ForeclosureBriefinSupportMotion4TRO_Burns

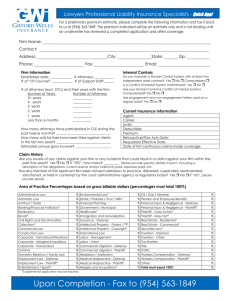

advertisement

STATE OF MICHIGAN IN THE JUDICIAL CIRCUIT COURT FOR THE COUNTY OF WASHTENAW * MICHAEL C. BURNS and * KAREN L. TOTTEN, * * Plaintiffs, * * Civil No.: v. * * MORTGAGE ELECTRONIC * REGISTRATION SYSTEMS, INC. and * COUNTRYWIDE HOME LOANS, INC., * * Defendant. * _______________________________________________ LEGAL SERVICES OF SOUTH CENTRAL MICHIGAN By: Anthony Greene (P47715) Paul D. Sher (P45094) Attorneys for Plaintiff 611 Church Street Ann Arbor, MI 48104 Telephone: (734) 998-6100 x. 26 ________________________________________________ BRIEF IN SUPPORT OF PLAINTIFF’S MOTION FOR TEMPORARY RESTRAINING ORDER Plaintiffs, MICHAEL C. BURNS AND KAREN TOTTEN, has filed the instant lawsuit against defendants MORTGAGE ELECTRONIC REGISTRATION SYSTEMS, INC. and COUNTRYWIDE HOME, alleging violations of the Truth in Lending Act, Mortgage Brokers, Lenders and Servicers Act, federal common law and state common law arising from a mortgage loan between the parties. Because defendants MORTGAGE ELECTRONIC REGISTRATION SYSTEMS, INC. and COUNTRYWIDE HOME have failed to adjourn the Sheriff's Sale scheduled for May 28, 2009 at 10:00 a.m., plaintiff has filed a Motion for Temporary Restraining Order. I. FACTUAL BACKGROUND Plaintiffs purchased the home located at 3459 Burbank Drive, Ann Arbor, Michigan. The real property is described as follows: UNIT NO 79 CHAPEL HILL CONDOMINIUM SECTION 2, ACCORDING TO THE CONSOLIDATED MASTER DEED RECORDED IN LIBER 2643, PAGES 330 THROUGH 645, INCLUSIVE , WASHTENAW COUNTY SUBDIVISION NO. 3, 4, 5, 6, 7, 8, , 9, 20, 28 AND 37, TOGETHER WITH RIGHTS IN GENERAL COMMON ELEMENTS AND LIMITED COMMON ELEMENTS, AS SET FORTH IN MASTER DEED AND AMENDMENTS THERETO AND AS DESCRIBED IN ACT 59 OF THE PUBLIC ACTS OF 1978, AS AMENDED. Plaintiffs purchased the above referenced property in 2000. On or about April of 2006 Plaintiffs received a brochure from Countrywide soliciting Plaintiffs to refinance their home. On or about April 20, 2006 Plaintiffs contacted Countrywide and began negotiating the refinancing of Plaintiffs’ home. Plaintiffs, at all times, believed that Countrywide would give them a single fixed rate loan. The documents presented to the Plaintiffs at the closing were numerous and confusing. Plaintiffs expected that the Countrywide representative would fully explain the documents to them before or at the closing. The agent who conducted the closing was a contract employee of Countrywide who was unknown to Plaintiffs. At the closing, Plaintiffs were presented with a thick stack of documents to sign. The closing agent did not offer to explain any of the documents, but simply rushed Plaintiffs through the signing. The entire process lasted approximately Forty-Five minutes. On information and belief, Plaintiff received a loan in the amount of $155,750.00 and was charged $7,486.00 in finance charges. The loan Plaintiff received was actually split into an 80/20 % loan format. Plaintiffs had no idea they were receiving 2 loans until they appeared at the closing and presented with the documents to sign. Plaintiffs were extremely confused because they did not know the rational for receiving two separate loans. When Plaintiffs asked why they were receiving multiple loans instead of 1 loan, the closing agent simply stated that Countrywide sometimes splits its loans. The disclosures were not grouped together but were stated separately. The Plaintiffs did not receive a TILA Disclosure Statement for the entire loan. Defendants therefore failed to provide Plaintiffs with a finance charge, annual percentage rate, amount financed. After the closing, Plaintiffs received copies of the documents they signed. Among these documents are 2 unsigned copies of the Truth in Lending Act’s required Notice of Right to Cancel. By certified letter dated March 27, 2009, Plaintiffs, through counsel, exercised their right under TILA to rescind the transaction. See Exhibit 1, attached. Plaintiffs’ rescission letter was received by Defendants on or before May 12, 2009. Plaintiff has fallen behind on her payments, and Defendants have commenced a foreclosure action. A Sheriff’s Sale is scheduled for Thursday, May 28, 2009 at 10:00 a.m. II. ARGUMENT In considering injunctive relief, the court must consider four factors: 1) Whether the plaintiff has shown a strong or substantial likelihood or probability of success on the merits; 2) Whether the plaintiff has shown irreparable injury; 3) Whether the issuance of an injunctive order would cause substantial harm to others; and 4) Whether the public interest would be served by issuing the injunction. Friendship Materials Inc. v. Michigan Brick Inc.. 679 F.2d 100, 102 (6th Cir. 1982), citing Mason v. County Medical Ass'n v. Knebel. 563 F.2d 256, 261 (6th Cir. 1977). In this case, Plaintiff's request meets all four of these requirements. A. Likelihood of Success on the Merits In this matter, defendants have violated the disclosure requirements of the Truth in Lending Act as well as state law. Plaintiff has rescinded the mortgage loan, but Defendants have failed to honor that rescission. Specifically, the Truth in Lending Act mandates that consumers have a right to rescind a transaction when it is a consumer credit transaction in which a non-purchase money lien or security interest is placed on the consumer's principal dwelling. 15 U.S.C. § 1635. The lender must give the consumer a notice regarding her right to rescind. In this case, Defendants clearly failed to provide Plaintiff with a proper notice. Defendant AFHL, its successors and assigns, also committed fraud by falsely stating Plaintiff’s income in the loan application. Plaintiff has always made less than $2,100.00 and Defendant AFHL reported that Plaintiff made more than $12,000.00 per month. Defendant’s conduct constitutes fraud and violates the Credit Repair Organizations Act. B. Irreparable Injury If a temporary restraining order is not granted, plaintiff will suffer an irreparable injury in that she will lose the ownership of her home. The risk is neither remote nor a mere possibility; rather, it is immediate in nature and very likely to happen on March 14, 2007. The loss of the home would be devastating to plaintiff who is a senior citizen living on a fixed income and would very likely render her homeless. If plaintiff loses her home, she can never be adequately compensated by monetary damages. The foreclosure sale must be enjoined to preserve the status quo pending adjudication of this case on the merits. If the foreclosure sale proceeds as scheduled, and then this Court ultimately finds that Plaintiff has validly rescinded her loan, plaintiff will still be denied her legal right to rescission because that right is extinguished upon foreclosure. The right to rescind under the Truth in Lending Act expires upon transfer of the property, whether that transfer is voluntary or involuntary. 12 C.F.R. § 226.15(a)(3). Thus, because the harm to plaintiff will be immediate and irreparable, this Court should grant Plaintiff's motion for a temporary restraining order. C. Balance of Harms The harm plaintiff will suffer if the property goes to foreclosure outweighs any harm to the defendants. If plaintiff succeeds on the merits of her case, she will remain the owner of the property at issue. If not, defendants would be free to continue with its foreclosure proceedings. Thus, Defendant will ultimately lose nothing in affording plaintiff the opportunity to have these claims fully adjudicated. Federal law requires a mortgage lender to give a mortgagor a notice of right to rescind. 12 C.F.R. § 226.23(b)(1). The notice must include various information, including the date the rescission period expires. 12 U.S.C. § 226.23(b)(1)(v). Usually a consumer has three days to exercise their right of rescission, however, if a lender fails to give the required disclosures the right of rescission can be extended for up to three years. 15 U.S.C. § 1635(f). A failure to include the date the rescission period expires has been found to be a material violation of the Truth in Lending Act, and as such, triggers the consumer's extended right to rescind the transaction. See Semar v. Platte Valley Fed. Sav. & Loan Ass'n. 791 F2d 699 (9th Cir. 1986) (rescission notice that omitted expiration date, although it stated that the right expired after three days, was a violation); Williamson v. Laffertv. 698 F.2d. 767 (5th Cir. 1983) (failure to fill in expiration date violated TILA); Reynolds v. D & N Bank. 792 F. Supp. 1035 (E.D. Mich. 1992) (creditor's failure to fill in expiration date was a violation); New Maine Nat'l Bank v. Gendron. 780 F. Supp 52 (D. Me. 1991) (rescission right is extended when expiration date has been omitted); Armstron v. nationwide Mortg. Plan. 288 B.R. 404 (Bankr. E.D. Pa. 2003) (notice lacked date of transaction as well as deadline for rescission). In this case, Plaintiffs never received all of the requisite Notices of Right to Cancel. Since the Defendants, and their successors and assigns, never provided Plaintiff with the Notices of Right to Rescind, Plaintiff has a continuing right to rescind the transaction which she exercised by letter on March 27, 2009 (Exhibit 1). Although the defendants have failed to take the necessary steps to reflect it, their security interest in the property is terminated under 12 U.S.C. § 1635 and they should not be permitted to proceed with the scheduled foreclosure sheriff's sale. Plaintiff has also deceived Plaintiffs who believed they were going to have one loan, not two loans. In this regard, Defendants have engaged in unlawful splitting of the loans. D. The Public Interest Plaintiff submits that the public interest favors the granting of the requested relief. The public has an interest in the orderly administration of justice with respect to this transaction which will be defeated if the relief sought is not granted. Public policy favors the proper adjudication of claims of predatory lending against homeowners. Additionally, public policy dictates that we should not render the plaintiff homeless without a full adjudication of her case on the merits. E. No Bond Should Be Required In this case, to require a bond in any substantial amount is effectively to deny plaintiff the relief requested. Plaintiff is a senior citizen of limited economic means and her income consists of $1,453.00 per month in Social Security benefits and pension benefits. Her fixed expenses are roughly equivalent to her income. III. CONCLUSION Plaintiff has shown a temporary restraining order should be issued because of her likelihood of success on the merits, the irreparable harm that will result if the order is not granted, the relative lack of harm to defendants if the order is granted, and the order will serve the public interest. Accordingly, plaintiff requests that this Court grant the Motion for Temporary Restraining Order enjoining any foreclosure sale or sheriff's sale pending an adjudication of the Plaintiff’s complaint. Respectfully submitted, LEGAL SERVICES OF SOUTH CENTRAL MICHIGAN _______________________________________________ By: Anthony Greene (P47715) Attorneys for Plaintiff 611 Church Street Ann Arbor, MI 48104 Telephone: (734) 998-6100 x. 26 _______________________________________________ By: Paul Sher (P45094) Attorney for Plaintiff 420 N 4th Ave Ann Arbor, MI 48104 Phone: (734) 665-6181 Dated: May 26, 2009

![[2012] NZEmpC 75 Fuqiang Yu v Xin Li and Symbol Spreading Ltd](http://s3.studylib.net/store/data/008200032_1-14a831fd0b1654b1f76517c466dafbe5-300x300.png)