RUSSIAN MARKET OF COSMETICS

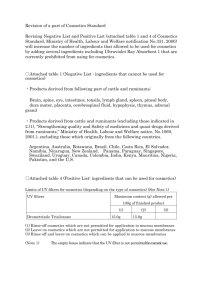

advertisement