II. Qualcomm Business Model and CDMA Cellular Technology

advertisement

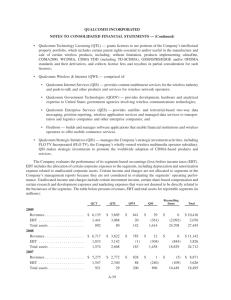

EECS 201/MBA 290C/IS 224/E298A Strategic Computing and Communications Technology QUALCOMM Challenges To Lead the Next Generation In Broadband Wireless Technology Chang, Dennis H. Sanz Merino, Ana Zubiller, Matthew Prof. David Messerschmitt Prof. Carl Shapiro October 28, 2004 TABLE OF CONTENTS I. Executive Summary II. Qualcomm Business Model and CDMA Cellular Technology III. Opportunities and Threats via Cellular Technology IV. Qualcomm Business Model and CDMA Cellular Technology Migration to 3G The Business Model Intellectual Property and the Impact of Royalties Current Direct Competition The Importance of Market-Timing Limited Impact of Network Effects Direct Competition in the Future New Entrants to CDMA/3G Markets The Impact of Non-Cellular Technology V. Economic Factors i. Economic Effects ii. Economic Drivers Economic Comparison i. Modularity ii. First Mover Advantage iii. Standardization iv. Maturity v. Installed User Base Recommendation for Future Strategy VI. Appendices VII. References VIII. Exhibits 1 I. EXECUTIVE SUMMARY This report is an evaluation of the strategic business challenges facing Qualcomm. It begins with an overview of Qualcomm’s history and its unique business model that is based primarily on selling chips and earning royalties. It includes a discussion of the evolution to the various 3G cellular technologies and Qualcomm’s involvement. The current and future threats in the cellular world are analyzed, and the complex relationships Qualcomm has with other players. Next, we analyze the upcoming threats to the existing cellular world from new broadband wireless technologies, such as WiMax. The new technologies are compared to Qualcomm’s CDMA2000 via technical and economic perspectives and using concepts from network economics. Finally, we provide some recommendations for Qualcomm’s business strategy going forward. Within the hypercompetitive telecommunications industry, we believe Qualcomm must continually innovate on their intellectual property, while at the same time capitalize on first mover advantage in their chipset business. Alternative technologies are emerging and threaten Qualcomm’s current business. However, by embracing change and developing further intellectual dominance in new standards and technologies, they will innovate against the threat, thus participating in both competitive and cooperative industries. This may seem cannibalistic, yet it forces older, weaker performing technologies more quickly into obsolescence. In the end, this drives the industry forward, while ensuring that Qualcomm’s technologies continue to meet customer demand for quality and performance – a very positive, albeit volatile impact on Qualcomm and its business model. 2 II. QUALCOMM BUSINESS MODEL AND CDMA CELLULAR TECHNOLOGY 1. Overview of CDMA and Cellular Industry To better understand Qualcomm’s business position and competitive strategy, it is useful to have a perspective of the worldwide cellular market. According to the EMC World Cellular Database June 2004 [via www.3gamericas.org], the estimated total number of world cellular subscribers is 1.527 billion. Based on data from September 2002, Figure 1 shows the distribution of world subscribers by technology. Clearly, GSM owns the largest share of the market, at around 69%. About 12% of subscribers use CDMA, the technology largely developed by Qualcomm and which it derives royalties from. Figure 1. Distribution of Subscribers by Technology (September 2002) Figure 2. Distribution of Subscribers by Technology by Region (September 2002) Source: Northstream via www.3gnewsroom.com/html/whitepapers/2003/wcdma-cdma2000.zip 3 Figure 2 shows the subscriber distribution separated by geographical region. Europe is dominated by GSM because of governments’ mandates early on in cellular development to have a standardized technology. CDMA’s presence is mostly in the Americas and Asia Pacific regions. In particular, CDMA is widely used in South Korea and the United States. In the U.S., the two major wireless carriers supporting CDMA are Sprint PCS and Verizon Wireless. The statistics above would seem to suggest that Qualcomm is relegated to a relatively small portion of the cellular market, in comparison with the large GSM subscriber share. The next generation technology, however, that is CDMA-based in any of its forms, offers Qualcomm tremendous opportunities. 2. Two Migration Paths to 3G Figure 3: Evolution to 3G Source: Qualcomm.com Figure 3 outlines the evolution paths to the two major International Telecommunication Union (ITU)-approved 3G technologies, CDMA2000 and UMTS. Essentially, the selling points of 3G are greater user capacity, backward compatibility with 2G systems, multimedia support and high-speed packet data services. UMTS is widely referred to as WCDMA, which is technically the air interface only, while UMTS really represents the system spanning different network layers. To be consistent, hereafter UMTS will just be referred to as WCDMA. There is also a third ITU-approved 3G standard in China, known as TD-SCDMA that was co-developed by the Chinese government and Siemens, but limited to the Chinese market. Since it doesn’t seem likely to spread to other markets, it will not be discussed further. 4 It is possible to cross paths of evolution; for example, a wireless carrier may opt to upgrade its cdmaOne network to GSM/GPRS, but due to significant switching costs, in particular large infrastructure changes and accommodating the existing installed base of users, this is not usually done. Qualcomm offers a GSM 1x solution that overlays CDMA2000 features onto GSM networks, and thereby reduces switching costs, but this has not been very popular among GSM operators. The natural thing for network operators to do is to migrate along the evolutionary paths. Qualcomm provides the controlled evolution to CDMA2000 from cdmaOne. This contrasts heavily with the more “open” GSM path to WCDMA. WCDMA, initially developed by Nokia, Ericsson, and endorsed by European groups and Japan’s NTT DoCoMo, was designed with the hopes of circumventing the many Qualcomm patents on CDMA and expected control of the next generation technology. Unfortunately for them, much of the ensuing litigation on IP rights ended in Qualcomm’s favor, and Qualcomm earns royalties on WCDMA technology. The impact of this will be discussed further in this section. 3. Qualcomm’s Business Model As one can see from Qualcomm’s history (See Appendix A), there have been many components to Qualcomm’s business model. What has emerged as its major source of revenues however is its litany of intellectual property - approximately 3000 patents pending and issued, with nearly 800 associated with CDMA technology. Its revenue sources also include chipsets and software, its BREW technology and applications, Eudora, and satellite communications technologies. (See Exhibit 3 for Detailed Product offerings.) The company’s focus is on developing and delivering digital wireless communications products and services based on the company's CDMA technology. In doing so, it licenses a significant amount of its intellectual property related to CDMA. As a result, this provides for a strategically complex business model that has morphed over time, but has consistently remained focused on commercializing its patent innovation. As one can see from the Charts below, CDMA and licensing account for the majority of Qualcomm’s business model. Based on our analysis in this paper we believe that CDMA technology will be threatened by alternative technologies and Qualcomm will need to make strategic choices regarding its business model to ensure its future success. 5 Operating Performance Revenue Breakdown 2003 5 4 CDMA Tech Licensing Wireless & Internet Strat Initiatives 3 Revenue Op Inc Net Inc 2 1 0 -1 2000 2001 2002 2003 2004* CHART A. Revenue CHART B. Operations Results 4. Intellectual Property and the Impact of Royalties Since WCDMA is likely to be adopted by GSM network operators instead of CDMA2000, and GSM’s cellular market share is substantial, it is expected to eventually become the dominant 3G technology. Qualcomm however, has a preference for greater adoption of CDMA2000 over WCDMA, because it essentially controls the development of CDMA2000 and thus can remain on the leading edge of making the most advanced chips. Furthermore, Qualcomm earns higher royalty rates on CDMA2000. While the rates are not well known to the public, it is estimated that they are 5.25% (for domestic handset sales) and 5.75% (exports) in the South Korean market and average about 5-6% worldwide, based on the ex-factory cost of the handset. Similar royalty rates may exist for WCDMA, but they are essentially divided amongst the various patent holders based on number of patents, and Qualcomm does not enjoy such a dominant portfolio here as in CDMA2000, so it is inherently a lower percentage. At the same time, since WCDMA is expected to be widely adopted, Qualcomm, while developing and promoting CDMA2000, has been actively involved in WCDMA, through asserting its IP rights as mentioned before, and providing its own line of WCDMA chipsets. As of February 2004, at 6 least 17 customers have signed up to use their GSM/WCDMA chipsets. Recently, Qualcomm made the announcement that it intends to eventually acquire 50% of the WCDMA chipset market. These royalties create some friction within its business. While its chipset operations are competing with other manufacturers – the licensing business is essentially providing some of its competitive advantage to its competitors. However, this is part of the tradeoff between models that incorporate royalties and promote “open” (albeit licensed) standards rather than proprietary capabilities. Yet, we believe that this does not conflict with their mission; rather it reinforces their focus on innovation. In the hypercompetitive chipset industry, by participating in both businesses, they are forced to continually innovate on their IP, while at the same time capitalizing on first mover advantage in their chipset business. This relationship may seem cannibalistic, yet it forces older technologies more quickly into obsolescence. In the end, this drives the industry forward, while ensuring that CDMA based technologies continue to meet customer demand for quality and performance – a very positive thing for Qualcomm and its business model. 7 III. OPPORTUNITIES AND THREATS VIA CELLULAR TECHNOLOGIES 1. Current Direct Competition The discussion of Qualcomm’s cellular competition usually entails a lengthy discussion regarding the standards war between CDMA and GSM technologies. It seems that Qualcomm has become synonymous with “CDMA” because it owns the lion’s share of the IP rights associated with that technology. So studying Qualcomm’s competition involves looking at the larger cellular market with mainly companies producing GSM (or TDMA, …) technology as rivals. Over time, it has become clear that the cellular market will not tip in favor of a single technology. It can be argued that GSM has emerged as the winner in terms of worldwide subscriber share, but other networks will likely remain. There are large sunk costs invested in deploying network infrastructure, and rolling out new technology is a slow and expensive process. Having established itself as the leader in CDMA, recently Qualcomm faces emerging, direct competition in producing CDMA chips. Three of the strongest rivals are Nokia, Samsung, and Texas Instruments. Please refer to Appendix D for a discussion of Qualcomm’s competition with these companies. 2. The Importance of Market-Timing An issue that is important in the deployment of the new standards is market timing. There is the opinion that Qualcomm filed its lawsuit against Texas Instruments that claimed violation of non-disclosure with the attempts to slow the latter’s release of its 1xRTT chipset. Another example of timing strategy involves the coalition of Nokia, Texas Instruments, and ST, which chose to pursue the 1xEV-DV path, bypassing 1xEV-DO, possibly as a preemptive move against Qualcomm. Although 1xEV-DV is more capable by offering both voice and data in the same spectrum, 1xEV-DO is already proven through trials. Also, improvements to VoIP technology could make 1xEV-DO competitive to 1xEV-DV in the near future, eliminating perceived advantages. Verizon Wireless has deployed 1xEV-DO in Washington, D.C. and San Diego with positive results. Sprint had initially considered 1xEV-DV but eventually opted for 1xEV-DO because of Verizon’s expected early rollout. Qualcomm’s support of 1xEV-DO through testing and trials has helped push it to market earlier than its competition. 8 3. Limited impact of Network Effects There are network effects by using the same technology, but they are weak, and the end user of the phone can still interact with another user using a different technology seamlessly. As long as the coverage of the network based on the standard reaches a critical level, then the enduser does not care what technology it is based on. There are however, considerations with regards to leaving the coverage area and entering different regions in the world. Europe in particular, has been GSM dominant due to government mandates, and thus will likely employ WCDMA, possibly influencing decisions in other regions in favor of WCDMA. If history is any indication however, this influence will not force the U.S. and other nations to strictly WCDMA, as it did not with GSM. Furthermore, the decision about which 3G technology to deploy is largely dependent on the type of existing infrastructure that can be upgraded. It will be interesting to see if carriers decide to support different standards on their networks and if phones are designed to be compatible with different standards. The latter is not likely today because of the prohibitive cost and size requirements in making such multi-mode chipsets and transceivers – although it may come about in the near future. 4. Direct Competition in the Future Reviewing the competitive forces at play and in observing the 2G cellular market in the past, we believe the market will not likely tip entirely in favor of one 3G technology standard, due to limited network effects and inertia from expensive past infrastructure investments. We have seen that different cellular technologies can co-exist. With regards to 2G technologies, the consensus is that CDMA is technically superior to GSM, justifying its existence. Similarly, with 3G, CDMA2000 is technically more capable and proven than WCDMA and enjoys an early market lead. Even companies like Nokia who is adverse to CDMA and paying royalties to Qualcomm, have joined in. It can be argued that they may just be trying to chip away at Qualcomm’s market share, but it seems to at least acknowledge that CDMA2000 will be around for some time to come. In any case, it seems that the competitive focus has shifted away from “GSM versus CDMA” as cellular companies compete and cooperate with different technologies as they enter next generation markets. 9 5. New Entrants to CDMA/3G Markets There is a significant barrier to new entry due to Qualcomm’s massive patent portfolio within CDMA. This is especially true for smaller companies who lack research funds and an army of lawyers. In 2002, Nokia proposed a 5% royalty cap for WCDMA, which would have lowered the barrier to entry by making it less costly to develop WCDMA chips, and possibly forcing Qualcomm to also lower its royalty rate for CDMA2000 to remain competitive. Although Nokia earned a significant share of WCDMA royalties at the time, it may have noticed its share eroding to Qualcomm. Qualcomm and others rejected Nokia’s proposal. Despite the large barrier to entry, there are successful large company entrants to the CDMA market, such as Nokia, Samsung, Texas Instruments, and ST. The WCDMA market will likely see more new entrants, since WCDMA is more open than CDMA2000. Qualcomm has more control of the development of CDMA2000 and will be able to remain at the leading edge of chipsets. Yet, entrants may not be a cause of much concern for Qualcomm as it signifies the maturity and adoption of the technology that can help grow the CDMA/3G markets. While Qualcomm’s share of the pie may decrease in size, overall it may enjoy growth in volume. 10 IV. THE IMPACT OF NON-CELLULAR TECHNOLOGIES In the previous section, we have seen that Qualcomm’s enjoys an advantageous competitive position within the cellular market. Both WCDMA and CDMA2000, the worldwideaccepted 3G standards, are variations of Qualcomm’s CDMA patented technology. However, we should not limit our study to the cellular world. Figure 4 shows the wireless landscape. The current trend is the evolution of wireless technologies towards broadband. A number of new technologies have been launched recently, attempting to take high bandwidth connections to wireless devices. Some of them have failed, such as non-geostationary satellites, LMDS or MMDS. But some others appear to be promising; in particular, Wi-Fi, WiMAX and Flash-OFDM. In this section we are going to analyze these technologies to assess whether they are a real threat to CDMA or not. We have looked into their technical characteristics first (see Appendix E), concluding that only WiMAX and FLASH-OFDM are threatening alternative technologies. Following we present a comparison of their economic characteristics. Figure 4 – Wireless Technologies vs. applications 11 1. Economic factors for Comparison The next step is to compare with CDMA in economic terms those technologies that, from our previous technical study, we have determined that that can be considered a threat. We illustrate in this section the main economic factors in the wireless industry and their drivers. Most of the network economic theories apply to the telecommunication markets as expected. On top of those, in a network where complementary as well as substitute links are owned by different firms, the questions of interconnection, compatibility, interoperability, and coordination of quality of services become of paramount importance. Economic effects: Very large fixed investment costs, part of which is sunk costs, and very low marginal costs; which encourage players to engage in price wars and price cuts. Economies of scale: reduced unit costs with increased output, thanks to the splitting of high fixed costs among a bigger number of units. This leads companies to consolidate and standardize their technology assets. Since scale in this industry is fundamental for technology providers, new technologies have a natural barrier to entry. This makes the initial sale from technology providers to service providers very critical. Network effects: more interest in a technology if there are more complementary products; or technology is more attractive to users if more networks support it and they can roam with their terminals. As we can see, we are talking about indirect network effects. Direct network effects do not exist or are rather weak, since the value of the technology for a user does not depend on the number of users that adopt it; a user will be able to communicate with the users of all the voice and data networks his/her service provider’s network interconnects to, independently of the technology those networks use, as mentioned in the previous section. Avoidance of lock-in to a single customer or supplier. Economic Drivers: Standardization: promotes faster adoption and facilitates interoperability between players. 12 Modularity: market efficiency in every interface increases performance and reduces costs. Further, more customers and suppliers mean lower lock-in risk. First-mover advantage: start building capacity and volume. 2. Economic comparison We now compare CDMA, WiMAX and Flash-OFDM in terms of standardization, modularity and first-mover advantage. Additionally, we have considered as comparison criteria maturity and installed user base, because they are also key success factors. Modularity CDMA: When Qualcomm started applying CDMA to cellular telephony, the technology was extremely interdependent. It was extremely complex, and posed some extraordinary challenges to its implementation. Qualcomm had to work in different parts of the industry’s value chain to solve the difficulties and make CDMA a reality. Qualcomm designed the first chipsets that would be included in network equipment and handsets. It also designed and manufactured the first handsets and network components. In fact, when the first trials were made in the early 1990s, the networks were Qualcomm from beginning to end. But this didn’t last for long. Qualcomm soon realized that if their technology was to be accepted worldwide it could not be the one and only vendor. Wireless carriers wanted to have several suppliers to avoid excessive dependence from any single vendor. Furthermore, the industry was dominated by existing equipment and handset manufacturers (Ericsson, Nokia, Motorola …) that had strong ties with the carriers. Qualcomm quickly realized that they needed to let other players in to have the technology succeed. In addition, Qualcomm’s customers did not like the fact that the company was also competing with them in the infrastructure and handset businesses. They felt that Qualcomm could be favoring itself by giving its own divisions earlier access to technology and greater knowledge that would boost the performance of its own equipment. To avoid this, Qualcomm made a bold move: it sold its equipment businesses to two of its customers: the network infrastructure division to Ericsson in 1999, and the handset division to Kyocera in 2000. This helped the company focus on activities in the value chain that created the most value (R&D, 13 licensing and chipset manufacturing), as well as make CDMA a more attractive option for everyone in the cellular industry. WiMAX: Moving over to WiMAX, modularity and interoperability have been part of its creed from the very beginning. Trying to avoid some of the pitfalls of Wi-Fi when it started, back in 2000, the WiMAX forum was established shortly after the standard was approved in January 2003 to guarantee the compatibility and interoperability of the different WiMAX implementations. The purpose of this open industry association, which comprises 97 members, is to promote a specific technology and ensure its global acceptance and the interoperability across different manufacturers. FLASH_OFDM: Regarding Flash-OFDM, it lacks modularity at the moment. Although Flarion licenses the FLASH-OFDM technology to other companies, the company produces all the component parts needed to create an end-to-end FLASH-OFDM network for mobile operators, including the RadioRouter® base station, modems (PC Card, CompactFlash Card, and Desktop modem), embedded chipsets, and system software. Standardization CDMA: From its beginning in the late 1980s, CDMA has been driven by Qualcomm, which protected it with a large number of patents. Rather than a standard, it is a sponsored (proprietary) technology that can be licensed on a non-discriminatory basis from Qualcomm by anyone. Qualcomm pursued this strategy deliberately. Understanding the value of the technology, they wanted to capture as much of it as they could. The intellectual property protection was the obvious first step. But from then on, they could have decided to keep every development inhouse and capture the whole value themselves. However, they decided to let other players into the market through a licensing program. That way, they would still be participating in their revenues, and the technology would have greater chances to be adopted worldwide. In addition, they enjoyed the benefits of modularity, allowing different players to focus on one part of the 14 value chain, with the potential improvements in performance and also the economies of scale of selling to a larger base of customers. In spite of being a sponsored technology, Qualcomm’s non-discriminatory licensing has become one of the standards in wireless communications. (Please see Appendix B regarding the battle for CDMA standardization) Figure 5: Impact of WiMAX on Structure Figure 6: Global Wireless Standards WiMAX: WiMAX, on the other hand, has always been considered an industry standard. Pioneered by the Institute of Electrical and Electronic Engineers (IEEE), WiMAX is one of a number of complementary wireless standards created by the IEEE to help ensure interoperability and reduce the risk of wireless technology deployment. First drafted in 2001 and finalized in January 2003, it is based on open technologies. In addition, and to avoid a situation like the one in 3G cellular telephony, with the European industry association (ETSI) deciding on a slightly different standard from the USsponsored CDMA2000, the WiMAX Forum has been working with ETSI to promote a unified standard based on 802.16. The standardization of the WiMAX technology will allow significant economies of scale that will quickly drive down the cost of equipment. Manufacturers will not bear the overhead of developing the technology, and their R&D efforts will be focused on differentiating their offerings from their competitors in performance or features. 15 FLASH-OFDM: Finally, moving over to FLASH-OFDM®, it is a proprietary signal processing technology at the moment. Flarion Technologies is the architect of FLASH-OFDM®. However, Flarion is aware of the advantages of standardization. Its strategy is to establish FLASH-OFDM® in the global standards bodies, and it is working closely with the IEEE on the standards group's 802.20 Mobile Broadband Wireless Access specification. First-Mover Advantage CDMA: Broadband CDMA did already enter the wireless markets worldwide some years ago. Starting in October 2000 in Korea with its CDMA2000 1X variant, and in October 2001 in Japan with W-CDMA, 3G CDMA networks have already been deployed in more than 15 countries, including the U.S., Canada, Brazil, and the Nordic Countries. The main user benefit of the existing 3G CDMA network deployments is higher mobility thanks to a more extensive service area. WiMAX: WiMAX, for its part, has not been deployed yet. Although the throughput speeds and geographical coverage of current radios are ostensibly superior to those of the past, there are virtually no widescale deployments of such equipment that conclusively demonstrate long-term profitability. According to research by META Group, the improving costs of WiMAX deployment will spur alternative telecommunications carriers to turn to the technology as a viable business model in 2006. FLASH_OFDM: Moving over to FLASH-OFDM, although there is no commercial deployment yet, some trials have already been performed in the U.S. In February 2004, Nextel announced its market trial in Raleigh-Durham, North Carolina. Cisco, IBM and Nortel, each supplying equipment or outsourcing services, also offered their employees to test the service, obtaining very positive feedback. In April the service provider expanded its Nextel Broadband service to paying customers and also extended the geographic reach of its Raleigh-Durham market to 16 include Research Triangle Park and Chapel Hill. All in all, the service is available across 1,300 square miles. Maturity CDMA: CDMA is a mature technology now. After being around for 15 years, it has achieved a widespread adoption worldwide. Its different variations are in various stages of adoption. CDMA2000 1xEV-DO is being deployed as of this writing, with more and more wireless carriers around the world adopting it. WiMAX: On the other hand, adoption of WiMAX is still an unknown. Much hype is surrounding the technology these days, and many companies are pledging their support. However, only if the efforts are successful and cost-effective equipment is created will the new technology achieve a major global footprint. In addition, WiMAX is still quite nascent. There are no commercial deployments yet, and the equipment is still being tested in the labs. The technology is quite new and somewhat complex. In spite of the thorough standardization process of the Institute of Electrical and Electronic Engineers (IEEE), its implementation is not straightforward, and manufacturers are having a hard time creating compliant equipment. Once they create separate network components, the task will be to ensure the interoperability between them. Again, the efforts of the WiMAX Forum will be crucial, but problems will still be encountered and will need time to be sorted out. FLASH_OFDM: FLASH-OFDM is also a nascent technology. Although some trials have already been done, the technology is still in its first stages. Besides, associated to its standardization, some modifications will likely need to be introduced to accommodate the demands of all the parties involved. 17 Adoption CDMA CDMA2000 1xEV-DO FLASHWiMAX OFDM® (IEEE 802.16a) Time Figure 7: Adoption of wireless technologies Installed User-Base Of the three technologies discussed, 3G CDMA is the only one that has an already installed user base. In addition, as 2G CDMA networks evolve naturally to 3G CDMA, most of its users will transition to 3G CDMA. 3. The Impact of Non-Cellular Communications Technologies In sum, CDMA complies with all the desired economic criteria: it is standardized, modular, has already entered the market, companies have been working on it for a few years now. It is also backward compatible with the installed base of CDMA users. Flash-OFDM is almost the opposite. It is in the same situation as CDMA was at its beginnings. Although Flarion is pushing to standardize it and also offers licenses to other companies, the technology is still proprietary and it is just starting to enter the market. Therefore, CDMA is in a clear advantageous position. In fact, by looking at investors’ reports, we have confirmed that their CDMA growth forecast has not been changed as a result of Nextel’s FlashOFDM trial. The situation with WiMAX is different. It has some disadvantages with respect to CDMA: the technology is not mature yet and has not entered the market. However, it has the 18 important advantage of its completely open standard, with no patents or licenses. This will likely favor its adoption by equipment manufacturers and makes us consider it an important threat. Apparently Qualcomm, aware of the danger, is trying to delay a mobile WiMAX technical standard until it can be shaped in such a way where it will not feel threatened, as Fujitsu Ltd. charged on October 21, 2004. Some industry insiders suggest that Intel is encouraging Fujitsu's accusations in order to avoid a direct confrontation itself with Qualcomm. Investors are not worried about WiMAX at the moment, since they consider its acceptance to be still spotty. However, they do note that this and other emerging technologies could potentially change the wireless landscape in the future. In the next section, we offer Qualcomm recommendations to defend against the WiMAX threat. BASED ON ECONOMIC CRITERIA, CDMA IS STILL THE WINNER Superior in maturity, installed user base and first-mover advantage Comparison criteria CDMA 2000 FlashOFDM WiMAX Modularity Standardization First-mover advantage Maturity Installed user base Additional comments Standardized, but also patented Open standard, but not mature nor deployed yet Patented, although Flarion pursues standardization Network trials underway by Nextel and Vodafone WiMAX WiMAX is is an an important important threat threat due due to to its its modularity modularity and and open open standard standard status status Figure 8 – Wireless Technologies Economic Comparison 19 V. RECOMMENDATION In conclusion, it is critical to recognize three significant factors in recommending a future strategy for Qualcomm. 1. CDMA2000, although a better technological standard is not being embraced as widely as the WCDMA standard – for the most part this is due to Qualcomm’s intellectual control and presently installed network infrastructures. 2. The threat of alternative technologies is eminent – WiMAX in particular is a nascent technology that significantly threatens its current IP and business model. 3. Innovation is key to extending Qualcomm’s business model – Intellectual property is Qualcomm’s competitive advantage. This must be levered to succeed in the face of stiff competition. These have been further detailed in three stages below: SHORT TERM First, Qualcomm should continue pushing the research in CDMA2000 technology to move as quickly as possible towards higher bandwidths and lower power consumption. This will accelerate the adoption of the technology by increasing performance, and capture market share before WiMAX or another competing technology with better performance characteristics challenges its dominance. Market share is extremely important in this industry, as we mentioned when talking about the economies of scale and network effects. It offers the possibility of preempting the market by grasping enough end customers and offering them a product that satisfies their broadband connectivity needs at a competitive price. MEDIUM TERM Concurrent with its push for CDMA2000, Qualcomm should advocate the early adoption of 3G technologies in general (i.e. include WCDMA and TD-SCDMA). Locking the market in to 3G could help slow the entry of WiMAX and Flash-OFDM. In particular, since WCDMA is likely to emerge as the dominant 3G standard due to the large GSM installed base, Qualcomm can profit from the side of the cellular market that was once considered its main rival. Even if it 20 becomes necessary to cannibalize its own CDMA2000 revenues, it is wise to embrace the WCDMA gorilla-to-be rather than fight it. While royalty rates are not as lucrative in comparison with CDMA2000, they can make up for it with innovation in WCDMA chipsets. Their target to capture 50% of WCDMA chipsets reveals the importance of this market to them. Furthermore, Qualcomm should support development of valuable user applications, whether via its developments in its BREW platform or another, in order to help make the case to upgrade to 3G. LONG TERM Again, Qualcomm can defend from the growing long-term threat of WiMAX, OFDM and other alternative technologies through innovation. One of the strongest points of WiMAX is its open standard, which also enables Qualcomm the ability to develop and profit from WiMAXenabled chipsets. While it cannot apply its CDMA IP-revenue model to WiMAX, it can similarly enjoy the positive feedback of the technology if it takes off. The promise of OFDM does not rest on WiMAX alone however, and Qualcomm can reap its technological benefits over CDMA in other ways. Recently, Qualcomm issued a proposal to 3GPP2 (the 3G standards body governing CDMA2000) that introduced the idea of combining OFDM and CDMA in a future EV-DO standard. Also, Qualcomm holds 26 approved OFDM patents and has filed 73 more. Qualcomm’s success in OFDM will likely depend on its ability to leverage its leading position in the mobile chipset market. In conclusion, within the hypercompetitive telecommunications industry, by participating in both competitive and cooperative businesses, Qualcomm must continually innovate on their IP, while at the same time capitalize on first mover advantage in their chipset business. This relationship may seem cannibalistic, yet it forces older, weaker performing technologies more quickly into obsolescence. In the end, this drives the industry forward, while ensuring that its technologies continue to meet customer demand for quality and performance – a very positive, albeit volatile impact on Qualcomm and its business model. 21 VI. APPENDICES APPENDIX A. BACKGROUND AND HISTORY OF QUALCOMM Professors Irwin Mark Jacobs and Andrew Viterbi founded digital signal processing equipment company Linkabit in 1968. M/A-COM acquired the company in 1980. Led by Jacobs, Viterbi and five other executives left M/A-COM Linkabit in 1985 to start engineer-focused Qualcomm (for "quality communications") to provide contract R&D services. The company's first home was located above a strip mall pizza parlor in San Diego. CEO Jacobs dreamed of modifying code-division multiple access (CDMA) -- a secure wireless transmission system developed during WWII -- for commercial use. In 1988 Qualcomm introduced OmniTRACS, a satellite-based system that tracks the location of long-haul truckers. By 1989, when Qualcomm unveiled its version of CDMA, the company was working on defense contracts worth $15 million. In 1990 the company interrupted the Cellular Telecommunications Industry Association's (CTIA) plans to adopt a rival technology called time-division multiple access when communications service providers NYNEX (now part of Verizon) and Ameritech (now part of SBC Communications) adopted Qualcomm 's maverick technology. Qualcomm initiated a CDMA public relations blitz and by 1991 Motorola, AT&T, Clarion, and Nokia had signed product development and testing agreements. The company went public in 1991 and introduced e-mail software Eudora that it licensed from the University of Illinois. That year Qualcomm and Loral Corporation unveiled plans for Globalstar, a satellite telecommunications system similar to the Iridium system. The CTIA adopted CDMA as a North American standard for wireless communications in 1993. In 1996 most of the major US cellular carriers upgraded to CDMA. However, Qualcomm’s earnings fell due to manufacturing startup expenses and R&D and marketing costs. Earnings bounced back the next year, and the company signed a contract to supply wireless ground stations for Globalstar. The company spun off its wireless phone service operations in 1998 as Leap Wireless International. It also formed Wireless Knowledge, a joint venture with Microsoft to develop software and services for Internet access from portable computing devices. 22 In 1999 Qualcomm and rival Ericsson settled a bitter dispute over the use of CDMA as an industry standard when they signed a cross-licensing deal. The cross licenses are royalty bearing for CDMA subscriber units sold by either party. In addition, Ericsson purchased Qualcomm's terrestrial CDMA wireless infrastructure business, including its R&D facilities, located in San Diego, Calif. and Boulder, Colo., and will assume select customer commitments, including a portion of vendor financing obligations, related assets and personnel. Qualcomm sold its handset operations to Kyocera in 2000. The company also bought SnapTrack (cell phone location software), and signed a potentially huge deal with China Unicom. The latter was a step forward for Chinese carriers and equipment makers itching to use CDMA in a region where the Global System for Mobile Communication (GSM) rules. Later that year rivals Nokia and Motorola teamed up to push for the standardization of Motorola's 1Xtreme technology over Qualcomm's high-data-rate (HDR) format for 3G networks. (However, 1Xtreme is based on Qualcomm's CDMA patents.) By mid-2000 the company made plans to spin off its semiconductor subsidiary, Qualcomm Spinco, to the public. Qualcomm cancelled the IPO a year later. In 2001 the Chinese government, after years of balking at CDMA in favor of 3G, granted Qualcomm and China Unicom permission to install a CDMA-based network. That year Microsoft sold its stake in Wireless Knowledge; the joint venture became a subsidiary of Qualcomm. In 2003 the company shut down the Wireless Knowledge subsidiary and absorbed the operations into the parent company. On October 28th, 2004, today in fact, Qualcomm announced that it would be supporting all three standards for 3G, which happen to be CDMA 2000, WCDMA, and TD-CDMA which also are the three technologies from which they will benefit. 23 APPENDIX B - BATTLE FOR CDMA STANDARDIZATION In section IV we have discussed the importance of standardization. We illustrate in this appendix the hard path that Qualcomm had to follow to achieve a CDMA standard. In 1988, Irwin Jacobs, Qualcomm’s Chairman, CEO and co-founder, decided to move the company’s attention into digital mobile communication and CDMA. The idea suddenly hit him and another Qualcomm founder, Klein Gilhousen, of applying what they had been doing for satellites to commercial terrestrial mobile networks – specifically, they were thinking about a technology called CDMA. There was nothing revolutionary about CDMA itself. Its earliest patents – for military applications of another CDMA spread spectrum protocol called “frequency hopping” – reached back to the 1940s. The technology languished for several decades, but the military finally employed it in 1962 during the Cuban Missile Crisis. The government declassified it in the mid1980s, and it became software available for free to anyone who wanted to use it. Jacobs and his team experimented with CDMA and became convinced it would be a better technology for wireless communications. They set to work to show that it would succeed and spent the next year developing a prototype system. However, by this time, TDMA was sweeping the world. In 1987, Europe had agreed on GSM (Global System for Mobile Communications), a TDMA-based standard. In the U.S., the standard-setting U.S. Telecommunications Industry Association (TIA) voted in January 1989 to proceed with TDMA and set up a committee to develop it as an official standard. In 1991 Japan’s telephone monopoly would also adopt a single standard, called PDC (Personal Digital Cellular), another TDMA variant. The U.S., however, was not a done deal. Unlike Europe and Japan, the U.S. had not actually mandated a single digital standard. In 1987, the FCC had actually declared that alternative digital technologies would be allowed in the current frequency band. This stance 24 reflected two FCC postures. While it faced a capacity-constrained analog system, the FCC really did not want to allocate any more bandwidth to digital – radio spectrum is, after all, a finite resource – so it hoped competition would encourage research into more capacity-efficient solutions. Also, the policy fit with the pro-competitive market flavor following the 1984 AT&T breakup. The upshot for Qualcomm was that although the TIA was in the process of standardizing TDMA, any willing player in the market might still choose CDMA. Qualcomm first introduced CDMA in 1989; three months after the TIA had endorsed TDMA. Qualcomm’s activities focused on getting national and international acceptance of their underlying technology through standards-setting organizations, in particular, the TIA. Jacobs headed to conferences and to the press to tell the standards-setting organizations and the industry why CDMA was better and more reliable and would not be an also-ran. In June 1989, Jacobs made a presentation to a Chicago conference of ranking telecom engineers. No one pointed out any glaring problems. But with the battles over TDMA versus a few other suggestions behind them, people weren’t interested in entertaining another idea. Other labs had tinkered with CDMA, but it just seemed too complex to be feasible. The component technologies were even well known, either in theory or in their application in military satellites, but putting them all together as Qualcomm envisioned and using them terrestrially met with considerable difficulties. Jacobs made several arguments for CDMA versus TDMA. Because of the efficiency of sending packets, CDMA offered more “bang for the buck” and was cheaper to run. It offered better voice clarity. And it allowed a “soft handoff” of conversations moving from one cellular tower’s range into another’s, which decreased the risk of a call being dropped1. Qualcomm naturally met opposition, and critics accused CDMA of failing to increase capacity under full load as much as it was advertised. They accused Jacobs of exaggerating CDMA’s advantages. Jacobs had faced and overcome critics within Qualcomm, too. However, Jacobs, Gilhousen, and Viterbi were able to devise solutions to the technology limitations pointed out by other colleagues. In this way, criticism and a diversity of opinion were constructive at Qualcomm. Fortunately the company had the right group of around 30 people with the required technical 25 competency to see and debate the whole picture; with only three minds, the outcome of CDMA may have been different. Luckily, decision makers at Pac Tel Cellular listened to Qualcomm and got their counterparts at Bell Atlantic, NYNEX, and Ameritech to listen. They all made investments on the order of a million dollars, which were small commitments from them but which helped Qualcomm pay for development. After months of feverish work by Qualcomm engineers, in November 1989, Qualcomm and PacTel Cellular demonstrated the first CDMA system in San Diego. Three months later, NYNEX Mobile successfully demonstrated CDMA in New York City. However, the equipment used in such tests was hardly portable and Qualcomm set about to develop integrated chipsets that would reduce the size and cost, and increase the attractiveness, of CDMA. In November 1991, the same year that the TIA released the rival TDMA standard, Qualcomm successfully demonstrated CDMA with these new chipsets. As CDMA's effectiveness was proven in a series of field demonstrations throughout the world, many key service providers and manufacturers signed agreements with Qualcomm in support of CDMA technology validation activities. By June 1992 the industry voted to proceed with a CDMA standard. That year, Qualcomm submitted the CDMA Common Air Interface (CAI) to the TIA for standardization. Finally, in 1993, the TIA gave the coveted standard designation to IS-95, which stands for Interim Standard 95, a CDMA protocol based on Qualcomm’s technology. The IS-95 standard became the foundation for a whole new generation of CDMA-based cellular systems. In 1995, CDMA was selected as a standard for Personal Communications Services (PCS). Commercially introduced that year, CDMA quickly became one of the world's fastest-growing wireless technologies. It proved not only to be superior to TDMA technologies, but to also have a greater potential for improvement. New variations of the modulation and codification schemes yielded higher capacities and bandwidths. In 1999, the International Telecommunications Union selected CDMA as the primary technology for third-generation (3G) wireless systems. Many leading wireless operators are now building or upgrading to 3G CDMA networks to provide more capacity for voice traffic, along with high-speed data capabilities. 26 QUALCOMM WORKED HARD TO STANDARDIZE CDMA After 4 years of negotiations and enhancements, the Telecommunications Industry Association (TIA) released CDMA-based standard IS-95 •TIA starts TDMA standardization •Qualcomm promotes CDMA at conferences and press. No interest: - Complexity - Exaggeration of advantages 1989 •Pac Tel Cellular, Bell Atlantic, NYNEX and Ameritech invest $1 million each •TIA releases TDMA standard 1991 •Qualcomm demostrates CDMA with smaller and cheaper chipsets 1992 •Industry requests CDMA standard 1993 •TIA releases IS-95 standard, based on CDMA •Qualcomm and Pac Tel Cellular demonstrate CDMA in San Diego - Non-portable chipsets •CDMA selected as PCS standard 1995 •CDMA commercial introduction 1990 •Qualcomm and NYNEX demonstrate CDMA in NY City - Non-portable chipsets 1999 •International Telecommunications Union (ITU) selects CDMA for 3G 3G 3G standards standards based based on on CDMA CDMA Figure 9 – CDMA Standardization Process 1 With the soft handoff feature, as a call moves between cells, base stations at two or more nearby cells receive the conversation. The system then selects the stronger of the two. Because calls are always being received by more than one base station, the odds of being dropped are less than with TDMA systems that use hard handoff. 27 APPENDIX C – REGULATORY ENVIRONMENT CDMA DOES NOT FACE REGULATORY CONSTRAINTS FOR 3G U.S., Europe and Asia open to CDMA based technologies Europe Asia •Technology standards imposed: • 2G: GSM • 3G: W-CDMA •Limited technology guidelines •Exception: Japan PDC (TDMA based) U.S. •Market dictate technology direction •CDMA was left out of the European market for 2G •CDMA variant W-CDMA accepted in Europe for 3G •U.S. and Asia always allowed CDMA. Both W-CDMA and CDMA2000 are alternatives for 3G Figure 10 – Regulatory environment 28 APPENDIX D – COMPETITOR DETAIL – NOKIA, SAMSUNG, TEXAS INSTRUMENTS Nokia is the leading mobile phone maker in the world and for many years has been developing GSM technology. So for a long time, Nokia’s interests in promoting GSM were at odds with Qualcomm’s, but since Qualcomm pulled out of the handset making business several years ago, the two were not directly competing. Qualcomm however, has been supplying Samsung, LG, and Sanyo with 3G chipsets, and these companies compete with Nokia in the handset business. As discussed earlier, Nokia and Ericsson developed WCDMA as a 3G technology to compete with Qualcomm’s CDMA2000 and circumvent its royalties, although it failed in doing so. However, Nokia does earn royalties for WCDMA and expects to be a big player in the CDMA business (with respect to WCDMA). Its CDMA handset market share was 8% in 2002, 15% in 2003, and is forecast to be 25% in 2005. This is threatening to Qualcomm’s dominant CDMA market share, especially if Nokia does not use Qualcomm’s chips. Samsung is another leader in the handset business and with Nokia account for nearly half of all handsets in the world. However, Samsung is Qualcomm’s biggest customer, amounting to 20% of its sales in 2003 – one of the many signs of a complex industry structure that involves co-opetition as much as competition. The South Korean cellular market is exclusively CDMA-based, and Samsung is the largest cell phone maker there. While Samsung and Qualcomm have a customer-supplier relationship and have mutual benefits in endorsing the adoption of CDMA technology, Samsung had a build (make) vs. buy dilemma. In 2003, Samsung began producing CDMA chips for its own phones. This will inevitably reduce the sales of chips by Qualcomm, at least to Samsung. With respect to royalties, however, Qualcomm can still extract them from Samsung via the IP needed to develop CDMA chips. Texas Instruments is the market leader in designing and manufacturing GSM chipsets and has therefore been a competitor with Qualcomm in the cellular chipset market. In May of 2003, Texas Instruments, Nokia, and STMicroelectronics formed an alliance to co-develop and market their own CDMA2000 1x chipsets, thereby crossing into Qualcomm’s territory. An earlier cross-licensing agreement with Qualcomm that swapped key patents allowed Texas Instruments to avoid paying royalties to Qualcomm for producing the chips. Not long after the announcement in May, Qualcomm sued Texas Instruments, alleging that it had violated a nondisclosure agreement by revealing that it did not have to pay royalties to Qualcomm, 29 but eventually in 2004 the court ruled in favor of Texas Instruments. This poses a significant competitive threat to Qualcomm. As a result Qualcomm has been trying to terminate the cross-licensing agreement in order to extract royalties from Texas Instruments, an increasingly formidable competitor in the CDMA space. A possible advantage that Texas Instruments may have over Qualcomm is in manufacturing, by operating its own fabs. Being “fabless,” Qualcomm outsources manufacturing to TSMC and IBM. It is possible that Texas Instruments may have an advantage in manufacturing costs but in today’s world of hyper competitive outsourcing, this may be competed away. 30 APPENDIX E – TECHNICAL COMPARISON OF TECHNOLOGIES CDMA: As we have seen in section II, there are several 3G CDMA variants. The most powerful one, CDMA2000 1X, provides bandwidth up to 2 Mbps and range up to 8.3 miles. It also permits hand-off at vehicular speeds (up to 75 mph). Additionally, CDMA2000 1X supports 35 traffic channels per sector per RF (Radio Frequency). Wi-Fi: Wi-Fi is the term used to refer generically to any type of IEEE 802.11 network, whether 802.11b, 802.11a, dual-band, etc. Combining its low cost (about US$36 a PC card and US$60 a Wi-Fi wireless router), and its high bandwidth (up to 54 Mbps with the 802.11a/g variants), WiFi could become a powerful competitor to broadband CDMA. However, Wi-Fi has some important disadvantages with respect to CDMA that makes us discard it as a substitute technology. Specifically, it has limited coverage range (up to 300 feet), has high power requirements, and lacks hand-off capability (a feature currently under development). In our view, Wi-Fi is rather complementary to CDMA and operators will likely integrate both technologies in their networks. WiMAX: WiMAX (Worldwide Interoperability for Microwave Access) refers to any type of IEEE 802.16 network. It is considered the next step beyond Wi-Fi. It includes numerous advances with respect to the 802.11 standard, such as quality of service, enhanced security, higher data rates (up to 70 Mbps), and mesh and smart antenna technology allowing better utilization of the spectrum. The MAC layer in the 802.16 standard has been designed to scale from one up to hundreds of users within one RF channel. Although its 802.16a variant does not allow mobility between cells; 802.16e, whose standard is expected to be in place by the end of 2004, will support subscriber stations moving at vehicular speeds. In fact, speeds of 120 to 150 kilometers per hour (75 to 93 miles per hour) have already been achieved in simulations. Also, with a range of up to 30 miles, WiMAX is expected to be the solution for the biggest limitation of Wi-Fi technology: range. Therefore, WiMAX is a strong future alternative technology to CDMA that we should take into account. It will initially compete in the data communications market and, once VoIP becomes fully regulated and technically operational, it will also threaten the voice market. 31 Flash-OFDM: FLASH-OFDM® is a new technology originated in Bell Labs in early 1998 and property of Flarion Technologies at this time. It stands for Fast Low-latency Access with Seamless Handoff (FLASH) Orthogonal Frequency Division Multiplexing (OFDM). The technology allows real-time data transmission rates of 1 to 1.5 Mbps (with burst rates of 3.2 Mbps) in wireless metropolitan area networks based on cell ranges of up to 15 kilometers or more, and it plans to deliver those rates to mobile users even when they are traveling at speeds up to 250 kilometers per hour (155 miles per hour). This would make FLASH-OFDM an option for deployment in high-speed trains. Because of its spread-spectrum design and the orthogonality of its tones, FLASH-OFDM captures the significant advantages of CDMA (frequency diversity and intercell interference averaging) and TDMA (intracell interference averaging), and avoids the limitations of each. These interference advantages allow the FLASH-OFDM physical Layer to enable far more capacity and spectral efficiency than preceding air interfaces. Given its technical characteristics, FLASH-OFDM is another powerful challenger to CDMA. 32 VII. REFERENCES Websites Qualcomm (http://www.qualcomm.com) Qualcomm CDMA2000 1xEV-DO Technology (www.qualcomm.com/technology/1xev-do/) Qualcomm CDMA Technologies (http://www.cdmatech.com/) Qualcomm Technology Licensing (http://www.qualcomm.com/technology/property.html) 3G Today (http://www.3Gtoday.com) WiMAX Forum (http://www.wimaxforum.org) IEEE 802.16 Standard Working Group (http://www.ieee802.org/16/) CDMA Development Group (http://www.cdg.org/cdg/index.asp) 3rd Generation Partnership Project (3GPP) (http://www.3gpp.org/) 3rd Generation Partnership Project 2 (3GPP2) (http://www.3gpp2.org/) Cellular Telecommunications & Internet Association ( CTIA ) (http://www.ctia.org/index.cfm) Flarion (http://www.flarion.com/about/default.asp) Flarion FLASH-OFDM Technology (http://www.flarion.com/products/flash_ofdm.asp) Nextel Wireless Broadband (http://www.nextelbroadband.com/ab_home.html) IMT-200 Implementation (http://www.itu.int/ITU-D/imt-2000/implementation.html) 3G Americas: Unifying the Americas though Wireless Technology (http://www.3gamericas.org/English/index.cfm) CDG : Worldwide : 2Q 2004 CDMA Subscribers Statistics (http://www.cdg.org/worldwide/cdma_world_subscriber.asp) CDMA Explained (http://www.cellular.co.za/cdma.htm) UMTS and 3G market share distribution (http://www.umtsworld.com/industry/Subscribers.htm) Articles 39 mln WLAN users by the end of 2004 (http://www.itfacts.biz/index.php?id=P1617) 3GNewsroom.com: 3G news (http://www.3gnewsroom.com/3g_news/) 802.16a (http://www.nwfusion.com/details/6536.html) 802.16e vs. 802.20 (http://www.wi-fiplanet.com/columns/article.php/3072471) A Big Step Up For Data (http://www.wirelessweek.com/article/CA329159?stt=001&text=qualcomm) Battle of the 3GSM basebands heats up (http://wireless.iop.org/articles/news/5/9/2) Chipset Alliance Challenges QUALCOMM's Kingdom (http://siliconvalley.internet.com/news/article.php/2207301) Competitors Building Blocks To Qualcomm's CDMA Chips? (http://www.wirelessweek.com/article/CA372419?spacedesc=Features&stt=001) 33 EV-DV Dying On The Vine? (http://www.wirelessweek.com/article/CA472507?text=qualcomm&stt=001 Everything OFDM is new again (http://www.equitekcapital.com/Investorinfo/Webpagecontent/flarion_articles/flarionbroadbandedge07150 4.htm) FLASH-OFDM makes more headway (http://www.americasnetwork.com/americasnetwork/article/articleDetail.jsp?id=122160) Has Qualcomm's Time Come: Part II (http://www.fool.com/news/commentary/2004/commentary040408dm.htm) Intellectual Property and WCDMA (http://www.thefeature.com/article?articleid=15266) Qualcomm Bullish In Its 2004 Outlook (http://nwc.mobilepipeline.com/devices/18100101) Qualcomm collects 3 trillion won from Korean handset makers (http://www.telecomasia.net/telecomasia/article/articleDetail.jsp?id=125189) Qualcomm: Top of the Wireless Food Chain (http://www.businessweek.com/investor/content/mar2004/pi20040312_1829_pi044.htm) Qualcomm vs. Nokia (http://www.fool.com/portfolios/rulemaker/2000/rulemaker001124.htm) Qualcomm’s Gathering Storm? (http://www.theinternetanalyst.com/IndustryFocus/Article.asp?target=%2Fstocks%2Findustryfocus%2Farti cle&ForumID=64&DocID=14347&sid=0) Qualcomm's persistence pays dividends in China (http://www.irps.ucsd.edu/about/innews2002/copley012802.php) Showdown At The CDMA Corral (http://www.wirelessweek.com/article/CA472508?spacedesc=Departments&stt=000) Texas Instruments Solidifies Wireless Plans (http://www.forbes.com/2003/05/15/cx_ah_0515txn.html) TI Challenges QUALCOMM to CDMA Duel (http://siliconvalley.internet.com/news/article.php/2202941) U.S. spotlight Shines on EV-DO (http://www.wirelessweek.com/article/CA292170?spacedesc=Wireless+Internet&stt=001) US Telcos Will Turn to WiMAX Within 18 Months (http://www.wimax.co.uk/PR2004/Sept2004/2083.htm) Why Qualcomm Keeps Ringing (http://www.businessweek.com/technology/content/apr2004/tc2004046_9562_tc055.htm) Wi-Fi Networking News: WiMAX Archives (http://wifinetnews.com/archives/cat_wimax.html) WiMAX Inches Closer to Reality (http://www.internetnews.com/wireless/article.php/3346241) Wireless Giants Set W-CDMA Royalty Rates (http://www.cellular.co.za/news_2002/112602wireless_giants_set_w.htm) Presentations What Does 802.16a means to an Operator?, Dr. Mohammad S. Shakouri, VP WiMAX Forum, 2003 34 Papers Operator Options for 3G Evolution, Northstream report, February 2003 (http://www.3gnewsroom.com/html/whitepapers/2003/wcdma-cdma2000.zip) Three Topics that Continue to Be Misunderstood by the Wireless World, Jeffrey K. Belk, Senior VP, Marketing, QUALCOMM Inc., 2004 (http://www.qualcomm.com/emd/pdf/3G_Myths_JBelk_5-12-04.pdf) Capacity Simulations and Analysis for cdma2000 Packet Data Services, Lin Ma and Zhigang Rong (Nokia Research Center), IEEE, 2000 3G Standardization in a Techno-Economic Perspective, Anders Henten and Dan Saugstrup (Center for Tele-Information, Technical University of Denmark), 2004 IEEE 802.16a Standard and WiMAX. Igniting Broadband Wireless Access, Worldwide Interoperability for Microwave Access Forum Analyst Reports Impact of Nextel's Trial of Flash-OFDM in North Carolina, Harris Nesbitt Gerard, February 2004 3G Wireless Technology. HSDPA to the Rescue?, Deutsche Bank, September 2004 A.G. EDWARDS & SONS, INC., 6 pages Investext Select, 6 August 2004, (English) PIPER JAFFRAY, 6 pages Investext Select, 6 October 2004, (English) SMITH BARNEY CITIGROUP, 6 pages SMITH BARNEY CITIGROUP (US RESEARCH), 5 pages 35 VIII. EXHIBITS Exhibit 1 - WiMAX Forum Members and Standardization Source: WiMAX forum (http://www.wimaxforum.org/about/) 36 Exhibit 2 - Forecast Confusion in the Growth of 3G Qualcomm expects that the number of subscribers of CDMA2000 technology will remain larger than for WCDMA, until around 2007 or 2008, when they will be equal. It is also expected that the number of 3G subscribers will account for nearly half of all subscribers by then. It is interesting to examine statistics from another source, UMTSworld.com, shown in Figure 11. In this chart, it shows that as of September 2003, the number of WCDMA subscribers comprise over a third of total 3G subscribers, with the remaining two-thirds being CDMA2000 subscribers. This is in striking contrast to the much larger CDMA2000 subscriber base shown in Figure 12, sourced from Qualcomm. UMTSworld.com is a group endorsing the WCDMA standard, so it is in their interests to make it appear more widely adopted with respect to CDMA2000. Unfortunately, they decided to only include CDMA2000 1xEV-DO, not the entire CDMA2000 lineup, which includes 1xRTT, an earlier version. Some consider 1xRTT a 2.5G technology, since it is comparable (at least in theory) to GPRS, a 2.5G technology. However, officially 1xRTT is classified as 3G. The conclusion that can be drawn is that expectations management is important to Qualcomm, since network operators and investors can be influenced by such data. Figure 11. Figure 12. Source: UMTSworld.com Source: Qualcomm.com 37 Exhibit 3 – Product and Service Offering I. Code-Division Multiple Access (CDMA) Technologies Group •Integrated circuits •Baseband •Intermediate-frequency •Power management •Radio-frequency •Systems software II. Technology Licensing Group •CDMA technologies and patents (cdmaOne, CDMA2000, WCDMA, TD-SCDMA) •Royalties from products incorporating CDMA technology III. Wireless and Internet Group •Digital Media •Digital motion picture delivery systems (under development) •Government systems •Development and Analysis Services •Wireless base stations and phones •Internet Services •Applications development software for wireless devices (BREW) •E-mail software (Eudora) •Wireless Systems •Low-Earth-orbit satellite-based telecommunications system (Globalstar) •Satellite and terrestrial two-way data messaging and position reporting systems and services (OmniTRACS, OmniExpress, TruckMAIL) 38