File

advertisement

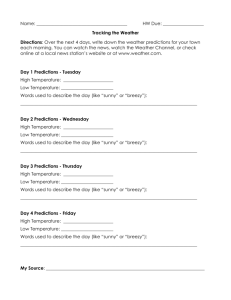

Running head: REPORT OF MEXICO 1 Mexico Names Husni Farsi Salemin Saleh Course Concepts International Trade Insert Instructor’s Name DIANE SIMSOVIC Date REPORT OF MEXICO 2 Introduction The process of analyzing a company to obviate the challenges of dwindling sales and deteriorating profitability is usually critical. This is because it requires company executives to engage themselves in numerous revitalization logistics, while considering factors that differentiate the available sale and profit recuperation options and their alternatives. Company managers involve themselves in purpose-oriented analysis and review of external or marketplace conditions and factors as well as trends to ensure that they chose the most suitable options. Additionally, the company in question explores and analyzes its internal situations and factors that have a direct bearing on sales and profits. This ensures that the process of averting further deterioration is successful from both external and internal perspectives. This is report includes the PEST-C analysis of the target market in Mexico and a SWOT analysis of Breezy Auto Parts as Breezy seeks to expand its market for profit sustenance. The report also includes analysis of the current situation of Breezy Auto Parts in terms of the challenges that the company is facing and the causes of the challenges. SWOT Analysis: Breezy Auto Parts Current Situation Strength Weaknesses Supplier to Dominant Manufacturers Focus on Domestic Market The high annual revenues that Breezy Breezy distributes its air filters in North REPORT OF MEXICO 3 records are attributed to the fact that Breezy America only, and this is an indication that it initially supplied its filters and carburetors to depends on confined market. Although the three big domestic automobile manufacturers. company dominates the domestic market This assisted that company to establish a firm overwhelmingly, it would be more successful domestic market base, with guaranteed auto if it had extended its sales beyond the domestic parts supply. With such a strong domestic boundaries. This has been one of Breezy’s market base, Breezy enjoys steady and weaknesses that have culminated in its uninterrupted domestic supply of filters and declining sales and profits as the rate of entry carburetors, recording remarkable revenues. As of new automobile manufacturers has a consequence, its profit levels skyrocketed, decreased, meaning that the company has and have remained high until recently when reached the upper limit of domestic market they began to dwindle. expansion. Partnerships with Neophyte Manufacturers Narrow Range of Auto Parts Through the creation of alliances with Breezy specializes in only two auto foreign automobile manufacturers, who took parts; air filters and carburetors, and from a initiatives to establish car manufacturing personal perspective, this product range is operations in North America, Breezy expanded narrow to some considerable extent. A narrow its sales. This augmented its business range of products is associated with limited proliferation, leading to high desirable profit sales and profits, and widening the range of margins that have been transferred to the products was raised as part of the options for present. Relationships with new automobile expanding sales and profits for the company. investors gave Breezy the opportunity to Keeping in mind that there are many auto parts expand its scope of operations, which came that make various models of vehicles, dealing REPORT OF MEXICO 4 along with augmented sales of auto parts, and with only two types of auto parts is absolutely profits thereof. a capacity limitation for Breezy. Redesigning Models Manufacturing Cost Rigidity The advent of new automobile It was mentioned that Breezy’s profits manufacturers from abroad enabled Breezy to are turning razor thin because its seize the opportunity to improve its brands of manufacturing plant is characterized by fixed carburetors and filters. This was realized manufacturing cost that never get adjusted through the stylistic redesigning of its auto even as sales continue falling. When operating parts to not match the foreign models, but also on fixed costs may be regarded as a strategy competitively meet novel auto parts’ standards. for Breezy to regulate the costs of production, Apparently, this initiative augmented the local the rigidity towards adjusting the costs to demand for its auto parts, culminating in match sales appears to do the company more higher sales that translated into profits. Product harm than good. redesigning also benefited Breezy in terms of Limited Influence on External Trends manufacturing cost reduction. Electronic Data Interchange Introduction The idea of introducing the Electronic The company has one critical weakness, and this is the inability to have any influence on external trends that affect its sales and Data Interchange or simply the EDI is regarded profits directly. In particular, Breezy has no as one of the strengths of Breezy as it assisted influence on the prevailing gas and oil prices, in enhancing transaction data and information in addition to being unable to track and transfer, thus improving communication influence the pace with which vehicle efficacy both internally and externally. manufacturers redesign their models to make According to Parsa and Popa (2003), better them efficacious in terms of fuel consumption. REPORT OF MEXICO 5 business operations reorganization, just-in-time For this reason, Breezy has been unable to stock, and speedy response are among the dynamically trigger changes in over board merits of EDI. These are among the benefits factors and trends in a manner that augments that Breezy reaped from the EDI introduction its sales and profits. leading to augmented operational efficiency, Inability to Redress Product Life Cycle and eventually to increased sales and profits. Phase Attainment of Initial Corporate Vision The introduction of the EDI is Breezy has already saturated the domestic market with air filters and associated with another Breezy strength; the carburetors, indicating that it is at the decline ability to successfully realize its original phase of life cycles as far as these auto parts corporate visions of becoming the leading air are concerned. This implies that the scope for filter and carburetor supplier in the entire sales expansion in an already saturated market North America. The improvement in has become restrained. The lack of proactive transactions as a result of EDI has enabled measures to revive the sales and profits of Breezy to occupy the lead supplier position up these two products is not only a weakness, but to date. Achieving this vision is classified as also a potential cause of failure of the two one of the strengths as it enables Breezy to products, if Breezy remains satisfied with the have some monopoly advantage in the status quo. distribution of these auto parts. Market Search Reluctance Firm Customer and Revenue Base The exclusive dominance in the The last strength of this company is that domestic market has driven Breezy towards it has a strong domestic customer base that is being reluctant in searching markets elsewhere attributed to the steady revenues of in the world. Consequently, as the fuel prices REPORT OF MEXICO 6 approximately one hundred million dollars that stake Breezy future, its tremendous dominance Breezy enjoy annually. The customer base has in North America becomes insignificant, and been established for over three decades, and the search for new market is perceived as a remains stable even as future revenue concerns belated action. arise. Opportunities Threats Broadening of Auto Parts Range Soaring Fuel Prices Breezy has the opportunity to widen its The most critical threat that Breezy is range of products, and this is by focusing on facing is the skyrocketing gas and oil prices manufacturing other auto parts, besides air and indeed, it is a concern to many other filters and carburetors. companies. Venturing into Overseas Markets Flattened and/or Slumped Car Sales To limit the deteriorating sales and The anticipation that driving will be an profits, Breezy can extend the sale of its expensive future activity has led to a decline in products beyond North America, into South car sales. This has been a threat to Breezy as America in places such as Mexico and vehicle manufacturers have resorted to elsewhere in the world. reducing manufacturing rates. Capitalization on Industry Best Practices Unpredictably High Cost of R&D Breezy can improve its sales and profits The need for Breezy to venture into by employing just-in-time inventory and other auto parts besides air filters and manufacturing, among other integrated carburetors creates a need for conducting industry best practices as foundations for research and development operations. The future advancements. uncertainty of whether R&D would yield fruit REPORT OF MEXICO 7 that compensate the incurred costs is a threat. PEST-C Analysis of Mexico Legal and Political Environment One of the factors that may influence Breezy’s business initiatives in Mexico is bureaucracy, and changes in the Mexican bureaucracy in recent decades have made the Mexican economic environment favorable for business. Decision-making speed and transparency at the Mexican federal government level, characterized by approved maximum administrative process time limits, have improved immensely. Under the Mexican Federal Regulatory Improvement Commission (COFEMER), many bureaucratic business impositions in terms of information and permit as well as registration requirements have been removed (Unger & Frankel, 2002). The frustrating and time consuming Mexican bureaucracy of past decades have dramatically reduced following deregulation and intense use of technology in government operations. This makes business for both domestic and foreign investor a simplified task. However, records reveal that automobile parts are among foreign products that are restricted, thus requiring strict checking. The reduced bureaucracy in the Mexican business environment has reduced incidences of corruption, making the Mexican economy favorable for Breezy to conduct business. Unger and Frankel (2002) concur with this by stating that lessening of excessive bureaucracy for corruption curtailing is a benchmark priority for the federal Mexican government. With respect to ethical aspects, the Mexicans are increasingly focusing attention to ethics in the corporate arena as they are viewed as a fundamental business success ingredient. Camp (2012) records that public criticism empowerment by Mexican accountability mechanisms is the root cause of negligence REPORT OF MEXICO 8 with regard to business and political ethics. Additionally, Anglo-Saxon ethnic nepotism is an acceptable business in Mexico (Unger & Frankel, 2002). Economic Factors The Mexican gross domestic product (GDP) has been growing steadily in last five years, according to the World Bank, with the current value being approximately 1260 billion dollars as shown in the GDP graph below. Billions of Dollars 1400 1200 1000 800 600 400 200 0 2010 2012 2014 Mexico GDP growth trend: Adapted from www.TRADINGECONOMIC.com|world bank group According to A.T. Kearney, Inc. (2008), the Mexican automobile industry contributed to a significant percentage of this GDP, which currently stands at about 4% of the total GDP, and about 20% of the manufacturing industrial sector as shown by the charts below. REPORT OF MEXICO 9 Service Sector 62% Industry 18% Construction, water, gas and electricity 8% Mining 5% Mexican GDP by sectors Automobile Industry-22.22% Food Industry21.1 Other Industries 56.67% Mexican GDP of industrial sector The GDP data above, along with the GDP growth rate data table below are an indication that the Mexican GDP is growing. Mexico GDP Growth Rate Mexico GDP GDP GDP Growth Rate GDP Growth Annual Rate Previous value 1260.91 1 1.6 Last Value Difference 1186.46 13.06 0.44 0.56 1.9 -0.3 Unit $US Dollars % % Change + + - Concerning the Mexican per capita income (PPP), the last five years have indicated a growth, except that the 2013 value is higher than that of 2014 as seen in the figure below. REPORT OF MEXICO 10 Mexican GDP Per Capita 8600 8400 Billion 8200 8000 $US 7800 7600 7400 2010 2012 2014 Year Adapted from www.TRADINGECONOMIC.com|world bank Mexican economy is the second largest in Latin America, and the import classification system of the nation has undergone modifications to ensure that it matches systems of industrialized nations. In addition to this, Unger and Frankel (2002) record that some products have been made duty free under the Mexico’s tariff regime. Indeed, auto parts are among the imports for which Mexico agreed to remove import tariffs starting from 2012 to 2014 (Villarreal, 2012). Due to duty and tariff burden reduction, the entry into the Mexican automotive market is now easier. For this reason, export through sales representatives such as agents, and through the establishment of a sale office present themselves as viable market entry options for Breezy. One of the merits of using sales agents is that Breezy will incur less upfront expenses. Furthermore, Breezy will be able to minimize the possibilities that its business in Mexico will be subjected to Mexican laws and legal provision. As well, Breezy will reduce instability risk emanating from the process of adapting to the new business environment in Mexico, along with reducing the degree to which Mexico’s foreign taxes will apply to its auto parts (Da Vinci, 2012). The drawbacks associated with using agents and distributors for exportation are that Breezy will have less control over its independent agents and distributors. Moreover, the company will have to pay REPORT OF MEXICO 11 dues for relative safety, along with being subject of import and export customs and rules governing auto parts manufactured outside Mexico. Finding faithful and proactive agents and distributions might also be difficult and expensive. With respect to establishing a sales office in Mexico, Breezy can establish it as a seriousness indictor to the new clients, thus hastening the establishment of the foreign customer base (Da Vinci, 2012). The other advantages include risk sharing, and foreign reputation building as well as knowledge benefits from partnerships with other companies in Mexico. The disadvantages of establishing a branch office are that Breezy will incur high costs if the venture fails. Also, Breezy is likely will undertake risks all by itself, besides having difficulties in the attempt to comprehend Mexico’s laws that govern corporate operations and employment as well as tax. Other difficulties associated with exporting auto parts into Mexico include bulk transportation difficulties, potential industrial disputes, and labor unionism challenges as well as linkage red tapes (Madlani, et al., 2013; Unger & Frankel, 2002). Cultural, Social, and Technological Factors and Additional Economic Considerations Breezy may also decide to enter the Mexican auto parts industry by setting up a manufacturing operation through a joint venture or through foreign direct investment. In that case, some of the benefits that the company may reap from a direct venture include flexibility, risk sharing, and opportunities to gain new expertise and prowess. According to Stewart and Maughn (2011), other advantages include the opportunity to gain new technological knowhow and simplified consolidation and divestiture processes. One disadvantage that Breezy might have to compete with in a joint venture includes poor integration emanating from cultural diversities and dissimilar management styles. Others include expensive research, initial leadership difficulties, communication hiccups and imbalances in expertise levels. If Breezy decides to initiate the manufacturing operation through foreign direct investment, some of the advantages REPORT OF MEXICO 12 that the company may experience include streamlined entry Mexico’s automobile industry, access to new resources, and minimized production cost. Other advantages include concrete and speedy multivariate and multilateral decision-making and policy making (Bartels & De Crombrugghe, 2009). The disadvantages of this approach include internal and external instabilities, gain sharing, and competition of sustaining competitive advantage between Breezy and Mexico. From a personal opinion, a joint venture would be more appropriate for Breezy that direct foreign investment. The questions that Breezy should ask a potential partner of a joint venture are questions about capability integration, knowledge exchange, and integration of diverse values and work ethics. Breezy should also gather the opinion of the potential partner about technicalities and logistic they should adopt for conflict resolutions, integrity commitments, and management control divisions, among other questions. The services that Breezy can acquire from the Export Development Canada as well as from Canadian Trade Commissioner Service include credit advice, risk management, and market evaluation services as well as solutions to financial problems. These services are instrumental for Breezy in the process of implementing the chosen approach of market entry into Mexico. Recommendations Having investigated the Mexican market, it has been identified as a viable market for Breezy to venture in. There are numerous automobile companies that can provide Breezy with a strong foreign client base. There are minimal cultural, economic, and political as well as social and technological hindrances for Breezy to establish itself in Mexico. All the same, it is recommended that Breezy should reconsider the market entry criteria in order to make a wellinformed research-based and client-oriented decision on the approach to adopt. REPORT OF MEXICO 13 Conclusion Entry into a new market, especially a foreign market, is a venture that requires careful deliberations to ensure that it does not culminate in outcomes that may harm a company beyond its situation before the initiation of the venture. In that regard, Breezy’s managers and market investigation agencies need to be proactive and extra careful in all actions and decisions to prevent occurrences that compromise the goal of averting sales and profits deterioration. Besides the conducted external and internal analysis for external market venture, Breezy should consider its already existing North American market and deliberate on mitigating any unaddressed inconsistencies that could be causing dwindling sales and profit deteriorating profits. REPORT OF MEXICO 14 References A.T. Kearney, Inc. (2008). Reigniting Mexico’s automotive industry. Chicago, Illinois. A.T. Kearney, Inc. Bartels, F. L., & De Crombrugghe, S. A. (2009). FDI policy instruments: Advantages and disadvantages. Vienna. United Nations industrial Development Organization (UNIDO). Camp, R. A. (Ed.). (2012). The Oxford handbook of Mexican politics. Oxford University Press. Da Vinci, L. (2012). Entering overseas markets. International Trade eLearning Suite for SMEsInTeLS. Retrieved November 12, 2014, from http://www.intels.biz/cours/view/89 Madlani, N, K., et al. (2013). Key credit factors for the auto suppliers industry. Standard & Poor’s Ratings Services Ratings Direct. Parsa, A., & Popa, S. (2003). Analysis of EDI success implementation factors and their interrelationship with the level of EDI implementation within Swedish companies. Industrial and Financial Economics. Stewart, M. R., & Maughn, R. D. (2011). International joint ventures, a practical approach. Portland. Davis Wright Tremaine LLP. Unger, F., & Frankel, R. (2002). Doing business in Mexico: A practical guide on how to break REPORT OF MEXICO 15 into the market. Melbourne, Australia. Council on Australia Latin America Relations: Australian Department of Foreign Affairs and Trade. Villarreal, M. A. (2012). Mexico’s free trade agreements. Congressional Research Service (CRS) Report. CRS.