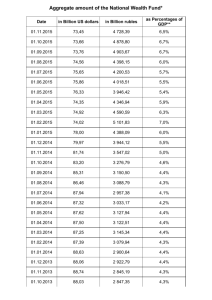

results of 2007

advertisement

Dear shareholders, partners and colleagues, Commercial bank ENERGOTRANSBANK finished 2007 with noteworthy financial indicators which we have the honor of presenting to you in this report. In the financial year, the Bank managed not only to keep its leading position in traditionally important activities, but also to find success in new market sectors which allow a very positive outlook on the future. This year, the position of the Bank in corporate business services strengthened: turnover and balances in customers’ accounts have increased substantially, the customer base has grown, and new bank products and provisions have been designed which ensured quality of services and comfort for customers. The Bank had distinctive achievements in the highly prospective sector of plastic cards. In 2007, the number of active card users at ENERGOTRANSBANK grew by one and a half, and Bank profits from salary payment programs were 7 times higher. Due to the increase of customers’ income and savings, one of the priorities has remained providing services to individuals. In 2007, the staff of ENERGOTRANSBANK implemented new Russian banking programs – “Gorod” (“City”)-a federal system, and a cooperative loyalty program called “Zolotoy Bonus” (“Golden Bonus”). Moreover, the Bank widened its range of services in the field of international funds transfers and in bank-managed funds. Individual operations with precious metals increased substantially. In its operation, CB ENERGOTRANSBANK aims for exceptional financial results, the highest in customer services and improving the Bank’s already solid reputation as a reliable financial partner. In the present competitive environment, designing new bank products is a complicated task, but impeccable service and reliable reputation is something that distinguishes ENERGOTRANSBANK from other depository institutions. In the long run, all our activities are targeted at establishing a strong financial institution able to compete with Russian and foreign international leaders through market positioning and the ability to focus on key objectives, a dynamic model of banking business able to react to challenges of the competitive environment faster than the others, and, most importantly, by forming the best team in corporate banking, constantly aimed at success. Commercial bank ENERGOTRANSBANK heartily wishes each of its partners great personal and corporate capitalization, happiness, health and success! 2007 ANNUAL REPORT Commercial bank ENERGOTRANSBANK 1 COMMERCIAL BANK ENERGOTRANSBANK Full name Public joint stock company Date of first registration in CB RF 27/12/1990 Registration number 1307 ОGRN (State registration number) 1023900000080 General license of CB RF # 1307 of 13/12/2005 1 233 333 193 (One billion two hundred and thirty three million three hundred Authorized capital and thirty three thousand one hundred and ninety three) rubles INN (Identification tax-payer number) KPP (Industrial Enterprise 3906098008 390501001 Classification Code) 042748701 BIC Codes of forms of federal state statistic monitoring OKPO (All-Russian Classifier of Businesses and Organizations) ОКFS (General Index of Forms of Incorporation) 22881700 16 ОКОGU (National Classifier of 15001 Government Entities and Administration) ОКАТО (All-Russian Classifier of Political Subdivisions) ОКОPF (All-Russia Classifier of Forms of Ownership) ОКVED (Russian National Classifier of Economic Activities) 27401368000 47 65.12 CB “ENERGOTRANSBANK” branches: 2 branches (Moscow, Sovetsk) 19 operating cash desks 1 Bureau de exchange 2007 ANNUAL REPORT Commercial bank ENERGOTRANSBANK 2 Licenses: - General license for performing banking operations #1307 of December 13, 2005 - License for performing precious metals operations # 1307 of December 13, 2005 - License of a professional participant of the security market for securities management unlimited validity period #039-07165-001000 of 26/11/2003. - License of a professional participant of security market for performing custody business #039-04153-000100 of December 20, 2000. - License of a professional participant of security market unlimited validity period for performing dealer activities #039-03840-010000 of December 13, 2000. - License of a professional participant of security market unlimited validity period for performing brokerage activity #039-03779-100000 of December 13, 2000. ENERGOTRANSBANK is: a user of the international information dealing system Reuters (DEALING—2000); a member of international transfer accounting system Society of Worldwide Interbank Financial Telecommunications (S.W.I.F.T.); a member of Moscow and Saint Petersburg Interbank Monetary Exchange; a professional participant of the security market; a nominal shareholder of RАО «ЕES Russia», PJSC; a participant of international money transfer systems including Western Union, MoneyGram, Leader, Migom, Contact, Anelik, Zolotaya Corona; an authorized member of the cash remittance system of MasterCard International; a member of the Russian payment system «Zolotaya Corona»; a member of the endowment insurance system (Certificate of filing the Bank in the Register of banks-members of endowment insurance system # 625 of February 10, 2005). A participant of the Register of banks able to act as a guarantor with the Customs authorities. (Notification #109 of 01/10/2007 of Federal Customs Agency of Russia). 2007 ANNUAL REPORT Commercial bank ENERGOTRANSBANK 3 BOARD OF DIRECTORS OF THE BANK Names Position Number of shares CV of the Bank owned, % of AC Vladimir Chairman of the 1680 shares Date of birth: 1949 Ivanovich Board of 0,00014% Education: Higher Scherbakov Directors of the Work experience: Bank 1989 – 1991 – Chairman of Goscomtruda of USSR 1991 – 1992 – First Under-Secretary of Prime Minister of USSR Since 1991 – President of International Fund «Interprivatizatsia» Chairman of the Board of Directors of group of companies «Avtotor» Igor Member of the 0,00 % Date of birth: 1959 Dmitrievich Board of Education: Higher Ivanov Directors of the Work experience: Bank 1989 – 1992 – Director of NPKT «ТОR» Chairman of the 1992 – 1993 – Director «Method», closed corporation Management 1993 – 1994 – President of JSCB «MicroBank» (Joint Stock Board Commercial Bank) 1994 – 1998 – Deputy Chairman of Management Board of CB «Roscomveteranbank» 1998 – 1999 – Deputy Chairman of Management Board of CB ENERGOTRANSBANK Since 1999 – Chairman of Management Board of CB ENERGOTRANSBANK Vladimir Member of the 0,00 % Date of birth: 1935 Alexandrovich Board of Education: Higher Durasov Directors of the Work experience: Bank 1986 – 1989 – Minister of Nonferrous metal industry of USSR 1989 – 1991 – First Deputy Chairman of Gosplan of USSR 1991 – 1992 – First Under-Secretary of Minister of Economic Affairs of USSR Since 1992 – Director of International Fund « Interprivatizatsia » 1999 – 2006 – Counselor of Director General of «Narodny Fond», OJSC Alexandr Member of the 0,00 % Date of birth: 1952 Evgenyevich Board of Education: Higher Sorokin Directors of the Work experience: Bank 1996 – Chief Designer of «Mashinvest», CJSC 1997 – Director of engineering technical centre – design manager of «Avtotor», CJSC 1998 – Engineering Director – director of ETC «Avtotor», CJSC 2001 – Deputy Director General - Engineering Director of «AvtotorHolding», OJSC. 2007 ANNUAL REPORT Commercial bank ENERGOTRANSBANK 4 2003 – Director General of «Avtoror-Engineering», LTD.. 2003 – 2007 – Director General of «Mashinvest», CJSC 2005 – Director General of « AVTOTOR-Holding», LTD.. 2007 – Director General of «AVTOTOR – TECHNOLOGIES AND DEVELOPMENT», LTD.. Pavel Member of the 18 900 shares Date of birth: 1930 Ivanovich Board of 0,00153% Education: Higher Zhikharev Directors of the Work experience: Bank until 1994 – President of Sberbank of RF 1994 – 2006 – Counsellor of Director General of "Narodny Fond", OJSC Mikhail Member of the 0,00 % Date of birth: 1942 Borisovich Board of Education: Higher Turkin Directors of the Work experience: Bank 1998 – Chief Engineer of Moscow representation of «Аvtotor», CJSC 1999 – Development Director of «Аvtotor», CJSC 2001 – Deputy Director General – director of development «Avtotor-Holding», OJSC 2003 – First Deputy Director General – Engineering Director of «Avtoror-Engineering», LTD.. 2003 – First Deputy Director General – Engineering Director of Moscow representation of «Avtotor», CJSC 2005 – First Deputy Director General – Engineering Director «Avtotor Group», LTD.. 2007 – First Deputy Director General – Engineering Director «AVTOTOR – TECHNOLOGIES AND DEVELOPMENT», LTD.. Petr Member of the 0,00 % Date of birth: 1930 Makarovich Board of Education: Higher Katsura Directors of the Work experience: Bank 1969 – 1985 – Deputy Director General of PA «АvtoVAZ» 1985 – 1992 – Head of Department of Sovmin USSR since 1992 – Vice-President of International Fund «Interprivatizatsia» 1999 – 2006 – Director General of « Narodny Fond», OJSC Nickolay Member of the 0,00 % Date of birth: 1948 Nickolaevich Board of Education: Higher Utkin Directors of the Work experience: Bank 1991 – Deputy CEO of «International Fund of Assistance of Privatization and foreign Investment», Closed Enterprise (later «International Fund of Investment and Privatization», CJSC) 2005 – Director General of «International Fund of Investment and Privatization», LTD.. 2007 ANNUAL REPORT Commercial bank ENERGOTRANSBANK 5 Valery Member of the 0,00 % Date of birth:1954 Mikhailovich Board of Education: Higher Shashkov Directors of the Work experience: Bank 1976 – 1998 - Master, Deputy Head of mechanical assembly production, Deputy Head of Labour Management Dept., Deputy Director of mechanical assembly production on economic affairs, Deputy Head of Head Economic Management Department, Deputy Director General on economic affairs АZLK 1998 – 1999 – Deputy Director on economic affairs Moscow representation of «Аvtotor», CJSC 1999 – 2001 – Deputy Director on economic affairs - Head of Economic Management Department " Avtotor-Holding ", PJSC 2001 – 2002 – Deputy Director on economic affairs - Head of Economic Management Department of Moscow representation of «Аvtotor », CJSC 2002 – 2003 – Director General of «Avtocapital – Invest», Ltd. 2003 – 2005 - Director General of «Avtocapital – Leasing», Ltd. 2005 – 2006 – Deputy Director on economic affairs of «Avtotor group», Ltd. с 2007 – Deputy Director on economic affairs of « Avtotor Holding», Ltd. MANAGEMENT BOARD Names Position Number of shares CV of the Bank owned, % of AC Igor Chairman of the 0,00 % Date of birth: 1959 Dmitrievich Management Education: Higher Ivanov Board Work experience: 1989 – 1992 – Director of NPKT «ТОR» 1992 – 1993 – Director «Method», Closed Enterprise 1993 – 1994 – President of JSCB «MicroBank» (Joint Stock Commercial Bank) 1994 – 1998 – Deputy Chairman of Management Board of CB «Roscomveteranbank» 1998 – 1999 – Deputy Chairman of Management Board of CB ENERGOTRANSBANK Since 1999 – Chairman of Management Board of CB ENERGOTRANSBANK 0,00 % Date of birth: 1962 г. Olga First Deputy Vladimirovna Chairman of the Education: Higher Gorbatova Management Work experience: Board 1992 – Chief Accountant of «Innovation-financial company «Multi», Closed Enterprise 2007 ANNUAL REPORT Commercial bank ENERGOTRANSBANK 6 1992 – 1993 – Chief Accountant of Association of scientific technical business and international cooperation «Ecomack» 1993 – 1994 – Chief Accountant of «Nickson», JSCB (Joint Stock Commercial Bank) 1994 – Chief Economist of «Financial Company «Тrend», Closed Enterprise 1994 – 1998 – Chief Accountant of CB «Roscomveteranbank» с 1998 – Deputy Chairman of the Management Board of CB ENERGOTRANSBANK Svetlana Deputy Chairman 0,00 % Date of birth: 1950 Efimovna of the Education: Higher Kononova Management Work experience: Board 1981 – Head of PED of city branch of «Stroybank» Bank 1981 – 1987 – Head of Department of capital building financing and loan of city branch of «Stroybank» Bank 1987 – 1990 – Head of Loan Department of Oktyabrsky office of «Promstroybank» Bank 1990 – 1991 – Deputy Chairman of the Management Board of CB ENERGOTRANSBANK 1991 – 1993 – Deputy Chairman of the Management Board of First branch of CB «Investbank» с 1993 – Deputy Chairman of the Management Board of CB ENERGOTRANSBANK Sergey Deputy Chairman 0,00 % Date of birth: 1971 Pavlovich of the Education: Higher Soloviev Management Work experience: Board 1993 – 1995 – Head of Currency Department of Kaliningrad FCB «Ufabank» 1995 – 1996 – Economist of Currency Department of ENERGOTRANSBANK 1996 – Economist of first category of Foreign relations Department of ENERGOTRANSBANK 1996 – 1997 – Deputy Director of FCB « ENERGOTRANSBANK» 1997 – 1999 – Director of Rozhdestvensky FENERGOTRANSBANK с 1999 – Deputy Chairman of the Management Board of ENERGOTRANSBANK Sergey Deputy Chairman 0,00 % Date of birth: 1958 Leonardovich of the Education: Higher Kokurin Management Work experience: Board 1994 – Manager of Customer services of JSCB «Microbank» 1994 – Head of operational services of JSCB «Microbank» 1994 – 1996 – Head of Department of settlement and credit accounts of Zelenogradsky branch of JSCB «Moscow Bank of Reconstruction 2007 ANNUAL REPORT Commercial bank ENERGOTRANSBANK 7 and Development » (АКB MBRR) 1996 – 1998 – Head of Operational Department of Zelenogradsky branch of JSCB МBRR 1998 – 2004 – Deputy Director of Moskovsky FCB ENERGOTRANSBANK 2004 – Deputy Chairman of the Management Board of ENERGOTRANSBANK Tatyana Chief Accountant Grigoryevna of the Bank Pankova 0,00 % Date of birth: 1964 Education: Higher Work experience: 1987 – Economist of Department of trade credit of Kaliningrad region office of Gosbank USSR 1988 – 1990 – Economist of Oktyabrsky office of CB «Promstroybank» 1990 – 1991 – Economist of the second category of ENERGOTRANSBANK 1991 – 1993 – Expert of First Branch of CB «Investbank» 1993 – 1995 – Economist of the second category of ENERGOTRANSBANK 1995 – 1997 – Deputy Chief Accountant of ENERGOTRANSBANK Since 1997 – Chief Accountant of ENERGOTRANSBANK 2007 ANNUAL REPORT Commercial bank ENERGOTRANSBANK 8 LIST OF SHAREHOLDERS AND SHARES OWNED Name of the Shareholder Shares in the authorized capital of the Bank (%) Limited Liability Company "North-Western Fund of private investments" 8,8544 % Limited Liability Company "Energofinance" 8,8544 % Limited Liability Company "Geocapital" 8,8544 % Limited Liability Company "Industrial investments" 8,8544 % Limited Liability Company "Narodny fund" 8,8461 % Limited Liability Company "International fund of investments and privatization" 3,0621 % Limited Liability Company "INVESTRESERVE" 4,9995 % Limited Liability Company «Aquatoria» 3,2219 % Limited Liability Company «Carvent» 1,3860 %, Total number of Shareholders of ENERGOTRANSBANK – 603 760 Legal entities – 112 Private persons – 603 648 The number of Shareholders of ENERGOTRANSBANK who own less than 1% of authorized capital of the Bank, – 603 751 Shareholders, total combined percentage of the authorized capital of ENERGOTRANSBANK – 43,0666%. The percentage of ownership by legal entities (including private entrepreneurs) in the authorized capital of CB «ENERGOTRANSBANK is 57,9304%. Contact COMMERCIAL BANK ENERGOTRANSBANK Public Joint-Stock Company Registered address: 83-A Kinicheskaya Str., Kaliningrad, 236016, Russia Notifications: 83-A Kinicheskaya Str., Kaliningrad, 236016, Russia Telephone / fax (4012) 590099, (4012) 451938 E-mail:mail@energotransbank.com Web-site: www.energotransbank.com, www.etbank.ru 2007 ANNUAL REPORT Commercial bank ENERGOTRANSBANK 9 BRANCHES OF THE BANK Branches: 1. Sovetsky branch of Commercial Bank ENERGOTRANSBANK (Public Joint Stock Company), registration No. 1307/01. Address: 9 Goncharova Str., Sovetsk, 238750, Kaliningrad region. 2. Moscovsky branch of Commercial Bank ENERGOTRANSBANK (Public Joint Stock Company), registration No 1307/4 Address: 3 Solyanka Str., building 3, 109028, Moscow. Operating cash desks: 1. 83-A Klinicheskaya Str, Kaliningrad 2. 10 Gorkogo Str., Kaliningrad 3. 6/8 Leninsky prospect, Kaliningrad 4. 7-9 Leninsky prospect (“Europe” shopping centre), Kaliningrad 5. 137 Leninsky prospect, Kaliningrad 6. 61 Prospect Mira (“Sputnic shopping centre”), Kaliningrad 7. 10 Musorgskogo, Kaliningrad 8. 4 Ploschad Pobedy, Kaliningrad 9. 90/92 Proletarskaya Str., Kaliningrad 10. 1 Sovetsky prospect, Kaliningrad 11. 33/37 Sovetsky prospect, Kaliningrad 12. 1 Chernyakchovskogo Str., Kaliningrad 13. 3 Chernyakhovskogo Str., Kaliningrad 14. 74 b Chernyakhovskogo Str., Kaliningrad 15. 40/2 Chernyakhovskogo Str., Kaliningrad 16. 14 Gaidara Str., Sovetsk 17. 2a Goncharova Str., Sovetsk, Kaliningrad region 18. 1 Internatsionalnaya Str., Sovetsk, Kaliningrad region 19. 42 Prospect Pobedy, Sovetsk, Kaliningrad region Bureau de exchange 29A Octyabrskaya Str., Kaliningrad 2007 ANNUAL REPORT Commercial bank ENERGOTRANSBANK 10 Correspondent banks As of 01/01/2008 correspondent banks of ENERGOTRANSBANK are: in Russian Federation – 24 banks overseas – 14 banks Main correspondent accounts: In RUR: # 30101810800000000701 in GRCC GU Bank of Russia in Kaliningrad region On the territory of Russian Federation Name of bank 1. SBERBANK OF RUSSIA 2. «RAIFFEISENBANK AUSTRIA» CJSC 3. «VNESHECONOMBANK» 4. «BANK OF MOSCOW», PJSC 5. «ALPHA-BANK», PJSC 6. «DEUTSCHE BANK», LTD.. 7. «RUSSLAVBANK», JSCB 8. «URALSIB», PJSC 9. BANK «VTB», LTD.. 10. Bank «CREDIT MOSCOW» 11. JSCB «PROBUSINESSBANK» (PJSC) 12. JSAC«METALLINVESTBANK», PJSC 13. МCB «EURASIA-CENTRE» (PJSC) 14. JSCB «FINPROMBANK» 15. ICB «Sudconbank» 16. CB «ANELIK RU» (LTD..) 17. Investment bank «TRUST» (PJSC) 18. «VNESHTORGBANK», PJSC 19. RNKO «Platezhny centre» (PJSC) 20. OSB of Kaliningrad № 8626 Currency RUB; USD; EUR BIC 044525225 Location Moscow RUB 044525700 Moscow RUB, USD, EUR RUB; USD RUB; USD RUB RUB; USD; EUR RUB; USD; EUR RUB; USD; EUR RUB; UAH 044525060 044525219 044525593 044525101 044552685 044525774 044525187 044583501 Moscow Moscow Moscow Moscow Moscow Moscow Moscow Moscow RUB; USD 044525986 Moscow RUB; BYR 044585163 Moscow RUB; USD; EUR RUB RUB USD RUB; USD; EUR RUB; USD; EUR RUB RUB 044585188 044552695 044583641 044583616 044525703 044030733 045017785 042748634 Moscow Moscow Moscow Moscow Moscow Saint-Petersburg Novosibirsk Kaliningrad Overseas Name of bank Ost-West Handelsbank AG Dresdner Bank AG Commerzbank AG Vilniaus Bankas AB Kredyt Bank PBI SA Raiffeisen Zentralbank Osterreich Aktiengeselischhaft AG 7. Norvik Bank 8. Parex Bankas 1. 2. 3. 4. 5. 6. Currency USD; EUR; GBP USD; EUR USD; EUR Multicurrency account USD; EUR SWIFT OWHBDEFF DRESPEFF COBADEFF CBVILT2X KRDBPLPW RZBAATWW Location Frankfurt-am-Mein, Germany Frankfurt-am-Mein, Germany Frankfurt-am-Mein, Germany Vilnius, Lithuania Warsaw, Poland EUR Vienna, Austria PLN; EUR; BYR; USD LATBLV22 Multicurrency account INDVLT2X Riga, Latvia Vilnius, Lithuania 2007 ANNUAL REPORT Commercial bank ENERGOTRANSBANK 11 MAIN RESULTS OF 2007 ENERGOTRANSBANK was founded in 1990 and is now one of the oldest commercial banks of Kaliningrad. Years of dynamic operation and professional development the Bank has widened range of its activities and take a leading position in Kaliningrad’s financial market. As a result, ENERGOTRANSBANK, as of 01/01/2008, is one of the largest regional banks by financial indexes (internal funds, assets, currency balance), by number of brunches (19 operating cash desks) and range of services provided. In 2007, a positive dynamic was observed in operating indicators, connected with the increasing the Bank’s its equity capital in December, 2006, thus making efficient use of growth potential. The financial result of operations of ENERGOTRANSBANK for 2007 was 196 021 405 rubles, 50 kopecks. Results of operating activities of the Bank kept pace with the overall growth in the domestic market for banking services: Indicator On 01.01.2007, On 01.01.2008, Growth rate, % 000’s of rubles 000’s of rubles Assets 4 804 157 6 479 638 1,35 Equity Capital (on 01.12.2006., 342 986 2 087 181 6,09 before the registration of an additional emission on 29.12.06) Revenues 1 021 137* 1 608 536 1,58 Revenues as a margin 416 772 583 481 1,4 Operating result from securities 100 368,1 147 438** 1,47 trading Operating result from foreign 64 481,2 109 618 1,7 currency services Other income 646 825 779 190 1,2 Credit portfolio 568 898 1 123 709 1,98 Deposits 342 147 414 742 1,21 Trading portfolio 140 036 242 345 1,73 *a one-time operation connected with the overvaluation of securities adds 502996 rubles to this figure. ** a one-time sale of Bank stock in the amount of 81 254 rubles is not included here. The financial result of operations of ENERGOTRANSBANK for 2007 was 196 021 405 rubles, 50 kopecks. After-tax, un-allocated (pure) profits of the Bank in 2007 totaled 138 797 193 rubles, 50 kopecks. The average balance of loans in 2007 in comparison with 2006 grew by 534 807 thousand rubles, which provided revenue growth of 70%. Complex banking services, development of new services and the adoption of a client-oriented approach have resulted in the expansion of the share of commission revenues in total operational revenues from 15% in 2006 to 25% in 2007. In 2007, the Bank determined the main areas of investment of funds and formed its own structure for investing through daughter companies: Closed-stock company Griffin and Griffin Investments ltd. The sum of investments in stocks of the daughter companies, respectively, was 501 667 297 rubles, 89 kopecks and 500 100 000 rubles. POSITION IN BANK SYSTEM OF THE RUSSIAN FEDERATION ENERGOTRANSBANK is a universal bank providing its customers with practically all modern banking services. According to the data of Russian bank ratings, made by Rosbusinessconsulting (RBC), ENERGOTRANSBANK has the following positions among Russian and regional banks as of January 1, 2008 (covering 2007): Index Positions among Russian banks Positions among regional banks (Kaliningrad) as of as of 01/01/2008 01/01/2008 Net assets 229 1 Currency balance 234 1 Ready assets 229 2 Balance sheet profit 211 2 Deposit portfolio 319 3 2007 ANNUAL REPORT Commercial bank ENERGOTRANSBANK 12 Loan portfolio 467 5 ENERGOTRANSBANK contributes much to the development of corporate business and the introduction of new services based on modern technologies. As the main bank of the largest automobile producer in the region, ENERGOTRANSBANK supports both the company itself, and its employees. In Kaliningrad ENERGOTRANSBANK has begun to introduce high technology products (e.g. the Gorod payment system and Zolotoy Bonus cooperative bonus program, as well as bank-managed investment funds), which allow Kaliningrad citizens to handle cash more efficiently and pay bills more conveniently. DEVELOPMENT PROSPECTS. In the nearest future, the Bank will keep its position as a universal financial institution, providing the widest range of banking facilities and basing relations with the customers on mutually beneficial partnership principles. The main operations of the Bank will remain issuing credit, currency services and plastic cards services. In credit services, the Bank has defined priorities for 2008 which are aimed at further development of short term loans for companies and entrepreneurs and introduction of new loan facilities. In 2008, the Bank plans to keep forming a product line of plastic cards covering all customers’ needs: Increasing the volume of emission of Zolotaya Corona smartcards and co-branded Zolotaya Corona - MasterCard cards for individuals and legal entities; Development of plastic cards for retail credit projects; Introduction of full-service «Mobile Bank»; Introduction of bonus programs and customer loyalty systems for card payments with the Zolotoy Bonus program; Concerning development of banking technologies, priority will be given to improving the technical level of bank systems, resulting in the development of modern services, in particular on-line banking, distant management of customers’ accounts, introduction of different plastic cards services, etc. In addition, new flexible forms of services of traditional banking facilities: operational services, collection of payment, deposit accounts, bank-managed funds, transfers, safety deposit boxes, etc. Service infrastructure is planned to be developed, including additional offices, operational cash-desks, currency exchange desks, cash-machines and self-service terminals. In each branch there will be opportunities for the full range of services. In order to increase efficiency, the management system of the Bank will be improved, working places will be better equipped, internal documentation regulation operations will be developed and optimized. Regarding customers services, the Bank will be focused on its traditional individual approach, providing the most convenient service. More attention will be paid to improving customer service quality by decreasing time of operations, increasing working hours and establishing a system of professional consultation on forms of cooperation with the Bank. 2007 ANNUAL REPORT Commercial bank ENERGOTRANSBANK 13 TYPES OF ACTIVITIES. On the basis of 18 years of experience in the banking business, ENERGOTRANSBANK provides the following services and performs the following transactions: Opens and service accounts in rubles and currency for residents and non-residents; money transfers abroad and reception of transfers from foreign countries without opening an account; settlement and cash services for legal entities and private persons; currency control agent services (transaction passports for import and export transactions); trade finance (letters of credit, documented collection); on-line services of the system Client-Bank; attracting free cash to be deposited under various terms and conditions; loans and financing services for different categories of customers, including factoring, bills of exchange, mortgage loans, interbank loans; securities trading (including bonds), dealing and brokerage of stocks and bonds of Russian enterprises, sales and purchase of bills of exchange of Russian companies and issuing of bills of exchange of the Bank; indemnity bonds; project financing and business plans; supervising and budgeting of customers’ projects; payment collection services; sales, purchases, conversion of non-cash currencies; sales, purchases, conversion of cash currencies; emission and acquiring of plastic cards of MasterCard International and Zolotaya Corona; transactions through international transfer systems including Western Union, MoneyGram, Leader, Migom, Contact, Anelik, Zolotaya Corona, and BLIZKO; receipt of payment of bills and other payments in the framework of the Gorod federal payment system; distant management of the account via on-line bank Faktura.ru; secure storage of valuables in individual safety deposit boxes; operations with precious metal coins; asset management; advisory services. 2007 ANNUAL REPORT Commercial bank ENERGOTRANSBANK 14 CORPORATE CLIENTS The qualitative and quantitative goals of ENERGOTRANSBANK in the Kaliningrad market of banking services are defined by the various policies of the Bank concerning price, range of services, and communication. The formation and development of our customer base is also considered in our policy. ENERGOTRANSBANK is attractive to clients for its high quality of service and development and implementation of new banking services. Offering online service for clients, installing high-speed equipment and time-saving software and the professionalism of our staff has allowed us to create favorable conditions for clients, resulting in growth in the client base in 2007 of 30%, with the number of new accounts opened per month doubling. This growth has driven revenues from clients up 43%, and the average account balance has grown by 165%. Thus, 2007 saw not only quantitative growth in our customer base, but also a qualitative gain. Business growth in Russia is very dynamic across most sectors, so all new technologies which optimize clients’ business enjoy high demand and quick market penetration. ENERGOTRANSBANK experienced 57% growth in the number of clients using the Client-bank service system, while plastic card use grew 406% and the number of programs for direct deposits of salaries was up 88%. Graphic 1. Dynamics of corporate clients 2005 +33% 2006 +43% 2007 +27% Graphic 2. Revenue from corporate clients (ruble and foreign currency accounts), mil. rubles. 2005 Outgoing 61 754 Incoming 61 572 2006 Outgoing 123 605 Incoming 123 800 2007 Outgoing 176 155 Incoming 177 594 Graphic 3. Dynamics of average balances in corporate accounts. 2005 +180% 2006 +104% 2007 +165% CURRENCY EXCHANGE OPERATIONS FOR CORPORATE CLIENTS Services for international commerce is a high-priority area. ENERGOTRANSBANK is the only regional bank in the Kaliningrad Region which has permission to issue customs guarantees. The number of contracts for international commerce is constantly growing, and each month the main office alone issues 40-50 ‘contract passports’. In 2007, the bank’s currency control section serviced 300 export and 1777 import contracts. Substantial growth indicators show the customer-orientation of the bank, which include a flexible pricing system, professional attitude toward clients and convenient working hours. The key success factor of the development of foreign exchange services of ENERGOTRANSBANK is the ability to respond quickly to changing of the exchange rate, so customers are offered the most profitable rate over the course of the day. Because of this clear competitive advantage, a tariff plan called "Currency guest" was devised in 2007, which allows customers of other authorized banks to buy or sell currency at ENERGOTRANSBANK without commission. This service was designed in a way allowing the client, who was served in the two banks, would succeed in conducting a currency purchase in one day. This has enabled us to increase the volume of currency purchases at ENERGOTRANSBANK among customers of other banks in 2007, which amounted to 1 070 233 dollars while selling of foreign currency to customers of ENERGOTRANSBANK rose by 86%, totaling a ruble equivalent of 29 976 458 321. To become more attractive as a bank, we offered currency exchange services from 9:00 to 18:00 in 2007, and bank workers filled out exchange documents at the request of the clients, offering a “fixed rate” service. The client could fix a 2007 ANNUAL REPORT Commercial bank ENERGOTRANSBANK 15 rate at which he wanted an exchange to be made for a determined period of time, and when the inter-bank exchange rate reached that mark, the bank worker fulfilled the operation momentarily. Graphic 1. Contract Passport dynamics For 2005 For 2006 For 2007 +66% +31% +67% Graphic 2. Dynamics of currency payments by corporate clients For 2005 For 2006 For 2007 +165% +37% +41% Graphic 3. Revenue from currency control section, rubles For 2005 For 2006 For 2007 1 742 255 1 832 900 3 871 009 2007 ANNUAL REPORT Commercial bank ENERGOTRANSBANK 16 CREDIT ACTIVITIES As in the previous year, the bank followed steady, conservative policies, built on the diversification of credit risks, a measured balance of loans in asset structures and acquired asset structures. The bank developed internal limits and standards for loans and has always followed them consistently. The decision for issuing of a loan was made after a careful study of the reliability of the borrower, methods of securing repayment, and the feasibility of the related project. In 2007, the Bank successfully used various types of loan products: overdraft credit, lines of credit, interbank lending, and factoring. Bank income from the placing of funds into loans and bills for 2007 totaled 185.7 million rubles, nearly doubling the corresponding figure from the previous year (96.7 million in 2006). Loans and loan equivalents in ruble equivalent as of January 1, 2008 was 3 299 899 thousand rubles, 1.37 times higher than on January 1, 2007, which growth in absolute terms being 888 907 thousand rubles. Loans without promissory notes - 1 410 495 thousand rubles. Graphic 1. Structure of loan portfolio on 01.01.2008. Promissory notes 57% Loans to corporate clients 26% Loans to private persons 2% Loans to private entrepreneurs 6% Interbank loans 9% In accordance with Federal Law No. 218-FZ from 30.12.2004 “Concerning credit histories”, ENERGOTRANSBANK has been cooperating with Global Payments Credit Services Ltd.., a credit history bureau, since 25.08.2005. The company is the second largest credit history bureau in Russia. HIGH-VALUE TRANSACTIONS No transactions considered large by Federal Law No. 208-FZ, signed on 26.12.1995 “Concerning Joint-Stock Companies”, or which would have required the approval process of large transactions according to the Bank’s by-laws, were carried out in 2007. Transactions in which the Bank has interest In the course of normal economic activity in 2007, ENERGOTRANSBANK carried out 30 transactions recognized under the federal law "Concerning Joint-Stock Companies" as transactions in which there is interest. All such transactions by the Bank in 2007 were tentatively approved in the manner provided specified in article 83 of the federal law "On Joint-Stock Companies", in the general meetings of shareholders of the Bank (Protocol № 9 from 28.04.2006, and Protocol № 11 of 09.06.2007). The list of transactions with interest, taking into account the requirements of the federal law "Concerning JointStock Companies", regulations of the federal executive authority for the Securities Market and article 26 of Federal Law № 395-1 of 02.12.1990 "Concerning banks and banking activities", are in the table below. In accordance with article 81of Federal Law № 208 - FZ dated 26.12.1995 "On Joint-Stock Companies", parties deemed to be interested in the carrying out of the Bank’s transactions are: PJSC "Avtotor-Holding groups", "Avtotor-1" Ltd., PJSC "Avtotor", "Garant Capital", Ltd.. "Baltic Automobile Factories", Ltd.. "Griffin Investment", JSC "Griffin". Transactions Transactions of issuing credit Quantity 1 Total Sum, Rubles 96 600,00 Period (in days, min/max) 273 2007 ANNUAL REPORT Commercial bank ENERGOTRANSBANK % / discount 14% 17 Transactions of issuing overdrafts Transactions of prolongation of credit Transactions of purchases of promissory notes Transaction of selling of promissory notes Transactions of exchange of promissory notes Transaction of purchase and sale of securities 1 1 16 000,00 34 000,00 366 365 7-13 % 14,50% 11 996 557,90 5,35 - 38,42 % 12 352 528,78 358-363 Given 188 days’ notice 2 190 752,40 221-360 5,35- 11,03 % 3 209 682,22 2007 ANNUAL REPORT Commercial bank ENERGOTRANSBANK 0-6% 18 PLASTIC CARDS In the financial year of 2007, plastic cards were one of the most important areas of operations. The Bank expanded its range of card products and improved the quality of service, adapting to the increasing needs of customers. In 2007, the Bank continued to issue Zolotaya Corona microprocessor cards in the retail market as well as MasterCard International cards for private and corporate clients. Last year, the total number of cards issued for MasterCard and Zolotaya Corona combine grew by 80% and the turnover on the cards increased by 50% In 2007, the Bank continued to actively implement salary payment programs with the use of Zolotaya Corona cards and MasterCard International in Kaliningrad, the Sovetsk and Moscow. Revenues for the servicing of such programs were 7 times higher than the previous year. In the past year, an overdraft program with credit cards was developed for private clients. A number of new services have been developed and implemented for cardholders. In particular, a trial operation of ATMs with cash-in capabilities and stations and kiosks which can facilitate non-cash banking operations. In 2007, the Bank began a network of 24-hour ATMs in the Kaliningrad region. An important development in the plastic card area was the implementation of an acquiring system of Zolotaya Corona smartcards at retail points. Cooperation with the Center of Financial Technologies group of companies has allowed the Bank to increase significantly the terminal network service of Zolotaya Corona smartcards, placing more than 50 terminals in shopping centers of the Wester retailing group. The implementation involved installing software, training sales personnel, and designing a plan to promote the use of joint card products using bonus and gift cards. CB ENERGOTRANSBANK successfully passed the certification for compliance with international norms and standards for MasterCard International system. In 2007, all the major stages of entry into payment system were completed, and the Bank received affiliate status in the payment system. Since then, the Bank has been able to issue MasterCard plastic cards with its own design and logo, as well as to provide a full range of plastic card services for customers using the international payment system. By providing its customers – private and corporate, with a complete line of card services, the Bank seeks to meet the growing needs of its customers to the fullest. An individual approach to work with each client is the overriding principle in the development of the Bank's card business. 2007 ANNUAL REPORT Commercial bank ENERGOTRANSBANK 19 RETAIL BUSINESS Infrastructure Services In 2007, ENERGOTRANSBANK actively expanded its retail network for private individuals in Kaliningrad and the Kaliningrad region. The Bank’s 15 operating cash desks account for 35% of all such service points in Kaliningrad, with only Sberbank having more. In 2007, all locations were upgraded to increase the range of services, with consideration of technical capabilities and client needs in the particular place. Many units have begun to implement not only the collection of utility payments, but also operations with plastic cards, and remittance services. 2007 also saw the opening of Kaliningrad’s only MONEY TRANSFER CENTER, established by ENERGOTRANSBANK, where clients can send money using 6 remittance systems, make deposits, exchange currency and pay utility payments. Also during the reporting period, three cash desks and three ATM were brought into service, and major work for the opening of an additional office in the town of Gurevsk was undertaken. In 2008, there are plans to install twenty-three ATMs, to open additional offices, and to expand further the range of services in operating cash desks. Maintenance of private accounts Over the year, the Bank has sought to become closer to customers, set the most convenient working hours, and offer integrated services, introducing new products for individuals. Our zeal has been rewarded, and in 2007 the customer base grew by 32%. Graph 1. Number of private clients 01.01.2006 01.01.2007 3 566 01.01.2008 5 198 6 867 The strategy for attracting clients’ savings in 2007 was conservative. We did not attempt to implement new deposits, but offered an alternative—a general fund under the Bank’s management. Our clients could diversify easily and generate income with their excess cash. Graphic 2. Private deposits in the course of the year; 000’s of rubles. 2005 2006 2 141 861 2007 2 581 455 2 527 089 Graphic 3. Capital under management of the general fund of Energotransbank, rubles. Yantar Yantar—Russian stocks Yantar—Energy resources 01.01.2006 9 241 400,00 0 7 100 000,00 01.01.2007 8 761 400,00 6 860 571,00 23 542 500,00 01.01.2008 5 977 000,00 23 410 695,22 27 542 500,00 General (investment) fund under Bank management The Yantar investment funds, managed by ENERGOTRANSBANK, are among the first funds registered by the Bank of Russia in the Kaliningrad region, and have shown high capital growth. In 2007, according to the AZIPI (Association for the Protection of Information Rights of Investors), the funds administered by ENERGOTRANSBANK are leaders by profitability and are among the 20 largest funds in Russia. According to the results for the 2007, Yantar Fund 2007 ANNUAL REPORT Commercial bank ENERGOTRANSBANK 20 was in second place for profitability among mixed investment funds. "Yantar-energy" was 8th in the profitability among funds of Russian shares. Analyzing the funds market, ENERGOTRANSBANK has registered a new fund - "Yantar-index", which allows our customers to obtain profitability close to the major stock indexes. Its advantage is that it is tied to stock indexes MICEX and RTS, which are less volatile than, for example, Russian second or third tier shares. On 01.01.2008, ENERGOTRANSBANK registered 5 new investment funds with different objectives, opportunities and income potential. Perspective plans for opening other investment funds specializing in short sales (a "bear fund") are being made. Money transfers For more than 5 years, ENERGOTRANSBANK has actively developed money transfer services. In 2007, we added 6 more systems to our existing services which included Western Union and BLIZKO. Now, ENERGOTRANSBANK offers the widest spectrum of services and systems in Kaliningrad. This has helped us to increase revenue from these operations 53%, and to increase the sales of other products. Graphic 1. Received and sent money transfer by system Received 8,44% LIDER Sent 8,58% ZOLOTAYA CORONA 3,52% 0,20% MONEYGRAM ANELIK BLIZKO CONTACT MIGOM 0,46% 0,03% 0,97% 26,17% 60,40% 0,06% 0,05% 1,53% 27,50% 62,10% Banking online In 2007, for the purpose of supplying optimal service to the clients of ENERGOTRANSBANK, a system for online banking was completed, which allows full banking services through the Internet. Using the Internet-Bank service, clients can make payments, receive and print confirmations over the Internet, and get updates on plastic cards and accounts by SMS. Utility payments Working in close collaboration with the Center of Financial Technologies Group (Novosibirsk), the Bank began implementing the federal system of service payment called "Gorod". This system allows the payment of utilities and other payments in an automated manner, while exchanging data with database providers. This technology allows migration toward a "paperless" electronic payments technology, accelerates settlement, and operates without a receipt-notification by the service provider. It is in operation on ATMs and terminals for collecting payments, thereby providing convenient service to the public. Thus, by optimizing a financial service, the Bank has solved a problem of socio-economic nature. During 2007, the Bank concluded agreements with leading providers of utility services in the city of Kaliningrad and the region: Simplex, Energosbyt (OJSC Yantarenergo), Kaliningradgazifikatsiya, and Antennaya Service Ltd.. Cooperating with the specialists of CFTG, databases of these service providers were connected to the Gorod payment system, with electronic document processing. At the end of the year the service was put into use throughout ENERGOTRANSBANK’s network. 2007 ANNUAL REPORT Commercial bank ENERGOTRANSBANK 21 Precious metal coins Over the course of 2007, the Bank successfully sold coins made from precious metals, including memorial coins, issued by the Bank of Russia. Our clients were offered several series of memorial coins including ‘Monuments of Architecture, “Historical Persons’, ‘Olympic Games’, ‘The Golden Ring’, and others. Rental of safe deposit boxes The demand for individual safe deposit boxes grows yearly. The Bank vault was refurbished in 2007, allowing more boxes to be put in, and the number of clients doubled. ASSET AND LIABILITY MANAGEMENT The main goal of asset and liability management is the maximizing of bank revenue at the assumed risk level, while fulfilling all obligations to Bank shareholders and clients. The guiding principle of asset and liability management of ENERGOTRANSBANK is the creation of an optimal allocation structure which maximizes the volume of attracted capital. A comprehensive approach to asset and liability management allows the following tasks to be accomplished: maintenance of current, mid-term and long-term liquidity, optimization of profitability of operations, risk management and minimization, diversification of Bank activity for the purpose of expanding the spectrum of services. In a market economy, and given the increasing level of competition, the formulation of bank liabilities and the optimization of their structure takes on more and more significance. The main conclusion which can be taken from 2007 is that the Bank managed to preserve its competitive advantages in the market and positioned itself for significant future development. 2007 ANNUAL REPORT Commercial bank ENERGOTRANSBANK 22 RISK MANAGEMENT The concept for risk management is to focus on the stable development of the Bank, the building of a long-term and effective business which maximizes profitability and minimizing all risks, associated with the Bank’s operations. The Bank’s risk management strategy takes into account external factors (changes in legislation, the competitive environment, etc.) and internal factors, connected with the carrying out of the Bank’s operations and transactions. The structure of operations in 2007 indicates that the Bank is exposed to the following types of risk: credit risks, currency risks, share risks, and operating risks. Management of credit risk is accomplished in accordance to normative and recommended documents of the Bank of Russia, and also with internal documents which abide by legislative and normative practices. Internal documents of the Bank concerning credit policy determine the principles and approach to the forming of the credit portfolio, the procedure of evaluating the financial condition of the applicants, the limitation of rights and the delegation of authorization to transact credit operations. Monitoring of the level of risk is performed by the Bank on a regular basis by determining the quality of loans and establishing the size of settlement reserves. The Bank manages market risk by determining the level of interest risk, share risk, and currency risk. The normative market risk of the Bank (rating or size of risk) is determined according to the requirements of the Bank of Russia. Currency risk is managed according to normative and internal practices, allowing determination and control of currency risk. Currency risk management entails: continual evaluation of currency risk, setting limits of operations in cash and non-cash transaction involving foreign currency, supervision of conformation to the specified limits, supervision of conformation to normative currency positions of the Bank (at the Head Office and at branches). Management of currency risk is carried out by the Bank continuously, with hedging of currency risks carried out by formation of currency basket depending on the dynamics of the rates of foreign currencies in the currency exchange market. The level of share risk is managed through constant monitoring of the dynamics of the securities market, establishment of the limits of operations with shares, and establishment of procedu res to insure the keeping of these limits. The size of share risk is evaluated by the Bank as the financial result taken from the profit / loss from the reassessment of shares at market value or by the formation of reserves corresponding to the normative requirements for share holdings, not offset by loans. The mechanisms for measuring interest risk used by the Bank allow the level of interest risk to be monitored and to effect measures for the lowering of that risk. Hedging of interest risk is performed by adjusting the level of interest rates in accordance with the market situation, the refinancing rate, etc. To reach the goal of effectively managing the Bank’s risks, procedures concerning operational risk have been implemented. This is risk that results in losses from operations. discrepancies in the nature and size of credit issuing activities and/or the requirements of current legislation on internal procedures of banking operation or other transaction, their violation by employees of the creditissuing organization or other persons (as a result of intentional or unintentional action or inaction). Insufficient informational functionality of credit-issuing organizations, insufficient technical or other systems or their breakdown, and other external factors. Instruments and methods for the control and management of operational risks include: regulations for the distribution of responsibility at all stages of financial decisions among departments and officials of the Bank; 2007 ANNUAL REPORT Commercial bank ENERGOTRANSBANK 23 methods of identification and evaluation of the level of accepted risks; due keeping of the limits on basic financial instruments and operations of the Bank, its procedures and their supervision; use of hedging instruments and insurance of risk; monitoring of key risks. Additionally, the Bank has recently engaged in the management of ‘reputation risk’, working out a series of measuring directed toward the timely identification of the risk of enabling a questionable transaction of a client. In an effort to perfect the control methods of the operational risk management system, the Board of Directors have adopted an official position entitled “Concerning the system of internal control in ENERGOTRANSBANK”, which entails criteria for evaluation of the effectiveness of the activity of management and the various departments of the Bank, including evaluation of the quality of risk management. For the organization of management of banking risks and supervision maintaining the maximum level of total risk within the framework of the internal control system of ENERGOTRANSBANK, a Committee for Risk has been organized. CODE FOR CORPORATE BEHAVIOUR ENERGOTRANSBANK adopted the code for corporate behavior recommended by the FKCB in relation to norms at the federal, regional, and corporate level. By following this codex, the Bank has been able to satisfy the interests of shareholders while carrying out the activities of ENERGOTRANSBANK in the reporting period. 2007 ANNUAL REPORT Commercial bank ENERGOTRANSBANK 24 Balance Sheet (form for publishing), as of 01.01.2008 Name of the credit organization: COMMERCIAL BANK “ENERGOTRANSBANK” public joint-stock company. Mailing address: 83а, Klinicheskaya str., Kaliningrad, 236016 Form code 0409806 Quarterly / Annual RUR, thousand I. ASSETS № Article 1 I 1. 2. 2.1. 3. 4. 5. 6. 7. 8. 9. 10. 11. II. 12. 13. 14. 14.1. 15. 16. 17. 18. 19. III. 20. 20.1. 20.2. 20.3. 21. 22. 23. 24. 25. 26. 27. 28. IV. 29. 30. V. 2 ASSETS Money funds Funds of credit organizations in the Central Bank of the Russian Federation Mandatory reserves Funds in credit organizations Net investments into commercial securities Net loan debts Net investments into investment securities held until repayment Net investments into securities available for sale Fixed assets, intangible assets and material reserves Interest receivable Other assets Total assets LIABILITIES Credits received from the Central Bank of the Russian Federation Funds of credit organizations Clients funds (noncredit organizations) Individuals’ deposits Debentures issued Liability to pay interest Other liabilities Reserves for possible losses on conditional terms of credit nature, as well as for other possible losses and operations with the residents of offshore zones Total liabilities OWN FUNDS SOURCES Funds of shareholders (share interest holders) Registered ordinary shares and interests Registered preference shares Not registered authorized capital of non-joint-stock credit organizations Own shares bought out from the shareholders Emission profits Reappraisal of fixed assets Expenses of future periods and payments that will be due and affecting the equity funds (capital) Funds and unused profits of previous years at the disposal of credit organization (losses of previous years being not paid off) Profit for distribution (loss) for the reporting period Total sources of own funds Total liabilities OFF-BALANCE SHEET LIABILITIES Irrevocable liabilities of the credit organization Guarantees issued by the credit organization ASSETS MANAGEMENT ACCOUNTS At the 01.01.08 At the 01.01.07 3 4 189625 194236 684998 50375 356377 231007 3186012 205926 18232 120684 101197 2324231 0 1051303 208374 199 30442 5938337 0 569818 165784 213 517696 4199785 0 0 2468177 492792 274498 8659 37328 0 92189 930316 323496 61740 3062 179438 5069 2793731 767 1267512 1233333 1233333 0 145881 145881 0 0 0 345917 116349 0 78800 345917 116349 4952 7778 1315162 138797 3144606 5938337 1817433 593271 2932273 4199785 139459 30657 140966 445 2007 ANNUAL REPORT Commercial bank ENERGOTRANSBANK 25 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. ACTIVE ACCOUNTS Cash Securities in trust Precious metals Credits granted Funds used for other purposes Settlements concerning asset management Accrued interest (coupon) income paid on interest (coupon) debentures Current accounts Expenses on asset management Losses on asset management NOMINAL ACCOUNTS Capital in trust Settlements concerning asset management Accrued interest (coupon) income received on interest (coupon) debentures Income from the asset management Profit from the asset management 0 61923 0 0 0 3813 0 38143 0 0 0 8004 24 0 0 0 8 711 29 0 56944 0 39182 0 0 0 8816 0 0 7713 2007 ANNUAL REPORT Commercial bank ENERGOTRANSBANK 26 Balance Sheet (form for publishing), as of 01.01.2008 Name of the credit organization: COMMERCIAL BANK “ENERGOTRANSBANK” public joint-stock company. Mailing address: 83а, Klinicheskaya str., Kaliningrad, 236016 Form code 0409807 Quarterly / Annual RUR, thousand № Article At the 01.01.08 1 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 2 Interest received and equated income from: Placement of funds in credit organizations Loans granted to clients (noncredit organizations) Provision of services in financial leasing Securities with fixed earnings Other sources Total interest received, and equated income Interest paid, and equated expenses on: Borrowed funds of credit organizations Borrowed funds of clients (noncredit organizations) Debentures issued Total interest paid, and equated expenses Net interest and equated income Net income from operations with securities Net income from operations with foreign currency Net income from operations with precious metals and other financial instruments Net income from reappraisal of foreign currency Commission income Commission expenses Net income from nonrecurring operations Other net operational income Administration and management expenses Reserves for possible losses Profit before taxation Taxes accrued (Including income tax) Profit for the reporting period At the 01.01.07 3 4 16479 272833 0 9105 4630 303047 5416 91103 0 11587 3783 111889 12083 45961 7997 66041 237006 79986 111180 7137 23883 3477 34497 77392 470769 65297 5069 -1530 80544 1941 -433 5376 -792 771 53255 2072 -1041 348054 193358 -117137 204762 65965 138797 126904 -85013 799716 206445 593271 2007 ANNUAL REPORT Commercial bank ENERGOTRANSBANK 27 Information about The Level of The Sufficiency of Capital, Amount of Reserves for Compensation for Doubtfull Loans and other Assets, as of 01.01.2008 Name of the credit organization: COMMERCIAL BANK “ENERGOTRANSBANK” public joint-stock company. Mailing address: 83а, Klinicheskaya str., Kaliningrad, 236016 Form code 0409808 № Article At the 01.01.08 At the 01.01.07 1 2 3 4 1 Own funds (capital), 2144308 2551266 2 Factual value of sufficiency of own assets (capital) (%) 50.9 70.8 3 Standard value of sufficiency of own assets (capital) (%) 10.0 10.0 4 Calculated reserve for possible losses on loans, loan debts and equated to it debts, RUR, thousand 204281 86751 5 Factual formed reserve for possible losses on loans, loan 6 7 debts and equated to it debts, RUR, thousand Calculated reserve for possible losses, RUR, thousand Factual formed reserve for possible losses, RUR, thousand 204281 6364 86751 6758 6364 6758 2007 ANNUAL REPORT Commercial bank ENERGOTRANSBANK 28 Audit Report Addressee: shareholders of COMMERCIAL BANK “ENERGOTRANSBANK”, Public Joint-Stock Company. Auditor: LLC Auditing Company “Kaliningradskiy Audit”. Audited entity: COMMERCIAL BANK “ENERGOTRANSBANK”, Public Joint-Stock Company. We have conducted an audit of the attached financial (balance sheet) reports of Commercial • COMMERCIAL BANK “ENERGOTRANSBANK” (Public Joint-Stock Company) for the period of January 1st through December 31st of 2007, inclusively. The financial (balance sheet) reports of Commercial • COMMERCIAL BANK “ENERGOTRANSBANK” (Public Joint-Stock Company) consist of: • Balance sheet of the credit organization for the period from 01.01.2007 to 31.12.2007; • Profit and loss statement of the credit organization as of January 1st, 2008 (the form №102); • Consolidated turnover statement reflecting the situation after the reporting period; • Explanatory note. The responsibility to prepare and provide this financial (balance sheet) report is vested in the executive authority of the COMMERCIAL BANK “ENERGOTRANSBANK” (Public Joint-Stock Company). Our responsibility is to express our opinion on the validity of this report in all significant matters and in compliance with accounting practices mandated by Russian Federation laws. We conducted the audit in accordance with: • The Federal Law dd. August 7th, 2001, № 119-FZ “On auditing activities"; • Federal Regulations (Standards) for Auditing Activities, adopted by the Act of the Russian Federation Government dd. September 23rd, 2002, № 696 (in the redaction of the Resolution of the Government of the Russian Federation dd. August 25th, 2006 № 523); • Internal regulations (standards) of the auditing activity of the National Federation of Consultants and Auditors; • Regulatory acts of the Central Bank of the Russian Federation. The audit was planned and conducted in such a way as to receive reasonable assurance that the financial (balance sheet) reports do not contain significant discrepancies. The audit was conducted on a selective basis and included: • Investigating evidence, through testing, that attests to the meaning and openness in the financial (balance sheet) reports of information about financial and economic activities of the entity being audited; • Evaluating principles and methods of accounting, the rules for preparing financial (balance sheet) reports; • Identifying the main evaluation criteria received by the management of the audited entity in preparation of financial (balance sheet) reports; • Evaluating the provision of financial (balance sheet) reports. In maintaining bookkeeping reports, COMMERCIAL BANK “ENERGOTRANSBANK” (Public Joint-Stock Company) used and adhered to the main methods and principles required by adhering to rules for maintaining bookkeeping accounting in credit organizations situated on the territory of the Russian Federation approved by the Central Bank of the Russian Federation dd. 05.12.2002 № 205-P (with amendments and additions). In preparing the annual report, COMMERCIAL BANK “ENERGOTRANSBANK” (Public Joint-Stock Company) was guided by the Instruction of the Central Bank of the Russian Federation dd. 17.12.2004 № 1530-U On the order for drawing up of annual bookkeeping report by credit organizations. We believe that the audit performed provides sufficient grounds to express our opinion on the validity of this report in all significant matters and compliance with the accounting practices mandated by Russian Federation laws. In our opinion, the financial (balance sheet) reports of the COMMERCIAL BANK “ENERGOTRANSBANK“ (Public Joint-Stock Company) truly reflect the financial standing as of December 31st, 2007, and the results of financial-economic activities for the period of January 1st to December 31st, 2007 inclusively, in all significant aspects, in accordance with the requirements of the legislation of the Russian Federation regulating the preparation of financial (balance sheet) reports. April 21, 2008 V.A. Volkov General Director LLC auditing company “Kaliningradskiy Audit“ 2007 ANNUAL REPORT Commercial bank ENERGOTRANSBANK 29