LIP Guidelines: Table of Contents

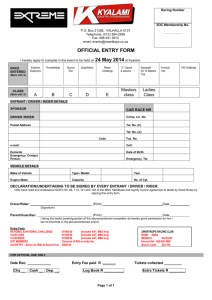

advertisement