PS2

advertisement

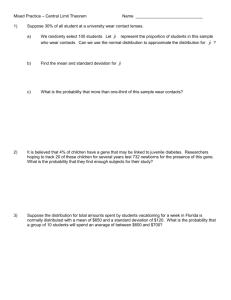

1 Problem Set 2 ECONOMETRICS Prof. Oscar Jorda Due Date: Friday, February 2 Instructions: The goal of the problem set is to understand what you are doing rather than just getting the correct result. Please show your work clearly and neatly. No credit will be given to late homework, regardless of the excuse. Please write your answers in the space provided. Analytical Problems (50 points) 1. A survey of 900 consumers reveals that annual purchases charged to credit cards averages $5,735 with a standard deviation of $513. a. Construct a 95% confidence interval for annual credit purchases. b. Mastercard wants to launch a marketing campaign consisting in upgrading some customers to a Gold card on the assumption that the average cardholder spends upwards of $6,500 per annum. Evaluate whether the marketing department’s assumption is valid by performing a test of H0 : = 6,500 against the alternative, HA : < 6,500 at the 95% confidence level. Show your work. 1 2 2. Suppose you are given a sample of 5 observations, x1 , …, x5 and you have the following two estimators for the mean: x 2 x1 2 x3 2 x5 3x 3x 4 and x 2 6 6 a. Show whether or not these estimators are unbiased (i.e. calculate E ( x ) and E ( x )) . b. Show which of these two estimators is more efficient (i.e. calculate V ( x ) and V ( x )). c. If you had to propose a competing estimator, which one would you propose and why? 3. [00 points] Average growth in the U.S. over the last 40 years has averaged 3.5% annual rate, with a standard deviation of 2%. In Argentina, the numbers are 5% average growth with a standard deviation of 5%. a. What country would you prefer to live in solely on the basis of the numbers reported here. Why? b. Assume the data is normally distributed, What is the probability that each country will hit a severe recession in any given year? Note: a severe recession is negative growth of 2% or more. 2 3 4. [00 points] A Stock market analyst wanted to test whether the rate of return of purchasing stock in a certain mutual fund exceeded the average return for the stock market as a whole. In other words, is the average excess return (mutual fund’s rate of return minus the market's average rate of return) positive or negative? We therefore want to test whether the average excess returns are zero or not. The excess rate of return was computed for 13 periods and the average was 5.1 percent with a standard deviation of 1.7 percent. Test the hypothesis at the 5% level of significance, assuming that excess returns are normally distributed. Derive a 95% confidence interval for the average excess returns. Is this mutual fund a good investment? 5. [00 points] Let X and Y represent the rates of return (in percent) on two stocks. You are told that X ~ N(15,25) and Y ~ N(8,4) and that the correlation coefficient between the two rates of return id –0.4. Suppose you want to hold the two stocks in your portfolio in equal proportion. a. What is the probability distribution of the return in your portfolio? b. Suppose you want to maximize your return. Does this portfolio accomplish that goal? c. Suppose you want to minimize your exposure (risk), What is your best strategy? 3 4 EViews Exercise (50 points) For this exercise you will need to download the excel file ``ps2.xls.'' This file contains data from the Current Population Survey of the U.S. Bureau of the Census. The following variables are contained: LNWAGE = log of wage rate of employed workers in dollars per hour SEX = 1 if the person is female, 0 otherwise ED = years of education AGE = age of employee NONWH = 1 if the person is non-Hispanic, nonwhite; 0 otherwise HISP = 1 if the person is Hispanic; 0 otherwise. There are 206 observations in the data-set.. 1. Give sample statistics for the variables in this study. Note, you should transform the variable LNWAGE into dollars per hour (call the variable WAGE) to obtain a more intuitive description. 2. Give the sample statistics of the variables WAGE, AGE and ED sub-sampled according to: SEX, NONWH, HISP respectively. Comment on the differences. 3. Calculate the correlation matrix for all the variables (leave LNWAGE as is). 4. Calculate the correlation between LNWAGE and ED for sub-samples based on SEX, NONWH, HISP. 5. Use pie charts to describe the racial composition of your data 6. In a 1 paragraph summary, comment on the wage differentials between: Males and Females; Whites and Non-Whites (note, you will need to include Hispanics into the Non-White category) and Non-Whites and Hispanics. 7. Find data for Real Fixed Private Investment in the Internet (you can use the sources listed in my web page). Load the data into Eviews and produce a graph and summary statistics. 4