Comprehension Quiz: Fiscal Policy vs

advertisement

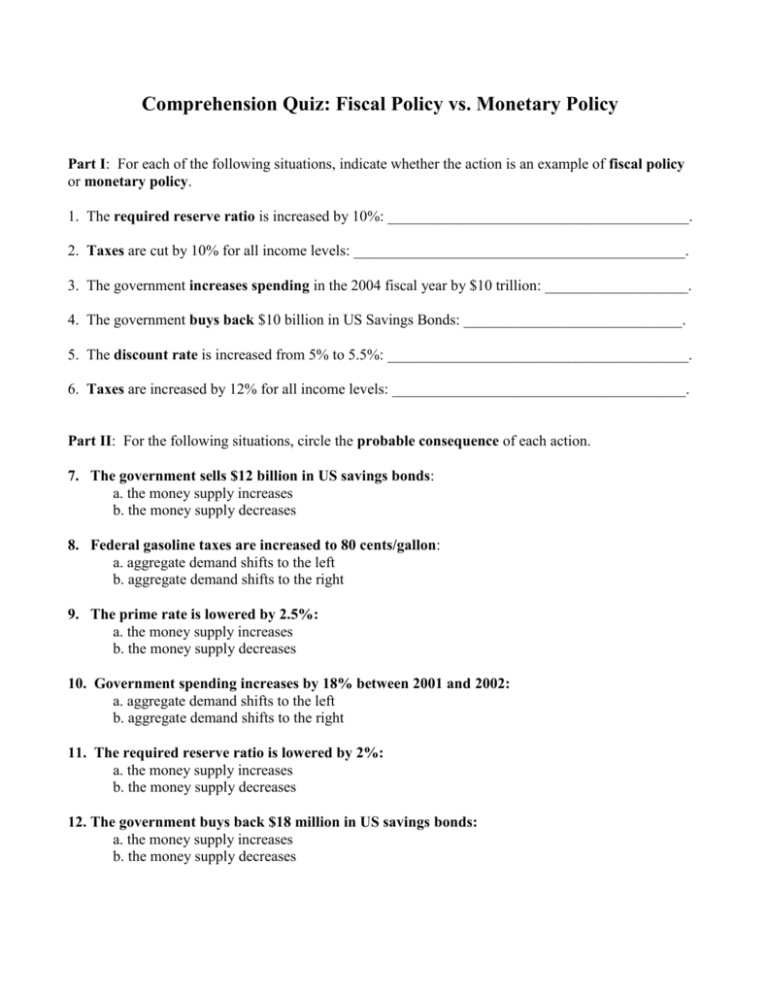

Comprehension Quiz: Fiscal Policy vs. Monetary Policy Part I: For each of the following situations, indicate whether the action is an example of fiscal policy or monetary policy. 1. The required reserve ratio is increased by 10%: ________________________________________. 2. Taxes are cut by 10% for all income levels: ____________________________________________. 3. The government increases spending in the 2004 fiscal year by $10 trillion: ___________________. 4. The government buys back $10 billion in US Savings Bonds: _____________________________. 5. The discount rate is increased from 5% to 5.5%: ________________________________________. 6. Taxes are increased by 12% for all income levels: _______________________________________. Part II: For the following situations, circle the probable consequence of each action. 7. The government sells $12 billion in US savings bonds: a. the money supply increases b. the money supply decreases 8. Federal gasoline taxes are increased to 80 cents/gallon: a. aggregate demand shifts to the left b. aggregate demand shifts to the right 9. The prime rate is lowered by 2.5%: a. the money supply increases b. the money supply decreases 10. Government spending increases by 18% between 2001 and 2002: a. aggregate demand shifts to the left b. aggregate demand shifts to the right 11. The required reserve ratio is lowered by 2%: a. the money supply increases b. the money supply decreases 12. The government buys back $18 million in US savings bonds: a. the money supply increases b. the money supply decreases Part III: Choose the best description of the each action. 13. Congress cuts taxes by 13% for all incomes. a. expansionary policy b. contractionary policy c. tight-money policy d. loose-money policy 14. During the Great Depression, Congress authorized billions of dollars in federal spending. a. demand-side economics b. supply-side economics c. classical economics 15. In reaction to an economic downturn in the late 1970’s, Congress passed massive tax cuts. a. demand-side economics b. supply-side economics c. classical economics 16. The inflation rate hits 7.5%, so the Federal Reserve raises the Discount Rate by three points. a. expansionary policy b. contractionary policy c. tight-money policy d. loose-money policy 17. Despite seven-straight years of falling GDP, the Congress of the nation of Dystopia takes no action and awaits the self-regulating force of the invisible hand to fix the economy. a. demand-side economics b. supply-side economics c. classical economics 18. The inflation rate hits 7.5%, so Congress postpones several large spending projects. a. expansionary policy b. contractionary policy c. tight-money policy d. loose-money policy