December 22, 2008

advertisement

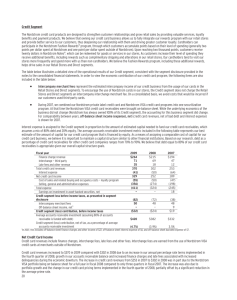

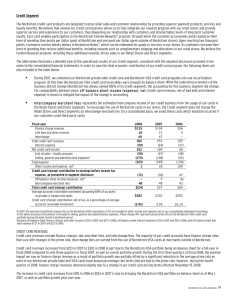

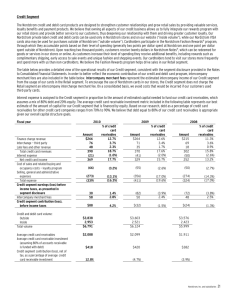

Industry: Retail – Department Store Investment Management Division November 16, 2010 Company: Nordstrom, INC. Ticker: JWN Recommendation: Price: $40.55 BUY BUSINESS DESCRIPTION Nordstrom, Inc., incorporated in 1946, is a fashion specialty retailer. As of March 19, 2010, the Company operated 187 stores located in 28 states in the United States. The Company operates in four segments: Retail Stores, Direct, Credit and Other. The Retail Stores segment includes its 112 Nordstrom full-line stores, 72 off-price Nordstrom Rack stores, two Jeffrey boutiques, and one clearance store that operates under the name Last Chance. The Direct segment’s merchandise is primarily shipped from its fulfillment center in Cedar Rapids, Iowa. Its Credit segment includes its wholly owned federal savings bank, Nordstrom fsb, through which it offers a private label card, two Nordstrom VISA credit cards and a debit card for Nordstrom purchases. Its other segment includes its product development team, called Nordstrom Product Group, which designs and contracts to manufacture private label merchandise sold in its Retail Stores and Direct segments. In addition, this segment includes the Company’s corporate center operations. (Reuters) HIGHLIGHTS Nordstrom Rack stores: The Rack stores had eighth consecutive year of positive sales growth with a same-store sales increase of 2.5% for FY2010. During 2009 Nordstrom opened thirteen Rack stores and the gross square footage increased by 4.1% during 2009. The recent economic recession has driven price as a top concern for most of the customers. Retailers who are more value oriented were able to sustain market share. Increasing Inventory Turnover: High inventory turnover indicates sustained demand for the offering among customers. It will also reduce the inventory costs and markdowns considerably. Increase in 3Q Profit and Revenue Growth: Nordstrom reported a 43% surge in thirdquarter profit. During the quarter the high-end department store earned $119 million, or 53 cents per share, compared with $83 million, or 38 cents, a year ago. Revenue grew 11.2% to $2.18 billion from $1.96 billion. Strong Analyst Response & Stock Growth: Shares of Nordstrom have gained 12% since the beginning of the year. The stock has 10 buy ratings and 11 hold ratings by analysts. Investment Management Division INVESTMENT SUMMARY Investment Positives Increasing e-commerce presence: Nordstrom has been focusing on Internet and mobile retailing to cater to the customer base increasingly preferring digital channels. National online retail sales still contributed for 7% of the total retail sales in 2009 and are expected to further increase. Nordstrom created a shared inventory between full-line stores and nordstrom.com. As a result, customers are able to find what they are looking for more often online. Increase demand for women’s accessories: Women’s accessories and footwear markets have seen significant revival in the first quarter of 2010. The fashion accessories market was down 10% from January through December 2009. However, according to a latest industry report, the market started showing signs of recovery as January - March fashion accessories sales were up 17%. NOTE: Nordstrom noted in a conference call that their strongest categories in October included jewelry, dresses and women's shoes. Increasing inventory turns will reduce markdowns: Nordstrom’s inventory turnover increased from 5.16 in FY2008 to 5.2 in FY2009. Despite slow down in sales Nordstrom’s inventory turnover increased to 5.41 in FY2010. This indicates efficient management of inventory and quick adjustment of the inventory to the sales. Strong 3Q Results: Nordstrom reported a 43% surge in third-quarter profit. During the quarter the high-end department store earned $119 million, or 53 cents per share, compared with $83 million, or 38 cents, a year ago. Revenue grew 11.2% to $2.18 billion from $1.96 billion. Many analysts saw 3Q results critical to a good holiday season. Nordstrom has led the way in earnings for the luxury retail department store industry. Investment Negatives Increase in bad debts: Nordstrom’s bad debt expenses have been rising and this will negatively impact the profitability of the credit segment. Bad debt expense increased to $251 in FY2010 from $173 in FY2009 due to increased write-offs reflecting consumer credit trends. Delinquency rates and write-offs ran at elevated levels throughout 2009. As of January 30, 2010, the company’s delinquency rate was 5.3%, an increase from 3.7% in FY2009 and 2.5% in FY2008. Write-offs increased $91 to $199, or 9.5% of average receivables in FY2010 compared with $108, or 5.6% of average receivables in FY2009. Excessive dependence on California: Nordstrom’s store network is concentrated in California. Due to its demanding location requirements, the company’s store network falls far short of national coverage, with most of its business concentrated on the east and west coasts and a particularly heavy presence in California. In California, unemployment rates in 2009 trended above the national unemployment rate. California’s unemployment rate is now nearly 3% higher than the national rate. In August 2010 California’s unemployment rate was 12.4% compared to the national 9.6% unemployment rate. 2 Investment Management Division INDUSTRY FINANCIAL ANALYSIS Sales Growth The company recorded revenues of $8,627 million during the financial year ended January 2010, an increase of 0.6% over 2009. For FY2010, the US, the company's only geographic market, accounted for 100% of the total revenues. Nordstrom generates revenues through four business divisions: retail stores 87.7% of the total revenues during FY2010, direct 9.3%, credit 4.3% and other -1.2%. Same-store sales grew 5.8%. Earnings Nordstrom’s EPS for 2008 decreased to $1.83 from $2.88 per share. In 2009 EPS increased to $2.01 from $1.83. The company now expects to earn $2.60 to $2.65 per share for the year, up from a range of $2.50 to $2.65 per share it forecast in August. Analysts expect predicted $2.64 per share. Cash Flow Nordstrom’s cash and cash equivalents increased by $723 to $795, primarily due to cash provided by operations of $1,251, partially offset by $360 of capital expenditures; and $182 of purchases, net of payments, made by their customers for third-party merchandise and services using Nordstrom Visa credit cards. Additionally, Nordstrom received proceeds from long-term borrowings of $399, repaid commercial paper and long-term borrowings totaling $300, and paid cash dividends of $139. Nordstrom expects for their operating cash flow to decrease due to an increase in working capital to support sales growth and payment of performance-related expenses. Nordstrom currently has a current ratio of 2.4x Balance Sheet and Financing Bad debt expense increased to $251 in 2009 from $173 in 2008 due to increased write-offs reflecting consumer credit trends. Net cash provided by financing activities was $13 in 2009 compared with $342 used in financing activities in 2008. Nordstrom issued $400 of senior unsecured notes at 6.75% due June 2014. After deducting the original issue discount, underwriting fees and other expenses of $4, net proceeds from the offering were $396. These net borrowings were partially offset by the repayment of $275 in commercial paper borrowings and regularly scheduled principal payments of $25 on other long-term borrowings. 3 Investment Management Division INVESTMENT RISKS Volatile Price of Cotton Cotton has pulled back by 16% during the last few sessions. The selloff came amid fears that monetary tightening might choke off Chinese demand, along with increased trading costs as a result of higher “margin requirements.” consumers are largely unaffected by the wobbling cotton prices. Most of the cotton bought at the peak - $1.523 a pound – is either in the fields or waiting to be delivered to mills. A prolonged price increase would weaken Nordstrom’s margins. Consumer Spending Consumer expenditure on Apparel and Services has decreased 4.3% in 2007-2008 and 4.2% in 2008-2009. A continuation in recessionary spending will negatively affect Nordstrom’s spending. Increase in luxury outlets store Nordstrom Rack, have seen 15 new openings this year alone, including one over the summer in designer-obsessed Manhattan. Nordstrom and Neiman Marcus have even turned to the internet to launch websites for their outlet stores this month, a move that is largely avoided in the retail space given the challenge of selling the limited stock of items that are all already on clearance. This does not paint a picture of solid uptrend and growth. Change in High-end retail With the trend in high-end consumer retail moving towards outlet stores and pushing discounts, the luxury market will not look like what it used to. 3 Ending thoughts Nordstrom Inc. is one of the most financially sound and responsible companies in the retail sector. Many analysts and I feel that the company has great potential moving forward as it has seen incredible growth in its operating income in the past two years, averaging 7.5% year-over-year, which is quite large for such an established company. 4