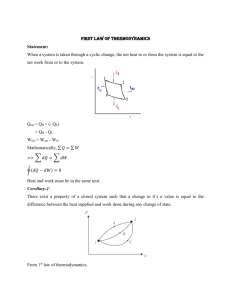

Financial Statement Analysis

advertisement

B10.2303.020 Financial Statement Analysis Stern School of Business New York University Spring 2008 Course Objective: Financial statements provide the most comprehensive corporate data available to users and investors without access to internal information. These data are widely used as inputs to a wide variety of decisions (economic, investments, public policy, and personal). This course is designed to help you understand the numbers reported by companies in their financial statements. It will give you the basic tools needed to analyze and compare data across industries as well as over time. The course will also introduce you to differences between U.S. GAAP and IFRS. Required Textbook The Analysis and Use of Financial Statements (3rd Edition) (WSF) Gerald I. White, Ashwinpaul C. Sondhi, and Dov Fried John Wiley & Sons, Inc., 2003 Assignments & Grading: 1. Group Assignments: Company Analysis In the first class session, Professor Sondhi will explain how you are to select a company which you (in teams of 3-5) will analyze. a. Direct method cash flow statement & analysis b. Comprehensive ratio analysis & discussion c. Adjusted analysis & discussion 2. Final Exam (Individual) Course Outline 1. Accounting Income – The Income Statement (WSF Ch 2) Issues in Revenue and Expense Recognition Analysis of Recurring versus Nonrecurring items Significance of Nonrecurring Items to Credit Analysis and Firm Valuation Introduction to the Concept of The Quality of Earnings 2. The Balance Sheet & Statement of Stockholders’ Equity (WSF Ch 2) Uses and Analyses of The Balance Sheet Uses and Analyses of The Statement of Stockholders’ Equity Balance Sheet Integrity 3. Analysis of Cash Flows (WSF Ch 3) Distinction between the direct and indirect statement of cash flows Recast an indirect statement of cash flows to a direct basis Games companies play with the statement of cash flows Definition and use of the concept of Free Cash Flows Analyze the impact of acquisitions and divestitures on reported cash flows Analysis of trends in components of cash flows Group Assignment 1: Prepare a direct method cash flow statement and analysis for selected company 4. Foundations of Ratio and Financial Analysis ( WSF Ch 4) Use of common-size statements Construction and use of activity, liquidity, solvency, and profitability ratios Construction and use of operating and cash cycle measures. Three- and Five-component disaggregation of return on assets, return on invested capital, and return on equity ratios Integrated analysis of ratios and its use in the evaluation of corporate performance. Computation and analysis of earnings per share and other ratios used for valuation. Analysis of Operating and Financial Leverage Group Assignment 2: Prepare a comprehensive ratio analysis of the selected company and discuss your findings 5. Analysis of Inventories (WSF Ch 6) Comparative analysis of the usefulness inventory and cost of goods sold data provided by different inventory methods. Analysis of cash flow and working capital effects of different inventory methods. Analysis of the impact of price changes on reported income under different accounting methods. Adjust the financial data and ratios of companies using different inventory methods. Analysis of the information content of two different signals transmitted by a decline in the LIFO Reserve. 6. Long-lived Assets - Analysis of the Capitalization versus Expensing Decision (WSF Ch 7) 7. 8 Capitalization versus expensing: Impact on financial statements and ratios. Analytical adjustments Additional Analysis of fixed asset data Long-lived Assets - Analysis of the Depreciation and Impairment (WSF Ch 8) Discussion and comparison of Depreciation Methods Impairment of fixed assets: Analysis of impact on ratios and cash flows Implications for Quality of Financial Reporting and Earnings Liabilities for Asset Retirement Obligations Analysis of Income Taxes (WSF Ch 9) The liability Method Deferred Tax Liabilities, Deferred Tax Assets, FIN 48, and The Valuation Allowance Deferred Taxes – Analytical Issues Analysis of Income Tax Disclosures 10. Analysis of Financing Liabilities (WSF Ch 10) Comprehensive review of debt including debt with equity features Bond Covenants Analytical Implications 11. Analysis of Leases and Off-Balance Sheet Debt (WSF Ch 11) Capital versus Operating Leases Analysis of Lease Disclosures Off-Balance Sheet Debt and its Implications for Quality of Financial Reporting and Earnings Securitizations Group Assignment 3: Prepare a comprehensive adjusted ratio analysis and discuss your findings

![[#WSFPHP-440] error in logical flow of wsf_class_writer.php](http://s3.studylib.net/store/data/008600200_1-8be823d2ab9ee72bbafe3e9a75f3c5f6-300x300.png)