Financial Analysis: Nordstrom Inc.

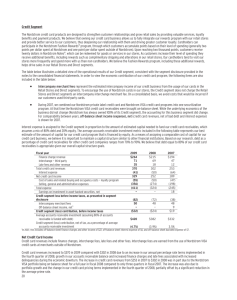

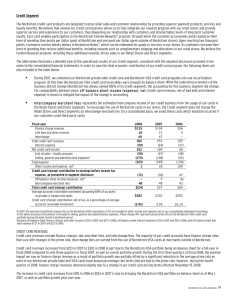

advertisement

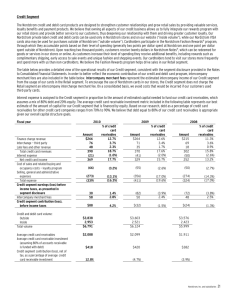

Recommendation In this paper I chose to analyze Nordstrom Inc. Based on financial analysis it is obvious that this popular retailer has created a well known name brand for its merchandise. Today this retailer has many loyal customers from all around the world. After my analysis I recommend that an investor buy Nordstrom stock. Even though the stock price is currently below its usual price range, the company’s overall financial condition is still positive. When comparing key fundamental ratios to industry standards, it seems that the company is well positioned to succeed in the future. The recent decline in stock value is more likely because of the overall current condition of the economy and weak stock market. The current low price makes for a good investment. Also the company’s strong brand name should allow it to compete well against the competition even as the economy gets weaker. Company Summary Nordstrom Inc. was founded in 1901 simply as a shoe store in Seattle. Today this retailer is known as one of the most popular fashionable stores in the nation. Leading the industry with a distinct supply of apparel, shoes and accessories for men, women and children, Nordstrom serves its customers professionally. With about 55,000 employees, 108 Full-Line stores, 54 Nordstrom Racks and the option of shopping on the web or through a catalog the company has facilities that accommodate its clientele. The business aspect of the company is segmented into four sectors; retail stores, the credit sector, the direct sector and faconnable boutiques. Each segment has a different role that plays a part in the success of the company. Nordstrom is by far one of the most popular fashion retailing stores in the in the nation, today. 1 Management Vision Based on the competitive environment that surrounds Nordstrom Inc., the management team has had to make specific decisions in order for the retailer to remain a leader in the industry. Even though the company’s capital budget is significantly higher than its historical norm, plans for future budgeting for the next five years are being set and will begin to take effect for fiscal 2007 at $3 billion. Nordstrom’s taking part in the top 55 U.S. markets is projected to increase from 44 to 51 during these next five years. The management team’s projections are for earnings to rise 8%-10% in the next 3 to 5 years. Nordstrom’s reasoning behind this increase is based on new efficiencies, the addition of new of high-end clothing brands, store opening plans, and a declining share count. Competitive Environment In order for Nordstrom to remain at the top of their industry, when compared to competitors, they are always sure their customers are satisfied. They have expert selling points that are unique from those of competitors along with strategic plans for diversifying the company. Not only does this retailer compete on pricing but also on service. Many of Nordstrom’s shoppers are loyal to the retailer and feel that in the long-run paying Nordstrom prices are cheaper than competing department stores because of the customer service they receive when buying or returning an item. Ratios & Ratio Analysis Liquidity (short-term solvency) Working Capital = 3,398,000 2 Current Ratio = 3,398,000/1,635,000= 2.07 Quick Ratio = (92,000+ NA +2,045,000)/1,635,000 = 1.31 (THOM) =(3,398,000-1,000,000)/1,635,000 = 1.47 (TEXT) Cash Ratio = 92,000/1,635,000 = .056 Long-Term Solvency Ratios Debt Ratio = total lib/ total assets = 4,485,000/5,600,000 = .80 Long-term Debt Ratio = 2,157,000/(2,157,000+ 1,115,000) = 1.93 Debt-to-Equity = 4,485,000/ 1,115,000 = 4.02 Long-term Debt to Equity = 4.02 Equity Multiplier = 5,600,000/ 1,115,000 = 5.02 Times Interest Earned = (1,173,000+ 90,000)/90,000 = 14.03 Cash Coverage = (1,173,000+269,000)/90,000 = 16.02 Profitability Ratios Operating Profit Margin = (1,173,000 + 90,000)/8,828,000 = .14 Net Profit Margin = 706,240/8,828,000 = .08 Asset Management Ratios Inventory Turnover = 8,828,000/956,000 = 9.23 (THOM) 3 = 5,526,000/956,000 = 5.78 (TEXT) Days Sales in Inventory = 365/8.82 = 38.99 (THOM) = 365/5.52 = 66.12 (TEXT) Receivables Turnover = 8,828,000/ 2,045,000 = 4.94 Days in Receivables = 365/4.31 = 84.69 Fixed Asset Turnover = 8,828,000/1,938,000 = 4.56 Total Asset Turnover = 8,828,000/5,600,000 = 1.57 ROA = 715,000/5,600,000 = .13 ROE = 715,000/457,000 = .64 DuPont Analysis ROA= 715,000/ 5,600,000 = 13% ROE = 715,000/ 1,115,000= 64% When comparing the retail industry’s fundamental ratio averages with those of Nordstrom Inc. in 2008, it is evident that financially Nordstrom is doing well compared to their competitors. When looking at the liquidity of Nordstrom’s Assets, the company is able to turn in their assets into cash quicker and with more ease than the retail industry’s average company. An example is Nordstrom’s Current Asset Ratio of 2.07 compared to the industry’s 1.81 shows that the company is in a favorable position with short-term solvency. 4 When comparing Nordstrom’s debt ratios to those of the retail industry it is apparent that the company has higher debt that the industry’s average. In 2008 Nordstrom’s debt ratio was 80% while the retail industry’s was 60%. Considering the difference between the two, there is a reasonable margin between the difference. Another example of Nordstrom’s debt is the debt-toequity ratio for Nordstrom, 4.02, is higher than the industry’s, 1.53. This shows that the company has borrowed money at a higher rate which can be attributed to their favorable position with liquidity. Also, when analyzing the company’s equity multiplier, at 5.02, we find a high equity multiplier, which shows the company is relying more on debt to spend on assets. This retailer’s high debt can be justified by their favorable position with liquidity. Nordstrom’s high debt has likely allowed them to invest more in profitable ventures. Another area in which Nordstrom appears to be above the industry in is profitability. Operating Profit Margin for 2008 is was 14% and the retail industry’s was 2%. Net Profit Margin at Nordstrom was 8% while the industry’s average was .4%. Overall, when comparing Nordstrom Inc. to the retail industry it is evident that they are above the industry with the area of short-term solvency. This cross-sectional comparison gives insight and justifies why the company might have higher debt and strong profitability when evaluated along side the industry. When looking at the course of Nordstrom’s finances over a series of time, it is clear that there have not been many significantly negative trends in the past few years. The company’s total assets have risen. Total liability and net worth has also increased. Sales have incremented in the past five years by a steady 8.10% and net income has increased by a 30.90%. 5 Estimates of Returns and Price Price/Earnings Ratio 5 year average, 2003 to 2007 13.7 + 14.5 + 16.5 + 16.4 + 16.6 / 5 = 15.4 Earnings per Share Estimate 2009 EPS = 2.90 Dividends per Share Estimate D2004 = .24 g = ((.68 / .24) ^ 1/5) – 1 = .23157 D2009 = .68 Rate of Return .04 + 1.15 [.14 - .04] = 15.5 % Intrinsic Value .68/ .155 - .12 = 19.42 Price Estimate Price/Earnings Ratio = 15.54 Earnings per Share Estimate = 2.90 15.54 * 2.90 = $45.07 Summary After Analyzing Nordstrom Inc.’s financial position it is evident that the company has a very stable financial standing with superior future prospects for growth and greater profitability. When looking at short term solvency the company has a strong performance in being able to convert assets into cash quickly. When looking at debt the company has a weaker performance based on their high debt. Nordstrom Inc.’s is able to remain in a favorable position because their high debt is offset by the company’s profitable liquidity. 6 After reviewing the company’s fundamental ratio’s this retailer is doing well above the industry averages. Also, based on the company’s history, management vision, competitive environment, and ratio analysis shown above I would recommend for an investor to buy stock in Nordstrom Inc. The company’s favorable position in the retail industry gives them a greater chance surviving this potential economic downturn. Therefore, it is my recommendation that investors take advantage of this low stock price. Buy it now, it’s a bargain! 7