47Totrinh.261108.English

advertisement

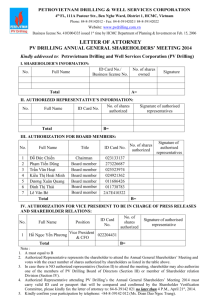

VIETNAM NATIONAL OIL AND GAS GROUP PETROVIETNAM DRILLING & WELL SERVICES CORPORATION ----------------------------- SOCIALIST REPUBLIC OF VIETNAM Independence - Liberty - Happiness ------------------------------ Ho Chi Minh City,…..date of November, 2008 Re: Approval for conversion the capital contribution to PVD share TRANSLATED COPY LETTER OF SUBMISSION To: Esteemed Shareholders of PV Drilling PetroVietnam Drilling & Well Services Corporation (PV Drilling) would like to express our sincere thanks to all Shareholders for your kind supports to PV Drilling over the past. Your strong supports had created more energy for us to continue developing and expanding our business with the target of bringing the long-term benefits to all of our Shareholders. The merging plan of PVD Invest into PV Drilling is not only to resolve the current difficulties for the investment of the two jack-up rigs PV DRILLING II and PV DRILLING III but also to develop and improve the current position of PV Drilling in the drilling market. As well, it is expected to bring the long-term benefits to all Shareholders. In order to determine a fair and reasonable conversion ratio between PVD Invest shares and the capital contribution of PVD Invest shareholders with PVD share, PV Drilling has invited an International auditing and consulting Company- PricewaterhouseCoopers (Vietnam), Ltd. to perform PVD Invest’s evaluation and determine the conversion ratio of shares and capital contribution between PVD Invest and PV Drilling when merging. In the PV Drilling’s EGM held on last Sunday the 09th of Nov. 2008, we already presented to all of you the reasons and benefits from the merger and get the approval for the followings objects: - Approval of the merger of PVD Invest into PV Drilling - Approval of the increased chartered capital through issuing new shares based on ratified conversion ratio for the share and capital contribution for jack-up rig PV Drilling III of PVD. - Approval for share conversion ratio between PVD Invest share and PVD share: 5,5 PVD Invest shares will be exchanged for 1 PVD share. - Assigning PV Drilling’s Board of Directors to approve the merging contract and make other decisions related to the implementation of the merging plan. As for the issue relating to “Approval on the conversion ratio between PV Drilling’s share and capital contribution (with the condition to exchange to PVDI share) of PVD Invest (such as convertible bond), the undersigned person’s name on the contract of capital contribution will 1 exchange 55,000 VND for 1 PVD share” could not be voted due to the fact that the number of shares attended the meeting or the valid authorized shares after deducting the number of shares from PetroVietnam (PVN) were not enough to vote as regulated. This issue is one of the requirements which was approved and got the agreement on the merger of PVD Invest into PV Drilling in the PVD Invest’s EGM. Therefore, in order to have your support on this matter, we would like to provide further information for your consideration and approval as follows: 1. PETROVIETNAM DRILLING INVESTMENT CORPORATION BACKGROUND PetroVietnam Drilling Investment Corporation (PVD Invest) was established on the 24th of April, 2007 with the initial charter capital of VND 1,000 billion, of which PV Drilling holds 51 per cent. Right after its formation, PVD Invest signed a building contract of the new jack-up rig PV DRILLING II with the purchased price of 191 millions USD. After capitalizing interest expenses and the costs incurred during the construction progress, the total investment cost is approximately 215 millions USD of which 30% were funded from charter capital contribution by shareholders (VND 1,000 billions) and 70% funded from debts (about USD 150 millions). PVD Invest had collected charter capital from shareholders for PV DRILLING II (of which PV Drilling increased the charter capital of 510 billions VND to contribute to PVD Invest) and had signed the loan agreement in December 2007 with the interest rate of SIBOR + 1.8%, with the term of 11 years (include 2 years of grace). Up until now, the lenders still keep their commitment that they will ensure to have enough fund for PVD Invest to proceed its project with the re-negotiated annual USD interest rate at deposit interest + 1.2%. To capture the opportunity to buy another rig which is being in construction, PVD Invest continued to sign the contract to buy the jack-up rig PV DRILLING III in Feb. 2008 with the purchased price of 206 millions USD. After capitalizing interest expenses and the costs incurred during construction progress, total investment cost is approximately USD 225 millions with the same capital structure of 30% funded from capital contribution of shareholders (1,000 billions VND) and 70% funded from debts (about 150 millions USD). PVD Invest had reached the first stage of capital contribution from current shareholders of about 466.8 billions VND (of which 255 billions VND contributed from PV Drilling). The second stage capital contribution of 533 billions VND is expected to be completed in the fourth quarter of 2008 under the form of capital contribution Agreement with the commitment of convertible condition to shares when PVD Invest meets the requirement for issuing additional shares in early 2009 when PVD Invest has 2 years of continuously audited financial statements as regulated. The second stage of capital contribution of 533 billions VND to PVD Invest, PVD Invest shareholders have agreed to invite PVN to contribute this amount with the condition to exchange to PVD Invest shares as stated above. Also, PVN will make an additional contribution of about 180 billions VND due to the following main reasons: - Capital contributing of PVN to PVD Invest will help PVN meet the requirement needed to be the guarantee for the loan of the Rig PV DRILLING III. 2 - The additional capital contributing of 180 billions VND of PVN compensate for the shortage amount of the loan because the actual loan amount, in reality, could be only about USD 135 millions or a little more while the projected loan is USD 150 millions. - The capital contributing of PVN into PVD Invest which is mentioned above is still in accordance with the initial capital contribution plan of PVD Invest (VND 1,000 billions) to invest in the Rig PV DRILLING III. As for the loan of USD135 million for the Rig PV DRILLING III, PVD Invest is now on the progress of signing the loan agreement with 03 MLAs: HSBC, ANZ and ABN AMRO with the amount of about USD115 million with the condition of PVN will be a guarantee for the loan. Currently, the construction of the two rigs DRILLING II và PV DRILLING III is in the construction progess by KFELS as scheduled and it is expected to be delivered in the 4th quarter of 2009 and beginning of 2010. The funding of the two loans for two jack-up rigs has overcome the global as well as local difficult financial situation and PVD Invest has been performing the payments to the builder on time and continue going forward to the stages of construction as schedule. 2. MERGING PLAN SUMMARY: - PV Drilling will issue a number of additional shares to make the conversion of 49% of the outstanding shares of PVD Invest with the conversion ratio of 5.5 PVD Invest shares exchanged for 1 PVD share and the capital contribution with the condition to exchange to PVD Invest share (such as convertible bond) with the conversion ratio of VND 55,000 to be exchanged for 1 PVD share. Notes: The capital contribution converted to PVD shares is the capital contributed with the condition to exchange to PVDI share with the rate of VND 55,000 to be exchanged for 1 PVD share when the merging plan is executed (such as convertible bond). Normal capital contribution is not qualified for the conversion. - As a result, total additional shares of PV Drilling which is planned to be issued for the conversion of shares and capital contribution for Rig PV DRILLING III investment are 25,716,554 shares. - Merging time: The merger is expected to be processed in the first quarter of 2009. At that time, amount of the above capital contribution is qualified to be exchanged for 1 PVD Invest share. Therefore, the value of that capital contribution is considered equivalent to 1 PVD Invest shares. 3 3. IMPACTS OF THE MERGER TO PV DRILLING SHAREHOLDERS’ BENEFITS: Short-term impacts: Short-term dilution to PVD shares: - After the merger, the total PVD outstanding shares will increase to 19.5%, equivalent to 25,716,544 additional PVD shares issued. The shareholding structure of the current shareholders of PV Drilling will be lowered by about 8.1% (from 49.6% to 41.5% after the merger). The EPS (Earning per share) will be diluted by about 11,0% in 2009 (from VND 6,334 to VND 5,635 per share) after PV Drilling issues additional shares for the merger. However, PVD share price, after the merger, will not be adjusted in the stock market because these are new shares issuance for the merger of PVD Invest. Short-term dividend decrease : Dividend to PV Drilling shareholders will be reduced by about 5.2% in 2009 (from 46.9% before the merger to 41.7% after the merger). This is mainly due to the increase in shares issued for the merger as mentioned above (please refer to the Appendix enclosed). Long-term benefits to PV Drilling shareholders: EPS and Dividend will increase in 2010 compared to no merger: From 2010, dividend for Shareholders will significantly increase because PV Drilling will operate 03 rigs . With the advantage in rig management experience, human resources utilization and the availablity of logistic system, PV Drilling will have cost savings especially in rig operation and management expenses , thus enhancing the businesss efficiency. Besides, PV Drilling will earn 100% net profit from rig operation services, causing EPS to increase to VND 7,835per share, which is VND 780 per share or 11.1% higher compared to the case no merger . Dividend in 2010 will be above 58% in comparison with the case of no merger (from 52.2% goes up to 58.0% after merger) (please refer to the Appendix enclosed). PVD share market price will increase after merger: After the merger, PV Drilling will have a very fast and firm development. The total asset value will increase from owning additional 02 (two) jack-up rigs in a very short time due to the completion of loan agreements in PVD Invest.. With 03 (three) rigs, PV Drilling’s asset value will be more than VND 11,000 billions, or three times higher in comparison with the current separate financial statements. PV Drilling will become a very strong Company in drilling and drilling-related services. The merger will improve the position of PV Drilling and increase the competitive advantage to other competitors in the region, resulting in an increase in business efficiency. These are the factors to ensure a firm development of PV Drilling, attract more investors, and increase the intrinsic value, lead to the increase in the market price of PVD shares. 4 Benefit from share premium: According to the above merger plan that is based on the valuation report of PVD Invest from PricewaterhouseCoopers, a Consulting Company for PV Drilling, the share swap ratio between PVD Invest and PVD shares is 5.5:1 (5.5 PVD Invest share will be swapped to 01 PVD share); and a capital contribution of VND 55,000 under convetible condition will be swapped to 01 PVD share. Therefore, the share premium resulted from the merger will be about VND 1,157 billions from the difference of VND45,000 pershare. As regulated, the fund from the share premium resulted from the difference between selling price with the face value of shares that were issued for restructuring of debts, supporting on capital will be distributed to PV Drilling shareholders based on the shareholding structure under the form of bonus shares after 01 or 03 years from the date that PV Drilling issues additional shares for the merger. Benefits to PV Drilling shareholders from PVN: - PVN will strongly support PV Drilling in funding debts: o PVN guarantees for the loans of PV DRILLING I and PV DRILLING III. o In future, in case the loan of PV DRILLING II becomes difficult, PVN agrees to guarantee the loan if necessary. o Currently, PVN is a prestigious and power group to get loans from the foreign banks in the international financial market. - Even though, PV Drilling has enough strength to compete with other drilling contractors in domestics or overseas, PVN will play a very important role in supporting PV Drilling in fierce competitive conditions or renting the rigs when the drilling rig market is significantly slow in Vietnam. 4. CONCLUSION: In the context that the global and Vietnam economies fluctuate downward, the year 2009 is predicted to be a difficult year. Regardless of the current situation, PV Drilling still achieve over profit the target in business performance. In which, the main profit comes from rig operation sector. With the investing strategy of buying the two jack-up rigs to expand business activity and in order to possess two addtional jack-up rigs, it probably takes PV Drilling at least three years. While PVD Invest had signed the contract of building two new jack-up rigs and the process for rasing capital for these two rigs is being almost completed; therefore the merging of PVD Invest into PV Drilling will help PV Drilling possess two jack-up rigs and bring it into service in the shortest time. In addition, from the above analysis of the impacts and the benefits from merger to PV Drilling shareholders, the merger will improve the business operation effeciently since the indirect management cost will be shared as well as interest expenses from using the equity of both companies. This is also the advantage of the merge and acquisition decision. 5 The merger is also help avoiding conflict of interests (if any) between the shareholders of PVD Invest and PV Drilling in the future. For all the above reasons, PV Drilling’s Board of Management realize that the merger of PVD Invest into PVD is not only necessary in this difficult economy period but also bringing up the long-term benefits for the shareholders. PV Drilling kindly request esteemed shareholders reconsider and agree with our merging plan as proposed. In which, PV Drilling will issue a number of additional shares in order to make the conversion of 49 per cent existing shares with the conversion ratio of 5,5:1 (5,5 PVD Invest shares exchanged for 1 PVD share) and the capital contribution with the condition to exchange to PVD Invest share from PVD Invest’s shareholders and PVN’s shareholders with the conversion ratio of 55,000 VND exchanged for 1 PVD share. In case the conversion of the capital contribution in PVD Invest (under convertible condition to PVD Invest shares) mentioned above in this Submission is not approved , the merger plan is considered to be cancelled (unless another decision is approved) due to it is one of the necessary conditions to do the merger that PVD Invest shareholders have already approved . With all the reasons mentioned above for the merging plan, PV Drilling’s Board of Members and Management team would be very appreciated if we have strong support and trust from all of the shareholders. This will help us to stabilize and develop steadily with the target of maximizing the value for the shareholders/investors of PV Drilling as the nature of this merger is bringing more benefits for the shareholders compared to that of the two separate companies. We strongly believed that the long-term faith of PV Drilling’s investors/shareholders will be rewarded. Yours faithfully, Chairman Signed ĐỖ ĐÌNH LUYỆN Translated from PV Drilling, approved by Hồ Ngọc Yến Phương Vice President, CFO 6