Tulsa Area Small Business Guide

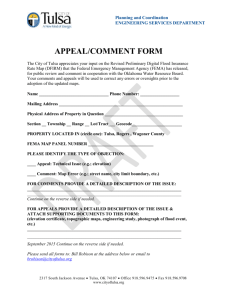

advertisement

Tulsa Area Small Business Resource Guide Establishing a new small business requires careful planning and there are numerous details to be considered when venturing into business for the first time. The objective of this guide is to assist you in finding the information and help you will most likely need. Initial Steps 1. Permits and Licenses City License Center 175 E. 2nd St., 4th Floor Tulsa OK 74103 (918) 596-9456 www.cityoftulsa.org Oklahoma Department of Commerce Business Development Division 900 N Stiles Oklahoma City OK 73104-3234 (800) 879-6552 www.okcommerce.gov Zoning information can be obtained from: Indian Nations Council of Governments (INCOG) 2 W. 2nd St., Suite 800 Tulsa Oklahoma 74103 (918) 584-7526 www.incog.org Note: INCOG has zoning authority for the city of Tulsa plus unincorporated areas in Tulsa County. Location of a business outside this area should be coordinated through the city or county involved. 2. The Oklahoma Tax Commission (OTC) The Tulsa office provides information on all business taxes, and issues sales tax permits, various other business tax licenses and permits, and registers employers for income tax withholding purposes, contact: Oklahoma Tax Commission 440 South Houston, 5th Floor Tulsa Oklahoma 74127 (918) 581-2399 or 1-800-522-8165 www.oktax.state.ok.us Note: The OTC holds local tax workshops on the 2nd & 4th Tuesdays of each month. To register for one of these highly recommended tax workshops call: (918) 449-6592 Revision #7.4 – 02-03-2014 3. The Internal Revenue Service (IRS) For information and publications about federal taxes, tax forms and specific requirements for Sole Proprietorships, Partnerships, and Corporations, go to: www.irs.gov Tulsa Office For local services and general assistance, contact: Internal Revenue Service 1645 S 101st E Ave Tulsa Oklahoma 74128 (918) 622-8482 4. Employers are required to pay Unemployment Insurance Taxes. For information, contact: Oklahoma Employment Security Commission 6128 E 38th St., Suite 405 Tulsa OK 74135 (918) 384-2300 www.oesc.ok.gov 5. The Occupational Safety and Health Act of 1970 (OSHA) affects all businesses. For information on compliance with the Act’s standards, contact: Oklahoma Labor Department 3017 N. Stiles, Suite 100 Oklahoma City, OK 73105 (405) 521-6100 or (888) 269-5353 www.labor.ok.gov 6. Worker’s Compensation Insurance is required by law for most types of employment. This insurance covers employees in the event of injury or death while on the job, contact: Worker’s Compensation Court, Kerr State Office Bldg., Suite 210 440 S. Houston Tulsa Oklahoma 74127 (918) 581-2714 or (800) 522-8210 www.owcc.state.ok.us 2 7. US Immigration and Naturalization Service Employment Eligibility Law requires every person you employee to complete a one page Form I-9. This form may be requested from: US Naturalization Service 4400 SW 44th Street, Suite A Oklahoma City Oklahoma 73119-2800 (800) 375-5283 www.uscis.gov Patents, Brand Names & Trademarks Brand names, patents and trademarks may be registered in the Patent Office of The US Department of Commerce. The best procedure is to have a patent attorney assist with patent applications and to search the records of the US Patent Office to determine if the name you propose to use is available. Should you proceed without a name search, you may infringe on an already registered name and could be held legally liable for financial damages, as well as the loss of any money you have invested in labels, literature and advertising. The actual registration of a brand name is relatively simple, and can generally be handled by the applicant. However, you are strongly advised to consult a patent attorney before completing the process. For additional information and forms, contact: US Patent & Trademark Office Commissioner for Parents P.O. Box1450 Alexandria, VA 22313-1450 (800) 786-9199 www.uspto.gov Corporations, Partnerships and LLCs Information about incorporating and partnerships can be obtained from: Secretary of State 2300 N. Lincoln Blvd., Suite 101 Oklahoma City, Oklahoma 73105-4897 (405) 521-3912 www.sos.state.ok.us Note: Consult an attorney prior to making a final decision. Revision #7.4 – 02-03-2014 Business Insurance New business owners should never assume that they cannot afford business insurance. Not having necessary insurance can lead to severe financial problems and the loss of the business. Insurance agents should be chosen carefully, specialize in business insurance, and fully understand the exact nature of the new business. Always ask for recommendations regarding the type of insurance coverage needed. Note: Business Insurance should be secured in advance of starting operations. Small Business Administration (SBA) Provides management counseling, financial aid and help in procuring government contracts to owners of small businesses, contact: SBA District Office 301 NW 6th St., Suite 101 Oklahoma City Oklahoma 73102 (405) 609-8000 www.sba.gov Tulsa SCORE Sponsored by the Small Business Administration, SCORE provides comprehensive business consulting and mentoring services to existing small businesses and those contemplating going into business. Mentoring services offered by Tulsa SCORE are provided at absolutely no cost to clients. To schedule an appointment with an experienced SCORE Mentor, call or e-mail: Tulsa SCORE, Chapter 194 907 S Detroit, Suite 1001 Tulsa Oklahoma 74120 (918) 581-7462 consult.tulsa@scorevolunteer.org Website: www.tulsa.score.org Better Business Bureau To secure potential customers and supplier information, and to explore the benefits of membership, contact your local BBB. Tulsa 1722 S Carson Ave., Suite 3200 Tulsa, Oklahoma 74119 (918) 492-1266 www.tulsa.bbb.org 3 Oklahoma State Employment Service Provides a placement service for employers. Publishes statistical data concerning the labor force in Oklahoma, contact: 6128 E. 38th Street, Suite 405 Tulsa, Oklahoma 74135 (918) 384-2300 www.oesc.ok.gov Tulsa Metro Chamber Small Business Center provides services to businesses: economic studies, statistical data networking and business directories, contact: One West 3rd St., Suite 100 Tulsa, Oklahoma 74103 (918) 585-1201 www.tulsachamber.com Small Business Hotline (918) 583-5463 Oklahoma Department of Commerce Research Division Provides statistical information on the state, contact: 900 N. Stiles Ave. Oklahoma City OK 73104 (405) 815-6552 (800) 879-6552 www.okcommerce.gov City-County Library System Provides comprehensive business resources, information and government documents, contact: Business and Technology Department 400 Civic Center – 4th Floor Tulsa, Oklahoma 74103 (918) 596-7977 www.tulsalibrary.org OSU Extension Center-Tulsa Co. Provides home based business information, contacts: 4116 E. 15th Street Tulsa, OK 74112 (918) 746-3706 www.fcs.okstate.edu/microbiz c.richert@okstate.edu Oklahoma Small Business Development Center (OSBDC) Provides counseling, economic development assistance and training to small businesses, contact: Northeastern State Univ. 3100 E. New Orleans Broken Arrow, OK 74014 (918) 449-6280 www.osbdc.org Tulsa Economic Development Corporation (TEDC) TEDC, a non-profit organization, has used public and private funds to finance Oklahoma Small Businesses since 1979. Loan projects range from $5,000 to $10 million. Special consideration is given to creating and retaining local jobs. Startups must submit a comprehensive Business Plan with three years of financial projections, contact: TEDC Creative Capital 125 West 3rd St., Second Floor Tulsa, OK 74103 (918) 585-8332 www.tedcnet.com Let Tulsa SCORE Help Start Your New Business-or-Grow Your Existing Business Plan To Attend One of Our No-Charge Introductory Workshops Held Monthly at: The Hardesty and Rudisill Regional Libraries FOR ADDITIONAL INFORMATION, OR TO SIGN UP FOR A WORKSHOP Go to: www.tulsa.score.org or Call: (918) 581-7462 Revision #7.4 – 02-03-2014 4