Financial Management I

Student Learning Objective (SLO) Template

.

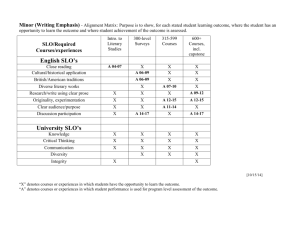

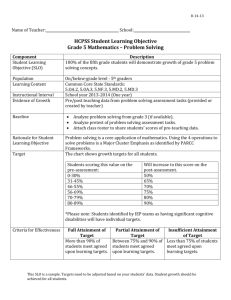

Content Area and Course(s): Family and Consumer Sciences: Financial Management I Grade Level(s): 9-12 grade Academic Year:2013-14

Baseline and Trend Data

What information is being used to inform the creation of the SLO and establish the amount of growth that should take place?

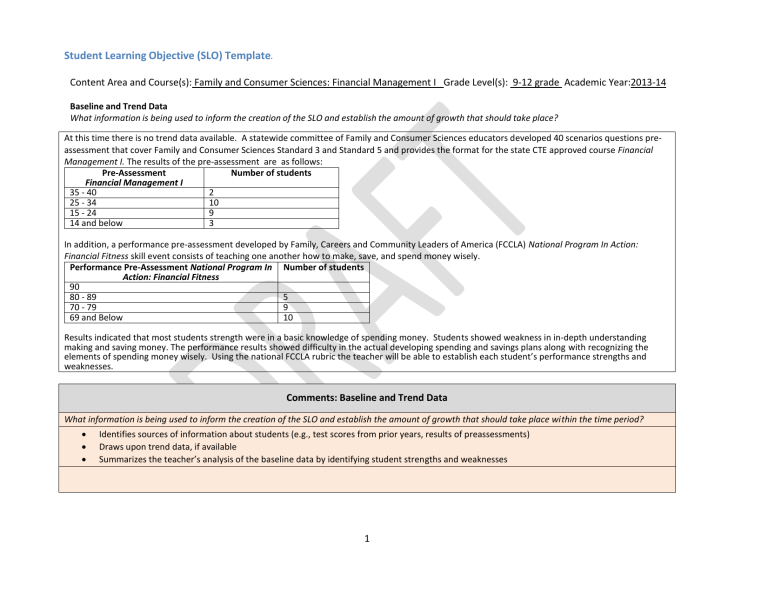

At this time there is no trend data available. A statewide committee of Family and Consumer Sciences educators developed 40 scenarios questions preassessment that cover Family and Consumer Sciences Standard 3 and Standard 5 and provides the format for the state CTE approved course Financial

Management I. The results of the pre-assessment are as follows:

35 - 40

Pre-Assessment

Financial Management I

25 - 34

15 - 24

14 and below

2

10

9

3

Number of students

In addition, a performance pre-assessment developed by Family, Careers and Community Leaders of America (FCCLA) National Program In Action:

Financial Fitness skill event consists of teaching one another how to make, save, and spend money wisely.

Performance Pre-Assessment National Program In

Action: Financial Fitness

90

80 - 89

70 - 79

69 and Below

Number of students

5

9

10

Results indicated that most students strength were in a basic knowledge of spending money. Students showed weakness in in-depth understanding making and saving money. The performance results showed difficulty in the actual developing spending and savings plans along with recognizing the elements of spending money wisely. Using the national FCCLA rubric the teacher will be able to establish each student’s performance strengths and weaknesses.

Comments: Baseline and Trend Data

What information is being used to inform the creation of the SLO and establish the amount of growth that should take place within the time period?

Identifies sources of information about students (e.g., test scores from prior years, results of preassessments)

Draws upon trend data, if available

Summarizes the teacher’s analysis of the baseline data by identifying student strengths and weaknesses

1

Student Population

Which students will be included in this SLO? Include course, grade level, and number of students.

The Financial Management I course is an elective at the high school. There are 24 students enrolled. The student population breaks down as described below:

5 students are on an IEP

3 students are on a 504 plan

10 males

14 females

9 freshmen

5 sophomores

6 juniors

4 seniors

15 Caucasian – 5 Hispanics – 2 African American – 2 Native American

Because there are four grade levels of students in this course the maturity level of the student will show improvement over the length in the course allowing for personal growth. As content in delivered using many techniques each student will have the opportunity to grow. The makeup these demographics include all students registered for this course.

Comments: Student Population

Which students will be included in this SLO? Include course, grade level, and number of students.

Identifies the class or subgroup of students covered by the SLO

Describes the student population and considers any contextual factors that may impact student growth

If subgroups are excluded, explains which students, why they are excluded and if they are covered in another SLO

Interval of Instruction

What is the duration of the course that the SLO will cover? Include beginning and end dates.

Financial Management I is a semester long Family and Consumer Sciences course. This SLO runs from August 25, 2013 to January 15, 2014.

Comments: Interval of Instruction

What is the duration of the course that the SLO will cover? Include beginning and end dates.

Matches the length of the course (e.g., quarter, semester, year)

2

Standards and Content

What content will the SLO target? To what related standards is the SLO aligned?

The Family and Consumer Sciences Technical Content Standards developed by The Ohio Department of Education have been developed into courses. The standards and benchmarks for Financial Management I are:

Standard 3: Demonstrate Personal Financial Literacy

Intermediate Benchmark A: Establish individual and family financial goals.

Intermediate Benchmark B: Illustrate financial institutions and services to meet financial goals

Standard 5: Become Consumer Savvy

Intermediate Benchmark A: Interpret the impact of advertising on individual and family consumer purchases.

Intermediate Benchmark B: Implement strategies for purchasing goods and services that meet individual needs and valued ends.

Intermediate Benchmark C: promote consumer rights and responsibilities.

Intermediate Benchmark D: Evaluate impact of consumer choices on renewable and nonrenewable resources.

Intermediate Benchmark E: Interrelate the economy and consumer decisions.

The two standards and seven benchmarks covers the depth and breathe of the Financial Management I course is one of the eight courses that is ODE approved for career tech funding. These specific technical content standards also follow the national model from the American Association of Family and

Consumer Sciences.

Comments: Standards and Content

What content will the SLO target? To what related standards is the SLO aligned?

Specifies how the SLO will address applicable standards from the highest ranking of the following: (1) Common Core State Standards, (2) Ohio

Academic Content Standards, or (3) national standards put forth by education organizations

Represents the big ideas or domains of the content taught during the interval of instruction

Identifies core knowledge and skills students are expected to attain as required by the applicable standards (if the SLO is targeted)

3

Assessment(s)

What assessment(s) will be used to measure student growth for this SLO?

The post-assessment was developed by a statewide committee of FCS educators that is CTE ODE approved consists of 40 scenarios questions that cover

Family and Consumer Sciences Standard 3 and Standard 5 that provides the format for the state CTE approved course. Financial Management I assessment. The performance post-assessment will be the rubric from FCCLA National Program In Action: Financial Fitness. For the students scoring 125 or greater in combination on the statewide developed assessments Financial Management I Pre-Assessment National Program In Action: Financial Fitness will complete Leadership Academy CCR 101 Personal Finance.

Comments: Assessment(s)

What assessment(s) will be used to measure student growth for this SLO?

Identifies assessments that have been reviewed by content experts to effectively measure course content and reliably measure student learning as intended

Selects measures with sufficient “stretch” so that all students may demonstrate learning, or identifies supplemental assessments to cover all ability levels in the course

Provides a plan for combining assessments if multiple summative assessments are used

Follows the guidelines for appropriate assessments

4

Growth Target(s)

Considering all available data and content requirements, what growth target(s) can students be expected to reach?

For purpose of scoring my SLO, I have set the following growth targets for my students based upon their overall pre-assessment and performance

pre-assessment scores:

Pre-Assessment

Scores

35 - 40

Number of

Students

2

25 - 34

15 - 24

10

9

14 and below 3

Post-Assessment

Scores

FCCLA Pre-

Assessment Scores

90

80 - 89

70 - 79

0 - 69

Number of

Students

0

5

9

10

FCCLA Post-Assessment

Scores

Target Score

Capstone for students above 125 pts. combined

Growth of 15 points

Growth of 20 points

Growth of 25 points

The capstone project Leadership Academy CCR 101 Personal Finance. This is a national third party vendor that provides an electronic delivery system with instant feedback for the student and teacher. Passage of this capstone project is based on national FCCLA scoring .

Comments: Growth Target(s)

Considering all available data and content requirements, what growth target(s) can students be expected to reach?

All students in the class have a growth target in at least one SLO

Uses baseline or pretest data to determine appropriate growth

Sets developmentally appropriate targets

Creates tiered targets when appropriate so that all students may demonstrate growth

Sets ambitious yet attainable targets

5

Rationale for Growth Target(s)

What is your rationale for setting the above target(s) for student growth within the interval of instruction?

Demonstrates teacher knowledge of students and content

The pre-assessment score and the rubric pre-performance assessment students demonstrate the basic knowledge of money management techniques and skills. As I move through the courses Financial Management I students will be able to demonstrate developmentally appropriate growth. Students who scored lower on the pre-assessment will be expected to demonstrate more growth to meet end of course expectations.

Explains why target is appropriate for the population

Students who scored lower on the pre-assessment will be expected to demonstrate growth in order to meet course expectations. In addition, the performance pre-assessment will allow students through the FCCLA skill event enough stretch for my highest performing students allowing them to demonstrate understanding of the content and possibly move to regional competition. In addition, those who scored high on the pre-test will be completing the Leadership Academy CCR 101 Personal Finance.

Addresses observed student needs

The scores from the pre and post-assessments along with the national FCCLA approved rubrics for the pre and post-performance assessment I was able to determine each students weakness and strengths. I compiled the two scores to determine each student’s growth target score. In addition, I have identified that any student who scored 125 points combined would then complete the capstone project Leadership Academy. This is a national third party vendor that provides an electronic delivery system with instant feedback for the student and teacher.

Uses data to identify student needs and determine appropriate growth targets

While students demonstrate basic knowledge of spending money I have allowed students to grow through not only assessments but will allow them to implement techniques that will not only lead to financial savvy individuals but will give students the opportunity to develop leaderships skills through competing at the regional level.

Explains how targets align with broader school and district goals

This SLO aligns with one of the districts goals to see that all students have increased their reading and writing skills across content.

Sets rigorous expectations for students and teacher(s)

By combining measures, I am targeting deficits in both content and performance knowledge by using national and state approved assessment tools. The pre and post-assessments are electronically scored and aggregate reports sent to the teacher to help determine strengths and weaknesses of each student. Accommodations identified on IEP students are provided. The performance assessments are evaluated by a team of two evaluators with accommodations identified for IEP students.

6

Comments: Rationale for Growth Target(s)

What is your rationale for setting the target(s) for student growth within the interval of instruction?

Demonstrates teacher knowledge of students and content

Explains why target is appropriate for the population

Addresses observed student needs

Uses data to identify student needs and determine appropriate growth targets

Explains how targets align with broader school and district goals

Sets rigorous expectations for students and teacher(s)