1 - Fasset

advertisement

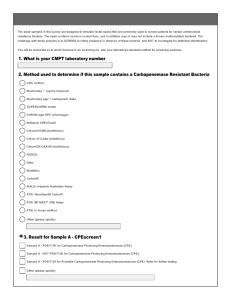

FASSET – CPE 15 2006 Budget and Tax Update Index MODULE 1 ..................................................................................................................... 1 2006/2007 Budget Review .......................................................................................... 1 MODULE 2 ..................................................................................................................... 7 Normal Tax Rates ....................................................................................................... 7 Rebates and Tax Thresholds....................................................................................... 8 Deductions .................................................................................................................. 8 Employees’ Tax: Pay as You Earn (PAYE) and Standard Income Tax on Employees (SITE).......................................................................................................................... 9 SITE ........................................................................................................................ 9 PAYE..................................................................................................................... 10 Provisional Tax .......................................................................................................... 10 Taxpayers defined for Provisional Tax purposes ................................................... 11 Persons exempt from making Provisional Tax payments ....................................... 11 Personal Service Companies and Trusts ................................................................... 11 Casual / Part-Time Employment ................................................................................ 12 Ring - fenced Assessed losses 1 MODULE 3 ................................................................................................................... 15 Fringe Benefits .......................................................................................................... 15 Travelling Allowance .............................................................................................. 15 Employer-Owned Vehicles .................................................................................... 16 Holiday Accommodation povided by Employer ...................................................... 16 Subsistence Allowance .......................................................................................... 16 Residential Accommodation supplied by Employer................................................ 17 Low Interest/Interest-Free Loans ........................................................................... 17 Other Benefits provided by Employer .................................................................... 18 Exemptions............................................................................................................ 19 Contributions to Pension, Retirement Annuity & Provident Funds ............................. 19 Pension Funds ...................................................................................................... 19 Retirement Annuity Funds ..................................................................................... 19 Provident Funds .................................................................................................... 19 MODULE 4 ................................................................................................................... 20 Capital Gains Tax ...................................................................................................... 20 Donations Tax ........................................................................................................... 21 Estate Duty................................................................................................................ 22 MODULE 5 ................................................................................................................... 24 Company Tax ............................................................................................................ 24 Close Corporations ................................................................................................ 24 Trusts .................................................................................................................... 24 MODULE 6 ................................................................................................................... 25 Secondary Tax on Companies .................................................................................. 25 Value Added Tax ....................................................................................................... 25 FASSET – CPE 15 2006 Budget and Tax Update MODULE 7 ................................................................................................................... 26 Wear and Tear Allowances ....................................................................................... 26 MODULE 8 ................................................................................................................... 28 Other Budget Issues ................................................................................................... 28 Exchange Control ...................................................................................................... 28 Emigration Limits ....................................................................................................... 28 Travel And Study Allowances .................................................................................... 28 Retention Of Records ................................................................................................ 29 Additional Information ................................................................................................ 30 FASSET – CPE 15 2006 Budget and Tax Update MODULE 1 “This is the year of plenty, when all South Africans will reap the fruits of economic growth.’ Trevor Manuel 2006/2007 Budget Review South Africa’s Finance Minister, Trevor Manuel unveiled his 10th budget for the country on 15 February 2006. The budget, through various tax cuts reflected the mood of the buoyant South African economy and the success of the South African Revenue Services (SARS) in its collection efforts. It is evident that South Africans are more compliant when it comes to tax matters than they were some ten years ago, when the entire budget amounted to just over R 160 billion, as opposed to over R 440 billion for 2006/7. The surplus in revenue was translated to tax savings in various areas and income sectors, for some more than others. These are detailed in the remainder of this module. Personal Income Tax The major focus of the budget was to provide personal tax relief to all South Africans. Total relief of R 13,5 billion is passed on individual taxpayers through the following: The primary rebate is raised to R 7 200 from R 6 300, increasing the income tax threshold by 14.3% to R 40 000. The increase in the primary rebate also increases the tax threshold for taxpayers aged 65 and over to R 65 000 from the previous level of R 60 000, an increase of 8.3%. Tax brackets are adjusted to provide relief across the income spectrum. Page - 1 - FASSET – CPE 15 2006 Budget and Tax Update Interest and Dividend Income Exemption As from 1 March 2006, the domestic interest exemption threshold will increase from R 15 000 to R16 500 (10%) for taxpayers younger than 65 years and from R 22 000 to R24 500 (11.40%) for taxpayers age 65 and over. It is also proposed to increase the proportion of the exemption applicable to foreign interest income and dividends from R 2 000 to R 2 500 per year. Proposed Rates of Transfer Duty, 2006/07 PROPERTY VALUE RATES OF TAX R0 - R500 000 0% R500 001 - R1 000 000 5% on the value above R500 000 R1 000 001 and above R25 000 plus 8% on the value over R1 000 000 It is also proposed to reduce the flat 10% transfer duty rate for companies and trusts to 8%, and will come into effect on 1 March 2006. It is estimated that the changes in the rates of transfer duties will place some R 4,5 billion back into the hands of taxpayers. Monetary Thresholds: Donations Tax, Estate Duty, Capital Gains Tax Donations Tax It is proposed that the annual donations tax exemption be increased from R 30 000 to R 50 000, effective from 1 March 2006. Estate Duty It is proposed that the estate duty exemption be increased from R 1,5 million to R 2,5 million, effective 1 March 2006. Capital Gains Tax The following proposals are made for tax years commencing on or after 1 March 2006: Page - 2 - FASSET – CPE 15 2006 Budget and Tax Update The annual capital gain/loss exclusion will increase from R 10 000 to R 12 500 The primary residence exclusion will increase from R1 million to R1.5 million The exclusion on death will increase from R 50 000 to R 60 000. Motor Vehicle Allowances As announced in the 2005 Budget, the deemed private kilometres for individuals who receive motor vehicle allowances will be increased to 18 000 per year, and the monthly taxable fringe benefit of a company car will be increased from 1.8% to 2.5% of the determined value of the vehicle, effective from 1 March 2006. The percentage of the monthly motor vehicle allowances subject to tax will be increased from 50% to 60% from 1 March 2006. It is anticipated that this move will cost the taxpayer some R 1,4 billion. Medical Scheme Contributions and Medical Expenses The new medical aid regime introduces monthly monetary caps for tax-free medical scheme contributions (with the caps to be adjusted annually) and increases the threshold for individual tax-deductible medical expenses from 5 to 7.5% of income. Taxpayers 65 years and older will continue to enjoy a full deduction for all medical expenses. These changes are effective 1 March 2006. Promoting Retirement Savings The tax on retirement funds will be reduced from 18% to 9% from 1 March 2006. Relief for Business: RSC Levy Reform By eliminating the RSC levies from 30 June 2006, the 2006 Budget provides direct tax relief amounting to some R 7 billion to business. Stimulating Small Business The monetary tax thresholds for small business will be adjusted as follows: For small business corporations, the following amendments will come into effect for tax years ending on or after 1 April 2006: Page - 3 - FASSET – CPE 15 2006 Budget and Tax Update o Firms with an annual turnover of up to R 14 million (increased from a level of R 6 million) will qualify for the special graduated corporate tax regime o The taxable income threshold for the reduced corporate tax rate of 10% will be increased from R 250 000 to R 300 000 o The small business income tax exemption threshold will be increased from R 35 000 to R 40 000. The one-time capital gains tax relief for small business will increase from R 500 000 to R 750 000 with effect from tax years commencing on or after 1 March 2006. Immediate 100% depreciation exists for individual small items purchased for business purposes. This threshold will increase from R 2 000 to R 5 000 for assets purchased on or after 1 March 2006. The VAT threshold for both small farmers and small business four monthly filers will increase from R1 million to R 1,2 million for tax periods commencing on or after 1 July 2006. The small business proposals are expected to benefit small business to the tune of R 400 million. Tax Amnesty for Small Business The proposed amnesty will allow SARS to waive taxes due by small businesses for years of assessment ending on or before 31 March 2004, where the turnover for the 2005 year of assessment does not exceed R 5 million. This waiver will require submission of an income tax return for 2005 as well as a non-disclosure penalty of 10% based on taxable income for 2005. It will not be available to taxpayers who have already disclosed the amounts concerned, or who have been formally notified that they are under investigation before applying for amnesty. It is also proposed to waive penalties, additional taxes and interest on the underlying taxes due. Page - 4 - FASSET – CPE 15 2006 Budget and Tax Update Incentives for Intellectual Capital and Training Extension and Increase of the Learnership Allowance It is proposed that this allowance be extended to October 2011. The maximum initial allowances will increase from R 17 500 to R 20 000 per year for existing employees and from R 25 000 to R 30 000 for new employees. Similarly, the maximum allowance upon the completion of the learnership will increase from R 25 000 to R 30 000 for agreements entered into from 1 March 2006. Given the additional expenses associated with employing disabled persons as learners, a more favourable allowance will be introduced effective 1 July 2006. An employer will be allowed to deduct an initial allowance of 150% of the annual salary of an existing learner with a disability, up to a maximum of R 40 000; and 175% for an unemployed learner with a disability, up to a maximum of R 50 000. The tax allowance for disabled persons completing a learnership will be 175 % of the employee's annual salary, up to a maximum of R 50 000. Enhancement of Scholarships and Bursaries Bursaries and scholarships for current and future employees will be tax-exempt as long as the employer's funds go directly to tuition and tuition-related expenses, and the employee agrees to repay the employer if the employee fails to fulfill their scholarship or bursary obligations. This proposal will take effect from 1 March 2007. Enhancement of Research and Development To encourage businesses to increase investment in R&D, the deduction for current R&D expenditure will be increased from 100% to 150%. In addition, the depreciation allowance for capital expenditure will be increased from the current 40:20:20:20 to 50:30:20. Page - 5 - FASSET – CPE 15 2006 Budget and Tax Update Zero-Rating of Municipal Property Rates It is proposed to zero-rate municipal property rates for VAT purposes for tax periods commencing on or after 1 July 2006. Consumption Taxes Alcoholic Beverages Excise duties on sparkling wine, unfortified wine, fortified wine, malt beer, alcoholic fruit beverages and spirits increase by 20%, 12.5%, 9.4%, 9%, 9% and 9.5% respectively with immediate effect. Tobacco Products The excise duties on cigarettes, cigarette tobacco, pipe tobacco and cigars will increase by 10.2%, 4.7%, 8.3% and 4.8% respectively with immediate effect. Road Accident Fund Levy The RAF fuel levy is to increase by 5 cents per litre effective 5 April 2006 to allow the fund to settle its expected road accident claims for 2006/07. Exchange Control: South African Resident Private Individuals Private individuals who are over 18 and tax payers in good standing have been permitted to invest abroad since 1 July 1997.The current limit is now increased from R 750 000 to R 2 000 000 per person. SARS Interest Rates Rates of interest Effective from 1 September 2005 Fringe benefits - interest-free or low-interest loan Effective from 1 November 2004 Late or underpayments of tax Refund of overpayments of provisional tax Refund of tax on successful appeal or where the appeal was conceded by SARS Refund of VAT after prescribed period Late payments of VAT Customs and Excise Page - 6 - Rate 8% p.a. 10,5% p.a. 6,5% p.a. 10,5% p.a. 10,5% p.a. 10,5% p.a. 10,5% p.a. FASSET – CPE 15 2006 Budget and Tax Update MODULE 2 Normal Tax Rates NORMAL RATES OF TAX PAYABLE BY NATURAL PERSONS FOR THE YEAR ENDED 28 FEBRUARY 2007 TAXABLE INCOME R 0 – R 100 000 R 100 001 – R 160 000 R 160 001 – R 220 000 R 220 001 – R 300 000 R 300 001 – R 400 000 R 400 001 and above RATES OF TAX + 18% of each R1 R 18 000 + 25% of the amount over R 100 000 R 33 000 + 30% of the amount over R 160 000 R 51 000 + 35% of the amount over R 220 000 R 79 000 + 38% of the amount over R 300 000 R 117 000 + 40% of the amount over R 400 000 NORMAL RATES OF TAX PAYABLE BY NATURAL PERSONS FOR THE YEAR ENDED 28 FEBRUARY 2006 TAXABLE INCOME R 0 – R 80 000 R 80 001 – R 130 000 R 130 001 – R 180 000 R 180 001 – R 230 000 R 230 001 – R 300 000 R 300 001 and above RATES OF TAX + 18% of each R1 R 14 400 + 25% of the amount over R 80 000 R 26 900 + 30% of the amount over R 130 000 R 41 900 + 35% of the amount over R 180 000 R 59 400 + 38% of the amount over R 230 000 R 86 000 + 40% of the amount over R 300 000 NORMAL RATES OF TAX PAYABLE BY NATURAL PERSONS FOR THE YEAR ENDED 28 FEBRUARY 2005 TAXABLE INCOME R 0 – R 74 000 R 74 001 – R 115 000 R 115 001 – R 155 000 R 155 001 – R 195 000 R 195 001 – R 270 000 R 270 001 and above RATES OF TAX + 18% of each R1 R 13 320 + 25% of the amount over R 74 000 R 23 570 + 30% of the amount over R 115 000 R 35 570 + 35% of the amount over R 155 000 R 49 570 + 38% of the amount over R 195 000 R 78 070 + 40% of the amount over R 270 000 Page - 7 - FASSET – CPE 15 2006 Budget and Tax Update Rebates and Tax Thresholds REBATES NATURAL PERSONS Amounts deductible from taxes payable: 2006 Primary Rebate .................................................... R 6 300 Additional Rebate (Applicable to taxpayers 65 years and older) ............ R 4 500 2007 R 7 200 R 4 500 TAX THRESHOLDS Maximum taxable income on which no tax is payable: 2006 2007 Natural Persons under 65 .................................... R 35 000 R 40 000 Natural Persons 65 years and older .................... R 60 000 R 65 000 Deductions Employee deductions are limited to the following: Business travel deduction against car allowance Certain medical expenses Contributions to pension and retirement funds Donations to certain public benefit organisations Page - 8 - FASSET – CPE 15 2006 Budget and Tax Update The following currently represent certain standard deductions, which may be utilised by taxpayers: MEDICAL EXPENSES: For taxpayers under 65 years of age, this deduction is limited to expenditure (including contributions), which exceeds 7.5% (up from 5%) of taxable income. For taxpayers over 65 years of age, there are no limitations and all expenses are deductible. Where the taxpayer qualifies as a “handicapped person”, the taxpayer may deduct all qualifying medical expenditure in excess of R500 for the year. CURRENT PENSION FUND CONTRIBUTIONS: This deduction is limited to the greater of R 1 750 or 7.5% of remuneration from retirement funding employment. CURRENT RETIREMENT ANNUITY FUND CONTRIBUTIONS: This deduction is limited to the greater of 15% of taxable income from nonretirement funding employment, R 1 750 or R 3 500 less Pension Fund contributions. Pay As You Earn (PAYE) & Standard Income Tax on Employees (SITE) SITE SITE is a procedure through which the normal tax in respect of the first segment of an Employee’s remuneration (R60 000 in all cases) is finally determined by the Employer and deducted under the PAYE system. SITE constitutes either a final or minimum liability, and is thus not refundable, except in certain instances. The most important exclusions from SITE systems are: Director’s remuneration Page - 9 - FASSET – CPE 15 2006 Budget and Tax Update Self-employed practitioners All taxpayers who receive remuneration as defined will thus have an element of SITE in their tax deductions but only amounts, which are PAYE in excess of the SITE liability, will be refundable. From an administrative point of view, the SITE liability is only calculated at the end of a tax period, but on a monthly basis, tax deductions are made in terms of the PAYE tables. PAYE Any employee’s remuneration, which is not ‘net remuneration’ as defined or exceeds SITE limits (R 60 000) is subject to monthly deductions according to the PAYE tables. 60% of any Travel Allowance Payment made to directors of private companies or members of close corporations in respect of services rendered are subject to PAYE. PAYE should be withheld from remuneration paid to labour brokers unless an exemption certificate is obtained. ANNUITIES from Annuity Funds are subject to PAYE and SITE. Provisional Tax Provisional taxpayers are required to make two payments during a tax year, i.e. every six months. In addition, provisional taxpayers with taxable income in excess of R 50 000 per annum (Companies and Close Corporations: R 20 000 per annum) should pay a third “top-up” payment to avoid interest leviable in terms of the Income Tax Act. Under normal circumstances, this 3rd provisional payment is due 6 months after a taxpayer’s year-end. In the case of a taxpayer with a February year-end, the “top-up” payment can be made by the end of September of every year. Page - 10 - FASSET – CPE 15 2006 Budget and Tax Update Taxpayers defined for Provisional Tax purposes Income earners not deriving remuneration as defined Directors of private Companies Members of Close Corporations Companies Persons Exempt from making Provisional Tax Payments Income earners with net remuneration not exceeding R 10 000 with effect from 1 March 2002 Non-residents Certain farming, fishing and diamond-digging operators Natural persons over 65 years of age not carrying on a business with taxable income not exceeding R 80 000 Non-resident ship or aircraft charterers Personal Service Companies and Trusts With effect from 1 August 2000, any personal services company or trust, as defined below, will be taxed on income at a rate of 35% and with effect from 1 April 2005 at 34%. Furthermore, the only allowable deduction will be limited to the amount of remuneration paid to the shareholders, members or other employees of the company or trust. A personal service company or trust is characterised by the following: a. the person rendering the service to a client is a connected person in relation to the company or trust, and b. such person would be regarded as an employee of the client were it not for the entity, or c. such person would be subject to the control and supervision of the client, or d. the amounts payable consist of earnings payable at regular daily, weekly, monthly or other intervals, or Page - 11 - FASSET – CPE 15 2006 Budget and Tax Update e. more than 80 % of the entity’s income is received from any one client or associated entity of the client. An exception applies to the above, if the entity employs more than three full time employees throughout the year of assessment who are not connected to the company or trust. Casual / Part-Time Employment PAYE must be deducted at a rate of 25% in respect of all employees who: Work for an employer for less than 5 hours per day (i.e. 22 hours per week) – OR – Who work for an employer without reference to a period Examples: Workers employed on a daily basis, who are paid daily and whose remuneration exceeds R 75 per day Casual commissions paid e.g. spotters fees Casual payments to casual workers for occasional services Fees paid to part-time lecturers Honoraria paid to office bearers of organisations/clubs Exemptions: If an employee works regularly for less than 22 hours per week and provides the employer with a written undertaking that they do not render services to any other employer, then they will be regarded as being in standard employment and tax must be deducted in accordance with the appropriate weekly or monthly tables. An employee who is in standard employment (i.e. works for one employer for at least 22 hours per week). Pensions paid to pensioners Page - 12 - FASSET – CPE 15 2006 Budget and Tax Update Commission agents not in possession of a tax directive (i.e. tax must be deducted according to the appropriate tax tables unless the SARS has issued the agent with a specific and current tax deduction directive) If an employer employs part time/casual employees they are required to issue the employee with an IRP5 certificate when their services are terminated. Where however, regular use is made of an employee and the employer and employee agree, a tax certificate (IRP5) need only be issued at the end of the particular year of assessment. No employee’s tax is required to be deducted from the remuneration of a full time student/scholar who is employed on a casual basis unless the remuneration will exceed the tax threshold for the relevant year of assessment. This provision does not however apply to a student/scholar who works for more than 5 hours per day as they are deemed to be in standard employment and will be subject to the deduction of SITE/PAYE in accordance with the appropriate tables. RING-FENCED ASSESSED LOSSES In years of assessment commencing on or after 1 March 2004 losses from secondary trades will be ring-fenced, which will preclude the offsetting of assessed losses against taxable income. Section 20A will only apply to an individual whose taxable income, before setting off any assessed loss or balance of assessed loss, is equal to or exceeds the level at which the maximum rate of tax is applicable. The restriction further applies where the person has, during any five year period, incurred an assessed loss in at least three years of assessment; or carries on any of the following trades: • Any sporting activities; • Any dealing in collectibles; Page - 13 - FASSET – CPE 15 2006 Budget and Tax Update • The rental of accommodation, vehicles, aircraft or boats (unless at least 80% of the asset is used by persons who are not relatives of such person for a least half of the year of assessment); • Animal showing; • Farming or animal breeding (otherwise than on a full-time basis); • Performing or creative arts; or • Gambling or betting. The person will be able to circumvent these provisions where he can prove that there is a reasonable prospect of deriving taxable income within a reasonable period and where he complies with other tests. Page - 14 - FASSET – CPE 15 2006 Budget and Tax Update MODULE 3 Fringe Benefits Travelling Allowance For The Tax Year Ending 2007 Rates per kilometre, which may be used in determining the allowable deduction for business-travel, where no records of actual costs are kept. WHERE THE VALUE OF THE VEHICLE IS (Including VAT) 0 - R 40 000 R 40 001 - R 60 000 R 60 001 - R 80 000 R 80 001 - R 100 000 R 100 001 - R 120 000 R 140 001 - R 160 000 R 120 001 - R 140 000 R 160 001 - R 180 000 R 180 001 - R 200 000 R 200 001 - R 220 000 R 220 001 - R 240 000 R 240 001 - R 260 000 R 260 001 - R 280 000 R 280 001 - R 300 000 R 300 001 - R 320 000 R 320 001 - R 340 000 R 340 001 - R 360 000 exceeding R 360 000 FIXED COST R/pa 15 364 20 910 25 979 31 513 36 978 47 512 41 771 52 629 58 334 64 591 69 072 74 777 79 918 85 440 88 793 95 218 100 011 100 011 FUEL COST c/km 47.3 49.4 49.4 54.8 54.8 57.2 54.8 57.2 65.9 65.9 65.9 65.9 69.3 69.3 69.3 69.3 77.1 77.1 MAINTENANCE COST c/km 22.5 26.2 26.2 30.5 30.5 39.8 30.5 39.8 43.8 43.8 43.8 43.8 52.5 52.5 52.5 52.5 68.0 68.0 Note: The fixed cost must be reduced on a pro-rata basis if the vehicle is used for business purposes for less than a full year. In the absence of a log book, it is deemed that the first 18 000 kilometres of the actual distance traveled during a tax year is traveled for private purposes and the balance, but not exceeding 14 000 kilometres, is traveled for business purposes. Page - 15 - FASSET – CPE 15 2006 Budget and Tax Update 60% of the traveling allowance must be included in the employee’s remuneration for the purposes of calculating PAYE. Alternatively: Where the distance traveled for business purposes does not exceed 8 000 kilometres per annum, no tax is payable on an allowance paid by an employer to an employee, up to the rate of 246 cents per kilometer regardless of the value of the vehicle. This alternative is not available if other compensation in the form of an allowance or reimbursement is received from the employer in respect of the vehicle. Employer-Owned Vehicles The taxable value is 2.5% of the determined value (usually the cash cost excluding VAT) per month. Where a second (and further) vehicle is made available to an employee or his family, and the vehicle is not used primarily for business purposes, the benefit is 2.5% per month on the vehicle with the highest value and 4% per month on the other vehicle(s). Where the employee bears the cost of all fuel used for the purposes of the private use of the vehicle (including traveling between the employee’s place of residence and his/her place of employment) the monthly percentage to be applied is reduced by 0.22 percentage points. If the employee bears the full cost of maintaining the vehicle (including the cost of repairs, servicing, lubrication and tyres) the monthly percentage to be applied is reduced by 0.18 percentage points. Holiday Accommodation Provided By Employer Employee taxed on – Lower of R 100 per day or prevailing market rate All costs incurred if accommodation is hired by Employer Subsistence Allowance The employee is taxed on the unexpended portion of any allowance given to an Employee for expenses for personal subsistence and incidental costs, e.g. Page - 16 - FASSET – CPE 15 2006 Budget and Tax Update o Accommodation and meals is subject to tax if required to spend at least one night away from home. o In order to simplify the administrative procedures, the amount in excess of the limits described below is taxable. Overseas Travel At the discretion of the Commissioner, who currently allows actual accommodation costs plus $190 per day for meals and incidental costs. This only applies for continuous periods outside the Republic not exceeding six weeks. Where this period is exceeded, allowance paid must be declared in full on Employee’s Tax Certificate and Employee must claim his/her actual expenditure as a deduction. Local Travel The deemed expenditure provision will be limited to the subsistence and incidental cost allowance of R196 per day for local travel. Residential Accommodation Supplied by Employer - DETERMINED BY FORMULA: (A - B) x C/100 x D/12: A = Remuneration (excluding any use of motor vehicle, or entertainment or travel allowances) B = R 20 000 C = 17 (at least 4 rooms) C = 18 (at least 4 rooms, power/fuel supplied by Employer) C = 19 (at least 4 rooms, furnished, power/fuel supplied by Employer) D = Number of months of occupation Any rental payment to Employer by Employee reduces formula determination Low Interest/Interest-Free Loans Amount taxed is difference between interest payable on the loan by Employee and official interest rate Subsidies taxed in full Page - 17 - FASSET – CPE 15 2006 Budget and Tax Update Short term loans, not granted regularly, not granted to all Employees, not in excess of R 3 000, are not taxable benefits Study loan to further Employees’ own studies is not a taxable benefit. Other Benefits The Act provides for the taxation of the following fringe benefits: Medical aid contributions Benefits from share incentive schemes Acquisition of any assets at less that market value including marketable securities Right of use of any assets Meals and refreshments Benefits granted to retired Employees Free or cheap services Housing subsidies and subsidy schemes Payment or release from payment of Employees’ debts Broad based employee equity In years of assessment ending on or after 1 January 2005 section 8B sets out the rules of broad-based employee share plans, aimed at incentivising employer companies to grant shares in themselves to a broad-base of employees. Employer companies may issue: qualifying shares up to a limit of R9 000 per employee in the current tax year and the immediate preceding two tax years. A tax deduction limited to a maximum of R3 000 per annum per employee will be allowed in the employer’s hands. Provided the employee holds onto the shares for at least five years there will be no tax consequences for the employee, other than CGT. Page - 18 - FASSET – CPE 15 2006 Budget and Tax Update Exemptions The Act provides for the following exemptions from fringe benefit taxes: Special uniforms Transfer and relocation costs Share incentive schemes (under certain circumstances) Study loans and bursaries Contributions to: Pension, Retirement Annuity & Provident Funds Pension Funds Any person may claim a deduction of his current contributions to a Pension Fund. The deduction is limited to the greater of: – o R1 750 or 7.5% of remuneration from retirement funding employment A maximum deduction of R 1 800 per annum is allowable for arrear contributions to a Pension Fund. Arrear contributions may be deducted from non-trade income. Retirement Annuity Funds A taxpayer may claim his current contributions to a Retirement Annuity Fund as a deduction which is limited to the greater of: 15% of income from non-retirement funding employment sources R 3 500 less any amount allowed for current Pension Fund contributions or R 1750 The maximum deductions of contributions with regard to the reinstatement of membership of a Retirement Annuity Fund is R 1 800 per annum Provident Funds Contributions to Provident and Benefit Funds are not allowed as deductions from the taxpayer’s income. Page - 19 - FASSET – CPE 15 2006 Budget and Tax Update MODULE 4 Capital Gains Tax Overview of CGT CGT is payable on the disposal of assets that take place on or after valuation date, i.e. 1 October 2001; in the case of South African residents, the tax will apply to disposals of all assets (including overseas assets); in the case of non-residents, the following assets will be subject to CGT: o immovable property, or any right or interest in a property (this includes a direct or indirect interest of at least 20% held alone or together with any connected person in the equity share capital of a company, where at least 80% of the value of the net assets of the company is, at the time of the disposal, attributable to immovable property in SA); and o any asset of a permanent establishment through which a trade is carried on in SA; a capital gain or loss is determined by calculating the difference between the proceeds i.e. the amount accruing to the seller, and the base cost of the disposed asset; base cost relates to the costs directly incurred in acquiring or improving the asset. Calculation Of CGT a capital gain or loss is calculated separately in respect of each asset disposed; once determined, gains or losses are combined for that year of assessment; an annual exclusion of R 12 500 (previously R10 000) then applies, in respect of natural persons only, to the sum of all gains and losses (R 60 000 in the year of death of the person); (previously R 50 000) Page - 20 - FASSET – CPE 15 2006 Budget and Tax Update the resulting capital gain or loss (if not specifically excluded, disregarded or deferred) is aggregated with all other gains or losses in the current tax year, and if it is; o an assessed capital loss, it is carried forward to the following year, or o a net capital gain, it is multiplied by the inclusion rate (see example). this taxable capital gain is included in taxable income and taxed at the normal income tax rates applicable. Effective Tax Rates Type of taxpayer Individuals Retirement funds Trusts - unit trusts - special trusts\ - other Life assurers - individual policyholder fund - company policyholder fund - corporate fund - untaxed policyholder fund Companies Small business corporations Employment companies Permanent establishments (branches) Inclusion Rate 25% N/A Statutory Rate 0-40% 0% Effective Rate 0-10% N/A N/A 25% 50% 30% 18-40% 40% N/A 4,5%-10% 20% 25% 50% 50% 0% 50% 50% 50% 50% 30% 30% 30% 0% 29% 0-29% 34% 34% 7,5% 15% 15% 0% 14.5% 0-14.5% 17% 17% Rollover relief Taxpayers can defer taxable recoupments and capital gains on the sale of business assets if they fully reinvest the sale proceeds in other qualifying assets within a period of three years. Tax on the recoupment and capital gain upon the disposal of the old asset is spread over the same period as wear and tear may be claimed for the replacement asset. Page - 21 - FASSET – CPE 15 2006 Budget and Tax Update Donations Tax Donations Tax is payable by any individual living in the Republic of South Africa, or any South African company or one managed or controlled in the Republic, on the value of any gratuitous disposal of property including the disposal of property for inadequate consideration and the renunciation of rights to property. Exemptions from Donations Tax 1. Donations between husband and wife. 2. Donations to charitable, ecclesiastical and educational institutions, and certain public bodies in the Republic of South Africa as approved by the Minister of Finance. 3. Casual donations up to R10 000 per year by donors other than natural persons. 4. Donations by natural persons on or after 1 March 2006 not exceeding R50 000 (previously R 30 000) per year. Donations Tax Rates: Donations tax is payable within 3 months after the donation at a flat rate of 20% on all donations on or after 1 October 2001. Estate Duty The general rule regarding estate duty is that if the taxpayer is ordinarily resident in the Republic at the time of death, all of his assets, wherever they are situated, will be included in the gross value of his estate for the determination of duty payable thereon. Page - 22 - FASSET – CPE 15 2006 Budget and Tax Update The dutiable amount is arrived at as follows: – Value of all property at date of death (including limited interests such as usufruct) R......................... Deemed property R......................... Gross value of property R......................... Deductions R......................... Net Value of Estate R......................... Abatement R (2 500 000) Dutiable Estate (A) R......................... Estate Duty 20% of A R......................... Deemed property includes insurance policies on the life of the deceased as well as property that the deceased was competent to dispose of immediately prior to his death. The most important deductions, in computing estate duty are:– Debts due at date of death Bequests to various charities Value of property at date of death bequeathed to a surviving spouse There is relief from Estate Duty in the case of the same property being included in the estates of spouses dying within 10 years of each other. The deduction is calculated on a sliding scale varying from 100% where the taxpayers die within 2 years of each other and 20% where the deaths are within 8 years of each other. Page - 23 - FASSET – CPE 15 2006 Budget and Tax Update MODULE 5 Company Tax The rate of South African Normal Company Taxation applicable to Companies (other than small business corporations and personal service companies) with financial years ending after 1 April 2005 is 29%. Companies are not entitled to any rebates except for foreign royalty and foreign taxes paid. Companies are also liable for Secondary Tax on Companies (STC) at 12.5% in respect of all dividends declared after 13 March 1996. Close Corporations: Close Corporations are treated exactly the same as Companies for taxation purposes. Trusts: With effect from 1 March 2002 all trusts other than those mentioned below will be taxed at a flat rate of 40%. Special trusts and testamentary trusts will be taxed at individual rates. With effect from 1 March 2000, income vesting in the Trust as a taxpayer (but not the income vesting in any of the beneficiaries of the Trust) will be taxed at a rate of 32% on taxable income up to R 100 000 and at a rate of 42% on the amount of taxable income in excess of R 100 000, with the exception of a trust created solely for a person who suffers from “mental illness” as defined in section 1 of the Mental Health Act, 1973; or a serious physical disability, where such illness or disability incapacitates the beneficiary from earning sufficient income to maintain himself/herself. Page - 24 - FASSET – CPE 15 2006 Budget and Tax Update MODULE 6 Secondary Tax on Companies (STC) A dual system for the taxation of Companies and Close Corporations exists in South Africa, one part being levied on taxable income and the other part on distributed profits. The tax is levied as follows: – Normal income tax as per the various company classifications A secondary tax of 12.5% on all profits distributed by companies in the form of dividends. Value Added Tax (VAT) South African legislation provides for a 2-tier system of VAT: Taxable supplies are levied at a standard rate of 14%, or at a rate of 0%. The following are certain of the taxable supplies subject to zero rates – Rice Vegetables Fruit Vegetable Oil Milk Brown Wheat Flour Eggs Edible Legumes Illuminating Paraffin Residential rentals are exempt from VAT. Page - 25 - FASSET – CPE 15 2006 Budget and Tax Update MODULE 7 Wear and Tear Allowances It is accepted that capital assets are often required to be applied to business and trade of companies and natural persons alike. The cost of these assets, when utilized in the production of income, may be deducted by the taxpayer over the estimated life of the assets. SARS provides guidance to taxpayers in respect of the period allowed to write off the cost of these assets. Write-off Periods acceptable to SARS ITEM Adding machines Air-conditioners: window type Aircraft: light pass/ commercial/helicopter Arc welding equipment Balers Battery chargers Bicycles Bulldozers Burglar Alarms (removable) Calculators Cash registers Cellular telephone Cheque writing machines Cinema equipment Cold drink dispenser Compressors Computer (main frame) Computer (personal computer) Computer software (main frames): Purchased Self-developed Computer software (personal computer) Concrete transit mixers Containers Crop sprayers Curtains Debarking equipment Delivery vehicles Period of writeoff (no. of years) ITEM Period of writeoff (no. of years) 5 4 3 6 6 4 Engraving equipment Excavators Fax machines 6 6 5 4 3 10 3 5 3 6 5 12 6 4 4 6 6 5 6 5 6 4 5 3 2 3 1 2 Fertiliser spreaders Fire extinguishers (loose units) Fishing Vessels Fitted carpets Fork-lift trucks Front-end loaders Furniture and fittings Gantry cranes Garden irrigation equipment (movable) Gas cutting equipment Gas heaters and cookers Gear shapers Graders Grinding machines Guillotines Gymnasium equipment Hairdressers equipment Harvesters Heat dryers 3 5 6 5 4 4 Heating equipment Hot water systems Incubators Ironing and pressing equipment Kitchen equipment Knitting machines 6 5 6 6 6 6 Page - 26 - 6 6 6 4 6 6 10 5 6 6 FASSET – CPE 15 2006 Budget and Tax Update Demountable partitions Dental and doctors equipment Dictaphones Drilling equipment (water) Drills Electric saws Electrostatic copiers Medical theatre equipment Milling machines Mobile caravans Mobile cranes Mobile refrigeration units Motorcycles Motorised chain saws Motorised concrete mixers Motor mowers Musical instruments Neon signs and advertising boards Ovens and heating devices Oven for heating food Oxygen concentration Paintings (valuable) Pallets 6 5 3 5 6 6 6 6 6 5 4 4 4 4 3 5 5 10 6 6 3 25 4 Passenger cars Patterns, tooling and dies Perforating equipment Photocopying equipment Photographic equipment Planers Pleasure craft etc. Portable concrete mixers Ploughs 5 3 6 5 6 6 12 4 6 Portable generators Portable safes Power tools (hand operated) 5 25 5 Public address systems Race horses Radio communication equipment Refrigerated milk tank Refrigerated equipment Refrigerators Runway lights 5 4 5 4 6 6 5 Laboratory research equipment Lathes Laundromat equipment Law reports Lift installations (goods) Lift installation (passengers) Sanders Security systems Seed separators Sewing machines Shop fittings Solar energy units Special patterns and tooling Spin dryers Spot welding equipment Staff training equipment Stainless steel containers Surveyors: Instruments Surveyors: Field equipment Tape-recorders Telephone equipment Television and advertising films TV sets, video machines and decoders Textbooks Tractors Trailers Traxcavators Trucks (heavy duty) Trucks (other) Truck mounted cranes Typewriters Vending machines (inc. video game) Video cassettes Washing machines Water distillation and purification plant Water tankers Water tanks Weighbridges (movable parts) Workshop equipment X-ray equipment 5 6 5 5 12 12 6 6 6 6 6 5 2 6 6 5 5 10 5 5 5 4 6 3 4 5 4 3 4 4 6 6 2 5 12 4 6 10 5 5 Where the value of an assets is less than R 5 000, the assets may be written off in one year. i.e. the year of acquisition. Page - 27 - FASSET – CPE 15 2006 Budget and Tax Update MODULE 8 Other Budget Matters Exchange Control South African Resident Private Individuals Private individuals who are over 18 and tax payers in good standing have been permitted to invest abroad since 1 July 1997. The current limit is now increased to R 2 000 000 per person. Passport endorsements South African residents traveling abroad on holiday or business currently have the travel allowance endorsed in their passports. This requirement is, with immediate effect, dispensed with. Companies and individuals will, where appropriate, need to continue to satisfy the authorities that their tax affairs are in good standing. Various other limits will also be adjusted. Emigration Limits Household & personal effects, Motor Vehicles, Stamps, coins & Kruger Rands R 1 000 000 Travel and Study Allowances Travel: Study: per adult pa. (over 12 years) R 160 000 per child pa. (under 12 years) R 50 000 per student pa. R 160 000 per student pa. (accompanied by spouse) R 320 000 Student Travel Allowance: per student R 50 000 per student (accompanied by spouse) R 100 000 Page - 28 - FASSET – CPE 15 2006 Budget and Tax Update Retention of Records Accounting Records Books of Prime Entry: Cash Books, Creditor’s Ledgers, Debtor’s Ledgers, Fixed Asset Registers, General Ledgers Journals, Petty Cash Books, Purchase Journals, Sales Journals, Subsidiary Journals and Ledgers – as well as supporting schedules to such Books of Account, etc – Original Microfiche 15 5 Vouchers, Working Papers, Bank Statements, Costing Records, Creditor’s Invoices and Statements, Debtor’s Invoices and Statements, Goods Received Notes, Journal Vouchers, Payrolls, Purchase Orders and Invoices, Railage Documents, Salary and Wages Registers, Sales Tax Records, Tax Returns and Assessments, etc 5 Employee Records: Expense Accounts, Payrolls, Employee Tax Returns,etc 5 Accident Records, Apprentice Records, Industrial Training Records, Staff Records, etc 3 Statutory & Share Registration Records: Annual Returns, Certificates of change of name, Incorporation to commence business, Founding Statements Memorandum and Articles of Association, Minute Books, Notices of Meetings, etc Indefinitely Branch Registers, Registers of: Directors Attendance, Debenture Holders, Directors and Officers, Directors’ Interests, Members and pledges and Bonds, etc. Cancelled share transfer forms 12 Page - 29 - FASSET – CPE 15 2006 Budget and Tax Update Additional Information Comparative Tax Rates RATES OF TAX (A) NATURAL PERSONS: Maximum marginal rate Reached at a taxable income Minimum rate Up to taxable income of (B) COMPANIES: Private and Public o Normal tax rate o STC rate Close Corporation o Normal tax rate o STC rate (C) TRUSTS: Maximum marginal rate Reached at a taxable income Minimum rate Up to taxable income of (D) SUNDRY: Donations Tax Estate Duty 2007 2006 2005 2004 40% 400 000 18% 100 000 40% 300 000 18% 80 000 40% 270 000 18% 74 000 40% 255 000 18% 70 000 29% 12.5% 29% 12.5% 30% 12.5% 30% 12.5% 29% 12.5% 29% 12.5% 30% 12.5% 30% 12.5% 40% Flat Rate 40% Flat rate 40% Flat Rate 40% Flat rate 40% Flat Rate 40% Flat rate 40% Flat Rate 40% Flat rate 20% 20% 20% 20% 20% 20% 20% 20% Page - 30 -