REGULATION ON TECHNICAL PROVISIONS OF INSURANCE

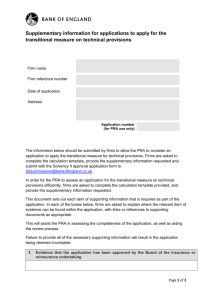

advertisement

REGULATION ON TECHNICAL PROVISIONS OF INSURANCE, REINSURANCE AND PENSION COMPANIES, AND ASSETS ON WHICH SUCH PROVISIONS ARE TO BE INVESTED Official Gazette Published in: 07.08.2007 – 26606 Published By: Prime Ministry (Undersecretariat of Treasury) PART ONE Objective, Scope, Basis and Definitions Objective ARTICLE 1 (1) The objective of this Regulation is to ensure that insurance and reinsurance companies set aside technical provisions to meet their existing and potential liabilities, and to regulate the methods and principles regarding the assets on which those provisions shall be invested. Scope ARTICLE 2 (1) This Regulation covers the insurance and reinsurance companies established in Turkey, Turkish branches of foreign insurance and reinsurance companies, and pension companies. Basis ARTICLE 3 (1) This Regulation has been prepared on the basis of Article 16 of the Insurance Law dated 3/6/2007 and numbered 5684, and Article 8 of the Private Pension Savings and Investment System Law dated 28/3/2001 and numbered 4632. Definitions ARTICLE 4 (Amended: O.G. 17.07.2012-28356) (1) The following expressions in this Regulation shall have the following respective meanings: a) Actuarial chain ladder method: Method used in the actuarial calculation of provision for outstanding claims , b) Stock Exchange: Domestic and foreign stock exchanges where money and capital market instruments are traded, c) (Annex:O.G.:28.07.2010-27655) *Assistance services: Outsourced services to complement the insurance coverage such as towing, salvage, provision of leased car, medical transport, provision of ambulance, glass replacement and locksmith services, ç) Law: Insurance Law No. 5684, d) Currency risk: Potential losses companies may incur in relation to their obligations in foreign currencies, due to changes in exchange rates, e)Expense shares: Expense portions and acquisition costs, f) Undersecretariat: Undersecretariat of Treasury, g)Premium: Written premiums, h) Company: Insurance and reinsurance companies established in Turkey, Turkish branches of foreign insurance and reinsurance companies, and pension companies, ı) Settlement and Custody Bank Inc.: Istanbul Stock Exchange Settlement and Custody Bank Inc., i) Group: A set of parent and affiliate corporations, which, albeit de jure independent, are related in terms of capital, management and auditing, and of which organization and finance matters are coordinated under a single parent corporation umbrella, regardless of differences in their fields of activities, j) Currency risk rate for foreign currency liabilities: Companies' sum of foreign currency reserves and assets based in foreign currencies, in proportion to the sum of their liabilities based in foreign currencies. PART TWO Technical Provisions Provision for unearned premiums (Amended:O.G.:28.07.2010-27655)*(Amended: O.G. 17.07.2012-28356) ARTICLE 5 (1) Companies are required to set aside provisions for unearned premiums, for contracts other than insurance contracts for which mathematical provisions were allocated. Provision for unearned premiums shall also be allocated in case of insurance contracts longer than one year, which contain insurance coverage renewed on annual or shorter than annual periods, for premiums corresponding the annual insurance coverage. (2) Contracts regarding the coverage conditional on death, life, and both death and life, as well as riders provided in addition to such coverage shall be regarded as life insurance contracts, and their premiums shall be deemed as life insurance premium. (3) In cases where riders are offered in a single package contract alongside the life insurance contract, such coverage shall be deemed wholly independent from the life insurance contracts they were offered with. (4) Provision for unearned premiums shall be comprised of the part of gross written premiums for the insurance contracts in effect, without deduction of any commissions or any other discounts, brought forward to the next accounting period(s) on a daily basis. In case of annual life insurance in effect, as well as life insurance where the saving premium exceeding one year is collected, it is comprised of the remaining amount of gross written premiums from which the part allocated for accumulation and expense shares of accumulation premiums are deducted. (5) When calculating the provisions for unearned premiums, the day on which the insurance coverage begins and the day on which it ends shall be taken into consideration as half days, and the calculation shall be carried out accordingly. (6) In case of contracts specified in the first paragraph of this article; parts corresponding to coming period(s) of the commissions paid to intermediaries provided that they are accrued, commissions taken for the premiums transferred to the reinsurer, amounts paid for non-proportional reinsurance treaties, underwriting expenses for the preparation of tariffs and sales of insurance contracts, as well as payments regarding assistance services shall be recognized under items of deferred income and deferred expenses and other related items in the accounting plan. For insurance contracts with terms longer than one year, the methods and principles regarding the deferral of income and expenses shall be established by the Undersecretariat. No bonuses, profit shares and similar commissions and expenses, which are not paid, in return of the contract concluded, and which can not be returnable upon the expiration of the contract, shall be taken into consideration in the income and expense calculations. (7) In case of reinsurance and retrocession transactions which can not be calculated on a daily or 1/24 basis, provisions for unearned premiums may be allocated on a 1/8 basis. (8) In case of cargo insurance contracts without a specific due date, provisions for unearned premiums are required to be allocated on the basis of estimated due dates determined according to the statistical data. In case such calculations can not be made, 50% of the premiums accrued in the last quarter shall be set aside as provision for unearned premiums . (9) The calculation of the reinsurer share in the provision for unearned premiums shall be based on the terms of the reinsurance treaties currently in effect. (10) In the calculation of the net premium, the amounts which are paid for non-proportional reinsurance treaties corresponding to the related period shall be considered as transferred premium. (11) In the calculation of provisions for unearned premiums pertaining to foreign currency based insurance contracts, if an exchange rate was not specified in the insurance contract, the foreign currency selling rates announced by the Central Bank of Republic of Turkey at the date of accrual of the relevant premium shall apply. (12) In the relevant accounting year, when drawing up the financial statements as per the current accounting period, the provision for unearned premiums specified in the end-of-year financial statements of the previous year shall be provided as the provision for unearned premiums brought forward from the previous period, and the sum of the unearned parts of the premiums for insurance contracts currently in effect as of the date of the financial statements shall be provided as the provision for unearned premiums of the period. Provision for unexpired risks (Amended:O.G.:28/07/2010-27655)*(Amended: O.G. 17.07.201228356) ARTICLE 6 (1) It shall be allocated in insurance branches where the risk exposure level during the insurance contract period is assumed to be incompatible with the timing of the earned premiums and it shall also be allocated when the provision for unearned premiums is inadequate in comparison with the risk exposure and the anticipated expenses of the company. (2) In the allocation of the provision for unexpired risks, the companies are required to carry out adequacy test for each accounting period covering the last 12 months, against the possibility that the paid claims which may arise due to insurance contracts in effect and for which the provision for unearned premiums is allocated is higher than the provision for unearned premiums for these contracts. (3) The adequacy test shall be conducted by multiplying the net provision for unearned premiums with the estimated net loss ratio. The estimated net loss ratio shall be calculated by dividing incurred losses (outstanding claims(net) + paid claims (net) - outstanding claims brought forward by earned premium (written premiums (net) + provision for unearned premiums (net) brought forward - provision for unearned premiums (net)). In case the estimated loss ratios for the branches to be determined by the Undersecretariat are higher than 95%, in the financial statements the net provision for unexpired risks shall be calculated by multiplying the rate exceeding 95% by net provision for unearned premiums, and the gross provision for unexpired risks shall be calculated by multiplying the rate exceeding 95% by the gross provision for unearned premiums. The difference between the gross amount and the net amount shall be taken into consideration as the share of the reinsurer. The part corresponding to the relevant period of the amounts paid for non-proportional reinsurance treaties shall be considered as the transferred premium for purposes of net premium calculation. The Undersecretariat may change this test method per branch, may perform adequacy tests applying different test methods and may request allocation of unexpired risk provision subject to these test methods. (4) The provision for outstanding claims used in the calculation of the provision for unexpired risks shall include the ultimate cost of the claims incurred but not yet paid, IBNR claims and related expenses as well as outstanding claims adequacy margin. (5) At the time of preparing and updating their own tariffs, the companies are required to take into consideration the provision for unexpired risks. (6) Unexpired risk provision for newly operating branches is calculated by the company actuary within twenty four months following the start of operation and the calculation method is reported to the Undersecretariat one week prior to the date of financial reporting set for the relevant account period. The provision for outstanding claims (Amended:O.G.:28.07.2010-27655)* (Amended: O.G. 17.07.2012-28356) ARTICLE 7 (1) Companies shall allocate outstanding claims provisions for ultimate cost of the claims incurred but not paid in the current or previous periods or for the estimated ultimate cost if the cost is not certain and for claims for losses incurred but not reported. (2) In the calculation of reserves for ultimate costs of claims incurred, calculated but not paid, all expenses required for the conclusion of claim files, including the calculated or estimated costs for adjusters, experts, consultants as well as legal and communication costs shall be taken into consideration. Principles and procedures on the deduction of recourse, salvage and similar income items shall be determined by the Undersecretariat. (3)Incurred but not reported claims, contents and implementation principles are calculated pursuant to the actuarial chain ladder method or other calculation methods to be determined by the Undersecretariat. (4)The Undersecretariat may determine a claims calculation method (actuarial chain ladder method) for incurred but not reported claims to be implemented by branches or companies. The companies shall disclose in the endnotes of their financial statements the method used to calculate incurred but not reported claims per branch. (5) The calculation principles regarding the incurred but not reported outstanding claims provisions regarding the life branch shall be determined by the Undersecretariat, by taking into consideration the amount of covers in this branch. (6) A separate calculation shall be made in order to test the IBNR claims amounts. In this calculation, gross amounts for the end of each accounting period covering the last 12 months shall be taken into consideration. Claims which took place prior to but reported after these dates shall be deemed IBNR claims amounts. In the calculation of IBNR claims, the weighted average calculated by dividing the claims pertaining to insurance and reinsurance companies regarding such claims in the last 5 or more years, incurred before such dates but reported afterwards and minus the income arising from these claims such as recourse or salvage, by the premium production for the years in question shall be taken into consideration. IBNR claims amount for the current accounting period shall be calculated by multiplying the aforementioned weighted average with the total gross premium production for the 12 months prior to the current accounting period. (7) In this test, the IBNR claims amounts should be calculated for each branch on the basis of premiums. Although reported during the current accounting period or in previous accounting periods, outstanding claims, which are not among the outstanding claims of the current accounting period, but are taken into consideration in the following year shall also be included in the calculation of the IBNR claims of the relevant branch. (8) The sum of the result of the test for each branch and the sum of the result calculated according to the third paragraph for each branch shall be compared and the method which gives the higher result shall be used in the calculation of as IBNR claims for each branch to be recognised in the financial statements. (9) In the calculations regarding the newly start up branches, the provision for IBNR claims and the adequacy of the provision for outstanding claims shall be calculated by the actuary during the first five years from the commencement of operations. Furthermore, in branches where large claims are eliminated by the actuary due to insufficiency of the number of claim files, the adequacy of the provision for outstanding claims shall be calculated for the eliminated large claims. (10) The Undersecretariat determines the principles and procedures on the calculation of adequacy difference of outstanding claims, how to send the table where this difference is calculated to the Undersecretariat and how the difference calculated is to be added on outstanding claim provision. (11) This statement to be drawn up as of the end of each accounting year shall reflect the adequacy ratio of the provision for outstanding claims, which is the ratio of the provision for outstanding claims allocated by the companies over the sum of the actually paid claims, including all expenses, regarding the files pertaining to those provisions. In case adequacy ratio of the provision for outstanding claims for each branch is lower than 100%, in order to calculate the adequacy margin, difference between the ratio and 100% shall be multiplied with the provision for outstanding claims of the current year. The adequacy margin for each branch shall be added to calculate the final provision for outstanding claims of the current year. (12) In drawing up the adequacy table and in the calculation of provision for outstanding claims, ultimate cost of the claims incurred but not yet paid, IBNR claims, and all expenses shall be taken into consideration. (13) The calculation of the reinsurer share in provision for outstanding claims shall be based on the terms of the reinsurance treaties currently in effect. (14) In case the ultimate cost of the outstanding claims is not determined, following the first notification of claims, companies shall open the files by accruing the outstanding claim amounts on the basis of the actuarial calculations based on the last five years' statistics of outstanding claims allocated for each branch, and after updating them as of the end of each accounting period on the basis of the current information, companies shall allocate additional provisions for the files for which adequate provisions were not allocated or shall make discount for excess provisions. (15) Although the calculation of provision for outstanding claims and IBNR claims shall be made on the basis of the contracts, in cases where reinsurance companies do not receive information to each contract from insurance companies, the reinsurance companies may make calculations based on the data provided by insurance companies. (16) In case the claims’ payment is made by a cheque or a bond, the amount of the cheque or bond shall not be deducted from outstanding claims before the amount of the cheque or bond is paid to the insured by the bank. (17) Claims regarding the foreign exchange based insurance contracts shall be valued using the exchange rate written on the contract. In case no exchange rate is specified in the contract, the claims shall be valued using the foreign currency selling rates announced by the Central Bank of the Republic Turkey on the Official Gazette as of the date of the financial statements. (18) In case vehicles are repaired by the contractual repair shops and service stations of the insurance companies, since the liability against the indemnity receiver is fulfilled through the reparation of the vehicle, the related files shall be deducted from the outstanding claims provisions and added to the paid claims account item after the insured signs a certificate of release or receives a document proving the delivery of the vehicle. Until the repair payment is made to the repair-shop or the service station, such amounts shall be recognized in the account items regarding the repair shop or service station, in the liabilities side of the balance sheet. Furthermore, the account items of the relevant repair shop or service station shall also specify the accounts from which the obligations arise. (19) In case the treatment of insureds is provided by contractual medical institutions of the insurance company, following the signature of the certificate of release or the authorisation for the payment, the related amounts shall be deducted from outstanding claim provisions and then included in the paid claims account item. The amount of payment is recognised in the account items of the medical institution under the liabilities side of the balance sheet until the treatment payment is made to the medical institution. Furthermore, the account items of the relevant medical institution shall also specify the accounts from which the obligations arise. (20) Regardless of the possibility of winning or losing the case, the outstanding claim provisions regarding the claims subject to lawsuits shall be in principal based on the value specified in the lawsuit. However, regardless of lawsuit value, the provision for outstanding claims to be set aside by the company shall be determined based on the documents kept by the company at the time the lawsuit is filed in case the company might guess this cost, but the company shall consider, for the provision for outstanding claims, the last calculated value based on the documents and reports in case claim amounts can be different because of a loss adjuster, actuary or expert reports that includes damage value before the lawsuit or in the progress of the lawsuit which provision will also include relevant interest and expenses thereof. Regarding the debt lawsuits of unknown amount, in case the amount can be guessed by the company because documents are not sufficient, outstanding claims provision is set aside on the best estimation based on the company's previous statistics of at least three previous years until such documents and reports are prepared. If courts decide against the company, the last court order is taken as the outstanding claim provision until the order becomes final with the completion of all legal phases. If courts decides in favor of the company, last amount determined as per the previous reports and documents is taken as the outstanding claim provision until the order becomes final with the completion of all legal phases. If such reports and documents do not indicate a valuation about damage value, outstanding claim provision is set aside while delay interest and expenses are added to the lawsuit amount. However, in case the court decides in favor of the company as the damage is not covered, subject to deduction, the damage is not occurred as stated or the damage is realized by neglect; outstanding claims provision is set aside on the best estimation based on the company's previous statistics of at least three previous years unless documents and reports indicating otherwise are available. On the other hand, if the claim is above insurance contract coverage limits except other items such as delay interest, court and proxy expenses demanded by the insured, companies shall deduct that excess part and all related expenses and interests from outstanding claim amounts. Deduction can be done on outstanding claim provisions based on related statistics in case the lawsuit is won pursuant to the principles set by the Undersecretariat. (21) Claims which do not entail claims payment, and which are not pursued by the indemnity receiver are required to be removed from the outstanding claims following the expiration date and to be registered as income. Mathematical provisions ARTICLE 8 (1) Life and non-life companies shall allocate adequate mathematical provisions in accordance with the actuarial principles, in order to cover their liabilities to the policyholders and beneficiaries for life, health and personal accident insurances with terms longer than one year. (2) In cases where personal accident, health, disability as a result of illness, or critical illness coverage for longer than one year is provided in addition to life insurances with terms longer than one year, the mathematical provisions for life insurances shall be calculated so as to include also the mathematical provisions calculated on actuarial basis for the additional coverage. (3) Mathematical provisions shall be the sum of the actuarial mathematical provisions and if it is committed the provisions for profit share allocated to the insured from revenues derived from the investment of those provisions calculated separately for each contract in effect, in accordance with the technical principles specified in the tariff, and described in sub-paragraphs (a) and (b) below. a) (Amended:O.G.:28/07/2010-27655)* Actuarial mathematical provisions are the difference between the premiums collected for the risk undertaken by the companies and the cash value of the liabilities to policyholders and beneficiaries. Actuarial mathematical provisions for life insurances with terms longer than one year shall be allocated based on the formula and principles specified in the technical principles of tariffs. Actuarial mathematical provisions shall be calculated by determining the difference between the cash value of the future liabilities of the insurer, and the current value of the premiums to be paid by the policyholders (prospective method). However, the sum of the actuarial mathematical provisions shall not be lower than the actuarial mathematical provisions calculated by determining the difference between the end value of the premiums paid by the policyholder and the risk exposure of the insurer (retrospective method) or by generally accepted actuarial methods approved by the Undersecretariat. In cases where actuarial mathematical provisions are found to be in the negative, it shall be assumed as zero. In life insurances where saving premium is also collected, the actuarial mathematical provisions shall be the sum of those premiums allocated to investment. Actuarial mathematical provisions shall be calculated based on accrual or collection principal, in accordance with the technical specifications of the tariff. b) Provisions for profit-share in participating policies shall be composed of the part of the revenues from the assets in which the provisions allocated for the liabilities to the policyholders and beneficiaries are invested, guaranteed benefits limited to the technical interest revenue calculated according to the profit share distribution system which is determined in approved profit share technical bases, and accumulated provisions for profit share for the previous year, Equalization provision (Amended:O.G.:28/07/2010-27655)* ARTICLE 9 (1) Equalization provision is allocated for credit and earthquake coverage, including riders, in all branches in order to stabilize the claims fluctuations which may occur in following accounting periods and to cover catastrophic risks. (2) The provision shall be calculated as 12% of net earthquake and credit premiums corresponding to each year. In the calculation of net premium, the amounts paid for non-proportional reinsurance treaties shall be considered as premiums transferred to reinsurance companies. In non-proportional reinsurance treaties covering more than one branch, the part of the transferred premium corresponding to earthquake and credit branches shall be determined by taking into consideration the share of these branches in the total premium amount, provided that no other calculation method has been stipulated by the company. (3) Equalization provision for business accepted by reinsurance companies on a proportional or nonproportional basis shall be 12% of the net premium earthquake and credit premiums corresponding to each year. The share of earthquake and credit premiums in the premium derived from the business accepted by reinsurance companies on a non-proportional basis shall be calculated with respect to the share of earthquake and credit premiums in business accepted on a proportional basis. (4) The allocation of provision shall continue until 150 % of the highest annual amount of net premiums received during the previous five financial years.At the end of the fifth year, in case the amount of provision based on the premium production remains lower than the amount of provision provided in the balance sheet for the previous year, the difference between the two amounts shall be recognized in equity under other profit provision item. The amount transferred to the equity may either be kept as provisions, or may be used for capital raising or claims payments. (5) In life insurances where death coverage is provided, the companies shall use their own statistical data in calculating the equalization provision. The companies which do not have the data set to enable the necessary calculation shall consider 11% of net death premium as premium written for earthquake coverage and allocate 12% of those amounts as equalization provision. (6) In case of an earthquake, or the credit branch registers a technical loss in the relevant accounting year, the provision allocated for credit and earthquake coverage may be used for claims payments. In case of loss, the amounts corresponding to the reinsurer as well as the amounts which are below the exemption limit specified in the contract shall not be deducted from equalization provision. Provision for bonus and rebates (Amended:O.G.:28/07/2010-27655)* ARTICLE 10 (1) Provision for bonus and rebates is the provision required to be allocated in case a bonus or rebate is committed to the insured with respect to the policies in effect in the current period and without the condition of the renewal of policy in following periods. In case insurance companies implement bonus and rebates, the provision shall be comprised of the bonus and rebate amounts allocated for the insured and beneficiaries according to the technical results of the current year. (2) The bonuses and rebates shall cover all amounts paid or to be paid to the beneficiary or the insured in the current accounting period. The payment shall be carried out through discounts from future premiums of the insured, or increases in mathematical provisions. The companies are required to specify in the contract the bonus and discount amounts they undertake. Actuary unit ARTICLE 10/A (Amended: O.G. 17.07.2012-28356)** (1) In order to have correct calculation of technical provisions and pricing, an actuary unit must be established in line with the portfolio and structure of the company which will have qualified actuaries, assistant actuaries, intern actuaries and staff in sufficient number together with necessary technical software and hardware. Minimum qualifications of actuary units are determined by the Undersecretariat. PART THREE Assets in which the Technical Provisions Shall Be Invested Assets covering technical provisions ARTICLE 11 (1) The companies are required to have adequate assets to cover their technical provisions. (2) The assets accepted as cover for technical provisions are as follows: a) Turkish Lira, b) Foreign currencies bought and sold by the Central Bank of Republic of Turkey, c) Current and time-deposit bank accounts in Turkish Lira, ç) Current accounts and participation accounts in participation banks, d) Blocked accounts for credit cards, e) Foreign exchange deposit accounts, f) Government bonds, treasury bonds and other financial assets issued by the state, g) Bonds and other fixed-income financial assets issued by the private sector, ğ) Stocks and other variable-income financial assets, h) Investment fund participation certificates, ı) Repo transactions, i) Receivables from technical operations and reinsurer shares in technical provisions, j) Loans offered with or without respect to insurance contracts, k) Real Estate, l) Fixed assets other than real estate, m)Taxes and funds paid in advance, and deferred tax assets. (3) Assets regarding the technical provisions allocated for the risks located in Turkey are required to be kept in custody within Turkey. (4) However, the companies may procure the custody services of a custodian other than ISE Settlement and Custody Bank Inc. for the custody of government bonds, treasury bonds and other financial assets issued by the state, provided that Capital Markets Board approval is obtained and necessary information regarding the assets to be kept in custody abroad and the value of those assets are transferred to ISE Settlement and Custody Bank Inc. or the so called Bank is enabled to access to those information. (5) In order to protect against exchange rate, interest rate and market risks the assets they have in their portfolios, the companies may become parties to option contracts, forwards, futures, and futures based on option contracts, within the terms specified by the Undersecretariat with reference to the opinion of the Capital Markets Board. (6) Methods and principles regarding rated financial assets issued by foreign countries and traded in foreign markets, as well as the real estate located in foreign countries as assets accepted as cover for technical provisions shall be determined by a Communiqué to be published by the Undersecretariat. (7) The companies cannot invest their mathematical provisions in the assets specified in subparagraphs (ç), (k), and (l) of the second paragraph, nor can they invest the technical provisions allocated for the life insurance contracts with profit share in the assets specified in sub-paragraphs (d), (i), and (m). (8) Assets invested and deposited by the companies shall be deposited at least in two financial institutions other than ISE Settlement and Custody Bank Inc. The assets are required to be distributed in a balanced manner among the financial institutions. (9) Within the framework of the measures to be taken with respect to the financial structures of companies, the Undersecretariat may determine the number of the financial institutions where the assets invested by the companies are deposited, and the shares of the assets to be deposited in such institutions, and may further limit the share of the assets deposited in financial institutions within the same group. (10) The Undersecretariat may require that the receivables from technical operations and reinsurer shares in technical provisions, which do not meet the criteria established by the Undersecretariat are not accepted as assets covering technical provisions. Calculation of the assets covering technical provisions ARTICLE 12 (1) The following principles shall be observed during the calculation of the assets accepted as cover for technical provisions; a) If the acquisition of an asset has indebted the company, the remaining amount after the deduction of the debt may be accepted as cover for technical provisions, b) Receivables from third parties may be accepted as cover for technical provisions only after the deduction of debts to those parties, c) After the amortization of tangible fixed assets, the allocation of the provision for impairment of financial assets and the allocation of the provision for doubtful debts from technical operations, the remaining part shall be accepted as cover for technical provisions, ç) Receivables in default may be accepted as cover for technical provisions only during the first two months following the default. Limitations regarding the assets covering the technical provisions ARTICLE 13 (Amended: O.G. 17.07.2012-28356) (1) Assets exceeding the rates specified below can not be accepted as asset covering technical provisions. a) The value of any single land, plot or building, or lands, plots or buildings which are in close proximity to each other so as to be considered as a single unit, or so as to be affected from the damage of one another, exceeding 10% of the gross technical provisions, b) Except financial assets issued by the government, money market or capital market instruments issued by a single issuer, exceeding 5% of the gross technical provisions, and in case the total of those financial assets do not exceed 40% of the gross technical provisions, money market or capital market instruments issued by a single issuer, exceeding 10% of the gross technical provisions, c) Money market or capital market instruments issued by a single group, exceeding 20% of the gross technical provisions, ç) Stocks (including subsidiaries, affiliates and joint ventures), other variable-return financial assets and type-A investment fund participation certificates, exceeding 30% of the gross technical provisions; those assets which are not traded in the exchange, exceeding 10% of the gross technical provisions, d) Advance loans extended without reference to an insurance contract, exceeding 5% of the gross technical provisions; loans extended to a single person, exceeding 1% of the gross technical provisions, e) Cash in terms of Turkish Lira and foreign currencies, exceeding 3% of the gross technical provisions, f) Deposits, current accounts, participation accounts and receivable from credit cards guaranteed by banks before a single bank, exceeding 40% of the gross technical provisions; and deposits, current accounts, participation accounts and receivable from credit cards guaranteed by banks before a bank within the same financial group, exceeding 20% of the gross technical provisions, g) The receivables from a single intermediary, subject to the deduction of the government bonds, treasury bonds, deposits, cash and foreign currencies offered as collateral for debts, exceeding 5% of the gross technical provisions; and the receivables from banks and similar intermediaries, exceeding 20% of the gross technical provisions, ğ) (Amended:O.G.:28/07/2010-27655)*The receivables from main activities, except the receivables from banks acting as intermediaries and the non-allowable part of a receivable from an intermediary as the provision for technical provisions as per paragraph (g), and excluding loans on policies and credit card accounts guaranteed by banks during the conclusion of the insurance contract with respect to the total amount of the contract as well as government bonds, treasury bonds, deposits, cash and foreign currencies offered as collateral for debts, exceeding 25% of the gross technical provisions, h) Investments in terms of foreign currency by the companies which do not have currency risk, exceeding 30% of the gross technical provisions, ı) The part exceeding 130% of currency risk rate for foreign currency liabilities. (2) The companies shall have adequate foreign currency or assets indexed to foreign currency, in proportion to their foreign currency liabilities arising from insurance contracts. (3) Currency risk rate for foreign currency liabilities can not be less than 70%. (4) The companies shall ensure an adequate risk distribution, and take measures to enable the daily valuation of assets. (5) Within the framework of the measures to be taken in relation to the financial structure of the insurance company and the protection of the rights and interests of policyholders and beneficiaries, the Undersecretariat is entitled to accept or reject any type of assets covering the technical provisions or can require the replacement of those assets with other type of assets. (6) Offering of advance loans without reference to insurance contracts requires the approval of the Undersecretariat. (7) In case the value of the assets falls below the minimum limits set in the present Regulation, or exceeds the maximum limits set therein, due to the price movements or the exercise of pre-emptive right, the limits mentioned in this Regulation should be fulfilled within a maximum of 30 working days. (8) The Undersecretariat may allow for the temporary breach of such limits due to the liabilities of companies to policyholders and beneficiaries. (9) Provided that the limits in sub-paragraphs (a), (b), (c) and (f) of the first paragraph are fulfilled and the written consent of the policyholder is obtained after notification about the risks concerning the indexed assets, in life insurance contracts indexed to real estate, money market and capital market instruments, term deposit accounts, participation accounts or foreign exchanges, the provisions shall be invested in those indexed asset(s). Principles regarding mathematical provisions ARTICLE 14 (1) The companies are required to fulfill the following general principles in calculating the mathematical provisions: a) Separate calculation principle: The mathematical provisions shall be calculated separately for each insurance contract according to the approved technical principles of the contract. If necessary, estimation methods and generalization techniques may be employed in the calculation of mathematical provisions. However, the amount of provision calculated by this method shall not be less than the calculation on insurance contract basis. b) Prudent calculation principle: The mortality tables, discounted mortality tables, morbidity tables and other tables as well as technical interest rate and expense shares to be used in the calculation of mathematical provisions shall be selected with prudence. c) Persistence of the calculation method throughout the term of the contract: The methods and assumptions used in the calculation of mathematical provisions can not be changed to the detriment of the policyholder and beneficiary throughout the term of the contract. ç) Calculation period: The mathematical provisions in life insurances where saving premium is also collected shall be calculated on a per-contract basis as of the first working day after the of premiums are received by the insurance company. (2) In cases where actuarial mathematical provisions can not be calculated on a daily basis, the insurance companies, upon the request of the policyholder, are required to take all measures necessary to calculate the claims on a daily basis and to declare those claims to policyholders. Insurance companies that can/do not make those declarations to policyholders are required to establish a system by which the mathematical provisions are calculated on a daily basis within at most three months following the written notification by the Undersecretariat. PART FOUR Miscellaneous and Final Provisions Oversight and stress test (Amended:O.G.:28/07/2010-27655)* ARTICLE 15 (1) For oversight purposes and within the periods specified, the companies shall send to the Undersecretariat the information, documents and tables regarding their technical provisions as well as assets in which those provisions are invested. (2) In order to determine the solvency position and adequacy of technical provisions of the company, the Undersecretariat may require the companies to apply a stress test with respect to their underwriting and catastrophe risks, as well as interest rate, exchange rate, securities, credit and liquidity risks. Gradual adequacy level PROVISIONAL ARTICLE 1 (1) The expected loss ratio used in the calculation of the unexpired risks provisions mentioned in the third paragraph of Article 6 of this Regulation shall be employed as 100% in the calculations for the year 2008. Gradual liability level PROVISIONAL ARTICLE 2 (1) In the calculations for the year 2008, 80% of the outstanding claims provisions calculated with reference to actuarial chain ladder method specified in the sixth paragraph of Article 7 of this Regulation shall be accepted. Gradual liability level for years 2010 and 2011 (Amended:O.G.:28/07/2010-27655)* PROVISIONAL ARTICLE 3 (1) A minimum of 80% of the amount calculated with reference to the actuarial chain ladder method specified in fourth paragraph of Article 7 of this Regulation can be employed in the calculations for the year 2010 and a minimum of 90% of the amount can be employed in the calculations for the year 2011. The companies shall disclose in the endnotes of their financial statements the rate used in the calculations. Regulation abolished ARTICLE 16 (1) Regulation on the Technical Provisions of Insurance, Reinsurance, and Pension Companies, and the Assets in which such Provisions are to be Invested, published in the Official Gazette dated 4/5/2007 and numbered 26512 has been abolished. Entry into Force ARTICLE 17 (Amended:O.G.:18/10/2007-26674) (1) This Regulation's; a) Article 16 shall enter into force on the date of the publication of this Regulation and shall be effective as of 30/9/2007, b) The remaining articles shall enter into force on 1/1/2008. Enforcement ARTICLE 18 (1) The provisions of this Regulation shall be executed by the Minister in charge of the Undersecretariat of Treasury. [*] This amendment/supplement has entered into force on the date of its publication and shall be effective from date September 30th, 2010. [**]This amendment enters into force on January 1st, 2015.