2013-36 - National Association of Insurance Commissioners

advertisement

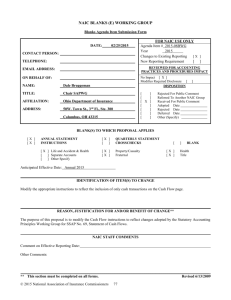

Ref# 2014-23 Statutory Accounting Principles Working Group Maintenance Agenda Submission Form Form A Issue: Treatment of Non-Cash Items in the Cash Flow Statements Check (applicable entity): P/C Life Health Modification of existing SSAP New Issue or SSAP Description of Issue: NAIC staff has received information that the guidance for the statutory accounting cash flow statement is unclear regarding the inclusion / exclusion of non-cash items. The following points highlight the inconsistencies with the existing cash flow guidance: 1. SSAP No. 69—Statement of Cash Flow (SSAP No. 69) identifies that the cash flow statement shall include cash, cash equivalents and short-term investments. From this direction, non-cash exchanges (outside of short-term investments) should be excluded. 2. Annual Statement Instructions / Worksheets imply that non-cash items are captured within the cash flow statement. (Examples include intercompany exchanges of non-cash assets or liabilities for other noncash assets or liabilities and situations when non-cash assets (e.g., bonds) are used to settle intercompany ceded premiums and/or commissions.) However, the Worksheets also indicate that they are “provided to facilitate completion” of the Cash Flow Statement, and that “reporting entities need to make adjustments to various lines consistent with their operations.” 3. The differences / inconsistencies between the statutory accounting guidance and the annual statement instructions regarding the inclusion of cash/non-cash items, was noted when SSAP No. 69 was initially developed (per Issue Paper No. 92), and was then subsequently identified with additional revisions per agenda item 2002-01. Issue Paper No. 92—Statement of Cash Flow, explicitly states: (bolded for emphasis) 1. This issue paper changes current statutory accounting to require that only cash transactions be included in the Statement of Cash Flow. The current Annual Statement Instructions are unclear and appear to indicate that any amount shown as consideration would be included in the statement. The guidance in SSAP No. 69, paragraph 2 was previously revised (agenda item 2002-01) as a result of further confusion about the presentation of cash and noncash amounts in the cash flow statement. The following shows the adopted revisions from agenda item 2002-01. SSAP No. 69—Statement of Cash Flows with revisions adopted June 10, 2002: 2. The Statement of Cash Flow shall be prepared using the direct method. Cash from operations shall be reported consistent with the Statement of Income, excluding the effect of current and prior year accruals. For purposes of the Statement of Cash Flow, cash shall include short-term investments. Specific instructions for the classification of items are provided in the Annual Statement Instructions. © 2014 National Association of Insurance Commissioners 1 Ref# 2014-23 4. SSAP No. 69 includes disclosures for transactions considered to be investing and financing that affect recognized assets and liabilities but do not result in cash receipts or cash payments in the period. As the disclosure excludes non-cash items that pertain to operating activities, without inclusion of these non-cash items in the cash flow statement, there is no current requirement to document these activities. As an example, since reinsurance would generally be considered an “operating” activity, under the existing guidance, bonds transferred in a reinsurance agreement would not be captured in the disclosure. Existing Authoritative Literature: SSAP No. 69—Statement of Cash Flow provides the statutory accounting guidance for the cash flow statement. Although this statement adopts a couple of GAAP pronouncements regarding the classification (e.g. financing, investing or operating) of specific transactions, it rejects the underlying GAAP guidance for the cash flow statement. The following GAAP standards are specifically noted as rejected: FASB Statement No. 95, Statement of Cash Flows, FASB Statement No. 102, Statement of Cash Flows—Exemption of Certain Enterprises and Classification of Cash Flows from Certain Securities Acquired for Resale, an amendment of FASB Statement No. 95, and FASB Statement No. 104, Statement of Cash Flows—Net Reporting of Certain Cash Receipts and Cash Payments and Classification of Cash Flows from Hedging Transactions, an amendment of FASB Statement No. 95. Although the statutory accounting guidance “rejects” the underlying GAAP guidance for cash flows, the guidance in paragraph 3 of SSAP No. 69 for the disclosure of non-cash investing and financing activities is essentially identical to the rejected GAAP guidance. Despite the similarities between SAP and GAAP, staff believes the original GAAP guidance was “rejected” as statutory accounting requires the cash flow statement to be completed under the direct method and requires inclusion of short-term investments. Under GAAP, reporting entities are allowed to utilize either the direct or indirect method, and only include cash and cash equivalents. Activity to Date (issues previously addressed by SAPWG, Emerging Accounting Issues WG, SEC, FASB, other State Departments of Insurance or other NAIC groups): Agenda Item 2002-01 - Cash Flow Disclosure of Noncash Transactions, resulted in revisions to address “confusion about the presentation of cash and noncash amounts in the Statement of Cash Flows.” Information or issues (included in Description of Issue) not previously contemplated by the SAPWG: None Convergence with International Financial Reporting Standards (IFRS): IAS 7, Statement of Cash Flows (IAS 7) is very similar to GAAP guidance in ASC 230. Although a variety of differences exists, notable differences for statutory accounting review include: ASC 230 requires entities to provide a schedule reconciling net income for the period with net cash flows from operating activities if entity follows direct method to prepare the financial statement. (This is not currently required under statutory accounting.) ASC 230 provides explicit instructions on how to report interest and dividends paid/received as operating or financing activities. ASC 230 requires non-cash investing and financing activities to be reported in a separate schedule which can either be appended to statement of cash flows or included in the notes to the © 2014 National Association of Insurance Commissioners 2 Ref# 2014-23 financial statements. (This is what is duplicated within statutory accounting.) IAS 7 has no such requirements regarding a specific schedule summarizing noncash transactions. Recommended Conclusion or Future Action on Issue: In order to ensure consistent completion of the cash flow statement, staff recommends that this agenda item be moved to the nonsubstantive active listing, with an exposure of the intent to clarify the guidance in SSAP No. 69 and/or the Annual Statement Instructions. Explicit revisions have not been proposed, as staff would first like to receive comments from regulators and interested parties on what they would prefer to have reflected and what is currently reflected in Cash Flow Statements. Depending on whether revisions are supported (and the extent of such revisions), staff suggests that consideration also occur on whether the GAAP guidance should be reflected as “adopted with modification” for statutory accounting. As there are elements of the statutory guidance that mirror GAAP, identifying the areas that are adopted, and those sections that are modified, or excluded from the adoption, may assist in understanding how the statutory accounting is intended to deviate from U.S. GAAP. The following bullets have been identified as elements in which information is requested from both regulators and reporting entities. Any additional information regarding the current guidance and/or the process to complete the cash flow statement is also welcome. Preference for inclusion/exclusion of non-cash operating items in the cash flow statement. Current practice of inclusion/exclusion of non-cash operating items. Preference for mirroring GAAP on cash flow scope (cash & cash equivalents), or preference for existing SAP (cash, cash equivalents & short-term investments). Identification of whether reporting entities follow the annual statement worksheets for completing the cash flow statement, or whether the results of these worksheets are routinely adjusted to reflect the scope of the SSAP (e.g., removal of non-cash items). Comments regarding whether a reconciliation of net income to cash (similar to what is completed under GAAP) would provide beneficial information. Recommending Party: Julie Gann – July 2014 Status: On August 16, 2014, the Statutory Accounting Principles (E) Working Group moved this item to the substantive active listing and exposed this agenda item requesting information on the cash and non-cash transactions currently reflected in cash flow statements and preferences on what should be included. The Working Group also directed NAIC staff to conduct a confidential state survey to collect regulator responses on the use of this statement. On November 16, 2014, the Statutory Accounting Principles (E) Working Group directed NAIC staff to draft revisions to clarify that items included in the cash flow statement should be limited to those that involve cash (as defined in SSAP No. 69), expand the SSAP No. 69 disclosure to include non-cash operating items, and send a referral to the Blanks (E) Working Group to incorporate instructions to the Cash Flow Worksheets to clarify the adjustments needed to remove non-cash items. On December 10, 2014, the Statutory Accounting Principles (E) Working Group voted, via e-vote, to move this item from the substantive active listing to the nonsubstantive active listing (as the proposed revisions only clarify guidance), and exposed revisions to SSAP No. 69 and the Annual Statement Instructions in accordance with the direction from the 2014 Fall National Meeting (Nov. 16, 2014). Proposed Revisions to SSAP No. 69 from Nov. 16, 2014 Recommendation: 1. This statement establishes statutory accounting principles for the Statement of Cash Flow. © 2014 National Association of Insurance Commissioners 3 Ref# 2014-23 SUMMARY CONCLUSION 2. For purposes of the Statement of Cash Flow, cash shall include cash, cash equivalents and short-term investments. The Statement of Cash Flow shall be prepared using the direct method and shall only include transactions involving cash. Cash from operations shall be reported consistent with the Statement of Income, excluding the effect of current and prior year accruals. Worksheets to facilitate completion of the Cash Flow Statement, which necessitate adjustments for reporting-entity specific insurance operations and for non-cash transactions, are provided in the Annual Statement Instructions. Disclosures 3. The financial statements shall disclose the following: 4. a. Transactions considered to be operating, investing and financing activities (consistent with the classifications in the Annual Statement) that affect recognized assets or liabilities but do not result in cash receipts or cash payments in the period (in narrative or schedule form); and b. The cash and noncash aspects of the above transactions identified as operating, investing or financing consistent with the classifications provided by the Annual Statement Instructions. Examples of noncash operating, investing and financing transactions include: i. Receiving non-cash financial assets from parent as a capital contribution. ii. Settling reinsurance transactions with exchange of non-cash financial assets. iii. Converting debt to equity; iv. Acquiring assets by assuming directly related liabilities, such as purchasing a building by incurring a mortgage to the seller; and v. Exchanging noncash assets or liabilities for other noncash assets or liabilities. Refer to the preamble for further discussion regarding disclosure requirements. Relevant Literature 5. This statement adopts FASB Emerging Issues Task Force Issue No. 95-13, Classification of Debt Issue Costs in the Statement of Cash Flows which requires that cash payments for debt issue costs shall be classified as a financing activity in the Statement of Cash Flow. This statement adopts with modification ASU 2012-05, Not-For-Profit Entities: Classification of the Sale Proceeds of Donated Financial Assets in the Statement of Cash Flows for all reporting entities. Donated assets with donorrestrictions as to the sale or use of the contributed financial assets, or cash receipts from the sale of donated assets that are restricted as to use are not considered available to meet policyholder obligations and are nonadmitted in accordance with SSAP No. 4—Assets and Nonadmitted Assets. 6. FASB Statement No. 95, Statement of Cash Flows, FASB Statement No. 102, Statement of Cash Flows—Exemption of Certain Enterprises and Classification of Cash Flows from Certain Securities Acquired for Resale, an amendment of FASB Statement No. 95, and FASB Statement No. 104, Statement of Cash Flows—Net Reporting of Certain Cash Receipts and Cash Payments and Classification of Cash Flows from Hedging Transactions, an amendment of FASB Statement No. 95, are rejected in this statement. Effective Date and Transition 7. This statement is effective for years beginning January 1, 2001. A change resulting from the adoption of this statement shall be accounted for as a change in accounting principle in accordance with SSAP No. 3—Accounting Changes and Corrections of Errors. In _(month/year –TBD)_, revisions were © 2014 National Association of Insurance Commissioners 4 Ref# 2014-23 incorporated to clarify that only transactions involving cash shall be included in the cash flow statement and to expand the disclosure to include non-cash operating transactions. Proposed Revisions to Annual Statement Instructions from Nov. 16, 2014 Recommendation: CASH FLOW The statement of cash flow is prepared using the direct method consistent with the Summary of Operations, excluding the effect of current and prior year accruals. All revenue, expenditures, purchases and sale transactions involving cash should be entered gross. Pursuant to SSAP No. 69—Statement of Cash Flow, for purposes of the cash flow statement, cash is defined to include cash, cash equivalents and short-term investments. Refer to SSAP No. 69 for accounting guidance regarding the disclosure of non-cash operating, investing and financing transactions. The following worksheets are provided to facilitate completion of the Cash Flow Statement. The format reflects common reporting practices. Reporting entities may need to make adjustments to various lines consistent with their operations. For example, changes in the asset for foreign exchange rates is typically associated with the investment portfolio and shown as an adjustment to investment income. Alternatively, the adjustment could be made to insurance operations if appropriate. The Worksheets exclude certain non-cash activities, (e.g., change in nonadmitted assets and change in AVR for Life and Fraternal companies), since the offset is to surplus and has no affect on cash, but adjustments are needed to remove other non-cash transactions. While the Worksheets do not take into account the cumulative effect of changes in accounting principles, the appropriate lines of the Cash Flow need to be adjusted for this change. Note that the Worksheets are designed to take into account all lines of the Assets and Liabilities, Surplus and Other Funds pages as well as the Summary of Operations. Cash from Operations Worksheet Ref. # Premiums Collected Net of Reinsurance 1.1 Summary of Operations (Page 4) Lines 1 + 2 – 25, current year ______________ 1.2 Assets (Page 2) Lines 15 + 16.2 (In part for amount related to earned premiums) + 16.3 (In part for experience rating and other amounts related to earned premiums), Column 1, current year less previous year ______________ 1.3 Liabilities (Page 3) Lines 8 + 9.2, current year less previous year ______________ 1.4 __________________________________________________________________________ ______________ 1.5 Total of 1.1 – 1.2 + 1.3 + 1.4 ______________ (Report on Line 1 of the Cash Flow) Net Investment Income 2.1 Summary of Operations (Page 4) Line 3, current year ______________ 2.2 Assets (Page 2) Lines 14 + 22, Column 1, current year less previous year ______________ 2.3 Liabilities (Page 3) Lines 12 (In part for investment related expenses) + 16 + 20, current year less previous year ______________ Amortization of premium from Investment Worksheet ______________ 2.4 © 2014 National Association of Insurance Commissioners 5 B8 + S8 + M9 + O9 Ref# 2014-23 2.5 Accrual of discount from Investment Worksheet B9 + S9 + M5 + O5 2.6 Depreciation expense (included in 2.1) ______________ 2.7 __________________________________________________________________________ ______________ 2.8 Total of 2.1 – 2.2 + 2.3 + 2.4 – 2.5 + 2.6 + 2.7 ______________ (Report on Line 2 of the Cash Flow) ______________ Miscellaneous Income 3.1 Summary of Operations (Page 4) Lines 5 + 6 + 8, current year ______________ 3.2 Assets (Page 2) Lines 16.2 (In part for all amounts not reported in Line 1.2 above) + 16.3, (In part for all amounts not reported in Line 1.2 above or Line 7.2 below) Column 1, current year less previous year ______________ 3.3 __________________________________________________________________________ ______________ 3.4 Total of 3.1 – 3.2 + 3.3 ______________ (Report on Line 3 of the Cash Flow) Benefit and Loss Related Payments 5.1 Summary of Operations (Page 4) Lines 20 – 43 – 7, current year ______________ 5.2 Assets (Page 2) Line 16.1, Column 1, current year less previous year ______________ 5.3 Liabilities (Page 3) Lines 1 + 2 + 4 + 6.3 + 9.1 + 9.3, current year less previous year ______________ 5.4 __________________________________________________________________________ ______________ 5.5 Total of 5.1 + 5.2 – 5.3 + 5.4 ______________ (Report on Line 5 of the Cash Flow) Net Transfers to Separate Accounts, Segregated Accounts and Protected Cell Accounts 6.1 Summary of Operations (Page 4) Line 26, current year ______________ 6.2 Liabilities (Page 3) Line 13, current year less previous year ______________ 6.3 __________________________________________________________________________ ______________ 6.4 Total of 6.1 – 6.2 + 6.3 ______________ (Report on Line 6 of the Cash Flow) © 2014 National Association of Insurance Commissioners 6 Ref# 2014-23 Commissions, Expenses Paid and Aggregate Write-ins for Deductions 7.1 Summary of Operations (Page 4) Lines 21 + 22 + 23 + 24 + 27, current year ______________ 7.2 Assets (Page 2) Lines 16.3 (In part for commissions and expense allowance due) + 17 + 19, Column 1, current year less previous year ______________ Liabilities (Page 3) Lines 10 + 11 + 12 (In part for amount not included in Lines 2.3 above; i.e., non-investment expenses) + 14 + 24.06, current year less previous year ______________ 7.4 Depreciation expense (included in 7.1) ______________ 7.5 __________________________________________________________________________ ______________ 7.6 Total of 7.1 + 7.2 – 7.3 – 7.4 + 7.5 ______________ 7.3 (Report on Line 7 of the Cash Flow) Dividends Paid to Policyholders 8.1 Summary of Operations (Page 4) Line 30, current year ______________ 8.2 Liabilities (Page 3) Lines 5 + 6.1 + 6.2 + 7, current year less previous year ______________ 8.3 __________________________________________________________________________ ______________ 8.4 Total of 8.1 – 8.2 + 8.3 ______________ (Report on Line 8 of the Cash Flow) Federal and Foreign Income Taxes Paid (Recovered) 9.1 Summary of Operations and Capital and Surplus Account (Page 4) Line 32 + 40 + tax amount included in Lines 34, 38 and 39, current year ______________ 9.2 Assets (Page 2) Lines 18.1 + 18.2, Column 1, current year less previous year ______________ 9.3 Liabilities (Page 3) Lines 15.1 + 15.2, current year less previous year ______________ 9.4 Total of 9.1 + 9.2 – 9.3 ______________ (Report on Line 9 of the Cash Flow) Cash from Investments Worksheet The following section provides a reconciliation of investment activity. Although non-cash items are included for reconciliation purposes, the Statement of Cash Flow shall only include transactions involving cash. In addition to excluding the lines that are explicitly non-cash items (e.g., change in admitted assets) from what is reported in the Statement of Cash Flow, adjustments are necessary to remove non-cash acquisitions or disposals. Cash proceeds from investments sold, matured or repaid shall be included in line 12. Cash remitted for acquired long-term investments is included in line 13. Bonds B1 Change in net admitted asset value for Bonds (Page 2) Column 3 current less previous year © 2014 National Association of Insurance Commissioners 7 ______________ Ref# 2014-23 B2 Change in assets nonadmitted for Bonds (Page 2) Column 2 current less previous year B3 Sum of B1 + B2 B4 Cost of Acquired Line 2 B5 Line 4 Line 8 Line 9 Schedule D-Verification Between Years, In part (Report on Line 12.1 of Cash Flow) Schedule D-Verification Between Years, In part ______________ Schedule D-Verification Between Years, In part ______________ Other amount increases/(decreases) Include non-cash items not already included in B4 through B9 B11 ______________ Accrual of Discount Line 3 B10 Schedule D-Verification Between Years, In part for cash disposal of bonds ______________ Amortization of Premium Line 7 B9 Unrealized Valuation Increase (Decrease), In part Total Foreign Exchange Change in Book/Adjusted Carrying Value, In part Current Year’s Other-Than-Temporary Impairment, In part ______________ Consideration on Disposals Line 6 B8 Schedule D-Verification Between Years, In part for cash acquisition of bonds (Report on Line 13.1 of Cash Flow) ______________ Total Gain (Loss) on Disposals Line 5 B7 ______________ Calculate from Schedule D-Verification Between Years Plus Minus B6 ______________ Total of B4 + B5 + B6 – B7 – B8 + B9 + B10 B3 – B11 (If difference is not = 0, identify differences and add to amount(s) in the appropriate line(s) or in B10) © 2014 National Association of Insurance Commissioners 8 ______________ ______________ 0 Ref# 2014-23 Stocks S1 Change in net admitted asset value for Stocks (Page 2) Column 3 current less previous year S2 Change in assets nonadmitted for Stocks (Page 2) Column 2 current less previous year S3 Sum of S1 + S2 S4 Cost of Acquired Line 2 S5 S6 Plus Line 4 Line 8 Minus Line 9 Unrealized Valuation Increase (Decrease), In part Total Foreign Exchange Change in Book/Adjusted Carrying Value, In part Current Year’s Other-Than-Temporary Impairment, In part Schedule D-Verification Between Years, In part for cash disposal of stocks ______________ Schedule D-Verification Between Years, In part (Report on Line 12.2 of Cash Flow) ______________ Schedule D-Verification Between Years, In part ______________ Schedule D-Verification Between Years, In part ______________ Accrual of Discount Other amount increases/(decreases) Include non-cash items not already included in S4 through S9 S11 ______________ Amortization of Premium Line 3 S10 Schedule D-Verification Between Years, In part for cash acquisition of stocks (Report on Line 13.2 of Cash Flow) ______________ Consideration on Disposals Line 7 S9 ______________ Total Gain (Loss) on Disposals Line 6 S8 ______________ Calculate from Schedule D-Verification Between Years Line 5 S7 ______________ Total of S4 + S5 + S6 – S7 – S8 + S9 + S10 S3 – S11 (If difference is not = 0, identify differences and add to amount(s) in the appropriate line(s) or in S10) © 2014 National Association of Insurance Commissioners 9 ______________ ______________ 0 Ref# 2014-23 Reconciliation of Bonds and Stocks to Schedule D – Verification Between Years Line 2, Cost of Bonds and Stocks acquired = B4 + S4 ______________ Line 4, Unrealized Valuation Increase (Decrease) + Line 8, Total Foreign Exchange Change in Book/Adjusted Carrying Value – Line 9, Current Year’s Other-ThanTemporary Impairment = B5 + S5 ______________ Line 5, Total Gains (Losses) = B6 + S6 ______________ Line 6, Consideration for Bonds and Stocks and Stock Disposed = B7 + S7 ______________ Mortgage Loans M1 Change in net admitted asset value for Mortgages (Page 2, Column 3, current year less previous year) ______________ M2 Change in assets nonadmitted for Mortgages (Page 2, Column 2, current year less previous year) ______________ M3 Total of M1 + M2 ______________ Schedule B – Verification Between Years M4 Line 2 Cost of Acquired In part for cash acquisitions M5 Line 4 Accrual of Discount M6 (Report on Line 13.3 of Cash Flow) ______________ Plus Minus Line 5 Line 9 Line 10 M7 Line 6 Total Gain (Loss) on Disposals M8 Line 7 Amount Received on Disposals In part for cash disposals M9 Line 8 Amortization of Premium and Mortgage Interest Points and Commitment Fees M10 Unrealized Valuation Increase (Decrease) Total Foreign Exchange Change in Book/Adjusted Carrying Value Current Year’s Other-Than-Temporary Impairment ______________ ______________ (Report on Line 12.3 of Cash Flow) ______ ______________ Other amounts increases (decreases) Include non-cash items not already included in M4 through M9 M11 ______________ Total of M4 + M5 + M6 + M7 – M8 – M9 + M10 M3 – M11 (If difference is not = 0, identify difference and add to amount(s) in the appropriate line(s) or in M10) ______________ ______________ 0 Real Estate R1 R2 Change in net admitted asset value for Real Estate (Page 2, Column 3, current year less previous year) ______________ Change in assets nonadmitted for Real Estate (Page 2, Column 2, current year less previous year) ______________ © 2014 National Association of Insurance Commissioners 10 Ref# 2014-23 R3 Total of R1 + R2 ______________ Schedule A – Verification Between Years R4 Minus Minus Line 6 Line 7 Line 8 Total Foreign Exchange Change in Book/Adjusted Carrying Value Current Year’s Other-Than-Temporary Impairment Current Year’s Depreciation ______________ Plus Plus Line 2.1 Line 2.2 Line 3 Cost of Acquired In part for cash acquisitions Cost of Additional Investments Made In part for cash investments Current Year Change in Encumbrances In part for cash changes ______________ R5 (Report the sum of Lines 2.1, 2.2 and 3 on Line 13.4 of Cash Flow) R6 Line 4 Total Gain (Loss) on Disposals ______________ R7 Line 5 Amounts Received on Disposals In part for cash disposals R8 Other amounts increases (decreases) (Report on Line 12.4 of Cash Flow) ______ Include non-cash items not already included in R4 through R7 R9 ______________ Total of R4 + R5 + R6 – R7 + R8 R3 – R9 ______________ (If difference is not = 0, identify differences and add to amount(s) in the appropriate line(s) or in R8) 0 Other Invested Assets O1 Change in net admitted asset value for Other Invested Assets (Page 2) Column 3 current less previous year O2 ______________ Change in assets nonadmitted for Other Invested Assets (Page 2) Column 2 current less previous year O3 ______________ Total of O1 + O2 ______________ Schedule BA – Verification Between Years O4 Line 2 Cost of Acquisition In part for cash acquisitions O5 Line 4 Accrual of Discount ______________ Plus Minus Line 5 Line 9 Line 10 ______________ O7 Line 6 Total Gain (Loss) on Disposals O8 Line 7 Amount Received on Disposals In part for cash disposals O9 Line 8 Amortization of Premium and Depreciation O6 O10 (Report on Line 13.5 of Cash Flow) ______________ Unrealized Valuation Increase (Decrease) Total Foreign Exchange Change in Book/Adjusted Carrying Value Current Year’s Other-Than-Temporary Impairment ______________ (Report on Line 12.5 of Cash Flow) ______ ______________ Other amounts increases (decreases) Include non-cash items not already included in O4 through O9 © 2014 National Association of Insurance Commissioners 11 ______________ Ref# 2014-23 O11 Total of O4 + O5 + O6 + O7 – O8 – O9 + O10 O3 – O11 ______________ (If difference is not = 0, identify differences and add to amount(s) in the appropriate line(s) or in O10) 0 Contract Loans and Premium Notes P1 Change in net admitted asset value for Contract Loans and Premium Notes (Page 2) Column 3 current less previous year P2 ______________ Change in assets nonadmitted for Contract Loans and Premium Notes (Page 2) Column 2 current less previous year ______________ P3 Total of P1 + P2 ______________ P4 Increase (Decrease) by Adjustment ______________ P5 Net Increase (Decrease) in Amount Paid and Received P6 Realized Gain (Loss) P7 Other amount increases (decreases) (Report on Line 14 of Cash Flow) ______________ ______________ Include non-cash items not already included in P4 through P6 P8 Total of P4 + P5 + P6 + P7 P3 – P8 ______________ ______________ (If difference is not = 0, identify differences and add to amount(s) in the appropriate line(s) or in P7) 0 Derivatives, Securities Lending Reinvested Collateral and Aggregate Write-ins for Invested Assets W1 Change in net admitted asset value for Derivatives, Securities Lending Reinvested Collateral and Aggregate Write-ins for Invested Assets (Page 2) Plus Plus W2 Column 3 Column 3 Column 3 Line 7 Line 10 Line 11 current year less previous year current year less previous year current year less previous year ______________ Change in assets nonadmitted for Derivatives, Securities Lending Reinvested Collateral and Aggregate Write-ins for Invested Assets (Page 2) Plus Plus Column 2 Column 2 Column 2 Line 7 Line 10 Line 11 current year less previous year current year less previous year current year less previous year ______________ W3 Total of W1 + W2 ______________ W4 Increase (Decrease) by Adjustment ______________ W5 Net Increase (Decrease) in Amounts Paid and Received (Report as cash from investments misc. on Line 12.7 if amount is a decrease and Line 13.6 if amount is an increase ______________ Realized Gain (Loss) ______________ W6 © 2014 National Association of Insurance Commissioners 12 Ref# 2014-23 W7 Other amounts increases (decreases) Include non-cash items not already included in W4 through W6 W8 Total of W4 + W5 + W6 + W7 W3 – W8 (If difference is not = 0, identify differences and add to amount(s) in the appropriate line(s) or in W7) ______________ ______________ 0 Receivable (Payable) for Securities X1 Change in net admitted asset value for Receivable for Securities (Page 2, Column 3, current year less previous year) X2 ______________ Change in assets nonadmitted for Receivable for Securities (Page 2, Column 2, current year less previous year) ______________ X3 Net change in Payable for Securities (Page 3, Column 1 less Column 2) ______________ X4 Total of X1 + X2 – X3 (Report absolute value as cash from investments misc. on Line 12.7 if amount is a decrease and Line 13.6 if amount is an increase) ______________ Reconcile Change in IMR Liability (Life and Fraternal Companies Only) 1 Change in IMR liability (Page 3, Line 9.4, current year less previous year) ______________ 2 Current period amounts transferred to IMR (primarily from Form for Calculating IMR, Line 2) ______________ 3 Current period amounts recognized in income (Summary of Operations, Page 4, Line 4) ______________ 4 Other amount increases (decreases) ______________ 5 Total of 2 – 3 + 4 ______________ 6 1–5 (If difference is not = 0, identify differences and add to amount(s) in the appropriate line(s) or in Line 4) 0 Reconcile Change in AVR liability (Life and Fraternal companies only) 1 Change in AVR liability (Page 3, Line 24.01, current year less previous year) ______________ 2 Current period amounts transferred to AVR (Page 4, Line 44) ______________ 3 Other amount increases (decreases) ______________ 4 Total of 2 + 3 ______________ 5 1–4 (If difference is not = 0, identify differences and add to amount(s) in the appropriate line(s) or in Line 3) Reconcile Unrealized Capital Gains (Losses) © 2014 National Association of Insurance Commissioners 13 0 Ref# 2014-23 1 2 Capital and Surplus Account (Page 4) Line 38 (In part excluding tax) + 39 (In part excluding tax), current year Increase (Decrease) by Adjustment from Investment Worksheet (Ref. # B5 + S5 + M6 + R4 + O6 + P4 + W4) 3 5 ______________ Increase (Decrease) on Cash, Cash Equivalents and Short-term Investments (Report on Line 12.6 of Cash Flow) 4 ______________ Depreciation (included in Line 2 and reported on Line 2.6 of Cash from Operations Worksheet) ______________ ______________ Total of 1 – 2 – 3 –4 (Amount should = 0, if not = 0 balance should be reported as cash from investments misc. on Line 12.7 if amount is an increase and Line 13.6 if amount is a decrease) 0 Reconcile Realized Capital Gains (Losses) 1 2 Summary of Operations (Page 4) Line 34, current year before transfer to IMR and before taxes Realized Gain (Loss) from Investment Worksheet (Ref. # B6 + S6 + M7 + R6 + O7 + P6 + W6) 3 ______________ Gain (Loss) on Cash, Cash Equivalents and Short-term Investments (Report on Line 12.6 of Cash Flow) 4 ______________ ______________ Total of 1 – 2 – 3 (Amount should = 0, if not = 0 balance should be reported as cash from investments misc. on Line 12.7 if amount is an increase and Line 13.6 if amount is a decrease) 0 Cash from Financing Worksheet These lines calculate Line 16 of the Cash Flow. Cash Provided (Applied): Surplus Notes and Capital Notes 1.1 Change in Surplus Notes – Liabilities, Surplus (Page 3) Line 32, current year less previous year ______________ 1.2 Change in Capital Notes – Liabilities (Page 3) Line 24.11, current year less previous year ______________ © 2014 National Association of Insurance Commissioners 14 Ref# 2014-23 1.3 __________________________________________________________________________ ______________ 1.4 Total of 1.1 + 1.2 + 1.3 ______________ (Report on Line 16.1 of Cash Flow) Capital and Paid In Surplus, Less Treasury Stock 2.1 Change in Capital – Liabilities, Surplus (Page 3) Lines 29 + 30, current year less previous year ______________ 2.2 Change in Paid in Surplus – Liabilities (Page 3) Line 33, current year less previous year ______________ 2.3 Change in Treasury Stock – Liabilities, Surplus (Page 3) Line 36, current year less previous year ______________ 2.4 Transfer from Unassigned Surplus to lines included in 2.1 or 2.2 ______________ 2.5 __________________________________________________________________________ ______________ 2.6 Total of 2.1 + 2.2 – 2.3 – 2.4 + 2.5 ______________ (Report on Line 16.2 of Cash Flow) Borrowed Money 3.1 Change in Borrowed Money – Liabilities, Surplus (Page 3) Line 22, current year less previous year _____________ 3.2 __________________________________________________________________________ ______________ 3.3 Total of 3.1 + 3.2 ______________ (Report on Line 16.3 of Cash Flow) Net Deposits on Deposit-type Contracts and Other Liabilities Change in Deposit-type Contracts – Liabilities, Surplus (Page 3) Line 3, current year less previous year ______________ 4.2 __________________________________________________________________________ ______________ 4.3 Total of 4.1 + 4.2 ______________ 4.1 (Report on Line 16.4 of Cash Flow) Dividends to Stockholders 5.1 Dividends to Stockholders – Capital and Surplus Account (Page 4) Line 52 ______________ 5.2 Change in Dividends to Stockholders – Liabilities, Surplus (Page 3) Line 23 of current year less previous year ______________ Total of 5.1 – 5.2 ______________ 5.3 (Report on Line 16.5 of Cash Flow) © 2014 National Association of Insurance Commissioners 15 Ref# 2014-23 Other Cash Provided (Applied) Aggregate Write-ins for Gains (Losses) to Surplus – Capital and Surplus Account (Page 4) Lines 51.4 and 53 ______________ Change in Misc. Liabilities (Page 3) Lines 17 + 18 + 19 + 21 +24.03 to 24.05 + 24.07 + 24.08 + 24.10 + 25 + 31 + 34, current year less previous year ______________ Change in Misc. Assets – Assets (Page 2) Lines 20 + 21 + 23 + 24 (In part for amounts not included elsewhere) + 25 (In part for amounts not include elsewhere), Column 1, current year less previous year ______________ 6.4 Transfer from Unassigned Surplus to lines included in 6.2 ______________ 6.5 Depreciation (included on Line 7.4 of Cash from Operations Worksheet) ______________ 6.6 __________________________________________________________________________ ______________ 6.7 Total of 6.1 + 6.2 – 6.3 – 6.4 + 6.5 + 6.6 ______________ 6.1 6.2 6.3 (Report of Line 16.6 of Cash Flow) Reconcile Change in Liability in Reinsurance in Unauthorized and Certified Companies 1 2 3 Change in liability for Reinsurance in Unauthorized and Certified Companies – Capital and Surplus Account (Page 4) Line 42 ______________ Change in liability for Reinsurance in Unauthorized and Certified Companies – Liabilities, Surplus (Page 3) Line 24.02, current year less previous year ______________ Total of 1 + 2 (Amount should = 0, if not = 0 balance should be reported as an adjustment to the appropriate line on the Cash Flow Statement) 0 Reconcile Nonadmitted Assets 1 Capital and Surplus Account (Page 4) Line 41, current year ______________ 2 Change in nonadmitted (Page 2, Column 2 Total, current year less previous year) ______________ 3 Other adjustments ______________ 4 Total of 1 + 2 + 3 (Amount should = 0, if not = 0, balance should be reported as cash from financing on Line 16.6) 0 Reconcile Change in Accounting Capital and Surplus Account, (Page 4) Line 49, current year Allocate all amounts due to change in accounting to the appropriate section of the worksheet © 2014 National Association of Insurance Commissioners 16 ______________ Ref# 2014-23 Supplemental Disclosure of Non-cash Transactions Report the amount of non-cash operating, investing and financing transactions consistent with the classifications contained on the Assets and Liabilities, Surplus and Other Funds (all except Health) Liabilities, Capital and Surplus (Health) page of the financial statement excluding amounts associated with policy or contract loans. Refer to SSAP No. 69, Statement of Cash Flows, for accounting guidance. Examples of non-cash investing and financing transactions include: Converting debt to equity; Acquiring assets by assuming directly related liabilities, such as purchasing a building by incurring a mortgage to the seller; and Exchanging non-cash assets or liabilities for other non-cash assets or liabilities. Receiving non-cash financial assets from parent as a capital contribution. Settling reinsurance transactions with exchange of non-cash financial assets. Illustration: The Company reported the following non-cash operating, investing and financing activities in 20___: 20.0001 20.0002 20.0003 20.0004 20.0005 Real estate acquired in satisfaction of debt Bonds & stocks acquired in a business acquisition Policy reserves acquired in a business acquisition Bonds acquired from parent as a capital contribution Remitted bonds to settle assumed reinsurance obligations G:\DATA\Stat Acctg\1. Statutory\A. Maintenance\a. Form A\1. Active Form A's\14-23 - SAP Cash Flow - 2.doc © 2014 National Association of Insurance Commissioners 17 Current Year XXX XXX XXX XXX XXX Prior Year XXX XXX XXX XXX XXX