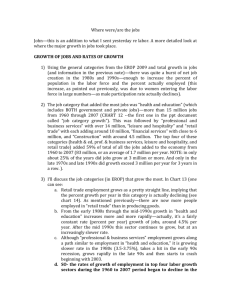

1 - World Bank

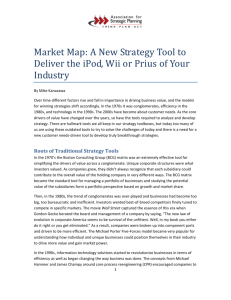

advertisement