10% 24.89% 31.24% 4.86% 11.65% 18.72% 21.97% 0.93 0.88 0.87 0.83 0.67 0.70 0.60 0.61 0.64 0.71 1.36 1.38 1.35 1.33 1.34 1.28 1.24 1.25 1.25 1.25 Limitations: 1. ROE is a return measure. It does not consider risk. It is incorrect to conclude that firm A performs better than firm B simply because firm A has a higher ROE than firm B. 2. ROE is based on “reported” accounting numbers. Therefore, one needs to examine (1) whether sales are not appropriately recognized, (2) whether NI is artificially boosted, and (3) whether assets (and associated liabilities) are hidden. Furthermore, an analysis will not be completed without a careful look at operating cash flows (recall the W.T. Grant case). Intel’s OCF/equity ratios during 1993-2004 are 0.37, 0.30, 0.31, 0.51, 0.47, 0.39, 0.35, 0.34, 0.24, 0.26, 0.30, and 0.34. The variation in this series is quite different from that in ROEs. Intel’s cash generating ability from operations is far more stable and has good performance in 2003 and 2004. Why? The answer is depreciation. Depreciation costs during 1993-2004 are 717, 1028, 1371, 1888, 2192, 2807, 3186, 4807, 6052, 5042, 4972, and 4590. This number is expected to be around 4400 (2005 10-K). So, the following is a summary of what we have found so far: 1. ROE seems to trend downward. 2. Although profit margin varies a lot over time, this does not seem to be the main reason why ROE is heading downward. 3. Concentration of investments in 2000 and 2001 (associated with high depreciation costs) is one of the reasons that profit margins in the two years are less than ideal. 4. Cash generating ability has been stable and good during the past 12 years. 5. Good cash generating ability and declining depreciation costs in recent years suggests that holding product market conditions constant, the profit margin in the near future should be promising. 6. So ROE could be further improved if Intel better utilizes its assets and/or adopts a slightly more aggressive financing strategy. -----------------------------------------------------------------------------------------------------------Group Tasks: (1) Download Wal-Mart Stores’ balance sheets and income statements from Chiang’s website. (2) Apply the techniques that you learned so far. (3) Your views. Submit a typed report in one week. Notes: All $ numbers in millions. SG&&A: Operating expenses. EBITDA: Operating income before depreciation. EBIT: Earnings before interest and taxes. @CF: Missing values; most likely, they have a value of zero. @NA: Not applicable. ------------------------------------------------------------------------------------------------------------