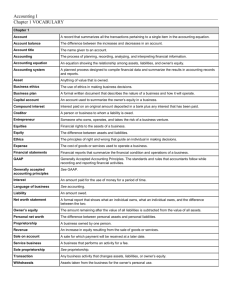

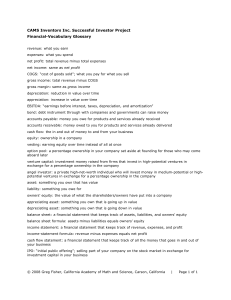

The Cash flow statement

advertisement