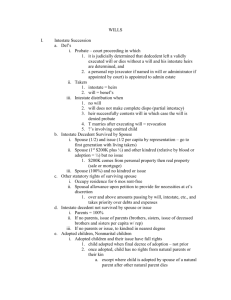

Wills-Mini-Review

WILLS MINI REVIEW P a g e | 1

EXECUTION

I.

REQUIREMENTS: 1) 18 + 2) writing + 3) signed + 4) testamentary intent + 5) T signs in presence of 2 witnesses + 6) W’s know it’s a will + 7) sign at T’s request – At the end (subscribe), at T’s request, and in T’s presence

Writing Holographic wills (all handwritten) given NO special tx – but if meet all requirements then valid

Exception: Oral Wills for Personal Property Up to $500 – if spoken in imminent peril of death; 2 disinterested Ws; T dies from imminent peril; 1W reduces to writing w/in 30 days AND; offered to probate w/in 6 months of T’s death

T’s Signature Any mark T INTENDS to be his signature satisfies the requirement – ANYWHERE on will – Can be by another person SO LONG AS at T’s direction + in T’s presence

Testamentary Intent Did T intend it to be will at TIME T SIGNED IT

Presence 2 tests

Scope of Vision Test In presence if parties COULD SEE each other sign where they to look

“Conscious Presence” Test In presence if conscious of where each other is and what each other is doing

II.

WILL EXECUTED IN ANOTHER JX: Valid in MO IF 1) writing ; 2) validly executed in accordance w/ i) MO law OR ii) law of state where executed (regardless of T’s domicile) OR iii) law of state where T domiciled at time of execution OR at time of death

III.

INTERESTED WITNESS: Fact that will makes gift to attesting W NEVER affects validity – interested W will LOSE gift UNLESS 1) 2 other disinterested Ws; or 2) W is an heir and they get lesser of either gift under will or intestate share

IV.

ADMITTING TO PROBATE: Basic idea – must prove that it is the last will

Traditional Way Oath of both attesting Ws before court – if unavailable/incompetent proof of W’s signature sufficient

Self Proved Wills At time will signed, T and Ws sign a self-proving affidavit under oath before a notary – then will can be admitted to probate WITHOUT the testimony of either witness

REVOCATION

I.

GENERAL RULES: Person who has capacity can revoke their will at any time prior to death

Duplicates: If multiple original wills are made revocation of one revokes all other original wills as well (NOT just a copy must be an original that revoke)

Revocation of Wills & Codicil: Revocation of a will revokes all codicils thereto BUT revocation of codicil does NOT revoke the will

II.

METHODS OF REVOCATION:

Express Revocation Usually by referencing in 2 nd will expressly revoking 1 st will

Revocation by Physical Act Intent to revoke + Physical Act (burning, tearing, canceling, obliterating, ripping, cutting, mutilating, destroying (do NOT have to write “void” on it) – MUST CROSS some content of the will

Extent of Revocation: Can be whole or partial depends on INTENT

Presumptions of Revocation:

Mutilated in T’s Possession if in T’s possession from time of execution to death presumed T did mutilating w/ intent to revoke

Can’t Find in T’s Possession If last seen in T’s possession/control and can’t find after death presume T destroyed w/ intent to revoke

Revocation by Proxy: Must be done at T’s direction +

in T’s presence

Lost Wills Statute: When will is destroyed but not revoked (b/c no intent or bad proxy) will can be admitted to probate if

Prove 1)due execution by W’s testimony AND 2)Contents substantially proven by i)copy, ii)attorney testimony, iii)testimony of someone who read will

Tort Liability of Lawyer: If attorney messes up execution/revocation of will attny can be sued for negligence (only mention)

Revocation by Inconsistency Where codicil makes no reference to will, or 2 nd will doesn’t expressly revoke 1 st , and the 2 have inconsistent provisions, the LATER document CONTROLS and thereby REVOKES THE INCONSISTENCY – but to extent possible 2 should be read together

Revocation by Operation of Law

Divorce Divorce following creation of will REVOKES all provisions in favor of ex-spouse

Marriage If T marries after execution, and spouse survives, spouse takes INTESTATE SHARE of T’s estate UNLESS appears from will that it was intentional OR T provided for spouse by transfers outside will

Omitted Child Child born/adopted after will executed gets INTESTATE SHARE UNLESS 1) appears from will it was intentional , 2) T had other kids at time of execution and gave substantially all of estate to other parent of omitted child OR

3) Provided for child by transfers outside will

III.

CHANGES TO WILLS & REVIVAL OF REVOKED WILLS

Change to Will After Execution : An interlineation, addition, or alteration to will made AFTER execution is INEFFECTIVE UNLESS

1) T re-executes the will (sign, Ws, etc) OR 2) T republishes will by codicil

Dependent Relative Revocation: REVOCATION can be disregarded IF it was based on, induced by, or premised on mistake of law or fact IF court satisfied that BUT FOR the mistake, T never would have made the revocation

TRICK : IF the 2 nd gift is SMALLER in amt than original, discuss DRR but don’t allow it Beneficiary gets nothing

Issue: Usually when make an interlineation and sign it thinking that will be sufficient to change the will

Will Revival: Will 1 comes back ONLY IF 1) Will 1 still exists; 2) T intended Will1 to be effective (look at reasons revoked W1 and

W2 and see which would prefer) AND 3) Will2 revoked by physical act – NOT automatic

Issue: Will 1, expressly revoked by Will2. T changes mind and revokes Will2 thinking Will1 will be effective

WILLS MINI REVIEW P a g e | 2

COMPONENTS OF A WILL

I.

INTEGRATION: What was present at time will executed and thus constitutes will?

Rule: Proponent must show 1) PRESENT when will executed AND 2) INTENDED by T to be part of will

Presumption: both elements presumed when 1)there is physical connection b/w pages (staple etc) internal coherence from provisions running from one page to the next

II.

CODICIL: Must be executed w/ same FORMALITIES as a will – a will is treated as having been executed on the date of the last validly executed codicil thereto (Doctrine of Republication)

III.

INCORPORATION BY REFERENCE

Rule: An extrinsic document (not present at execution) can be incorporated so part of will IF 1) document is IN EXISTENCE at time will executed 2) REFERENCE TO in the will as being in existence 3) CLEARLY IDENTIFIABLE from the will AND 4)INTENT to incorporate the document is shown

Exception: List Disposing of Tangible Personal Property – A will can refer to a statement/list disposing of TANGIBLE PERSONAL property (other than money, or property used in business) not specifically disposed of in the will

Requirements: 1) Dated 2) EITHER signed OR in T’s handwriting AND 3) describe the property w/ reasonable certainty

Existence/Alteration: Can be written before OR after will executed and CAN be ALTERED AT ANY TIME

IV.

ACTS OF INDEPENDENT SIGNIFICANCE: A will may dispose of property by reference to acts and events that have significance apart from their effect on the disposition made by the will

TEST: Valid IF act has SOME LIFTIME SIGNIFICANCE other than providing for testamentary gift

LAPSE,ADEMPTION, AND EXONERATION OF LIENS – MOST TESTED WILLS ISSUE

I.

LAPSE: MOST TESTED

Lapse Generally: IF a will beneficiary dies BEFORE or w/in 120 HOURS of T’s death, a gift to him lapses/fails residuary

Anti-Lapse Statute: Absent contrary will provision, statute saves gift IF 1) Predeceasing beneficiary was a RELATIVE of T (by blood not by marriage) AND 2) LEFT DESCENDANTS who survive T (beneficiaries will take by substitution) – does NOT apply to gifts made w/ survivorship clauses

Class Gifts: If 1 member of class gift predeceases, the gift does NOT lapse and other class members who survive take share

Anti-Lapse Class gift rule gives way to anti-lapse when class member was w/in scope (family) and leaves descendants who survive T by 120 hours

Residuary: If residue devised to 2 or more persons and 1 fails for any reason, absent contrary will provision the SURVIVING residuary TAKES ENTIRE RESIDUARY in proportion to their interests in residuary

Anti Lapse Anti-lapse takes precedence so if residuary was to family who left descendants they take the share

II.

ABATEMENT: If T’s estate is not enough to pay for all expenses and gifts pay CREDITORS FIRST then abate in following order

1.

Intestate Property

2.

Residuary Devises

3.

General Legacies gift of money w/ no source specified

4.

Demonstrative Legacies money w/ source

5.

Specific Devises gifts of things

Pretermitted Spouse/Child: Abatement rules APPLY to raise money to fund the share of a pretermitted spouse/child

Taxes Exemption: Money to pay TAXES is raised by pro rata contribution of all beneficiaries (don’t use abatement)

III.

ADEMPTION: When SPECIFICALLY bequeathed property is NOT owned by T at death, the bequest is adeemed and fails (only specific bequests – not general or demonstrative legacies) – may be adeemed in whole or in part

Sale by Guardian or Conservator: Ademption does NOT apply specific devisee entitled to a general legacy equal to the amt of the sale proceeds that were not expended in T’s care

Insurance Proceeds: Gift is STILL ADEEMED – NOT ENTITLED to insurance proceeds from specific bequest being destroyed

Stocks/Securities:

Specific a gift of stock is specific if it uses words like “my” shares and ademption APPLIES b/c indication of specific set of shares

Non-Specific gift of stock w/ no possessive words like “my” means it is NOT specific and ademption does NOT

APPLY – executor will go an buy shares needed w/ funds from estate and give to beneficiary

Increase: If additional shares cam by Stock SPLITS get original AND additional shares ; If came by dividends get

ONLY the original shares

Does NOT matter if gift is specific or not

Merger: A SPECIFIC devise of stock IS entitled to shares of another entity acquired by merger, consolidation of corp

IV.

EXONERATION OF LIENS: does beneficiary take free of any liens/mortgages on property – does estate have to pay off

After: If mortgage created AFTER T executed will, then lien/mortgage is EXONERATED and beneficiary takes free

Before: If mortgage created BEFORE T executed will, then lien/mortgage is NOT EXONERATED and benif takes subject to

WILL CONTESTS

I.

BASICS:

Standing: Any person who’s share would INCREASE were the will contest successful

Time: must be brought w/in 6 months of publication of notice of appointment

Necessary Parties & Notice: All persons interested in will’s probate or rejection (heirs and all beneficiaries) are ncesary parties and MUSt be served w/ process w/in 90 days after contest petition is FILED

ALWAYS INCLUDE THESE 3 THINGS

WILLS MINI REVIEW P a g e | 3

II.

GROUNDS FOR WILL CONTEST

Defective Execution

Valid Revocation

Lack of Capacity Did T understand 1) nature of act doing ; 2) Nature/Character of property ; 3) Natural objects of his bounty ;

4) Understand disposition wanted to make – EXTREMELY LOW STANDARD

Time: Only must have capacity at time will was executed or shortly before/after

Not Adequate: Mere old age, physical frailty, sickness, failing memory, vacillating judgment

Burden: Proponents have to make out prima facie case of capacity then burden shifts to opponents to disprove

Presumption: Presumption of incompetence arises if adjudicated incompetent at time of execution BUT presumption

NOT CONCLUSIVE – could have been written during a lucid interval

Insane Delusion Where T is otherwise sane, but will (or gift in it) was product of an insane delusion it will NOT be upheld

Insane Delusion – NO BASIS in fact or reason that T adheres to against all reason and evidence

Undue Influence 1) Exertion of influence + 2) Effect to overcome the mind/will of T + 3) Will wouldn’t have been executed this way BUT FOR THE INFLUENCE

Burden: On will contestants to show undue influence

Insufficient: by themselves 1) mere opportunity to exert influence ; 2) mere susceptibility to influence due to age, illness ; 3) mere “unnatural disposition”

Extent: Can be shown as to entire will or only part of will

Suspicious Circumstances: MAY also tend to show undue influence

Mistakes/Ambiguities

Plain Meaning Rule: If the language in the will is unambiguous, evidence is NOT admissible to show that the T made a mistake in describing a beneficiary or the property that was to be subject of the gift

Ambiguities:

Latent Clear on face but misdescription when applied to facts – extrinsic evidence IS admissible to cure ambiguity, INCLUDING T’s declarations of intent

Patent Uncertainty appears on face of will – extrinsic evidence IS admissible to cure ambiguity BUT NOT T’s declarations of intent to third parties

Blanks: Courts will NOT fill in blanks in the T’s will

Fraud If execution of will or including of gift in it is result of fraud, it won’t be enforced

Elements: 1) False representations speaker KNEW to be false ; 2) Made w/ INTENT to deceive ; 3) T’s IGNORANCE of falsity ; 4) RELIANCE upon those representations induced T to act

III.

NO CONTEST CLAUSES: Upheld in MO regardless of whether there is probable cause for the contest (action to construe a will is

NOT a contest and will NOT result in forfeiture under a no-contest clause)

INTESTACY (applies to probate estate)

I.

ISSUE = Lineal Descendants (kids and grandkids)

II.

WHO TAKES

Surviving Spouse:

No Kids = spouse gets ALL

Kids who Also Kids of SS = SS gets $20,000 + ½ of balance

Kids Not all also Kids of SS = SS gets ½ of estate

NO Surviving Spouse:

Kids = ALL

If No Issue: In equal shares to Parents, Brothers, and Sisters

If NO Issue, Parents, or Siblings: In equal shares to Grandparents, Aunts, Uncles

Escheat: If there is no relative w/in the 9 th degree, AND no kindred of prior deceased spouse w/in 9 th degree ONLY THEN will it escheat to the state

III.

DISTRIBUTION: WHAT PERCENTAGE

PER CAPITA w/ RIGHT OF REPRESENTATION : All takers equally related get equal shares, if not all equally related then 1 share is given to each line of descent

If will says Per Stirpes: Then continue only with line of descent – even if equally related can get unequal shares

IV.

PROBATE ESTATE: Intestacy only applies to the probate estate

Probate Estate = What could have been controlled by a will had the decedent executed one

NOT Including: 1) Property passing by right of survivorship ; 2) Property passing by contract (life ins, EE plan death benefits);

3) POD (Payable on Death) and TOD (Transfer on Death) transfers ; 4) Property held in trust (including revocable trust);

5) Property over which decedent had power of appointment

V.

SPECIAL CASES

Stepchildren or Foster Child: A stepchild or foster child who has not been adopted has NO INHERITANCE RIGHTS from stepparent/foster parent UNLESS equitable adoption (obtained custody by agreeing to adopt and then didn’t do it)

Non-Marital Children: Has FULL inheritance rights from MOTHER and her kin

Father:

Child from Father: Child inherits from Father ONLY IF 1) participated in marriage ceremony (even if invalid) before or after birth ; 2) Man adjudicated father in paternity suit DURING lifetime ; 3) AFTER death adjudicated paternity by clear and convincing evidence

WILLS MINI REVIEW P a g e | 4

Father from Child: Father can only inherit IF 1) openly treated child as theirs AND 2) Didn’t refuse to support

½ Blood Siblings: ½ bloods get ½ shares (UNLESS all ½ bloods)

PROBLEMS FOR INTESTACY & WILLS

I.

SIMULTANEOUS DEATH ACT: Person MUST survive decedent by 120 hours (5 days) or treated as predeceased

Does NOT Apply to: 1) Survivorship Clauses ; 2) Explicit Contrary Will Provision ; 3) Right of Survivorship

DOES apply to: 1) Insurance proceeds

II.

DISCLAIMERS: Heir/beneficiary can disclaim (turn down) bequest IF done 1) in WRIITNG 2) IDENTIFY property being disclaimed

3) BEFORE acceptance AND 4) w/in 9 months of decedent’s death – can disclaim ANY benefit including life ins proceeds, death benefits etc.

Result: Passes as if disclaimant predeceased – lapse w/ possible anti-lapse

III.

ADVANCEMENTS ON INTESTATE SHARE: lifetime gift made to heir w/ intent that gift be applied against any share inherit from donor’s INTESTATE estate

CL: ANY lifetime gift to child or descendent PRESUMED to be advancement

MO: NOT an advancement UNLESS 1) writing by declarant OR 2) acknowledged in writing by heir

Hochpot Method:

Intestate estate + Adavancement = Hochpot

Divide Hochpot among heirs

Person who got advancement subtract out amt of advancement from their share – if value exceeds your share you do NOT have to pay money

IV.

SATISFACTION OF GIFT IN A WILL: Lifetime gift is NOT a prepayment of any interest under a will UNLESS 1) Will provides for it ;

2) T declares in contemporaneous writing ; OR 3) Devisee acknowledges in writing

V.

PRETERMITTED CHILDREN: Child born or adopted AFTER execution of will (remember republication w/ codicil)

Rule: Entitled to INTESTATE SHARE UNLESS 1) will shows it was intentional ; 2) T had other children at execution + left substantially all estate to parent of pretermitted child ; OR 3) Provided for by transfer outside of will + Intent (shown by T’s declarations, amt of transfer, or other evidence)

VI.

CHILDREN THOUGHT TO BE DEAD

CL: No relief UNLESS both mistake + what would have been done but for mistake appeared in terms of will

MO: If at time of execution of will, T fails to provide for child solely b/c believes child is dead, child receives their INTESTATE share

VII.

CONDUCT BARRING PARTY FROM SHARING IN ESTATE:

Homicide : Person who INTENTIONALLY (not recklessly or negligently) kills the decedent is NOT entitled to ANY benefit from decedent’s estate

Effect: Property passes as if predeceased

Joint Property w/ Rt of Survivorship: Killer keeps their share but does NOT get decedent’s share

Acquittal: Acquittal at criminal law is NOT controlling

Abandonment : Surviving spouse is disqualified from inheritance and elective share etc IF 1)abandoned deceased spouse w/o cause for 1 year OR 2)abandons and continues w/ an adulterer

RIGHTS OF SURVIVING SPOUSE

I.

EXEMPT PROPERTY, FAMILY ALLOWANCE & HOMESTEAD ALLOWANCE

Exempt Property: Surviving spouse (if none, unmarried minor children) are entitled to = 1 car + ALL furniture, appliances, utensils, clothes, family bible, and all other books

Family Allowance: SS or dependent children (actually being supported) are entitled to a REASONABLE ALLOWANCE in $ out of estate for MAINTENANCE OF FAMILY during administration UP TO 1 YEAR ( NOT charged against intestate share etc )

Homestead Allowance: SS, (if none unmarried minor kids) entitled to homestead allowance = ½ value of estate (excluding exempt property and family allowances) NOT to exceed $15,000 ( IS charged against property passing by intestacy etc )

II.

PRETERMITTED SPOUSE: Spouse left out b/c married wasn’t until AFTER will gets INTESTATE share UNLESS 1) intentional OR

2) other provisions outside of will + intent that transfer be in lieu of provision in the will

III.

ELECTIVE SHARE: SS of a testate decedent (does have will) IS entitled to claim an elective share of the T’s AUGMENTED ESTATE – in lieu of any property left to SS in will – Decedent MUST have been domiciled in MO at time of death

Amt: ( 1/2 if no descendants; 1/3 if had descendants) MINUS ( homestead allowance + value of lifetime transfers to SS )

Augmented Estate: Probate estate + Transfers made in fraud of marital rights + Insurance proceeds, employee benefits, or annuities TO SS (not to others) + Property held by couple w/ right of survivorship + Lifetime gifts/transfers to SS

Fraud of Marital Rights Made w/ INTENT + PURPOSE of defeating spouse’s rights

Factors: 1)T retained interest/control; 2)Size of transfer v. size of estate; 3)Extent supported by consideration;

4)How near death transfer made; 5)Did T hide transfer from SS

Procedure: MUST ELECT – NOT AUTOMATIC

Funding: ALL testamentary gifts are reduced pro rata in order to raise $ to fund – rules of abatement do NOT apply

ESTATE ADMINISTRATION

IV.

PROBATE: Proceeding at which instrument is judicially established as the last executed will

Personal Representative: Court issues “letters” to personal representative – if named in will then EXECUTOR (letters testamentary) – If NOT named then ADMINISTRATOR (letters of administration)

WILLS MINI REVIEW P a g e | 5

Can be person nominated in will; then SS; then Beneficiary best suited to serve; then 3 rd party appointed by court

Time: Will – must be offered by later of 6months of 1 st publication of letters OR 30 days after filing action to contents

No Notice: If notice of granting of letters has not previously been given, the will must be presented w/in 1 YEAR OF

DEATH

Venue: Proper in county of decedent’s domicile

Creditors Claims:

Personal Rep must publish notice of administration in legal section of newspaper (1x/week for 4 weeks)

Rule: Thereafter all claims are BARRED UNELSS they are filed w/ probate court w/in 6 MONTHS of first publication

V.

INDEPENDENT ADMINISTRATION: MO law PERMITS independent (non-court supervised) administration WHEN 1)law provides for it OR 2)all will beneficiaries or intestate heirs consent to it

Revocation: Can be revoked by improper conduct on part of administrator (when directed by will) OR when any ONE withdraws consent (if based on consent)