Accountancy and Business Law - Heriot

advertisement

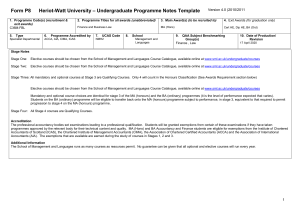

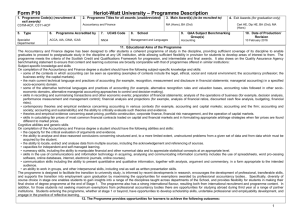

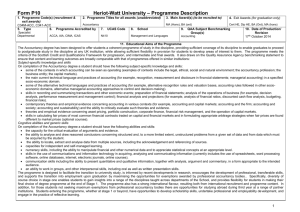

Heriot-Watt University – Undergraduate Programme Notes Form P8 1. Programme Code(s) (recruitment & exit awards) C33M-ABL 5. Type 6. 2. Programme Titles for all awards (unabbreviated) 3. Main Award(s) (to be recruited to) 4. Exit Awards (for graduation only) MA (Hons) Cert HE, Dip HE, BA (Ord) Accountancy and Business Law Programme Accredited by Specialist Departmental 7. UCAS Code NN32 ACCA, AIA, CIMA, ICAS 8. School Management and Languages 9. QAA Subject Benchmarking Group(s) 10. Date of Production/ Revision 06 March 2016 Accounting, Law Stage Notes Stage One: If candidates wish to maximise exemption claims from examinations set by professional Accountancy bodies then they are advised to refer to the List of Courses Accredited by Professional Accountancy Bodies issued separately by the Department of Accountancy and Finance. Elective courses should be chosen from the School of Management and Languages Course Catalogue, available online at www.sml.ac.uk/undergraduate/courses Stage Two: If candidates wish to maximise exemption claims from examinations set by professional Accountancy bodies then they are advised to refer to the List of Courses Accredited by Professional Accountancy Bodies issued separately by the Department of Accountancy and Finance. Elective courses should be chosen from the School of Management and Languages Course Catalogue, available online at www.sml.ac.uk/undergraduate/courses Stage Three: There are 4 Qualifying Courses at Stage 3. These are Management Accounting Techniques and Decisions, Contemporary Issues in Accounting, Law Course 1 and Law course 2. If candidates wish to maximise exemption claims from examinations set by professional Accountancy bodies then they are advised to refer to the List of Courses Accredited by Professional Accountancy Bodies issued separately by the Department of Accountancy and Finance. Elective courses should be chosen from the School of Management and Languages Course Catalogue, available online at www.sml.ac.uk/undergraduate/courses Mandatory and optional course choices are identical for stage 3 of the MA (honours) and the BA (ordinary) programmes (it is the level of performance expected that varies). Students on the BA (ordinary) programme will be eligible to transfer back onto the MA (honours) programme subject to performance, in stage 3, equivalent to that required to permit progression to stage 4 on the MA (honours) programme. Stage Four: All Stage 4 courses are Qualifying Courses. Accreditation The professional accountancy bodies set examinations leading to a professional qualification. Students will be granted exemptions from certain of these examinations if they have taken programmes approved by the relevant body for their technical content and quality. MA (Hons) and BA Accountancy and Business Law students are eligible for exemptions from the Institute of Chartered Accountants of Scotland (ICAS), the Chartered Institute of Management Accountants (CIMA), the Association of Chartered Certified Accountants (ACCA) and the Association of International Accountants (AIA). The exemptions that are available are earned during the study of courses in Stages 1, 2 and 3. Additional Information The School of Management and Languages runs as many courses as resources permit. No guarantee can be given that all optional and elective courses will run every year. 1 Heriot-Watt University – Undergraduate Programme Notes Form P8 1. Programme Code(s) (recruitment & exit awards) C33M-ABL 5. Type 6. 2. Programme Titles for all awards (unabbreviated) Programme Accredited by Specialist Departmental 7. UCAS Code NN32 ACCA, AIA, CIMA, ICAS 3. Main Award(s) (to be recruited to) 4. Exit Awards (for graduation only) MA (Hons) Cert HE, Dip HE, BA (Ord) Accountancy and Business Law 8. School Management and Languages 9. QAA Subject Benchmarking Group(s) 10. Date of Production/ Revision 06 March 2016 Accounting, Law Progression Requirements From Stage 1 to Stage 2: at least 90 credits, with all courses that are pre-requisite for study at a higher level at grade D or better, plus additional courses (if required) so that no less than 4 courses are passed at Grade D or better. From Stage 2 to Stage 3: at least 210 credits, with all courses that are pre-requisite for study at a higher level at grade D or better. In addition at least 4 mandatory/optional courses at SCQF level 8 must be passed at Grade C, or better, at the first attempt. Students who fail to achieve the Grade C requirement to progress on the honours route will transfer to stage 3 of the BA (ordinary) Accountancy & Business Law degree, provided at least 4 courses at SCQF level 8 are passed at Grade D, or better (including pre-requisite courses). From Stage 3 to Stage 4: at least 360 credits, with all courses that are designated or pre-requisite for study at Stage 4 at grade D or better. In addition at least 4 mandatory/optional courses at SCQF level 9 must be passed at Grade C, or better, at the first attempt. Students who fail to achieve the Grade C requirement to progress on the honours route will transfer to the BA (ordinary) Accountancy & Business Law degree for graduation (provided at least 4 courses at SCQF level 9 are passed at Grade D, or better, including both designated Accountancy courses and at least two designated Law courses). Stage 3: Both designated Accountancy courses - Management Accounting Techniques and Decisions, Contemporary Issues in Accounting. At least two SCQF level 9 designated Law courses. A student who fails to meet the progression requirements for moving to the next stage of a programme of study will be permitted one further opportunity to register for and complete enough courses to meet the progression requirements or else may change programme. A student in stage 1 or stage 2 of a programme of study who fails to obtain at least a Grade E following re-assessment in any course that is not a pre-requisite for study at a higher level will be permitted to progress to the subsequent stage of the programme with one opportunity to register for and complete the course, so long as the student meets the credit requirement for progression and the student would not be required to complete six courses in any semester. Note: from 2013/14 onwards for progression from stage 2, and 2014/15 for progression from stage 3, the progression requirement to the honours stream will be raised to at least six grade Cs. 2 Heriot-Watt University – Undergraduate Programme Notes Form P8 1. Programme Code(s) (recruitment & exit awards) C33M-ABL 5. Type 6. 2. Programme Titles for all awards (unabbreviated) Programme Accredited by Specialist Departmental 7. UCAS Code NN32 ACCA, AIA, CIMA, ICAS 3. Main Award(s) (to be recruited to) 4. Exit Awards (for graduation only) MA (Hons) Cert HE, Dip HE, BA (Ord) Accountancy and Business Law 8. School Management and Languages 9. QAA Subject Benchmarking Group(s) 10. Date of Production/ Revision 06 March 2016 Accounting, Law Award Requirements Ordinary Degrees The BA ordinary degree will be awarded where 360 credits have been obtained, with no less than 4 courses at Scottish Credit and Qualification Framework level 9 passed at Grade D, or better, including both designated Accountancy courses and at least two designated Law courses. Where a student obtains grade A in no less than five out of eight courses completed at stage 3 (SCQF level 9), the examination board will consider whether to make the award of Bachelor of Arts with distinction. Honours Degrees Honours classification is determined by a weighted average of marks attained in 12 Qualifying Courses taken over Stages 3 and 4. All 8 courses completed at stage 4 are qualifying courses and these courses have a weight of 80% in the average. Out of the Scottish Credit and Qualification Framework level 9 Qualifying Courses completed at stage 3 only the best 4 will count in the weighted average. These will have a weight of 20% in the average. Where the weighted average falls into a “discussion zone”, the Progression Board will give further consideration on a case by case basis. Resits of Stage 3 Qualifying Courses are allowed but only in order to gain credits for the course. For the purposes of determining the degree classification, the mark obtained in the first assessment of a Qualifying Course must be used. The accompanying Programme Structure provides details of courses, awards and credits for the programme. The accompanying Programme Description template provides details of aims, outcomes, teaching & learning and assessment policies for the programme. List of Optional courses to be appended 3