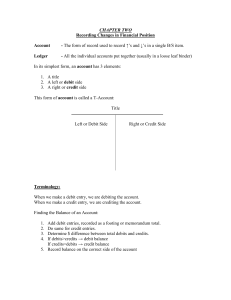

T-Accounts

advertisement

BAF3/4M Introduction to Ledger, T-Account & Trial Balance (2 part lesson) Overview In this activity you will learn how to record transactions in a T-account General Ledger and prepare a Trial Balance to see that the ledger is in balance. Overall Expectations EIV.02 assess the impact of technology on the accounting functions in business; FAV.03 demonstrate an understanding of the basic procedures and principles of the accounting cycle for a service business. Specific Expectations AF3.01 use accounting or application software to record transactions for a service business; FA1.03 identify the users and uses of accounting. The Ledger: The ledger is used to record business transactions and keep track of the balances in each specific account. If you wanted to know how much cash the business has to write a cheque, you would look in the ledger. If you wanted to know how much the business owes on a bank loan, you would look in the ledger. T-Accounts: T-Account is an accounting form we use to keep track of the specific balance in an account. If a business has a total of 25 accounts in the Ledger, there will be 25 pages with each account having a T-account format page. Below you will see what a T-account looks like. BAF3/4M Introduction to Ledger, T-Account & Trial Balance (2 part lesson) T- Accounts have 3 basic elements: a title, a debit side (the left side) and a credit side (the right side) Watch T-Accounts & The Ledger Part 1 * DEBITS & CREDITS • Debit (Dr.) indicates left; Credit (Cr.) indicates right Entering an amount on the left side is called debiting the account Entering an amount on the right side is crediting the account • Debit balance Debit amounts exceed the credits • Credit balance Credit amounts exceed the debits Tabular Versus Account Form Tabular Summary Account Form CASH $15,000 CASH -7,000 1,200 Debit Credit 1,500 15,000 7,000 -600 1,200 600 -900 1,500 900 -200 600 200 -250 250 600 1,300 -1,300 Balance 8,050 $8,050 Copyright John Wiley & Sons Canada, Ltd. 6 *Note how much easier it is to make sense of the transactions when they are recorded in the T-Account form* BAF3/4M Introduction to Ledger, T-Account & Trial Balance (2 part lesson) THE DEBIT/CREDIT PROCEDURE • Debit does not mean increase or decrease Can be either depending on the type account • Credit also does not mean increase or decrease also depends on account type • Assets are on the debit side of the equation Increases are also on debit side; decreases on credit side • Liabilities are on the credit side Increases are on the credit side; decreases on the debit side DOUBLE ENTRY ACCOUTING Each transaction is recorded with equal debits and credits : Every transaction affects at least two accounts Total debits always equals total credits • Accounting equation will always stay in balance Assets = Liabilities + Owner’s Equity • Every account has a normal balance Either debit or credit • Balancing the T-account In order to balance the T-account we follow a three-step process: 1. Total both sides of the T-account 2. Subtract the smaller amount from the bigger 3. Record the balance on the side of the larger BAF3/4M Introduction to Ledger, T-Account & Trial Balance (2 part lesson) THE TRIAL BALANCE • • • List of accounts and their balances at a specific time Proves that debits equal credits Uncovers errors Watch the video T-Accounts and the Ledger Part 2 * Step One: Create a 3 line heading similar to making a balance sheet. WHO, WHAT, DATE Step Two: List all asset accounts with their balances. Remember this goes on the DEBIT side (the right side) Step Three: List all liability & equity accounts with their balances. Remember that these are CREDIT balances and go on the left side (credit side) Step 4: Total the debit and credit balances. If they are the same, double underline them. If they are not the same then a mistake has been made. BAF3/4M Introduction to Ledger, T-Account & Trial Balance (2 part lesson) IF YOU MAKE A MISTAKE & THE TOTALS DO NOT ADD UP, FOLLOW THESE STEPS: 1. Re- add the trial balance columns 2. Check the numbers from the ledger against those in the trial balance. Make sure that none are missing, none are on the wrong side and none are the wrong amount. 3. Re-calculate account balances 4. Check that there is a balanced accounting entry in the accounts for each transaction. LIMITATIONS OF A TRIAL BALANCE • Does not prove: That all transactions have been recorded, or That the ledger is correct • Numerous errors may exist even though the trial balance columns agree Total debits and total credits may be equal, but may still be posted to the wrong account or in the wrong amount