CICA Handbook Accounting Part II GAAP for Private Enterprises

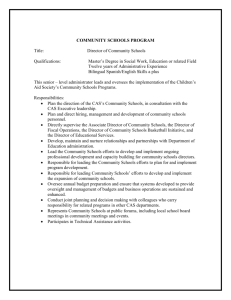

advertisement