Harbord & Szymanski, Restricted View

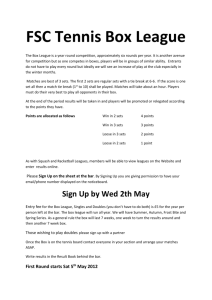

advertisement