Reviewer policy - Czone - East Sussex County Council

advertisement

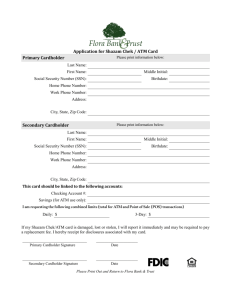

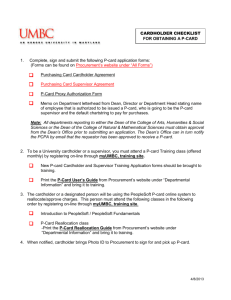

Purchasing Card Guide For Reviewing Managers Revision Record Author John Ross John Ross Chris Andrews Creation date 24 December 2009 14 April 2010 13 March 2012 Version 1.2 Status Draft Final Final Purpose This document outlines the roles and responsibilities of reviewing managers in relation to the operation of the purchasing Card Programme. Contents 1. Introduction .................................................................................... 2 2. Overview of the Purchasing Card Process .................................. 2 3. Limits .............................................................................................. 2 3.1 Monthly Credit Limit ....................................................................... 2 3.2 Transaction Limit ........................................................................... 2 4. Restricted categories..................................................................... 2 5. Transactions ................................................................................... 3 5.1 What the cards can be used for .................................................... 3 5.2 What the cards cannot be used for ............................................... 3 5.3 The Transaction .............................................................................. 3 5.4 After the Transaction...................................................................... 3 5.5 Monthly Timetable .......................................................................... 4 5.5.1 Key steps in each billing period ................................................. 4 6. Summary of Reviewing Managers’ duties and responsibilities . 5 7. Application Process ....................................................................... 5 8. Training ........................................................................................... 6 9. Job Change/Department Change.................................................. 6 10. Leaving employment.................................................................... 6 11. Action during periods of Absence, Annual leave ...................... 6 11.1 Cardholders .................................................................................. 6 11.2 Reviewing Managers on leave ..................................................... 6 12. Security ......................................................................................... 7 13. Monitoring..................................................................................... 7 14. Disciplinary code ......................................................................... 7 Associated documents ...................................................................... 8 P-card Administrator contact details ............................................... 8 1. Introduction East Sussex County Council has adopted Purchasing Cards (p-cards) as part of its procure to pay process. A p-card will be issued to members of staff who are directly involved in purchasing goods or services on behalf of ESCC. Each card is allocated its own set of agreed spend limits. In addition an online system, Smart Data On Line (SDOL), which also forms the card statement, allows cardholders, managers, and internal audit to view transactions. SDOL is also the source of data, provided by the bank, for upload into the SAP financial system. 2. Overview of the Purchasing Card Process The transaction details appear in SDOL within 24-48hrs of the cardholder making a purchase with their p-card. The cardholder must then check and reconcile their transactions. Default cost assignments are allocated, however, cardholders and managers can adjust the assignments if required. The transaction itself cannot be altered. Reviewing managers check these transactions on line once the cardholder has completed their reconciliation and provided the required documentation. The supplier will have already been paid so the manager’s role is to check the actions of the cardholder. The supplier gets paid by the Bank within 4 working days of the transaction. ESCC makes one monthly payment to our bank to cover all card transactions. 3. Limits 3.1 Monthly Credit Limit The default monthly card limit is £1000. However, this can be varied on request providing it has been signed off in the Card Application Form or via the P-card Amendment Request form. 3.2 Transaction Limit The default maximum transaction limit is set to £250. This can be varied providing it is signed off in the Card Application Form or via the P-card Amendment Request form. This limit is inclusive of any VAT, carriage charges etc. It is not permitted for cardholders to ask a supplier to “split” a transaction to make a payment above the card transaction limit. Managers must monitor this in SDOL. 4. Restricted categories All cards are automatically set with the following payment types blocked. For Help, Support and Advice Contact RBS Operations on 0870 909 3702 Page 2 of 8 Withdrawing cash Utilities Staff – Temporary Recruitment Vehicle fuel – petrol/diesel 5. Transactions The p-card and SDOL act together to make the purchasing of items as easy as possible whilst enhancing the controls, visibility, and management information available. It is intended to be used to enhance efficiencies by replacing purchases made using imprest accounts, and purchases made by staff using their own cash or credit cards. 5.1 What the cards can be used for The cards can be used to make purchases of services or products (excluding those listed below) in support of ESCC business as long as the value of the purchase is within the credit limits allocated to the card as outlined above. You should be conscious of the need to ensure value for money for the authority with all purchases. Where the service or product being purchased is available through an existing contractual arrangement (following link for details) this arrangement should be used. In all cases it is advisable that you as the reviewing manager agree the type of procurement that will take place with the cardholder before purchases are made. 5.2 What the cards cannot be used for The purchasing cards cannot be used for the withdrawal of cash purchase of personal items or services payment of personal expenses or debts personal gain – collecting store reward points etc for personal account utilities (gas, heating, heating oil, water, telecoms) Vehicle fuel (petrol, diesel) 5.3 The Transaction Cardholders are responsible for the transactions made with their card and therefore must always personally place the order. This is done in the following ways: Employee presented card Using the card on line Ordering by fax or telephone 5.4 After the Transaction Your member of staff must review all their transactions for accuracy and to adjust the VAT amount, the cost centre, and GL code, where appropriate. Once completed For Help, Support and Advice Contact RBS Operations on 0870 909 3702 Page 3 of 8 the Cardholder Reviewed box will be ticked and the cardholder will notify the reviewer that their transactions are ready for checking. Purchasing Cards deliver process efficiencies for low value purchases. To get maximum process efficiency, the bulk of the postings should be made automatically to the default cost centre (linked to the cardholder) and default GL code (linked to the merchant type used for that purchase). The process efficiencies are reduced where purchases are re-coded to very low levels of detail and small amounts of VAT are being reclaimed. The cardholder must download a statement from SDOL. This will act as the cover sheet for the filing process. The receipts and Transaction Log must be attached to the statement before being passed to you as the reviewing manager. Transactions should not be reviewed unless the documentation has been received. You then review the receipts and the transactions in SDOL and tick the Supervisor Reviewed box to indicate you agree with the transaction. Managers are responsible for the control of their budgets and the purchasing activities of their staff, and you should check that the transactions fall within ESCCs policy on p-card use. Once approved the receipts log and associated statement must be retained by you as VAT evidence. Please note that this information must be made available for inspection by departmental management, HMRC, and Internal Audit. VAT evidence must be retained for the current year and the previous three years. 5.5 Monthly Timetable The billing period for the Purchasing cards is from the 3rd day of any month to the 2nd day of the following month. Reviewing managers must ensure that all transactions are correctly coded for cost centre and VAT by the 10th day of the month. Any transactions not reviewed and approved by then will automatically be loaded into SAP and the departments will have to accept any discrepancy within their own budgets. The transactions will be loaded into SAP on or near the 11 of each month. N.B No transactions should be left with an un-reviewed status in SDOL. If you are unable to review by the 10th you must do so as soon as possible after this date to ensure compliance with P-card Policy. 5.5.1 Key steps in each billing period On 3rd of month, or nearest working day after this, the cardholder will log on to Cards Online download the latest statement and complete the reconciliation of their transactions. On completion you will be sent the statement, transaction log and receipts/goods received notes in time for you to complete your review by the 10th day of the month. In your review you should: For Help, Support and Advice Contact RBS Operations on 0870 909 3702 Page 4 of 8 ensure VAT is processed correctly1 ensure that the correct cost centre and GL code have been applied to each transaction question personal use and gain challenge maverick spend It is essential that reconciliation by the cardholder and review by the Reviewing Manager is completed by the 10th day of the month as this forms the basis of the data that will be uploaded into our SAP Financial System. 6. Summary of Reviewing Managers’ duties and responsibilities Once the cardholder has reconciled their transactions they should inform you that the transactions are ready for you to approve. Do not review and authorise the transactions before they have been reconciled by the cardholder and you have received the statement, transaction log, and receipts. Check that the transactions have been reviewed and reconciled to the correct cost centre, GL code, and that the VAT amount is correct. Once this has been done you can review the transactions. In addition Reviewing Managers should: Ensure that the card is used in accordance with the ESCC P-card policy, and to take action where necessary Ensure that the cardholder keeps up to date with transaction reconciliation. Review all transactions for compliance with P-card Policy. Report any problems that the cardholder is experiencing to the card administrator. Report any changes in the cardholder’s circumstances to the P-card Administrator that might affect their card use (such as name or job changes). Take responsibility for ensuring that card transactions are reconciled promptly within SDOL Review and reconcile transactions in the absence of the cardholder Review the cardholder’s transactions in SDOL once these have been reconciled by the cardholder. Ensure that a deputy approver is available for cover during periods of absence. Ensure that leavers are reported to the P-card Administrator and their P-card is destroyed by being cut through the magnetic strip and the chip before the cardholder leaves. 7. Application Process The line/budget manager can either nominate a member of staff to be a cardholder or they can support an application for a P-card by determining if it is appropriate for the member of staff to be issued with a P-card. They must also agree with the cardholder what the card will be used for, the financial limit for a single transaction, a monthly card limit where these are different to the default values, and who will act as 1 Refer to P-card VAT Procedure For Help, Support and Advice Contact RBS Operations on 0870 909 3702 Page 5 of 8 a reviewing manager for the transactions (See Purchasing Card Application Process). The application must be approved by the Department’s Assistant Director. Departments or units must not have a shared card. An individual is required to be responsible for their own transactions. 8. Training A pre-condition for use of the card is that the cardholder and reviewing manager must attend a training session. The course is aimed at introducing the card process, use of the card and SDOL, explaining the p-card policy and guidelines, and answering any queries which you may have. 9. Job Change/Department Change Upon notice of a job change and/or Departmental change that impacts on your member of staff who is a cardholder, advise the P-card Administrator as soon as possible. The card may need to be assigned to a new cost centre and have its limits reviewed to reflect the change of post and responsibilities. For changes to an existing card the Purchasing Card Amendment Form should be used. It is essential to ensure that you request, and are given, all existing purchasing card documentation including transaction logs, statements, and any receipts/goods received notes requiring action. 10. Leaving employment Prior to leaving the employment of East Sussex County Council the cardholder must destroy their P-card by cutting it through the magnetic strip and the chip. It is essential to ensure that you are also given all purchasing card documentation including transaction logs, statements, and any receipts/goods received notes requiring action before the leaving date. 11. Action during periods of Absence, Annual leave 11.1 Cardholders Cards may not be used whilst the holder is absent or on leave. Cardholders must ensure that their reviewing manager has all the necessary documentation to process transactions in SDOL by the due date. Remember transactions typically appear in the system within 24 – 48 hours. 11.2 Reviewing Managers on leave Reviewing managers must appoint a deputy to act on their behalf during periods of leave or absence. For Help, Support and Advice Contact RBS Operations on 0870 909 3702 Page 6 of 8 The financial impacts of not completing this process are considerable. The initial impact will be that the department will lose budget as the full cost of any unrecovered VAT will accrue to the department. 12. Security The card provided is to be used by the cardholder and should not be used by anyone else. It is the responsibility of the cardholder to ensure it is retained in a secure location A PIN is issued to cardholders and they will use this instead of signing a receipt. The PIN must not be revealed to anyone Many secure websites use password access to authenticate cardholders and passwords must remain confidential. Cardholders and reviewers will be given access to SDOL using a security password. This must not be revealed to any one. Note: It is not possible to delete transactions from SDOL, All transactions for each card are the cardholder’s responsibility. 13. Monitoring Monitoring of p-card purchasing will be carried out by the P-card Administrator and Corporate Procurement to ensure compliance with existing contractual arrangements and to determine who is not undertaking their reconciliation and review responsibilities. The cardholder and reviewing manager will initially be given support to undertake these tasks, however, repeated failure will result in the facility being removed (see disciplinary code below). Cardholders and reviewing managers accept this responsibility as part of the user agreement. 14. Disciplinary code Reviewers are responsible for ensuring that cardholders comply with the requirements of the Purchasing Card policies and initiating the disciplinary process if necessary. The following actions may result in disciplinary action being taken using the existing disciplinary processes as appropriate, and may lead to removal of the card or reviewing facility. Failure to comply with the policies, guidance notes, handbooks etc for the use of Purchasing Cards. Repeated failure to reconcile/review transactions in a timely fashion Withdrawing or attempting to withdraw cash with the cards Using the card to make private purchases For Help, Support and Advice Contact RBS Operations on 0870 909 3702 Page 7 of 8 Associated documents Purchasing Card Policy Purchasing card VAT procedures Purchasing Card Guide for cardholders Purchasing Card Application Process Purchasing Card Amendment Request Purchasing Card Transaction Log These documents, further information and the associated forms are all available in the E-Procurement section of the intranet P-card Administrator contact details Address: Pcard Admin, CRD Finance, East D, County Hall, Lewes, BN7 1UE Email: PCard.Admin@eastsussex.gov.uk For Help, Support and Advice Contact RBS Operations on 0870 909 3702 Page 8 of 8