Financial Source Documents: Business Accounting Guide

advertisement

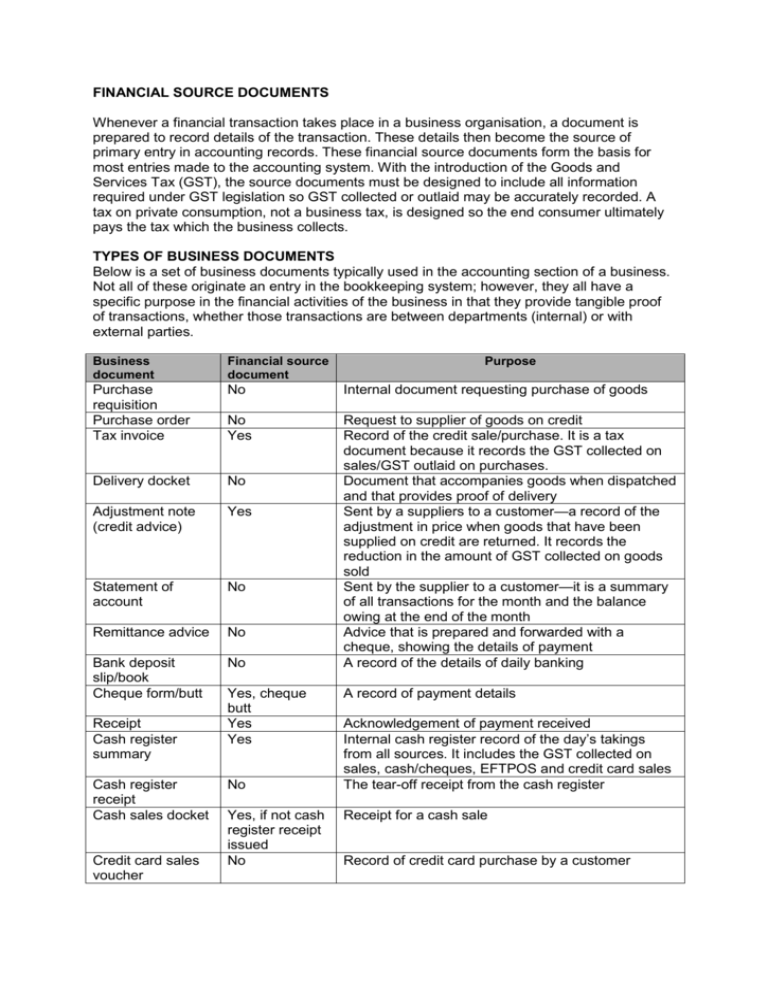

FINANCIAL SOURCE DOCUMENTS Whenever a financial transaction takes place in a business organisation, a document is prepared to record details of the transaction. These details then become the source of primary entry in accounting records. These financial source documents form the basis for most entries made to the accounting system. With the introduction of the Goods and Services Tax (GST), the source documents must be designed to include all information required under GST legislation so GST collected or outlaid may be accurately recorded. A tax on private consumption, not a business tax, is designed so the end consumer ultimately pays the tax which the business collects. TYPES OF BUSINESS DOCUMENTS Below is a set of business documents typically used in the accounting section of a business. Not all of these originate an entry in the bookkeeping system; however, they all have a specific purpose in the financial activities of the business in that they provide tangible proof of transactions, whether those transactions are between departments (internal) or with external parties. Business document Financial source document Purchase requisition Purchase order Tax invoice No Internal document requesting purchase of goods No Yes Delivery docket No Adjustment note (credit advice) Yes Statement of account No Remittance advice No Bank deposit slip/book Cheque form/butt No Request to supplier of goods on credit Record of the credit sale/purchase. It is a tax document because it records the GST collected on sales/GST outlaid on purchases. Document that accompanies goods when dispatched and that provides proof of delivery Sent by a suppliers to a customer—a record of the adjustment in price when goods that have been supplied on credit are returned. It records the reduction in the amount of GST collected on goods sold Sent by the supplier to a customer—it is a summary of all transactions for the month and the balance owing at the end of the month Advice that is prepared and forwarded with a cheque, showing the details of payment A record of the details of daily banking Receipt Cash register summary Cash register receipt Cash sales docket Credit card sales voucher Yes, cheque butt Yes Yes No Yes, if not cash register receipt issued No Purpose A record of payment details Acknowledgement of payment received Internal cash register record of the day’s takings from all sources. It includes the GST collected on sales, cash/cheques, EFTPOS and credit card sales The tear-off receipt from the cash register Receipt for a cash sale Record of credit card purchase by a customer Business document Financial source document Credit card credit voucher Credit card merchant summary EFTPOS credit receipt No No No Purpose Record of a credit card credit allowance to a customer for returns or overcharging Summary that is attached to daily credit card sales and returns, and banked with the daily deposit A receipt generated at the point of sale and signed by the customer FLOW OF SOURCE DOCUMENTS PURCHASING GOODS/SERVICES ON CREDIT SELLING GOODS/SERVICES ON CREDIT Purchase requisition Customer’s purchase order received Purchase order forwarded to supplier Goods/services delivery docket and tax invoice issued to customer Goods/services delivery docket and tax invoice received from supplier Faulty/damaged goods returned by customer Faulty/damaged goods returned to supplier Adjustment note issued to customer Supplier’s adjustment note received Statement issued to customer Supplier’s statement received Customer’s remittance advice and cheque received Remittance advice and cheque sent to supplier Receipt issued to customer Supplier’s receipt received