Global Business Theories: Eclectic Paradigm & More

advertisement

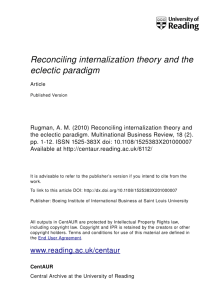

Samila Amany ECLECTIC PARADIGM (OLI PARADIGM) MARKET IMPERFECTION/ INTERNALIZATI ON LOCATION SPECIFIC ADVANTAGES STRATEGIC BEHAVIOR VERNON’S LIFE CYCLE MODEL Global JV/ Alliances A global JV will be successful if the entry mode is eclectic paradigm when product advantage presents: Product or company specific advantages must exist in order for a successful Global JV. Study shows that a Joint Venture is often seen as a viable business in imperfect market. Studies show a failure rate of 3061%, and that 60% failed to start or faded away within 5 years (Osborn, 2003). And that is when the allocation of goods and services by a market is not efficient. Location specific advantages are when the company derives greater benefit through a foreign establishment such as Global JV. Vernon suggests a Joint Venture should happen after the initial stages of a product life cycle. If a global Joint Venture happens in initial stages the chances of unsuccessful transfer may occur. Global Car Manufacturing An example to this theory would be Saab’s car company acquired by General Motors, which many of its loyal customer wrung their collective hands over the perceived loss of Swedish ingenuity. This theory provides a framework to manufacturer industries as to when determining if it is beneficial to pursue. By By Brian Douglas, Special to AsianWeek, May 30, 2003 http://news.asianwe ek.com/news/view_ article.html?article _id=77c0a69dc719 730116ced5853c66 1024 The market imperfection in global car manufacturing falls in majority times specially in Asia due to cultural differences, as was the case with the alliance between Renault, a French car company, and Nissan I have a very interesting example. This one is my own experience and knowledge. For example in Iran all the Automobile parts are provided by western European countries however; all the assembly lines are completed in Iran. This is due to the location specific advantage because of the cheap Plant costs, cheaper fixed assets, as well as cheaper labors. But all the parts are made in mostly “France”. The use of joint ventures stems from theories on how strategic behavior influences competitive positioning of the firm. According to Alan Rugman the motivations to joint venture for strategic reasons are numerous. One main example for strategic behavior in Auto Industry would be the top Auto manufacturers come up with Hybrid cars. This idea is revolutionary and other manufacturers will imitate the original design. Global Oligopolies Global Oligopoly can be defined in Eclectic Paradigm when an oligopoly organization has One imperfection that comes to mind when it comes to Global Oligopolies is; where competitive Advantages (natural and created) that are available only or primarily in a particular place. One strategic behavior or innovativeness for global oligopolies in our era is either The product life cycle of a product in global oligopolies depends on the industry. For example ipod and The Automobile’s life cycle has certainly shortened. However; The usage life cycle may have been shortened on the other hand the life cycle for the research and analysis for the same automobile may have been longer than before. In general automobile life cycle like many other industries has been shortened. Licensing Vs. Other Modes Of Entry company specific advantages, such as a comparative advantage over other companies. A very unique example could be OPEC. OPEC are a few nations that are trying to control the production and price of the oil. interdependence requires that multinational firms maintain tight control over foreign operations so they have the capability to launch attack against their global competitors (as Kodak has done with Fuji). Global Oligopoly location is very uneven in the world since most MNE’s headquartered in developed countries. to merge with one another or buying out the smaller competitors. Based on OLI Paradigm the Licensing or supply through a foreign affiliate is a more profitable strategy in serving the foreign market. The Multinational enterprises have several choices of entry mode, ranking from the market (arm's length transactions) to the hierarchy (wholly owned subsidiary). The Multinational enterprises choose internalization where the market does not exist or functions poorly so that transactions expenses of the external route are high. The subsistence of a particular know-how or core ability is an asset that can give rise to economic rents for the firm. These rents can be earned by licensing the Firm Specific Advantages to another firm, exporting products using this Firm Specific Advantages as an Nakos, Brouthers and Keith D. proposed that (1) mall and medium-sized enterprises (SMEs) with greater firmspecific advantages will tend to prefer equity modes of entry to better exploit this advantage; (2) location-specific advantages (such as small niche markets) means SMEs will tend to prefer more equity-based modes of entry; and (3) internalization advantages will mean SMEs may prefer more equity-based modes of entry. Source from: Entry mode choice of SMEs According to Barlette and Ghoshal; Foreign direct investment is chosen as the preferred mode of entry as strategic behavior in recent years. iphone by Apple! Apple and other tech manufacturers are in the global oligopoly as not many of them are in the market, however they are in a fierce competition and ought to attempt to come up with new products in a regular basis which reduces the products life cycle. On the other hand aerospace industry is almost in an oligopoly situation where for the most part this industry has not changed in the last 50 years. Although I have to add that it has had changes here and there however compare to 50 years in tech industry, the aerospace industry had minimal changes. Therefore; the life cycle of the products in this industry may be longer than high tech industry. Based on Vernon’s Model, Licensing or any mode of entry falls under the last stage which is “Standardized Product Stage”. Off-Shoring To India Of Software Development Global FDI In Banking Industry input, or adjustment subsidiaries abroad. Source from: OLI Paradigm - The Eclectic Theory was evolved by John Dunning Entrepreneur.com According to one of the aspects of Eclectic Paradigm it is better for a company to exploit a foreign opportunity itself, rather than through an agreement with a foreign firm. This recent phenomenon has couple cons; the first imperfection to the market maybe to the economy of the country that sends the jobs to India. due to high unemployment, I personally was impacted by off-shoring resulting 2 years of unemployment and receiving unemployment insurance. The other con may be to the firm in long run due to the lack of knowledge of the needs of target and niche market. Where the company derives greater benefit through a foreign establishment, in the Eclectic Paradigm theory it is called Location Specific Advantages. Here, location advantage is due to lower cost of workforce. According Karsten Schudt, outsourcing Software Development to India has its own strategic behaviors such as; The activity is performed with the low cost while maintaining the high quality. He argues that this has reduced the company’s risk exposure to changing technology and changing buyer preferences. The development of the software is one the last stages of Vernon’s life cycle. The software is developed in India and will be available in international market. Due to the exclusiveness of the industry these type of products have a medium life cycle. It is longer than ipod and other gadgets however; shorter than many other non-tech products. According to Dunning’s eclectic theory correlation between each OLI variable and FDI is explained in detail. t is concluded that monopolistic advantages of technology and management experience of foreign investors along with China’s low labor cost and great market potential might be important factors attracting FDI in China. Since each investor directly deals with the Banking industry in the host country, the imperfection that comes to mind would be different banking rules and regulations that each investor has to deal with it. And also since this is not IMF or World Bank then investing in developing countries would be risky at the same time highly profitable in short run. One should do careful analysis before investing in high risk areas of the world. There are many advantages on how to Invest the money in the global market. Iran has an interest rate of 22% on CD’s as well as very low taxation policy. Swiss on the other hand has a very safe banking system no one will ever know about one’s banking information, therefore; many take advantage of this and Invest in the Swiss bank as oppose to other first world countries banks. According to Hans Degryse; competing banking firms relax overall competition by lowering future barriers to entry. banks strategically commit to disclose borrowers information. By doing this, they invite rivals to enter their market. Disclosure of borrower information increases an entrant's secondperiod profits. This dampens competition for serving the firstperiod market. Source from: Softening Competition by In my opinion Foreign Direct Investment has variety of life cycle depending on which country is the host country, as well as the nature of the investment. It can also depend of the charting period. FDI life cycle can differ from one country to another country. Music Download Industry By definition of OwnershipLocation- and Internationalization (OLI) Paradigm, the music industry due to its nature of downloading online will meet two of the aspects which is ownership and the internationalization . The latter one is the most important due to the power of internet this industry has expanded fast around the world. The reason could be teenagers are more into computers and this is the target group for music industries, therefore only by contracting between the artists and the companies, this industry could take over. The imperfection in the music industry could be the free downloads that are available online around the world. Which can be detrimental to the music industry. For example there are Persian Music web sites that are available online at no cost, therefore people would listen and download the music at no cost. Based on the definition of the Location Specific Advantages, music industry has no “location Specific Advantage” due to the nature of the business which is downloading music online. The definition is based on a particular place that has advantage over the other places for the life of the business. Whereas here internet can be all around the world. Enhancing Entry: An Example from the Banking Industry http://ideas.repec.o rg/p/sef/csefwp/85. html One Strategic Behavior in the Music download industry could be that amateur as well as young musicians have the opportunity to introduce themselves to the global market. The life Cycle of the products are shortened in any technology industry such as music industry. As mentioned the sooner the musician can be introduced to the global market the shorter their product life cycle will be.