Northwestern University Law Review

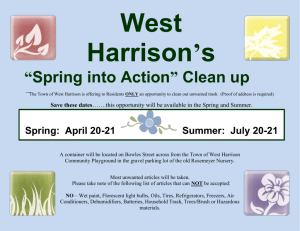

advertisement