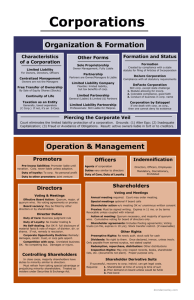

Sole Proprietorship

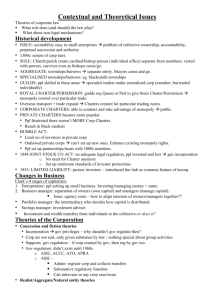

advertisement