smud's pv program - Donald Aitken Associates

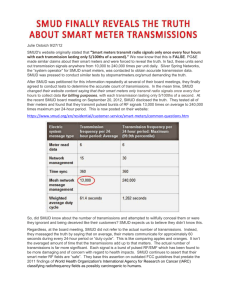

advertisement